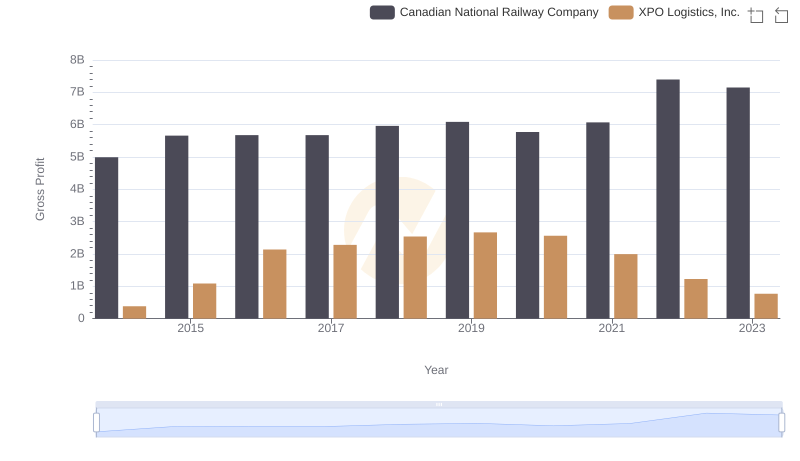

| __timestamp | Canadian National Railway Company | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 56600000 |

| Thursday, January 1, 2015 | 6424000000 | 298000000 |

| Friday, January 1, 2016 | 6537000000 | 1108300000 |

| Sunday, January 1, 2017 | 6839000000 | 1196700000 |

| Monday, January 1, 2018 | 7124000000 | 1488000000 |

| Tuesday, January 1, 2019 | 7999000000 | 1594000000 |

| Wednesday, January 1, 2020 | 7652000000 | 727000000 |

| Friday, January 1, 2021 | 7607000000 | 741000000 |

| Saturday, January 1, 2022 | 9067000000 | 941000000 |

| Sunday, January 1, 2023 | 9027000000 | 860000000 |

| Monday, January 1, 2024 | 1186000000 |

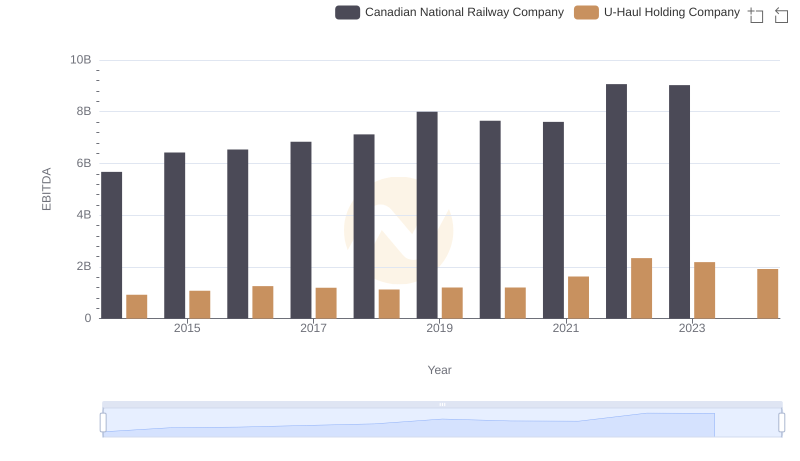

Unveiling the hidden dimensions of data

In the world of transportation and logistics, Canadian National Railway Company (CNR) and XPO Logistics, Inc. have carved out significant niches. Over the past decade, CNR has consistently outperformed XPO in terms of EBITDA, a key profitability metric. From 2014 to 2023, CNR's EBITDA grew by approximately 59%, peaking in 2022 with a 9% increase from the previous year. In contrast, XPO's EBITDA saw a more volatile trajectory, with a notable peak in 2019, followed by a dip in 2020, and a modest recovery thereafter.

This comparison highlights the resilience and growth strategy of CNR, which has maintained a steady upward trend, while XPO's performance reflects the challenges and opportunities in the logistics sector. As the global economy evolves, these companies' financial health will be crucial in shaping the future of transportation and logistics.

Who Generates Higher Gross Profit? Canadian National Railway Company or XPO Logistics, Inc.

