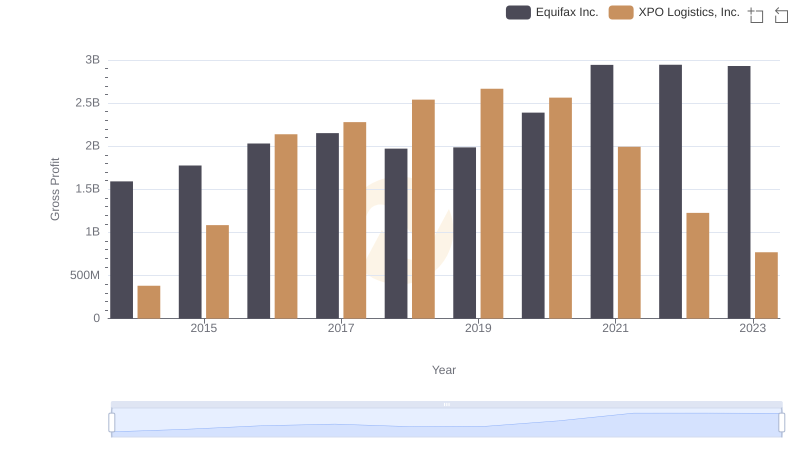

| __timestamp | Equifax Inc. | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2436400000 | 2356600000 |

| Thursday, January 1, 2015 | 2663600000 | 7623200000 |

| Friday, January 1, 2016 | 3144900000 | 14619400000 |

| Sunday, January 1, 2017 | 3362200000 | 15380800000 |

| Monday, January 1, 2018 | 3412100000 | 17279000000 |

| Tuesday, January 1, 2019 | 3507600000 | 16648000000 |

| Wednesday, January 1, 2020 | 4127500000 | 16252000000 |

| Friday, January 1, 2021 | 4923900000 | 12806000000 |

| Saturday, January 1, 2022 | 5122200000 | 7718000000 |

| Sunday, January 1, 2023 | 5265200000 | 7744000000 |

| Monday, January 1, 2024 | 5681100000 | 8072000000 |

Data in motion

In the competitive landscape of American business, Equifax Inc. and XPO Logistics, Inc. have been vying for dominance in annual revenue since 2014. Over the past decade, XPO Logistics has consistently outpaced Equifax, boasting revenues that are often more than double those of its competitor. For instance, in 2016, XPO's revenue was approximately 365% higher than Equifax's. However, Equifax has shown steady growth, with a notable 116% increase in revenue from 2014 to 2023.

The year 2021 marked a turning point for XPO, with a significant drop in revenue, while Equifax continued its upward trajectory. By 2023, Equifax's revenue reached 5.3 billion, closing the gap with XPO's 7.7 billion. This trend suggests a potential shift in market leadership. As these giants continue to evolve, investors and industry watchers should keep a close eye on their financial strategies and market adaptations.

