| __timestamp | Cisco Systems, Inc. | Fair Isaac Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 27769000000 | 539704000 |

| Thursday, January 1, 2015 | 29681000000 | 568246000 |

| Friday, January 1, 2016 | 30960000000 | 616183000 |

| Sunday, January 1, 2017 | 30224000000 | 645046000 |

| Monday, January 1, 2018 | 30606000000 | 721776000 |

| Tuesday, January 1, 2019 | 32666000000 | 823238000 |

| Wednesday, January 1, 2020 | 31683000000 | 933420000 |

| Friday, January 1, 2021 | 31894000000 | 984074000 |

| Saturday, January 1, 2022 | 32248000000 | 1075096000 |

| Sunday, January 1, 2023 | 35753000000 | 1202504000 |

| Monday, January 1, 2024 | 34828000000 | 1369320000 |

Unleashing insights

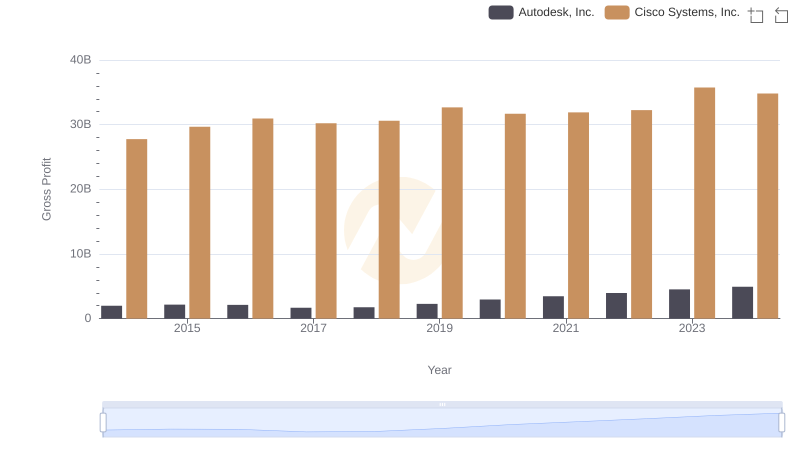

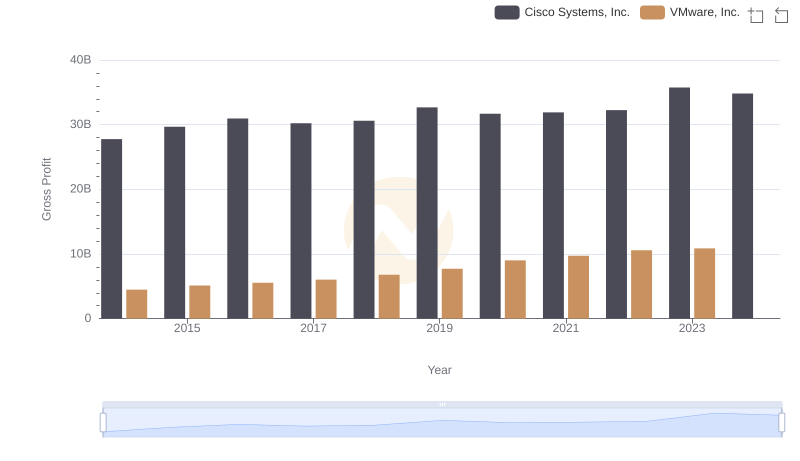

In the ever-evolving landscape of technology and finance, Cisco Systems, Inc. and Fair Isaac Corporation (FICO) have carved distinct niches. From 2014 to 2024, Cisco's gross profit has shown a robust upward trend, peaking at approximately $35.8 billion in 2023, a 29% increase from 2014. Meanwhile, FICO, a leader in analytics software, has seen its gross profit grow by over 150% during the same period, reaching around $1.37 billion in 2024.

This comparison underscores the diverse strategies and market dynamics that drive these two industry leaders, offering valuable insights for investors and analysts alike.