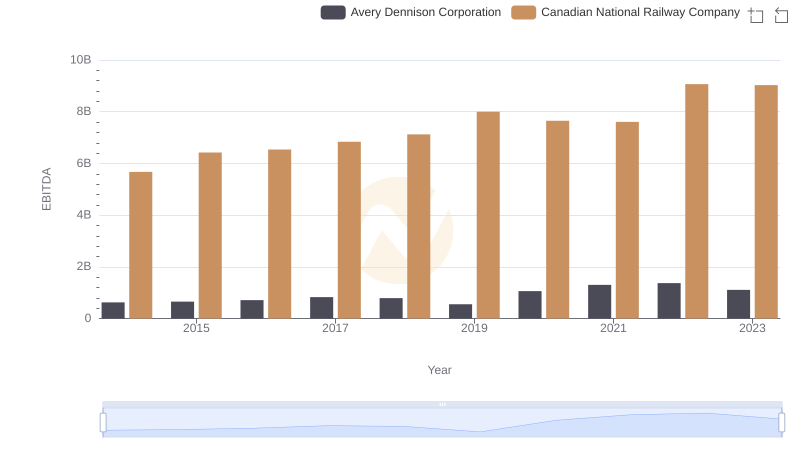

Professional EBITDA Benchmarking: Canadian National Railway Company vs Avery Dennison Corporation

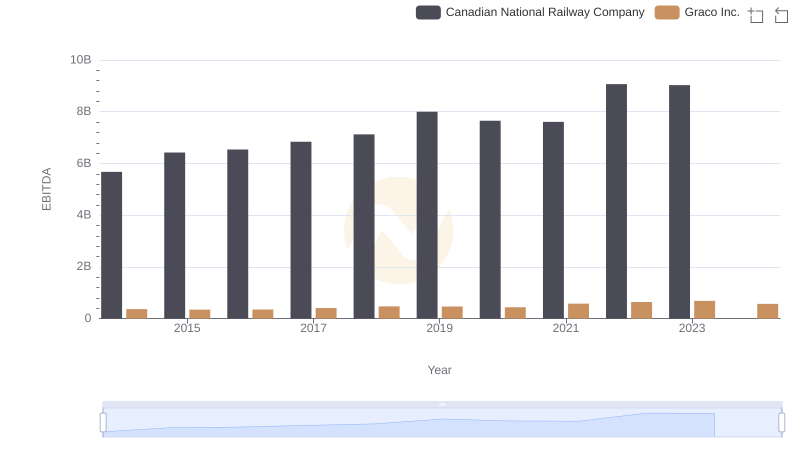

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and Graco Inc.

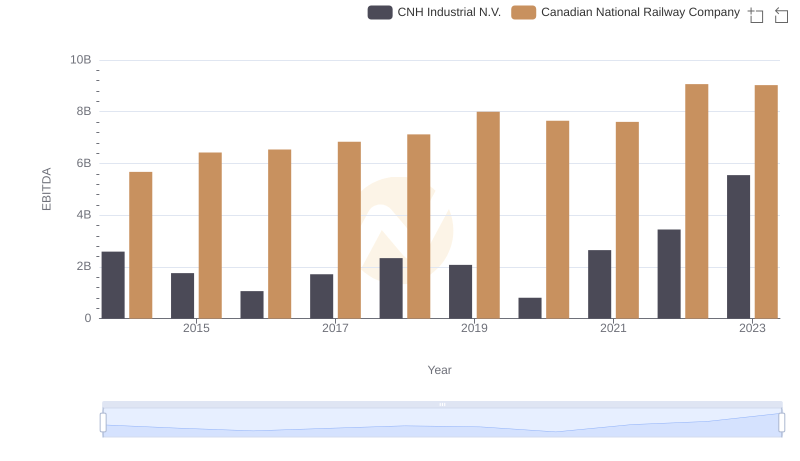

A Professional Review of EBITDA: Canadian National Railway Company Compared to CNH Industrial N.V.

EBITDA Metrics Evaluated: Canadian National Railway Company vs Saia, Inc.

EBITDA Analysis: Evaluating Canadian National Railway Company Against U-Haul Holding Company