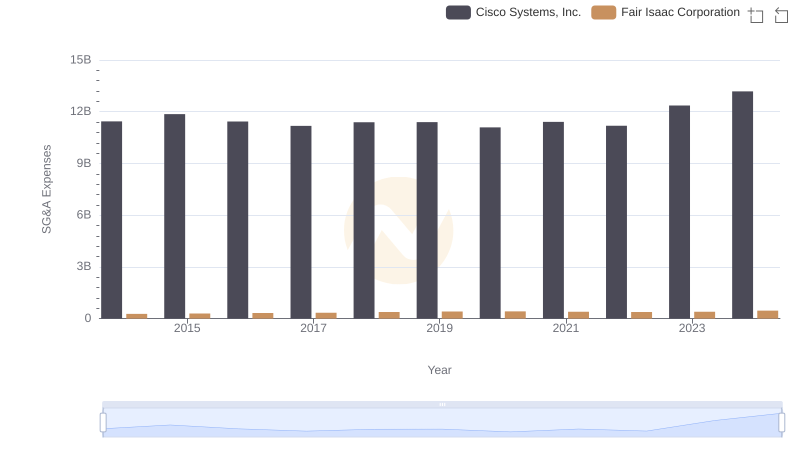

| __timestamp | Cisco Systems, Inc. | Fair Isaac Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 12709000000 | 194313000 |

