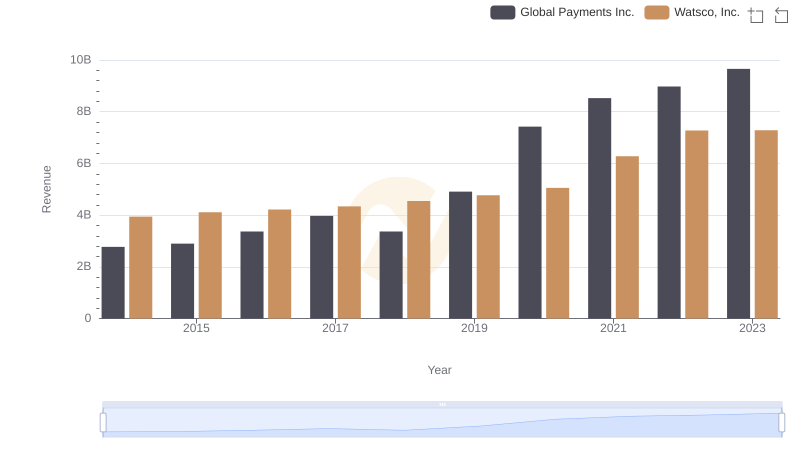

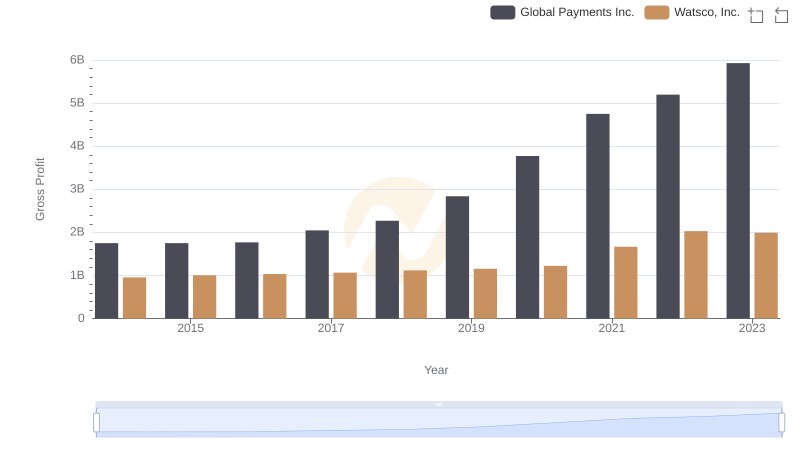

| __timestamp | Global Payments Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1022107000 | 2988138000 |

| Thursday, January 1, 2015 | 1147639000 | 3105882000 |

| Friday, January 1, 2016 | 1603532000 | 3186118000 |

| Sunday, January 1, 2017 | 1928037000 | 3276296000 |

| Monday, January 1, 2018 | 1095014000 | 3426401000 |

| Tuesday, January 1, 2019 | 2073803000 | 3613406000 |

| Wednesday, January 1, 2020 | 3650727000 | 3832107000 |

| Friday, January 1, 2021 | 3773725000 | 4612647000 |

| Saturday, January 1, 2022 | 3778617000 | 5244055000 |

| Sunday, January 1, 2023 | 3727521000 | 5291627000 |

| Monday, January 1, 2024 | 3760116000 | 5573604000 |

In pursuit of knowledge

In the ever-evolving landscape of financial efficiency, Global Payments Inc. and Watsco, Inc. stand as intriguing case studies. Over the past decade, from 2014 to 2023, these companies have showcased distinct trajectories in managing their cost of revenue. Global Payments Inc. has seen a steady increase, with costs rising by approximately 265% from 2014 to 2023. In contrast, Watsco, Inc. has experienced a more moderate increase of about 77% over the same period.

This divergence highlights the varying strategies employed by these companies in navigating their respective industries. While Global Payments Inc. has aggressively expanded its operations, reflected in its rising costs, Watsco, Inc. has maintained a more stable growth pattern. This analysis provides valuable insights into how different business models impact financial efficiency, offering a compelling narrative for investors and industry analysts alike.

Revenue Showdown: Global Payments Inc. vs Watsco, Inc.

