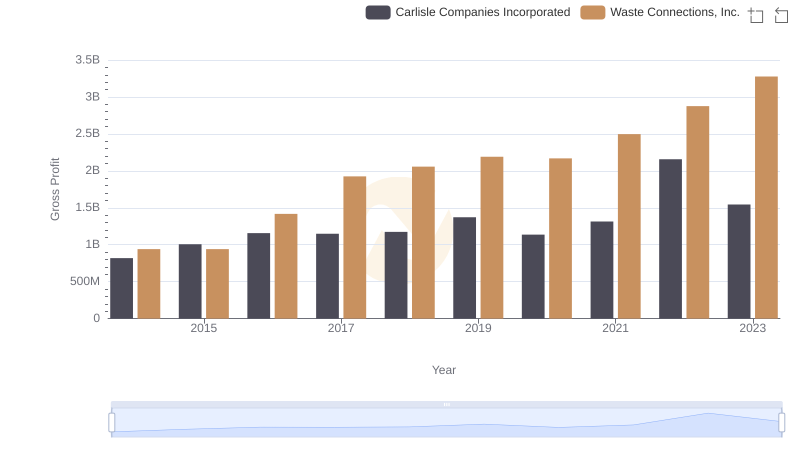

| __timestamp | Booz Allen Hamilton Holding Corporation | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762580000 | 940778000 |

| Thursday, January 1, 2015 | 2680921000 | 939878000 |

| Friday, January 1, 2016 | 2825712000 | 1418151000 |

| Sunday, January 1, 2017 | 3112302000 | 1925713000 |

| Monday, January 1, 2018 | 3304750000 | 2057237000 |

| Tuesday, January 1, 2019 | 3603571000 | 2189922000 |

| Wednesday, January 1, 2020 | 4084661000 | 2169182000 |

| Friday, January 1, 2021 | 4201408000 | 2497287000 |

| Saturday, January 1, 2022 | 4464078000 | 2875847000 |

| Sunday, January 1, 2023 | 4954101000 | 3277438000 |

| Monday, January 1, 2024 | 2459049000 | 3727885000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding the trajectory of gross profits is crucial for investors and analysts alike. Over the past decade, Booz Allen Hamilton Holding Corporation has demonstrated a robust growth in gross profit, with a remarkable increase of approximately 79% from 2014 to 2023. This growth underscores the company's strategic prowess in the consulting sector. Meanwhile, Waste Connections, Inc. has also shown a commendable upward trend, with its gross profit more than tripling over the same period, reflecting its stronghold in the waste management industry.

Interestingly, the data for 2024 shows a significant drop for Booz Allen Hamilton, indicating potential market shifts or strategic realignments. However, the absence of data for Waste Connections in 2024 leaves room for speculation. As these trends unfold, stakeholders must stay vigilant to capitalize on emerging opportunities.

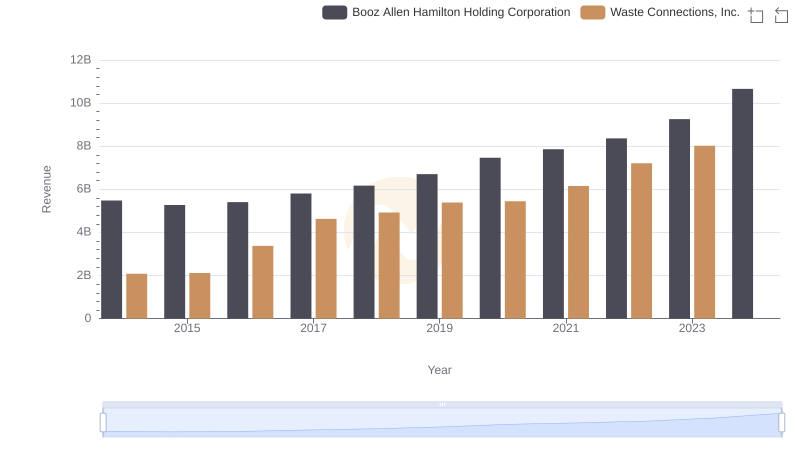

Annual Revenue Comparison: Waste Connections, Inc. vs Booz Allen Hamilton Holding Corporation

