| __timestamp | Canadian National Railway Company | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4992000000 | 4102700000 |

| Thursday, January 1, 2015 | 5660000000 | 4072000000 |

| Friday, January 1, 2016 | 5675000000 | 4267200000 |

| Sunday, January 1, 2017 | 5675000000 | 4778000000 |

| Monday, January 1, 2018 | 5962000000 | 4901900000 |

| Tuesday, January 1, 2019 | 6085000000 | 4805500000 |

| Wednesday, January 1, 2020 | 5771000000 | 4967900000 |

| Friday, January 1, 2021 | 6069000000 | 5194200000 |

| Saturday, January 1, 2022 | 7396000000 | 4284100000 |

| Sunday, January 1, 2023 | 7151000000 | 4098000000 |

| Monday, January 1, 2024 | 4514400000 |

Cracking the code

In the world of industrial titans, Canadian National Railway Company and Stanley Black & Decker, Inc. have long been stalwarts of their respective sectors. Over the past decade, from 2014 to 2023, these companies have showcased intriguing trends in their gross profit margins. Canadian National Railway has seen a robust growth trajectory, with its gross profit increasing by approximately 43%, peaking in 2022. This growth underscores the resilience and strategic prowess of the railway industry in North America.

Conversely, Stanley Black & Decker experienced a more volatile journey. Despite a peak in 2021, their gross profit saw a decline of about 21% by 2023. This fluctuation highlights the challenges faced by the manufacturing sector amidst global economic shifts. As we delve into these trends, the data offers a compelling narrative of industrial evolution and market dynamics.

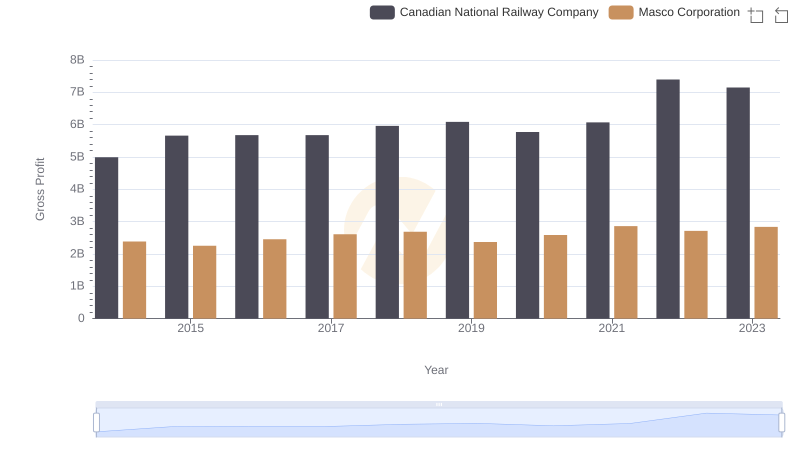

Gross Profit Analysis: Comparing Canadian National Railway Company and Masco Corporation

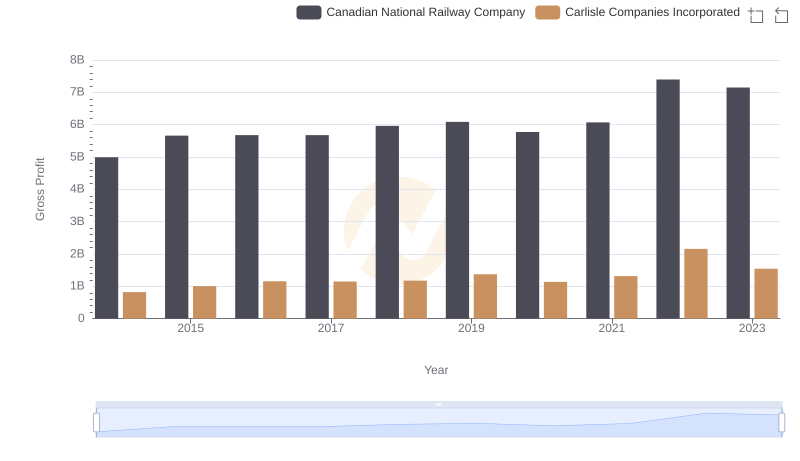

Gross Profit Analysis: Comparing Canadian National Railway Company and Carlisle Companies Incorporated

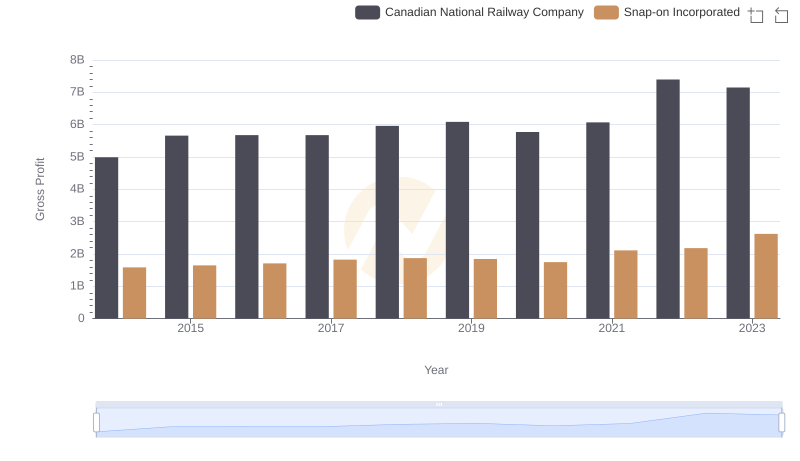

Gross Profit Trends Compared: Canadian National Railway Company vs Snap-on Incorporated

Comparing Cost of Revenue Efficiency: Canadian National Railway Company vs Stanley Black & Decker, Inc.