| __timestamp | Canadian National Railway Company | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 1575000000 |

| Thursday, January 1, 2015 | 6424000000 | 1601000000 |

| Friday, January 1, 2016 | 6537000000 | 1484000000 |

| Sunday, January 1, 2017 | 6839000000 | 1367000000 |

| Monday, January 1, 2018 | 7124000000 | 1974000000 |

| Tuesday, January 1, 2019 | 7999000000 | 1518000000 |

| Wednesday, January 1, 2020 | 7652000000 | 827000000 |

| Friday, January 1, 2021 | 7607000000 | 1391000000 |

| Saturday, January 1, 2022 | 9067000000 | 1515000000 |

| Sunday, January 1, 2023 | 9027000000 | 1556000000 |

| Monday, January 1, 2024 | 1422000000 |

In pursuit of knowledge

In the world of transportation and aerospace, Canadian National Railway Company (CNR) and Textron Inc. have been pivotal players. Over the past decade, CNR has consistently outperformed Textron in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, CNR's EBITDA surged by approximately 59%, peaking in 2022 with a remarkable 9.07 billion. In contrast, Textron's EBITDA exhibited more volatility, with a notable dip in 2020, reflecting the broader economic challenges of that year. However, Textron rebounded by 2023, achieving a 1.56 billion EBITDA. The data highlights CNR's resilience and strategic prowess in maintaining a steady upward trend, while Textron's journey underscores the challenges and recoveries typical in the aerospace sector. As we look to the future, these insights provide a compelling narrative of industry dynamics and corporate strategy.

Comprehensive EBITDA Comparison: Canadian National Railway Company vs Pentair plc

A Professional Review of EBITDA: Canadian National Railway Company Compared to RB Global, Inc.

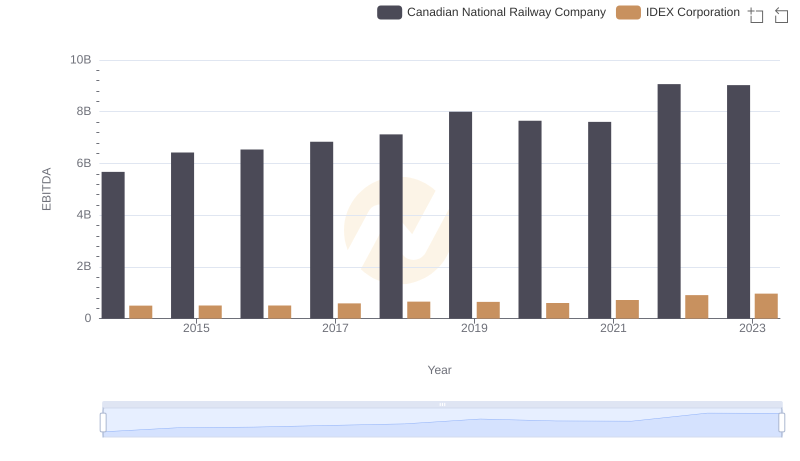

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and IDEX Corporation

EBITDA Analysis: Evaluating Canadian National Railway Company Against Comfort Systems USA, Inc.

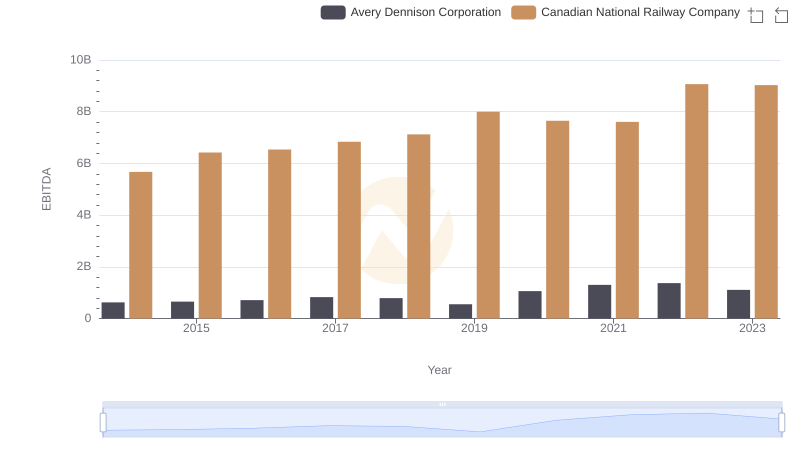

Professional EBITDA Benchmarking: Canadian National Railway Company vs Avery Dennison Corporation

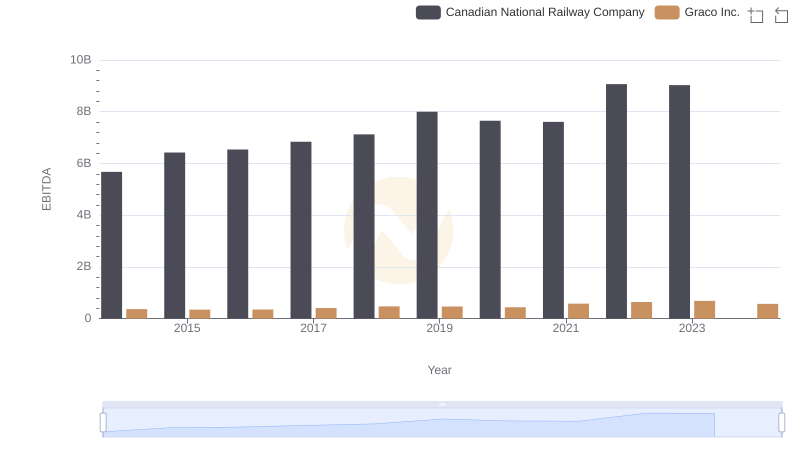

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and Graco Inc.

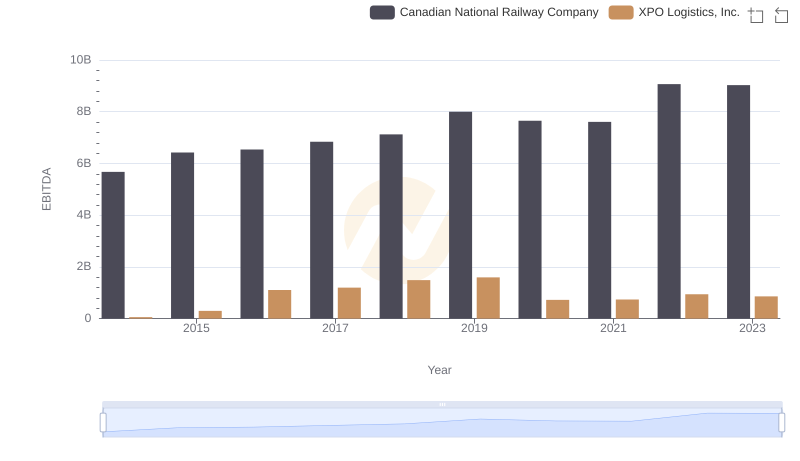

EBITDA Metrics Evaluated: Canadian National Railway Company vs XPO Logistics, Inc.