Gross Profit Analysis: Comparing Waste Connections, Inc. and Carlisle Companies Incorporated

Cost Insights: Breaking Down Waste Connections, Inc. and Booz Allen Hamilton Holding Corporation's Expenses

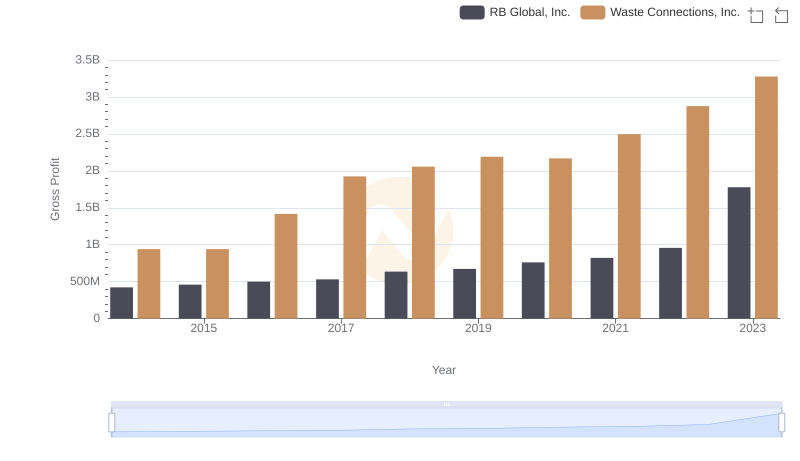

Waste Connections, Inc. and RB Global, Inc.: A Detailed Gross Profit Analysis

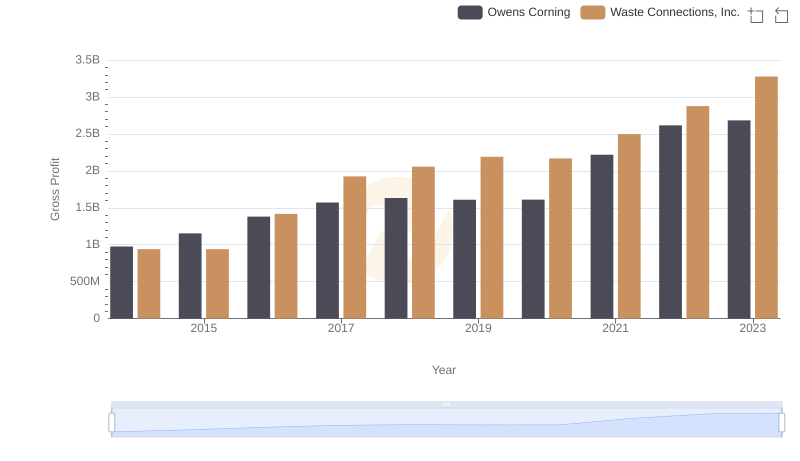

Who Generates Higher Gross Profit? Waste Connections, Inc. or Owens Corning

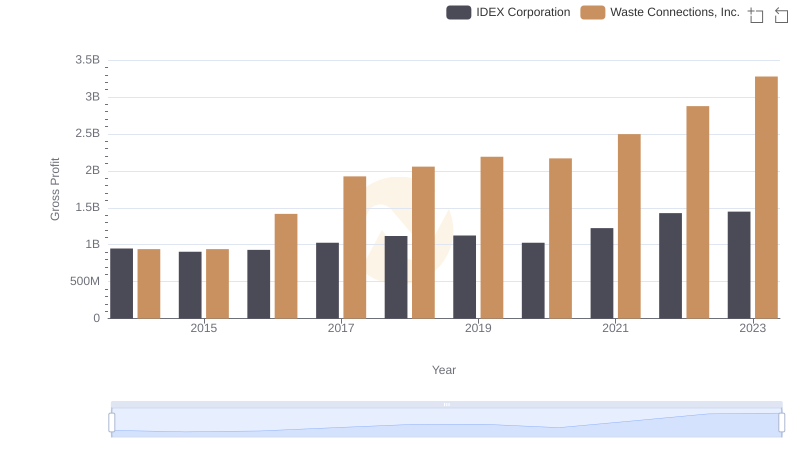

