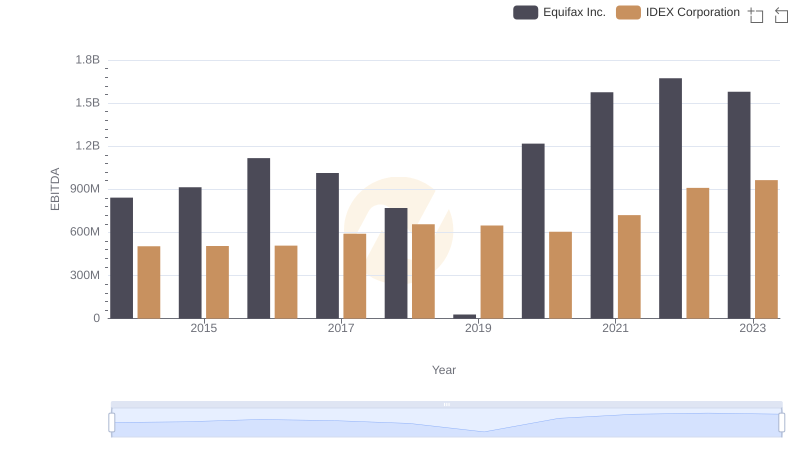

| __timestamp | Avery Dennison Corporation | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 629200000 | 842400000 |

| Thursday, January 1, 2015 | 657700000 | 914600000 |

| Friday, January 1, 2016 | 717000000 | 1116900000 |

| Sunday, January 1, 2017 | 829400000 | 1013900000 |

| Monday, January 1, 2018 | 794300000 | 770200000 |

| Tuesday, January 1, 2019 | 557500000 | 29000000 |

| Wednesday, January 1, 2020 | 1062000000 | 1217800000 |

| Friday, January 1, 2021 | 1306900000 | 1575200000 |

| Saturday, January 1, 2022 | 1374100000 | 1672800000 |

| Sunday, January 1, 2023 | 1112100000 | 1579100000 |

| Monday, January 1, 2024 | 1382700000 | 1251200000 |

Cracking the code

In the ever-evolving landscape of corporate finance, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a crucial metric for evaluating a company's operational performance. This analysis pits two industry giants, Equifax Inc. and Avery Dennison Corporation, against each other over a decade, from 2014 to 2023.

Equifax Inc. has demonstrated a robust growth trajectory, with its EBITDA peaking in 2022 at approximately 1.67 billion, marking a 98% increase from 2014. Avery Dennison, while also showing growth, reached its highest EBITDA in 2022 at around 1.37 billion, a 118% rise from its 2014 figures. Notably, both companies experienced a dip in 2019, with Equifax's EBITDA plummeting to a mere 29 million, highlighting potential challenges faced during that period.

This comparative analysis underscores the resilience and strategic prowess of both corporations, with Equifax maintaining a slight edge in EBITDA growth over the years.

