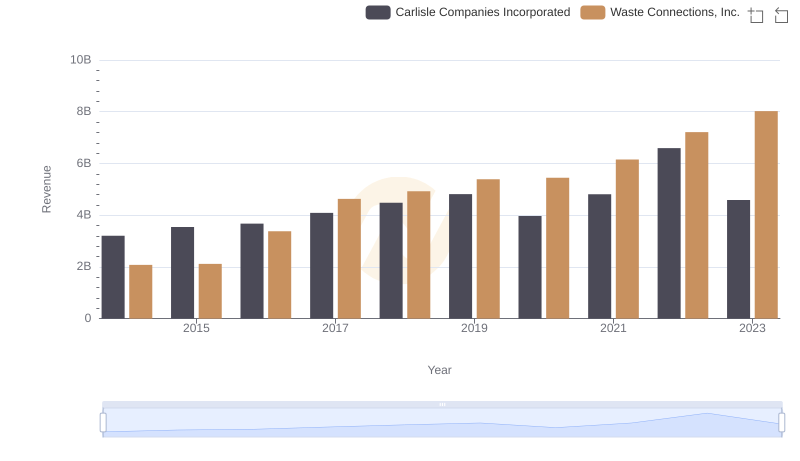

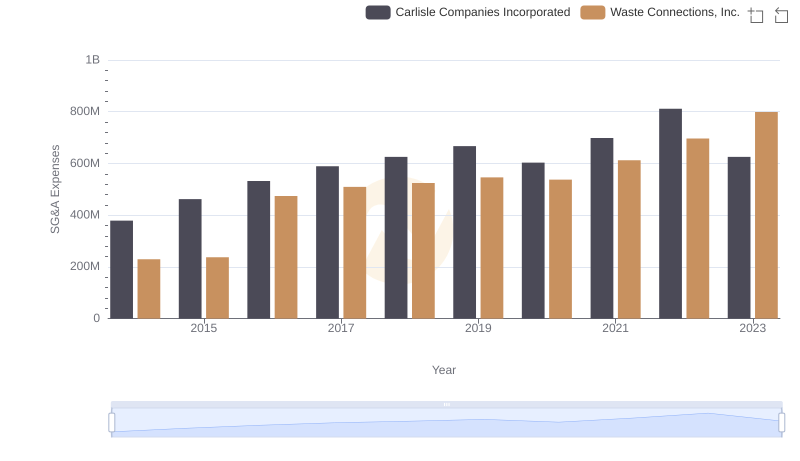

| __timestamp | Carlisle Companies Incorporated | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 819500000 | 940778000 |

| Thursday, January 1, 2015 | 1006700000 | 939878000 |

| Friday, January 1, 2016 | 1157300000 | 1418151000 |

| Sunday, January 1, 2017 | 1148000000 | 1925713000 |

| Monday, January 1, 2018 | 1174700000 | 2057237000 |

| Tuesday, January 1, 2019 | 1371700000 | 2189922000 |

| Wednesday, January 1, 2020 | 1137400000 | 2169182000 |

| Friday, January 1, 2021 | 1314700000 | 2497287000 |

| Saturday, January 1, 2022 | 2157400000 | 2875847000 |

| Sunday, January 1, 2023 | 1544000000 | 3277438000 |

| Monday, January 1, 2024 | 1887700000 | 3727885000 |

Unleashing insights

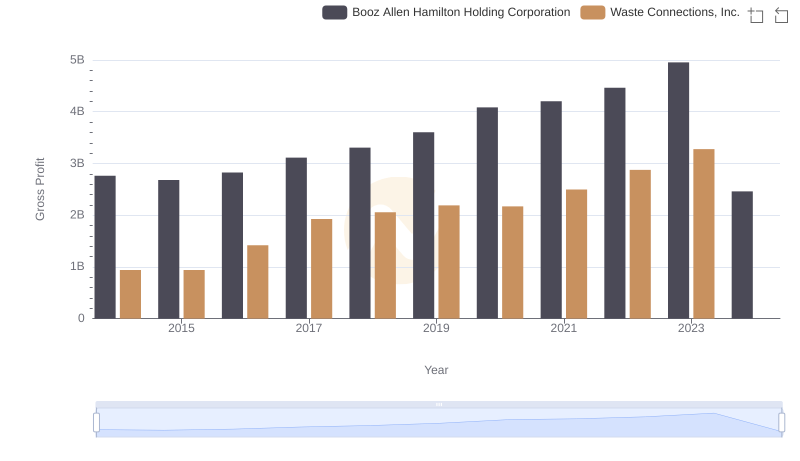

In the ever-evolving landscape of industrial services, Waste Connections, Inc. and Carlisle Companies Incorporated have emerged as key players. Over the past decade, Waste Connections has consistently outperformed Carlisle in terms of gross profit. From 2014 to 2023, Waste Connections saw a remarkable growth of approximately 248%, peaking in 2023 with a gross profit of over $3.3 billion. In contrast, Carlisle Companies experienced a more modest increase of around 88% during the same period, reaching its highest gross profit in 2022.