Gross Profit Comparison: Waste Connections, Inc. and IDEX Corporation Trends

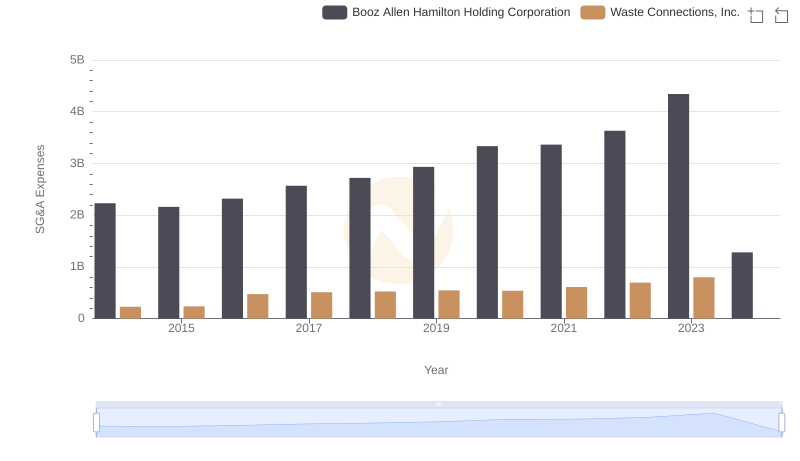

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Booz Allen Hamilton Holding Corporation

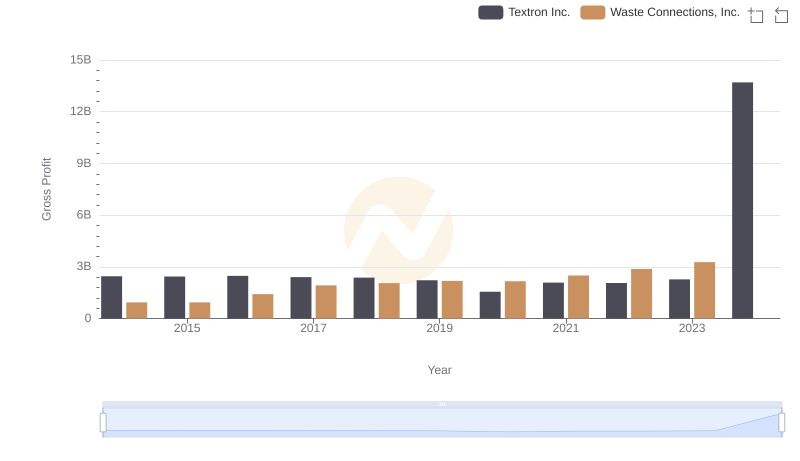

Gross Profit Comparison: Waste Connections, Inc. and Textron Inc. Trends

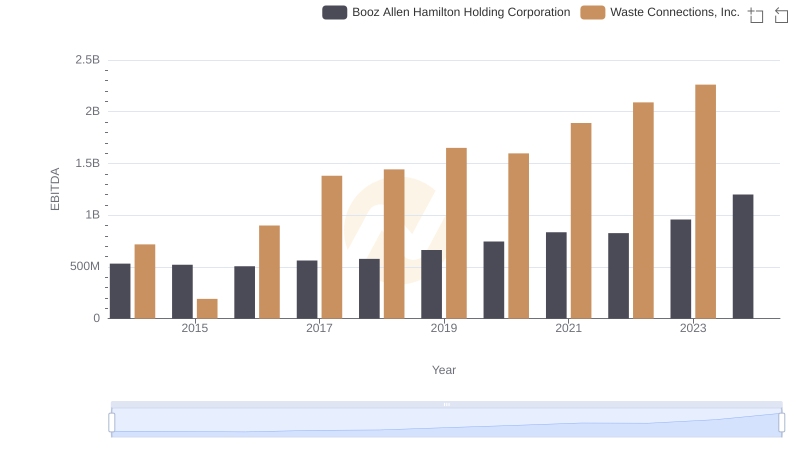

EBITDA Analysis: Evaluating Waste Connections, Inc. Against Booz Allen Hamilton Holding Corporation