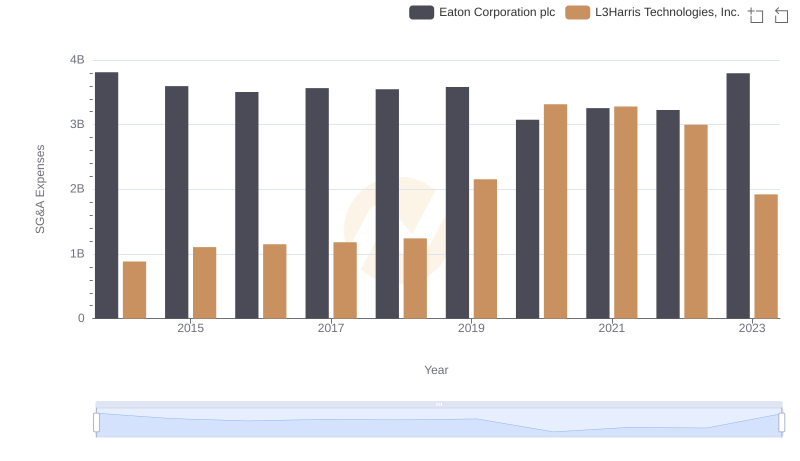

| __timestamp | Eaton Corporation plc | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 144817000 |

| Thursday, January 1, 2015 | 3596000000 | 153589000 |

| Friday, January 1, 2016 | 3505000000 | 152391000 |

| Sunday, January 1, 2017 | 3565000000 | 177205000 |

| Monday, January 1, 2018 | 3548000000 | 194368000 |

| Tuesday, January 1, 2019 | 3583000000 | 206125000 |

| Wednesday, January 1, 2020 | 3075000000 | 184185000 |

| Friday, January 1, 2021 | 3256000000 | 223757000 |

| Saturday, January 1, 2022 | 3227000000 | 258883000 |

| Sunday, January 1, 2023 | 3795000000 | 281053000 |

| Monday, January 1, 2024 | 4077000000 |

Unleashing the power of data

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Eaton Corporation plc and Old Dominion Freight Line, Inc. have showcased contrasting strategies in handling these costs. Eaton, a global power management company, consistently reported higher SG&A expenses, averaging around $3.5 billion annually. In contrast, Old Dominion, a leading freight transportation company, maintained a leaner approach, with expenses averaging just under $200 million per year.

Despite Eaton's larger scale, Old Dominion's SG&A costs grew by approximately 94% over the decade, reflecting strategic investments in growth. Meanwhile, Eaton's expenses fluctuated, peaking in 2014 and 2023. This analysis highlights the diverse approaches to cost management in different industries, offering insights into how companies can optimize their operational efficiency.

Eaton Corporation plc vs Old Dominion Freight Line, Inc.: Annual Revenue Growth Compared

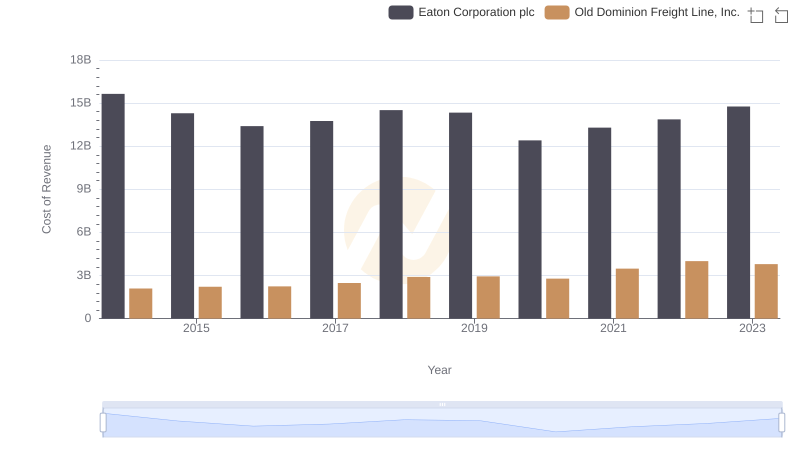

Cost of Revenue Trends: Eaton Corporation plc vs Old Dominion Freight Line, Inc.

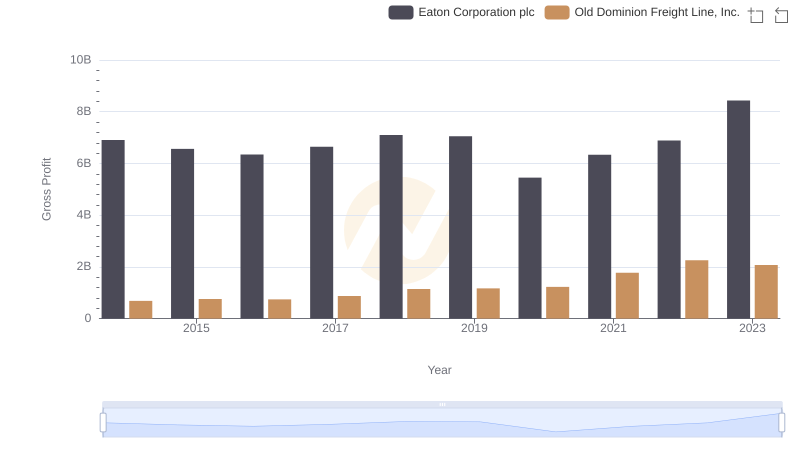

Gross Profit Analysis: Comparing Eaton Corporation plc and Old Dominion Freight Line, Inc.

Cost Management Insights: SG&A Expenses for Eaton Corporation plc and AMETEK, Inc.

Who Optimizes SG&A Costs Better? Eaton Corporation plc or L3Harris Technologies, Inc.