| Thursday, January 1, 2015 | 14209000000 | 172277000 |

| Friday, January 1, 2016 | 15678000000 | 202993000 |

| Sunday, January 1, 2017 | 15383000000 | 213494000 |

| Monday, January 1, 2018 | 16172000000 | 218425000 |

| Tuesday, January 1, 2019 | 17334000000 | 287436000 |

| Wednesday, January 1, 2020 | 16363000000 | 349555000 |

| Friday, January 1, 2021 | 15558000000 | 554928000 |

| Saturday, January 1, 2022 | 16794000000 | 576663000 |

| Sunday, January 1, 2023 | 17471000000 | 663808000 |

| Monday, January 1, 2024 | 15747000000 | 761490000 |

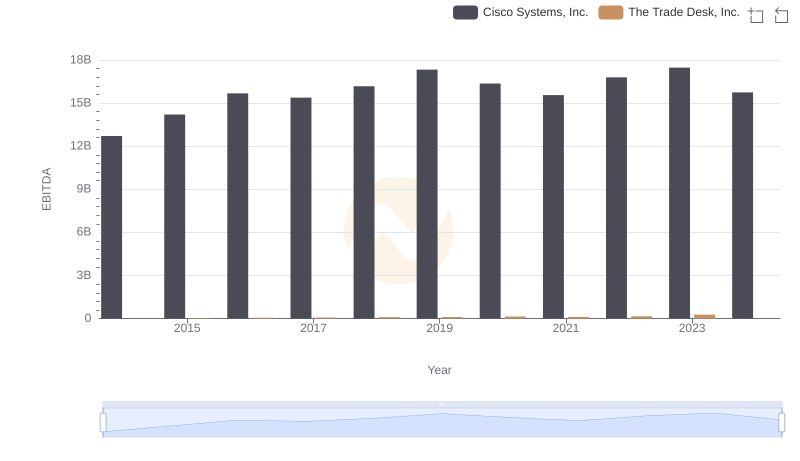

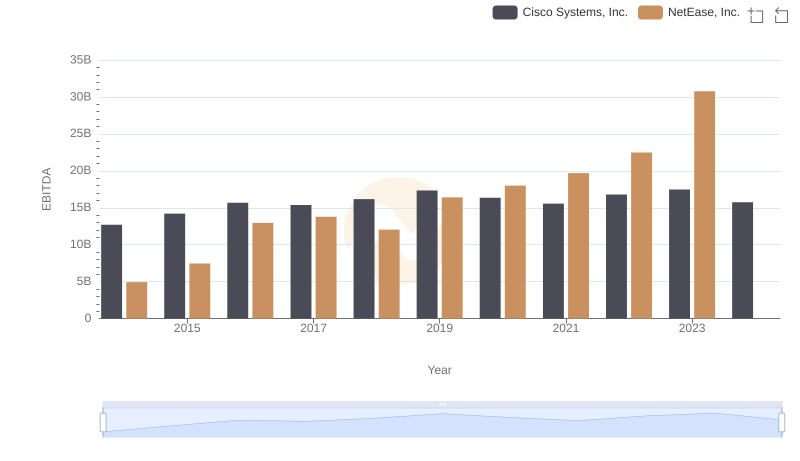

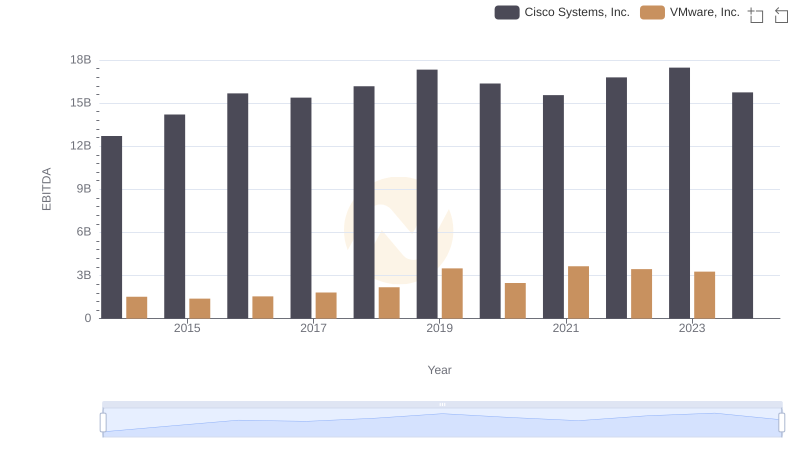

Unleashing the power of data

In the ever-evolving landscape of technology and analytics, Cisco Systems, Inc. and Fair Isaac Corporation (FICO) stand as titans in their respective domains. Over the past decade, from 2014 to 2024, Cisco's EBITDA has shown a robust growth trajectory, peaking in 2023 with a 37% increase from its 2014 figures. Meanwhile, FICO, a leader in analytics and decision management, has demonstrated a remarkable 292% growth in EBITDA over the same period, reflecting its strategic advancements in AI and machine learning.

Cisco's EBITDA, consistently surpassing $15 billion annually, underscores its dominance in networking and cybersecurity. In contrast, FICO's EBITDA, though smaller in absolute terms, highlights its agility and innovation in a competitive market. This analysis not only showcases the financial health of these giants but also offers insights into their strategic directions in a rapidly changing technological landscape.

