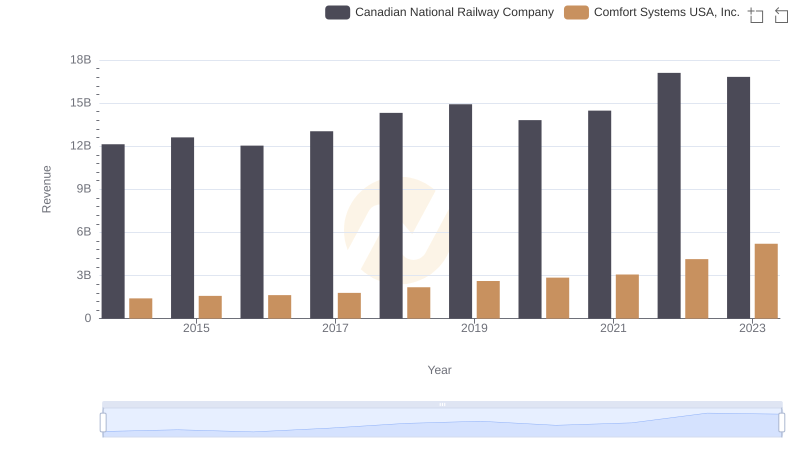

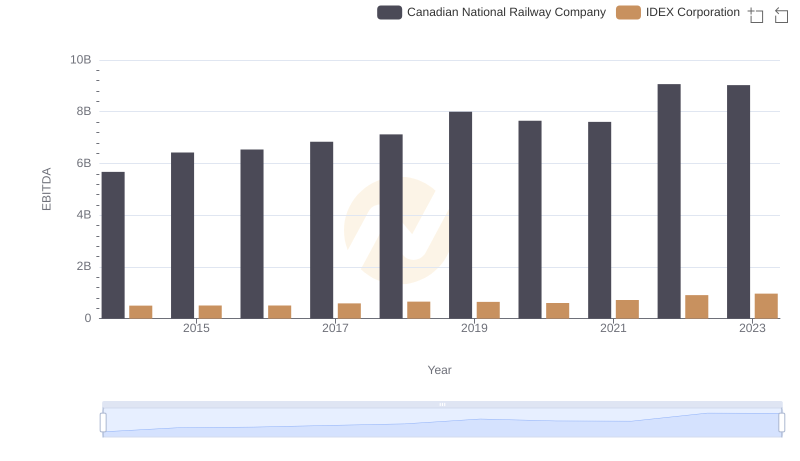

| __timestamp | Canadian National Railway Company | Comfort Systems USA, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 63455000 |

| Thursday, January 1, 2015 | 6424000000 | 112580000 |

| Friday, January 1, 2016 | 6537000000 | 126974000 |

| Sunday, January 1, 2017 | 6839000000 | 137151000 |

| Monday, January 1, 2018 | 7124000000 | 191982000 |

| Tuesday, January 1, 2019 | 7999000000 | 229518000 |

| Wednesday, January 1, 2020 | 7652000000 | 276904000 |

| Friday, January 1, 2021 | 7607000000 | 282506000 |

| Saturday, January 1, 2022 | 9067000000 | 352446000 |

| Sunday, January 1, 2023 | 9027000000 | 497652000 |

Cracking the code

In the world of finance, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a crucial indicator of a company's operational performance. This analysis juxtaposes the financial journeys of Canadian National Railway Company and Comfort Systems USA, Inc. over the past decade.

From 2014 to 2023, Canadian National Railway Company has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 59%. This growth reflects the company's strategic initiatives and operational efficiencies, positioning it as a leader in the transportation sector.

Comfort Systems USA, Inc. has also shown impressive growth, with its EBITDA surging by nearly 683% over the same period. This remarkable increase underscores the company's expanding footprint in the building services industry.

Both companies exemplify resilience and adaptability, navigating economic challenges to achieve significant financial milestones.

Comparing Revenue Performance: Canadian National Railway Company or Comfort Systems USA, Inc.?

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and IDEX Corporation

Key Insights on Gross Profit: Canadian National Railway Company vs Comfort Systems USA, Inc.