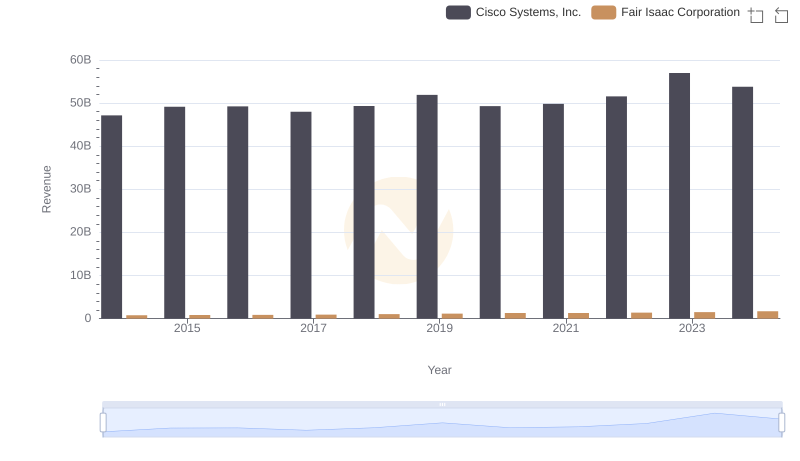

Annual Revenue Comparison: Cisco Systems, Inc. vs Fair Isaac Corporation

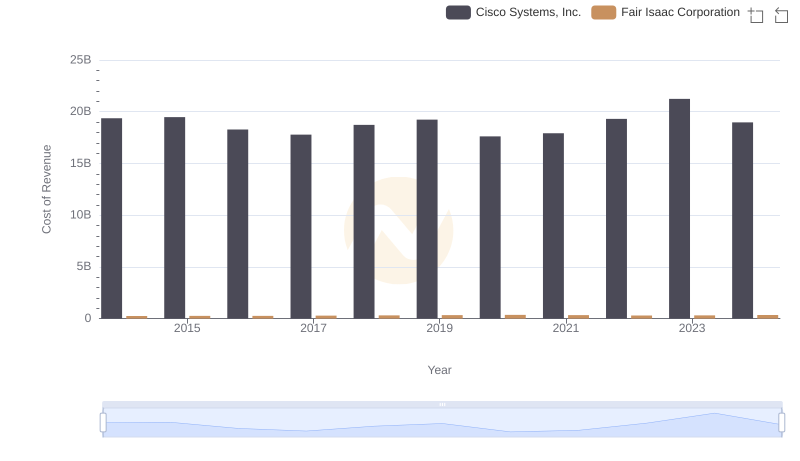

Cost Insights: Breaking Down Cisco Systems, Inc. and Fair Isaac Corporation's Expenses

Gross Profit Analysis: Comparing Cisco Systems, Inc. and Autodesk, Inc.

Cisco Systems, Inc. vs VMware, Inc.: A Gross Profit Performance Breakdown

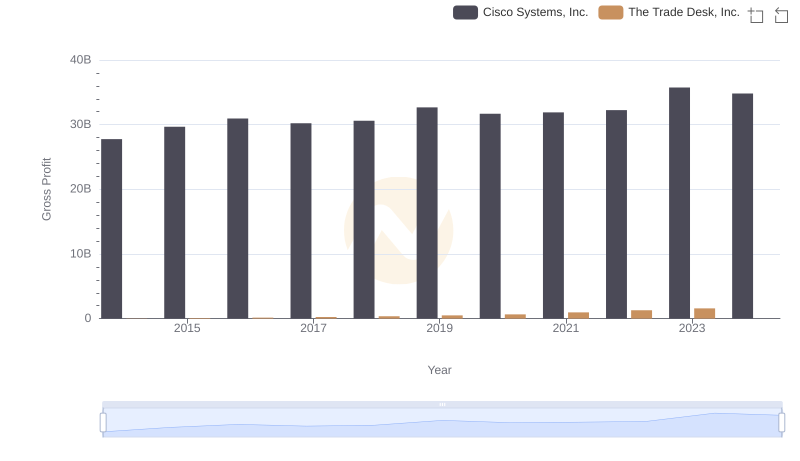

Gross Profit Analysis: Comparing Cisco Systems, Inc. and The Trade Desk, Inc.