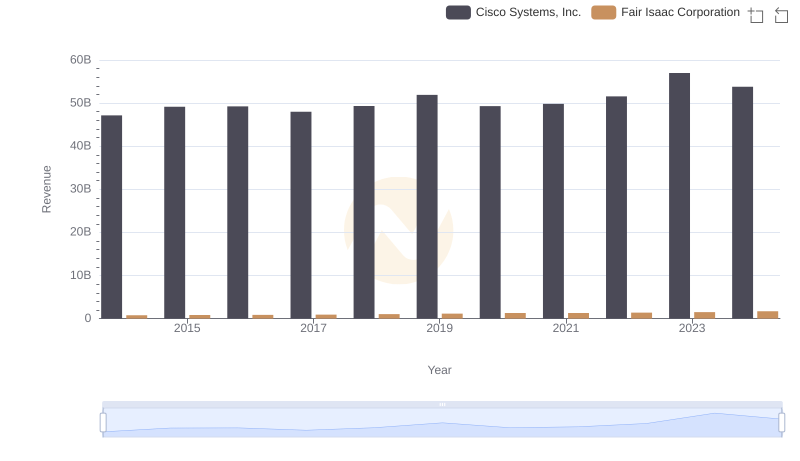

Annual Revenue Comparison: Cisco Systems, Inc. vs Fair Isaac Corporation

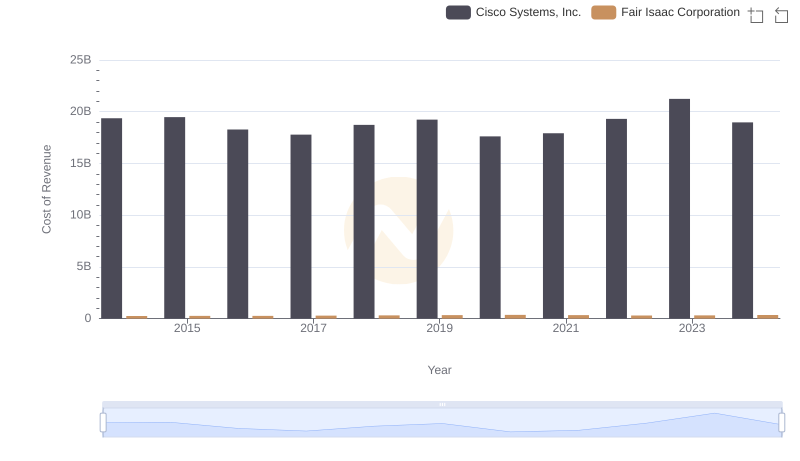

Cost Insights: Breaking Down Cisco Systems, Inc. and Fair Isaac Corporation's Expenses

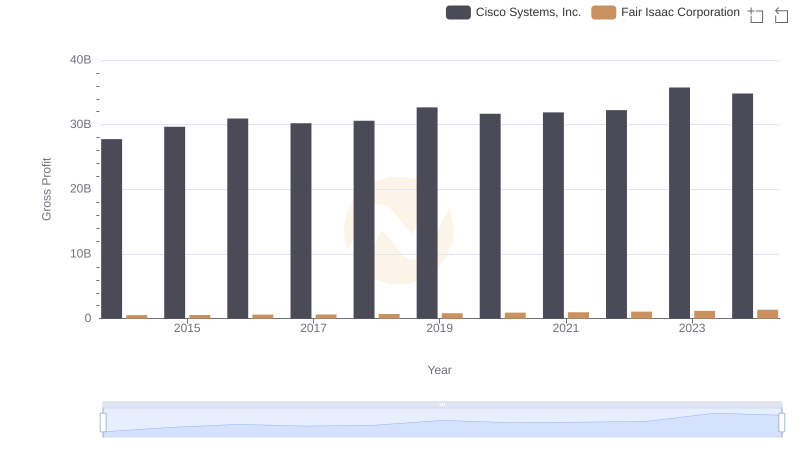

Cisco Systems, Inc. vs Fair Isaac Corporation: A Gross Profit Performance Breakdown

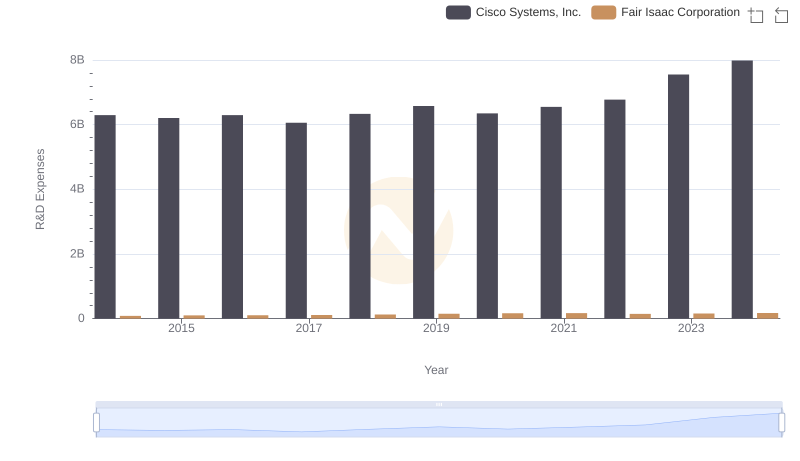

Analyzing R&D Budgets: Cisco Systems, Inc. vs Fair Isaac Corporation

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and Fair Isaac Corporation

Professional EBITDA Benchmarking: Cisco Systems, Inc. vs The Trade Desk, Inc.

Comparative EBITDA Analysis: Cisco Systems, Inc. vs NetEase, Inc.

Cisco Systems, Inc. and VMware, Inc.: A Detailed Examination of EBITDA Performance

Comparative EBITDA Analysis: Cisco Systems, Inc. vs NXP Semiconductors N.V.