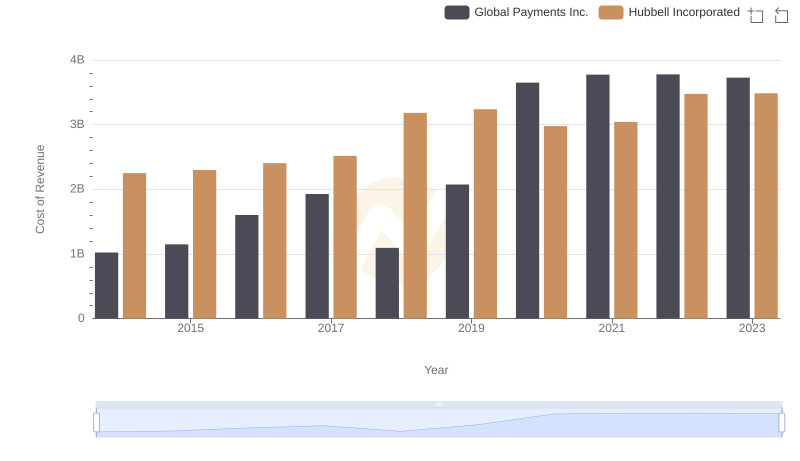

Cost Insights: Breaking Down Global Payments Inc. and Hubbell Incorporated's Expenses

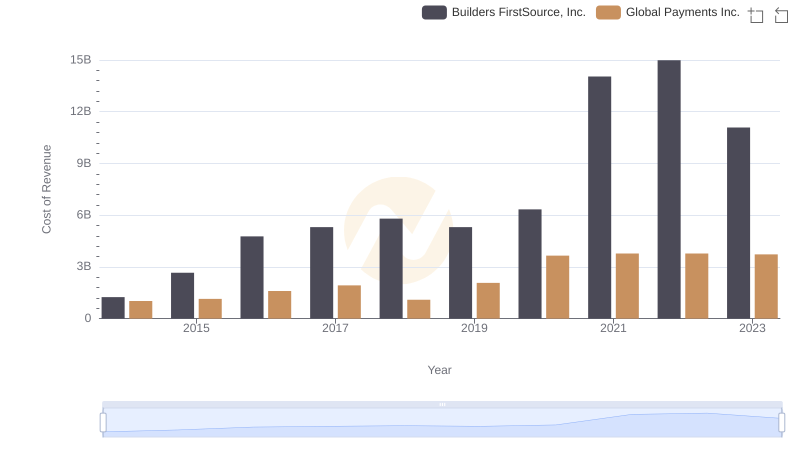

Global Payments Inc. vs Builders FirstSource, Inc.: Efficiency in Cost of Revenue Explored

Global Payments Inc. vs EMCOR Group, Inc.: Efficiency in Cost of Revenue Explored

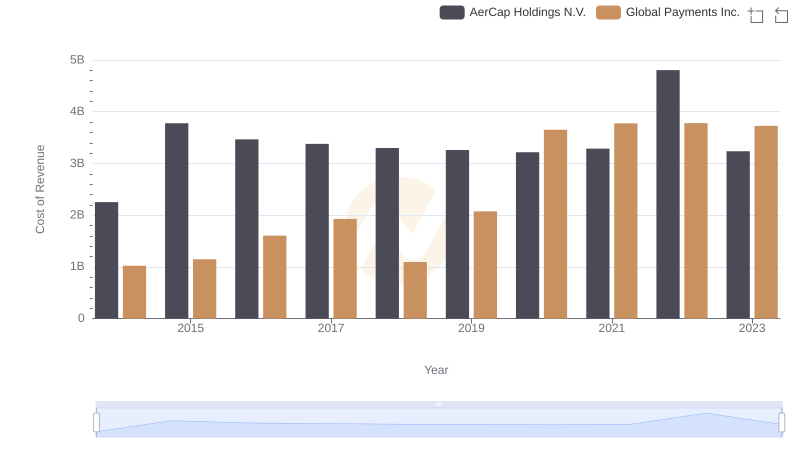

Cost of Revenue: Key Insights for Global Payments Inc. and AerCap Holdings N.V.