This trend highlights Waste Connections' robust growth strategy and market adaptability, particularly in the waste management sector. Meanwhile, Carlisle's performance, though steady, suggests potential areas for strategic improvement. As we look to the future, these insights provide a valuable lens through which investors and industry analysts can assess the competitive dynamics and growth potential of these two industrial giants.

Revenue Showdown: Waste Connections, Inc. vs Carlisle Companies Incorporated

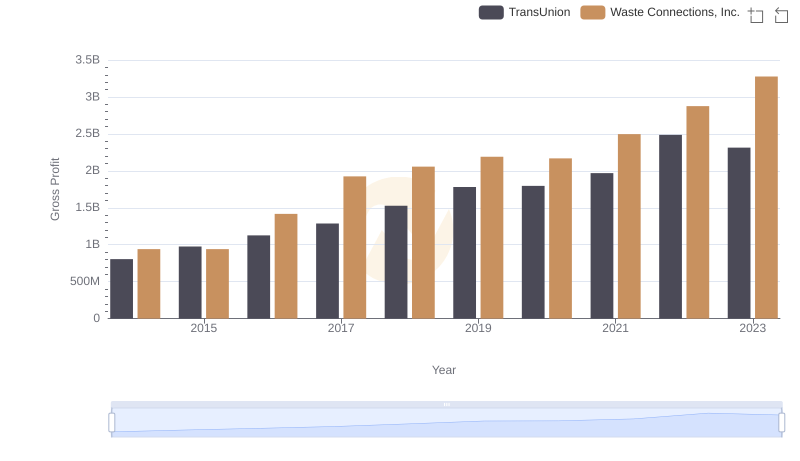

Who Generates Higher Gross Profit? Waste Connections, Inc. or TransUnion

Who Generates Higher Gross Profit? Waste Connections, Inc. or Stanley Black & Decker, Inc.

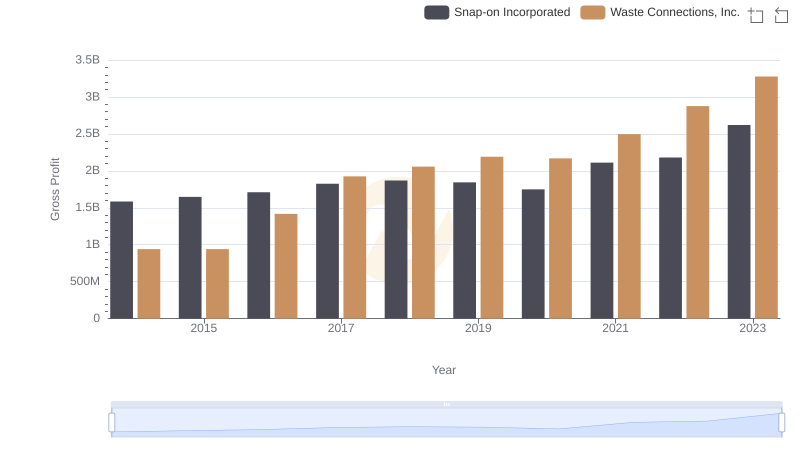

Waste Connections, Inc. vs Snap-on Incorporated: A Gross Profit Performance Breakdown

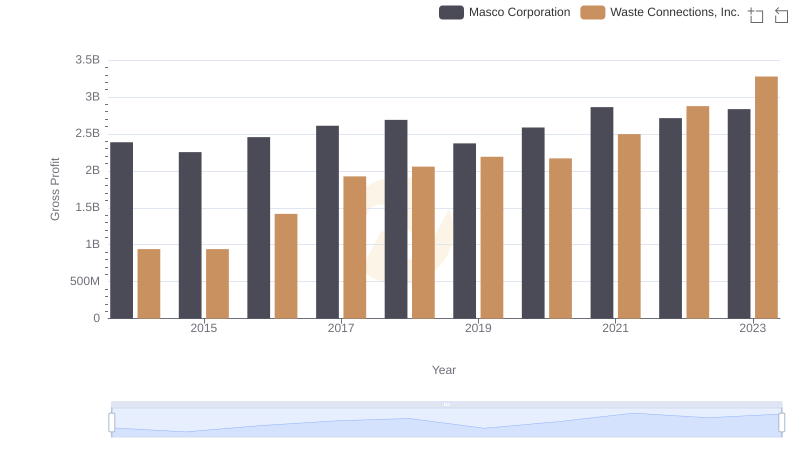

Gross Profit Trends Compared: Waste Connections, Inc. vs Masco Corporation

Gross Profit Comparison: Waste Connections, Inc. and Booz Allen Hamilton Holding Corporation Trends

Selling, General, and Administrative Costs: Waste Connections, Inc. vs Carlisle Companies Incorporated