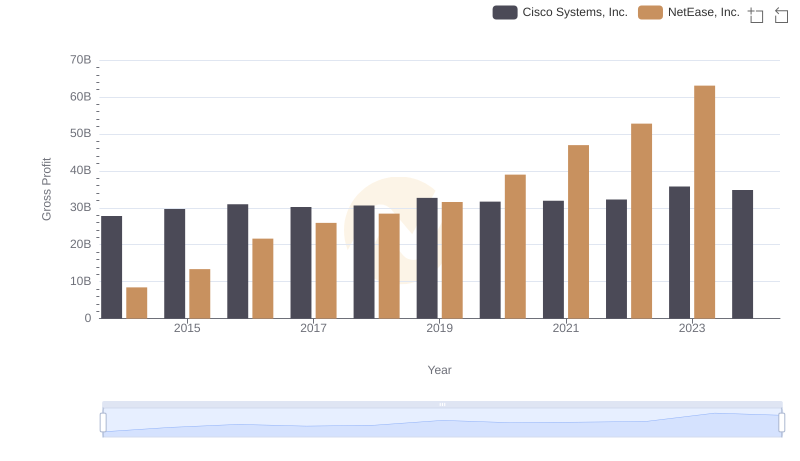

Gross Profit Comparison: Cisco Systems, Inc. and NetEase, Inc. Trends

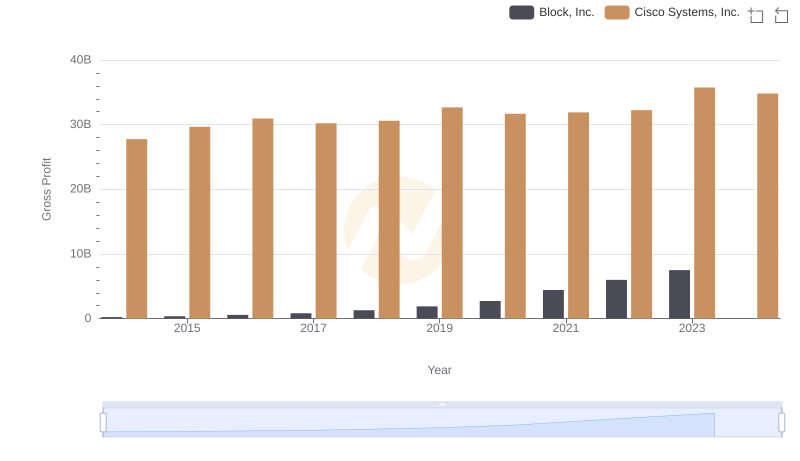

Gross Profit Comparison: Cisco Systems, Inc. and Block, Inc. Trends

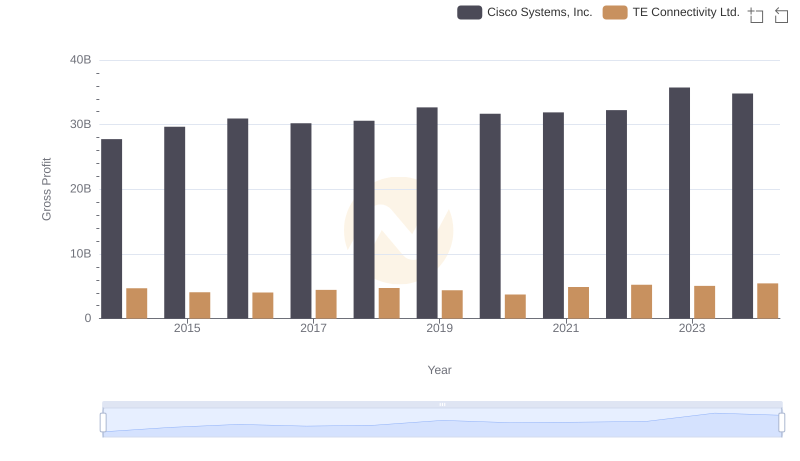

Who Generates Higher Gross Profit? Cisco Systems, Inc. or TE Connectivity Ltd.

