| __timestamp | Avery Dennison Corporation | Canadian National Railway Company |

|---|---|---|

| Wednesday, January 1, 2014 | 629200000 | 5674000000 |

| Thursday, January 1, 2015 | 657700000 | 6424000000 |

| Friday, January 1, 2016 | 717000000 | 6537000000 |

| Sunday, January 1, 2017 | 829400000 | 6839000000 |

| Monday, January 1, 2018 | 794300000 | 7124000000 |

| Tuesday, January 1, 2019 | 557500000 | 7999000000 |

| Wednesday, January 1, 2020 | 1062000000 | 7652000000 |

| Friday, January 1, 2021 | 1306900000 | 7607000000 |

| Saturday, January 1, 2022 | 1374100000 | 9067000000 |

| Sunday, January 1, 2023 | 1112100000 | 9027000000 |

| Monday, January 1, 2024 | 1382700000 |

Igniting the spark of knowledge

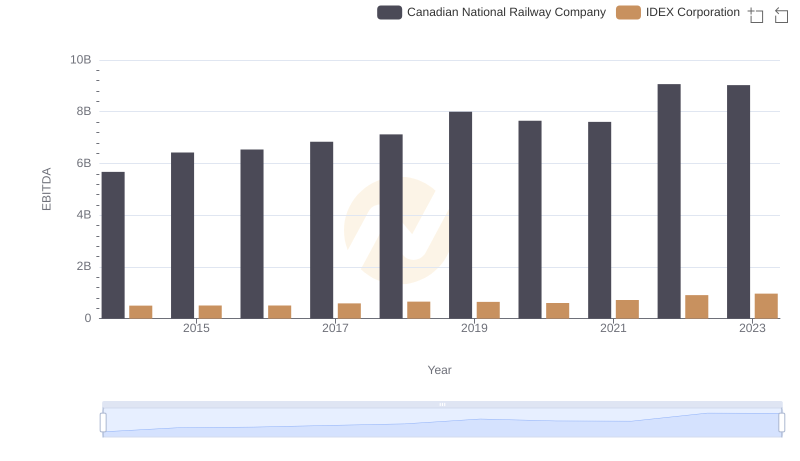

In the world of transportation and manufacturing, Canadian National Railway Company (CNR) and Avery Dennison Corporation stand as titans. Over the past decade, CNR has consistently outperformed Avery Dennison in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, CNR's EBITDA surged by approximately 59%, peaking in 2022 with a remarkable 9.07 billion. In contrast, Avery Dennison's EBITDA grew by about 118% during the same period, reaching its zenith in 2022 with 1.37 billion.

This comparison highlights the resilience and strategic prowess of these companies. While CNR's dominance in the railway sector is evident, Avery Dennison's impressive growth in the manufacturing sector cannot be overlooked. As we move forward, these trends offer valuable insights into the financial health and strategic direction of these industry leaders.

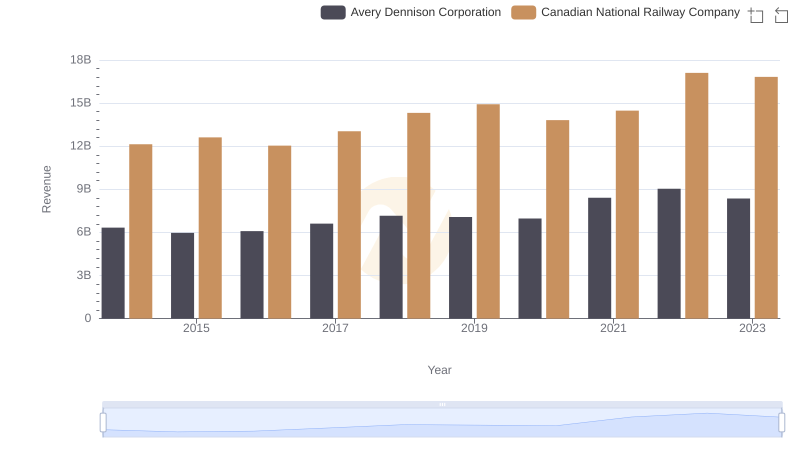

Canadian National Railway Company and Avery Dennison Corporation: A Comprehensive Revenue Analysis

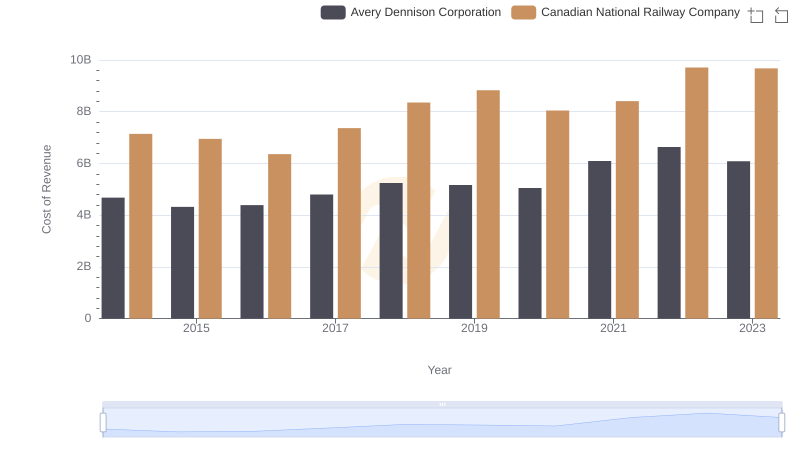

Cost of Revenue Trends: Canadian National Railway Company vs Avery Dennison Corporation