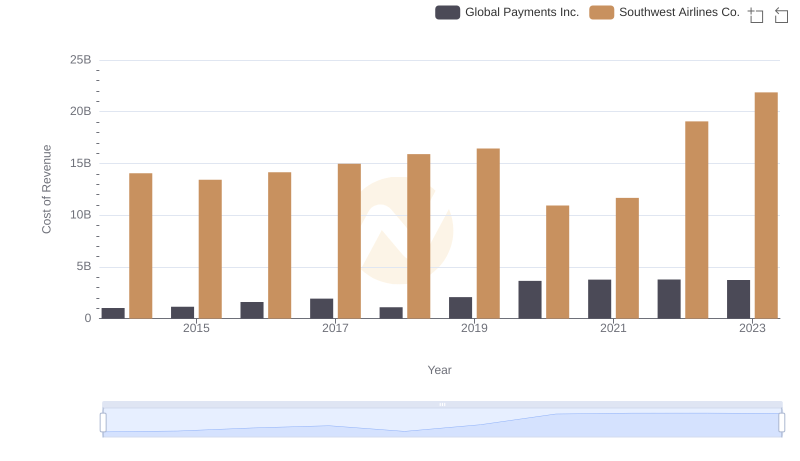

Analyzing Cost of Revenue: Global Payments Inc. and Southwest Airlines Co.

Cost of Revenue Trends: Global Payments Inc. vs TransUnion

Gross Profit Comparison: Global Payments Inc. and Watsco, Inc. Trends

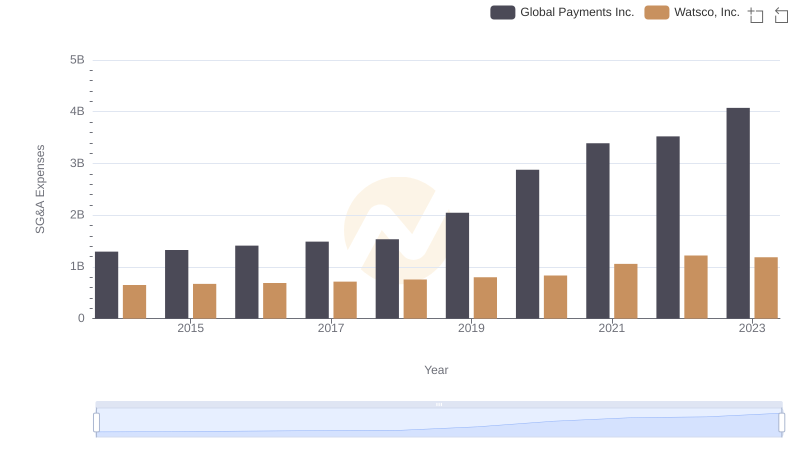

Global Payments Inc. vs Watsco, Inc.: SG&A Expense Trends

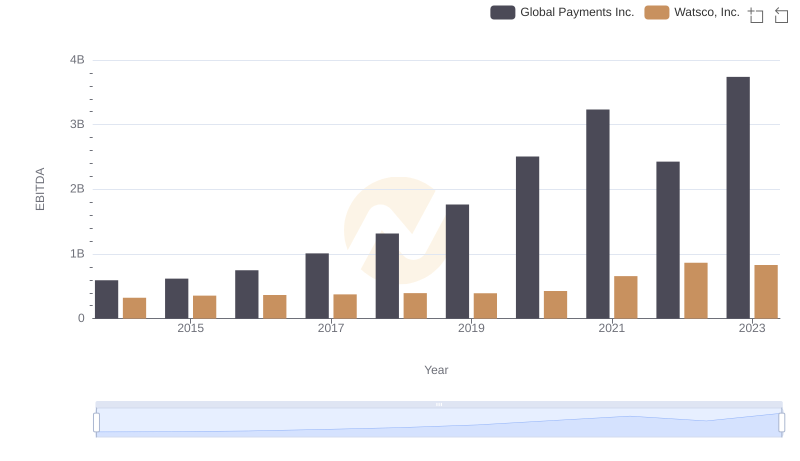

EBITDA Metrics Evaluated: Global Payments Inc. vs Watsco, Inc.