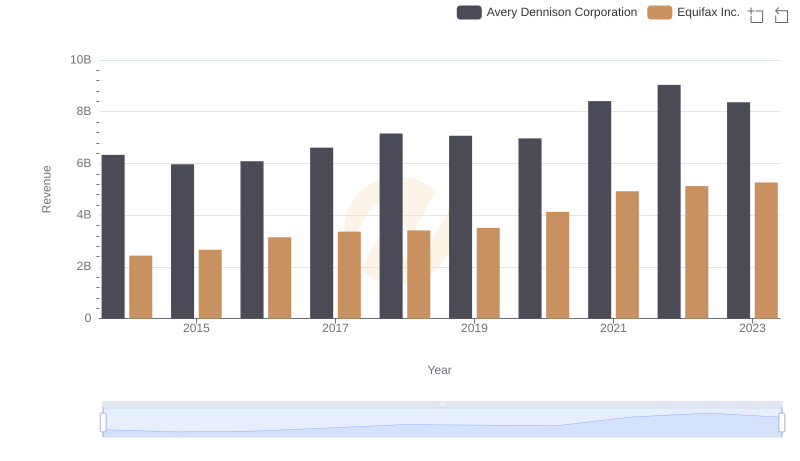

Equifax Inc. and Avery Dennison Corporation: A Comprehensive Revenue Analysis

Equifax Inc. and IDEX Corporation: A Detailed Examination of EBITDA Performance

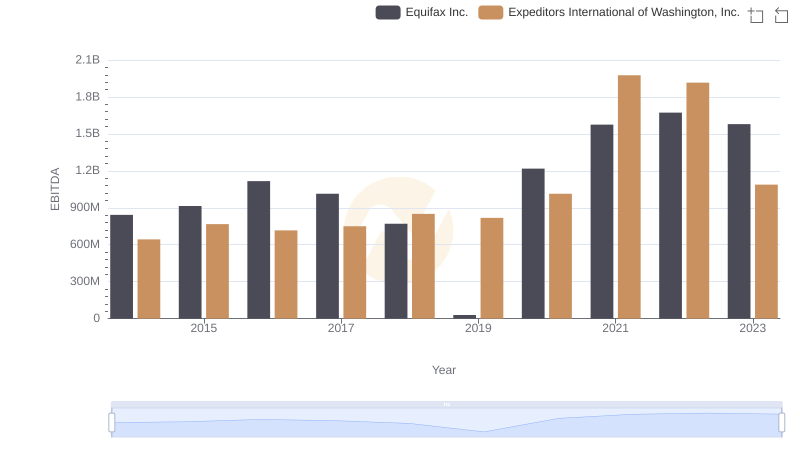

EBITDA Analysis: Evaluating Equifax Inc. Against Expeditors International of Washington, Inc.

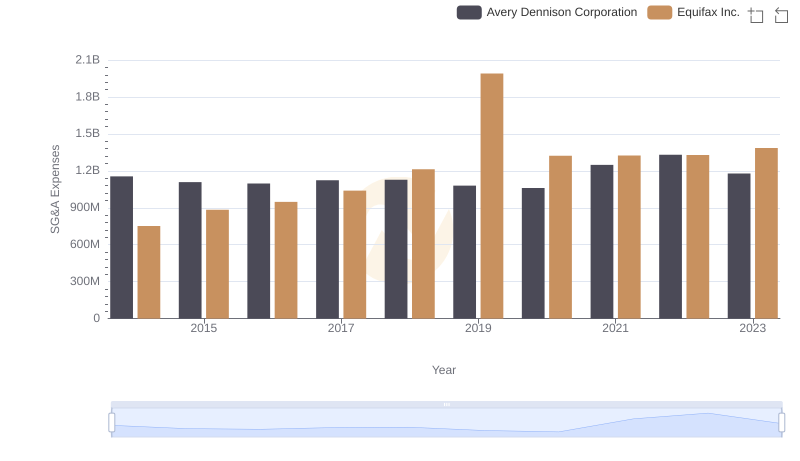

Breaking Down SG&A Expenses: Equifax Inc. vs Avery Dennison Corporation

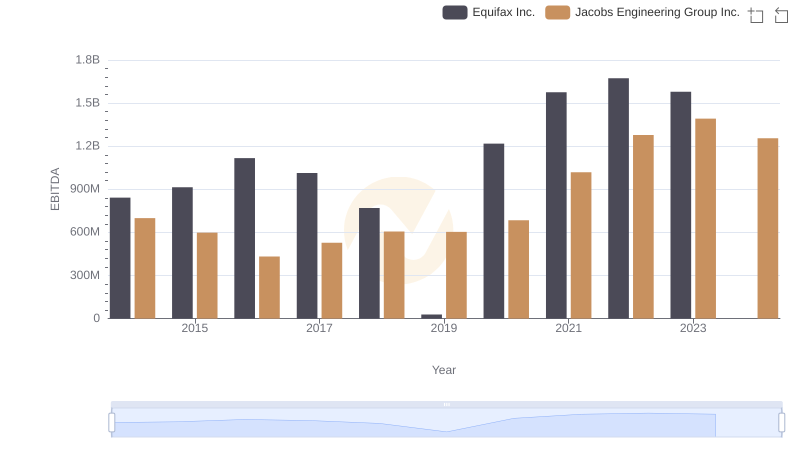

Equifax Inc. vs Jacobs Engineering Group Inc.: In-Depth EBITDA Performance Comparison

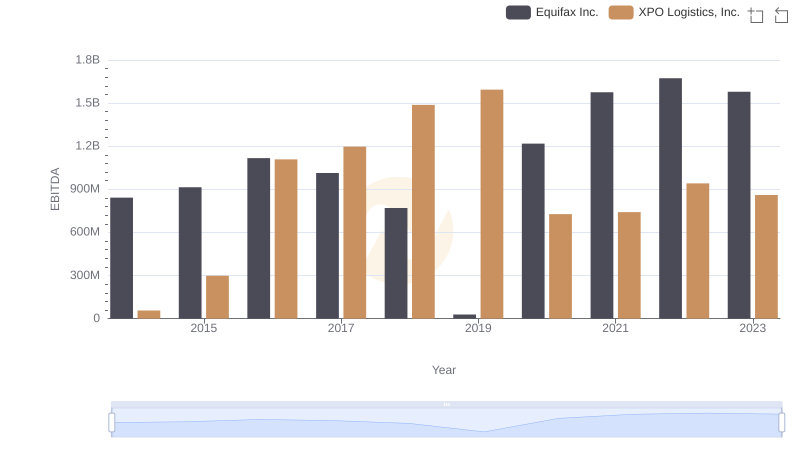

Professional EBITDA Benchmarking: Equifax Inc. vs XPO Logistics, Inc.