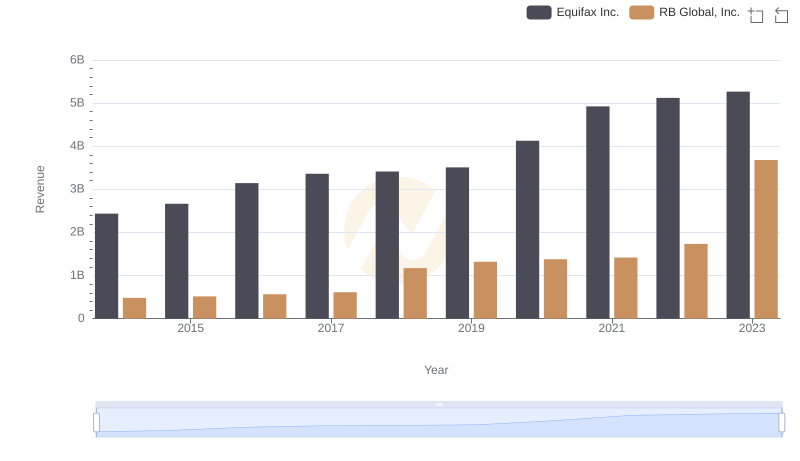

Equifax Inc. vs RB Global, Inc.: Examining Key Revenue Metrics

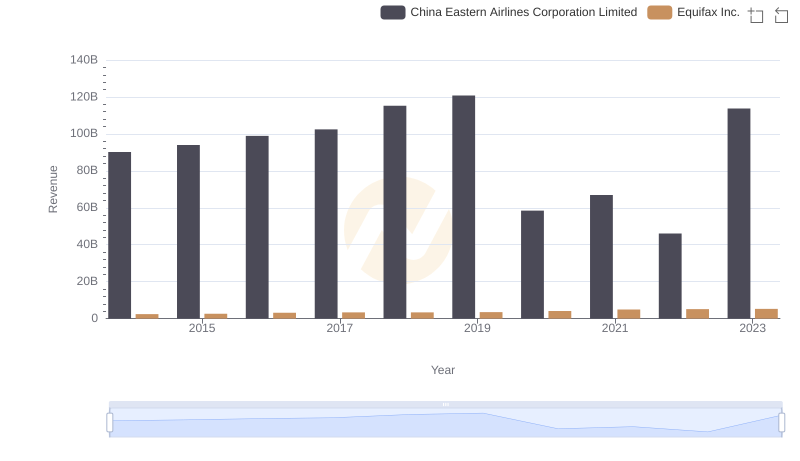

Breaking Down Revenue Trends: Equifax Inc. vs China Eastern Airlines Corporation Limited

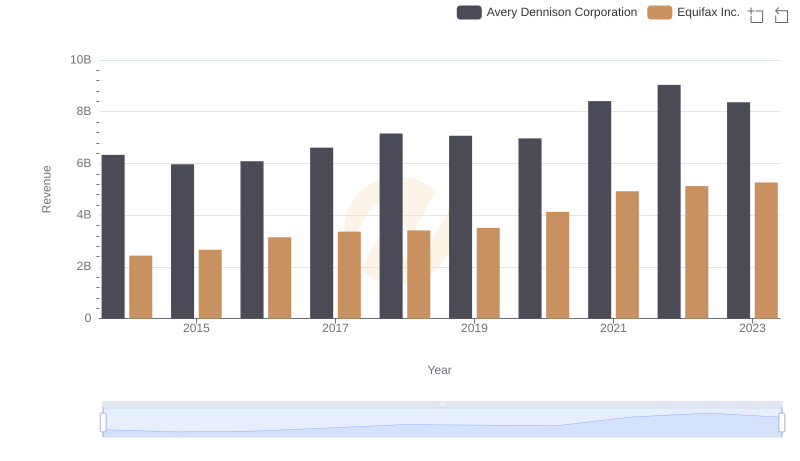

Equifax Inc. and Avery Dennison Corporation: A Comprehensive Revenue Analysis

Equifax Inc. vs XPO Logistics, Inc.: A Gross Profit Performance Breakdown

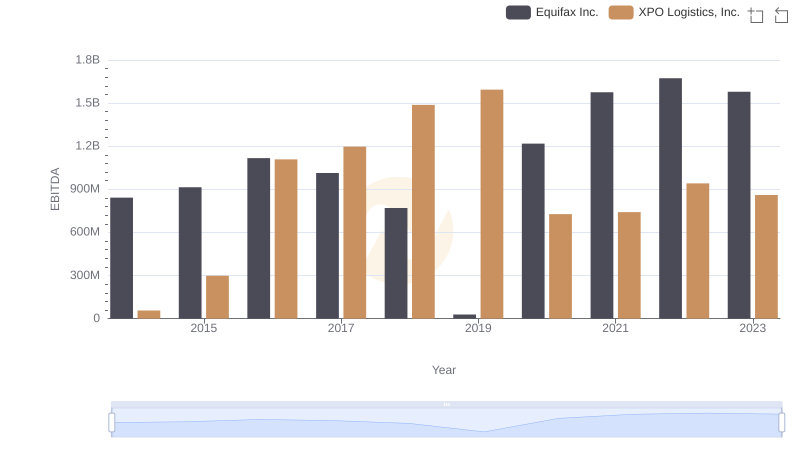

Professional EBITDA Benchmarking: Equifax Inc. vs XPO Logistics, Inc.