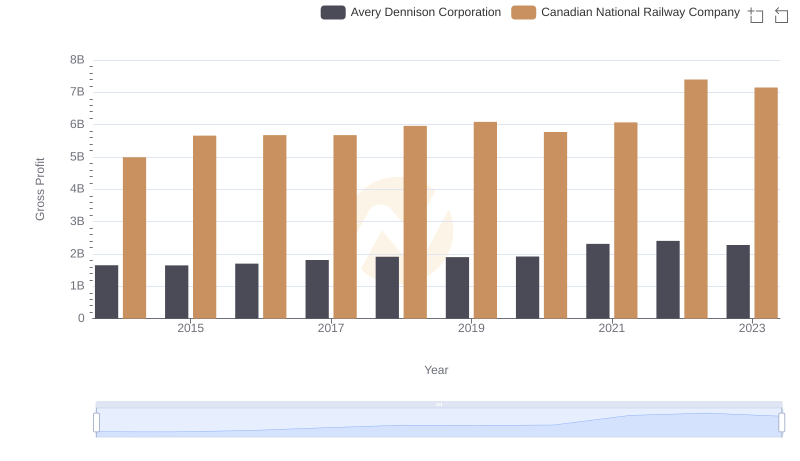

Gross Profit Comparison: Canadian National Railway Company and Avery Dennison Corporation Trends

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and IDEX Corporation

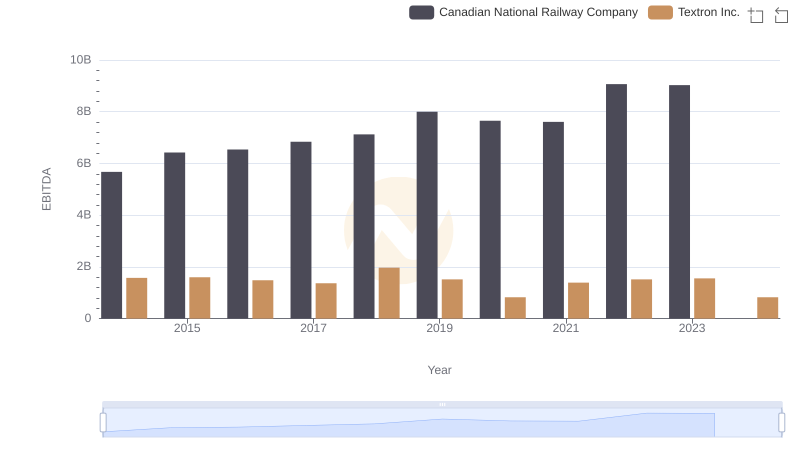

EBITDA Performance Review: Canadian National Railway Company vs Textron Inc.

EBITDA Analysis: Evaluating Canadian National Railway Company Against Comfort Systems USA, Inc.

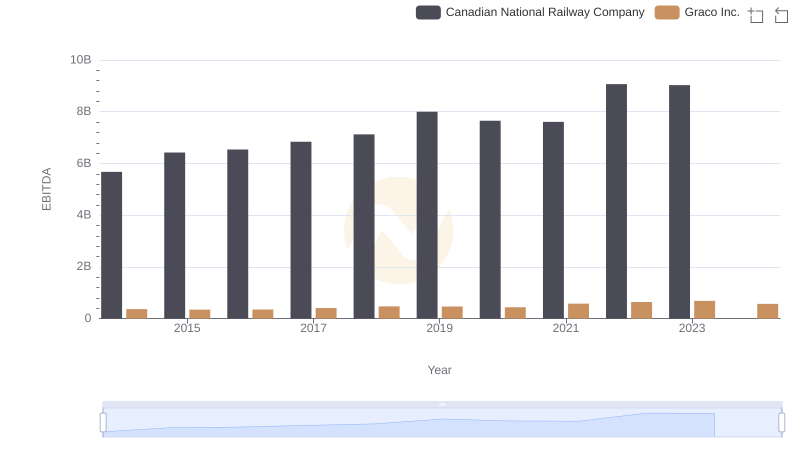

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and Graco Inc.

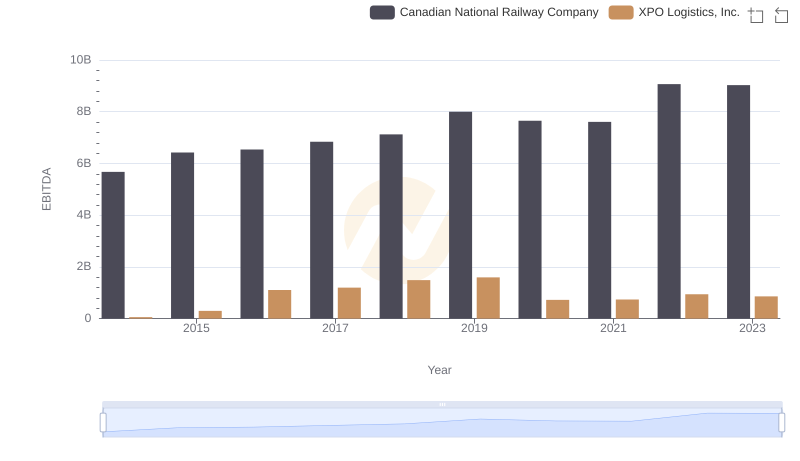

EBITDA Metrics Evaluated: Canadian National Railway Company vs XPO Logistics, Inc.