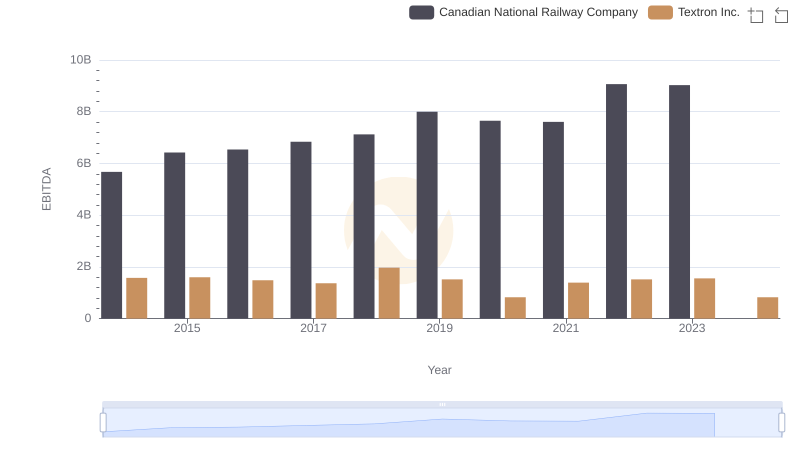

EBITDA Performance Review: Canadian National Railway Company vs Textron Inc.

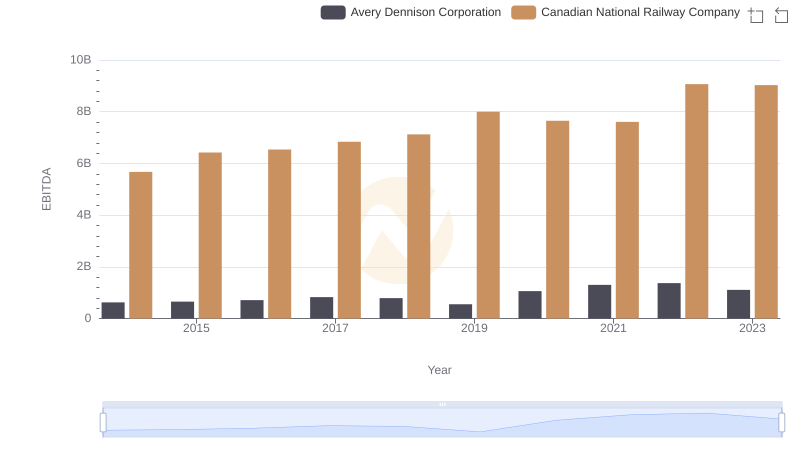

Professional EBITDA Benchmarking: Canadian National Railway Company vs Avery Dennison Corporation

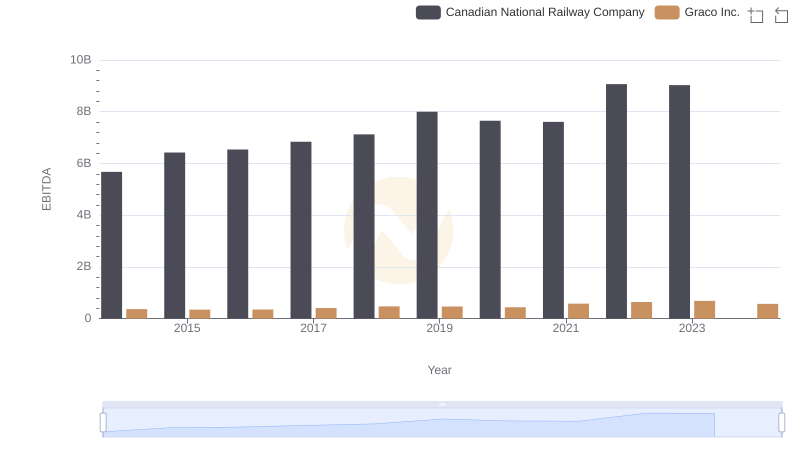

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and Graco Inc.

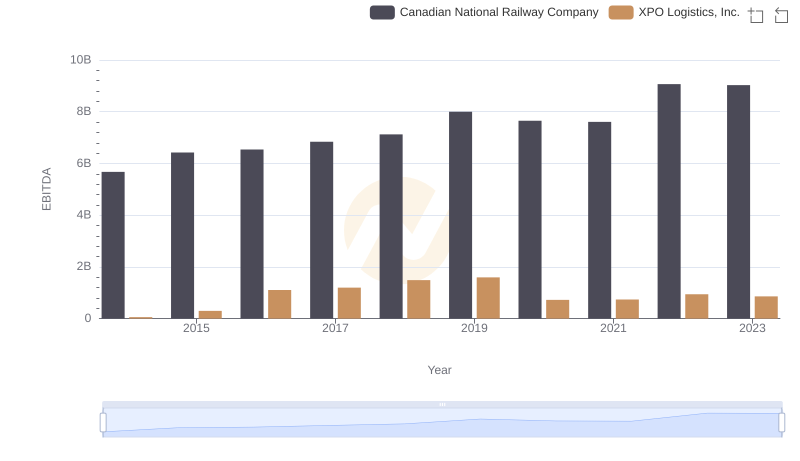

EBITDA Metrics Evaluated: Canadian National Railway Company vs XPO Logistics, Inc.