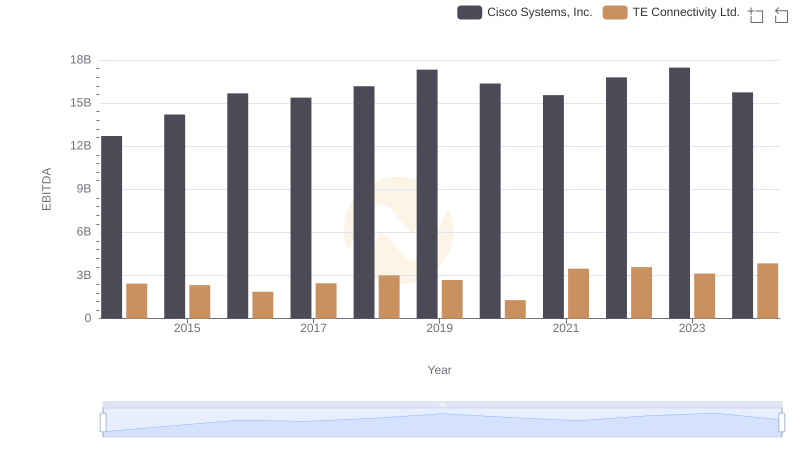

Professional EBITDA Benchmarking: Cisco Systems, Inc. vs TE Connectivity Ltd.

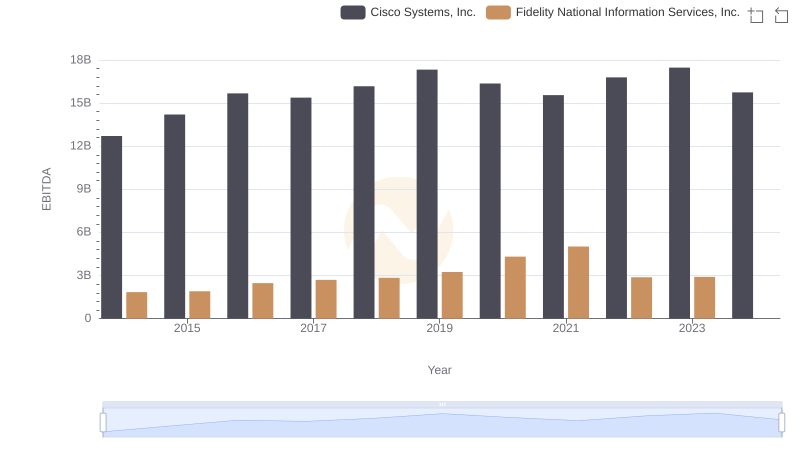

Comprehensive EBITDA Comparison: Cisco Systems, Inc. vs Fidelity National Information Services, Inc.

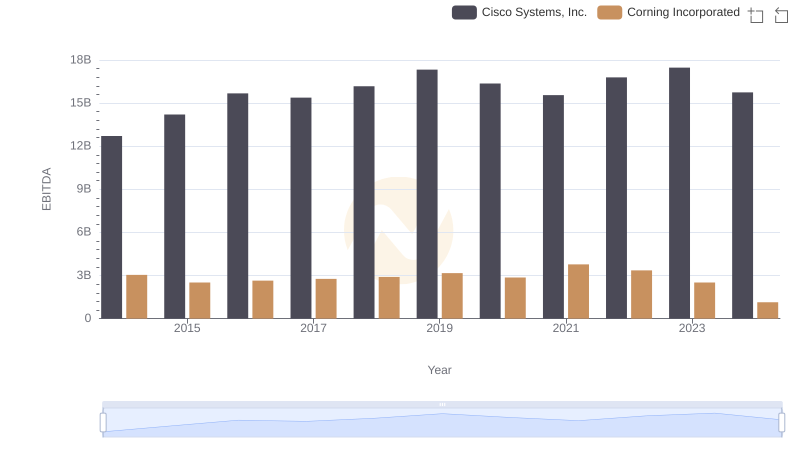

Cisco Systems, Inc. vs Corning Incorporated: In-Depth EBITDA Performance Comparison