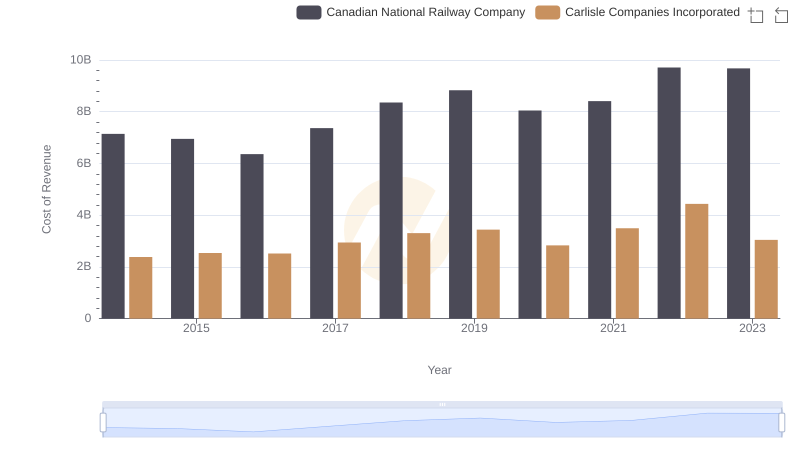

| __timestamp | Canadian National Railway Company | Carlisle Companies Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 4992000000 | 819500000 |

| Thursday, January 1, 2015 | 5660000000 | 1006700000 |

| Friday, January 1, 2016 | 5675000000 | 1157300000 |

| Sunday, January 1, 2017 | 5675000000 | 1148000000 |

| Monday, January 1, 2018 | 5962000000 | 1174700000 |

| Tuesday, January 1, 2019 | 6085000000 | 1371700000 |

| Wednesday, January 1, 2020 | 5771000000 | 1137400000 |

| Friday, January 1, 2021 | 6069000000 | 1314700000 |

| Saturday, January 1, 2022 | 7396000000 | 2157400000 |

| Sunday, January 1, 2023 | 7151000000 | 1544000000 |

| Monday, January 1, 2024 | 1887700000 |

Unlocking the unknown

In the world of North American industry, Canadian National Railway Company (CNR) and Carlisle Companies Incorporated (CSI) have carved out significant niches. Over the past decade, CNR has consistently outperformed CSI in terms of gross profit, showcasing the strength of its operations. From 2014 to 2023, CNR's gross profit surged by approximately 43%, peaking in 2022. In contrast, CSI experienced a more modest growth of around 88% during the same period, with a notable spike in 2022.

CNR's robust growth can be attributed to its strategic expansions and efficient operations, while CSI's fluctuations highlight its adaptive strategies in a competitive market. The year 2022 marked a significant milestone for both companies, with CNR achieving its highest gross profit and CSI experiencing a remarkable increase. As we look to the future, these trends offer valuable insights into the evolving landscape of North American industry.

Cost of Revenue Comparison: Canadian National Railway Company vs Carlisle Companies Incorporated

Canadian National Railway Company vs Watsco, Inc.: A Gross Profit Performance Breakdown

Canadian National Railway Company vs TransUnion: A Gross Profit Performance Breakdown

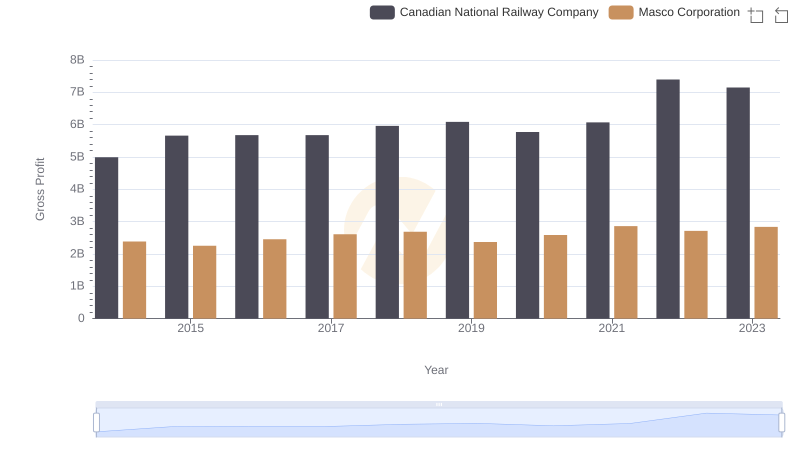

Gross Profit Analysis: Comparing Canadian National Railway Company and Masco Corporation

Gross Profit Comparison: Canadian National Railway Company and Stanley Black & Decker, Inc. Trends

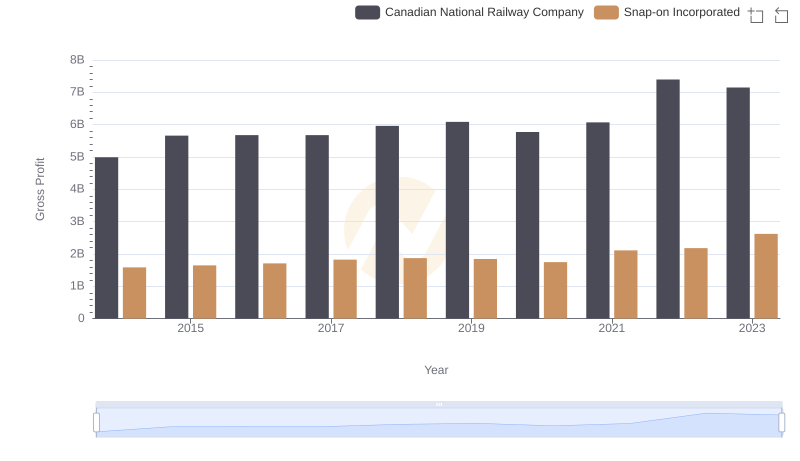

Gross Profit Trends Compared: Canadian National Railway Company vs Snap-on Incorporated