Key Insights on Gross Profit: Cisco Systems, Inc. vs NXP Semiconductors N.V.

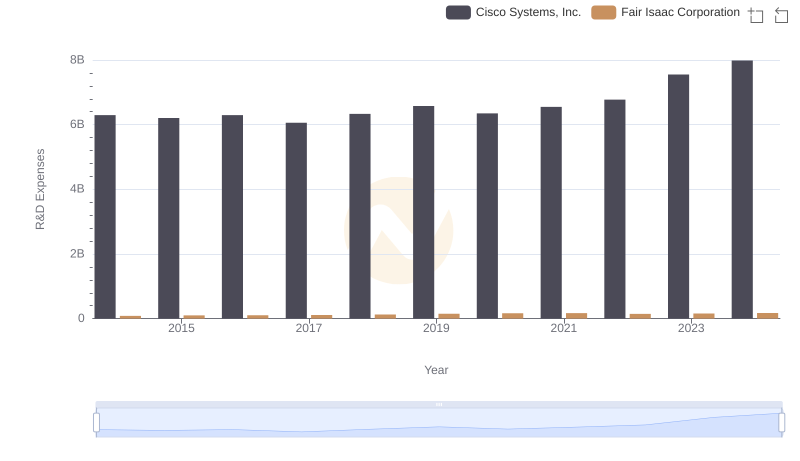

Analyzing R&D Budgets: Cisco Systems, Inc. vs Fair Isaac Corporation

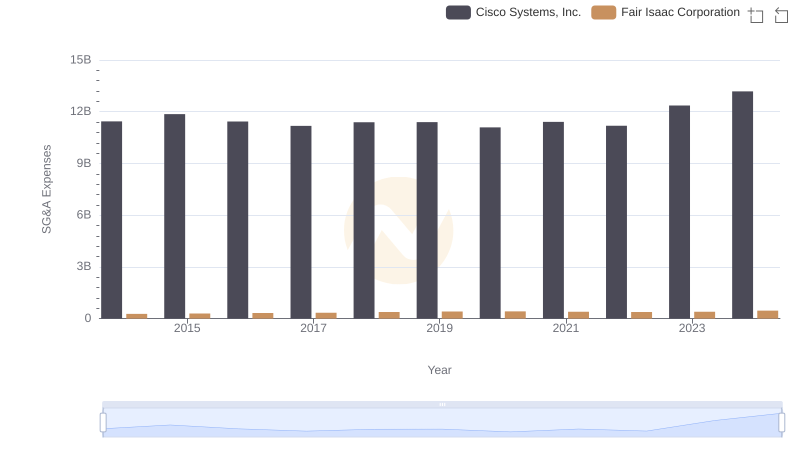

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and Fair Isaac Corporation

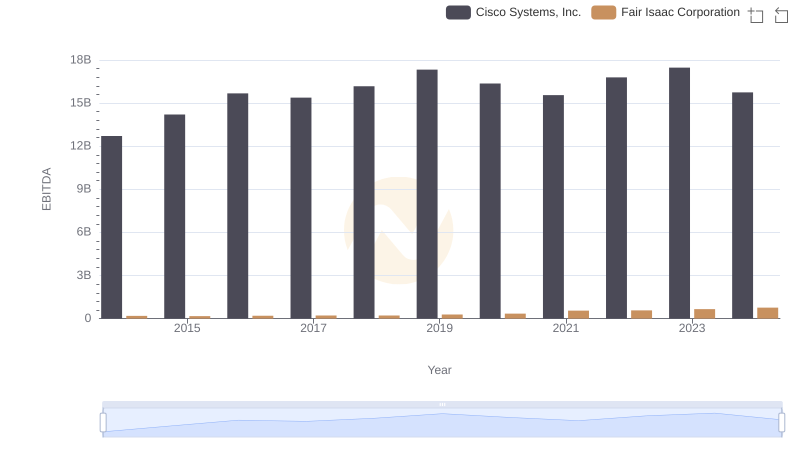

EBITDA Analysis: Evaluating Cisco Systems, Inc. Against Fair Isaac Corporation