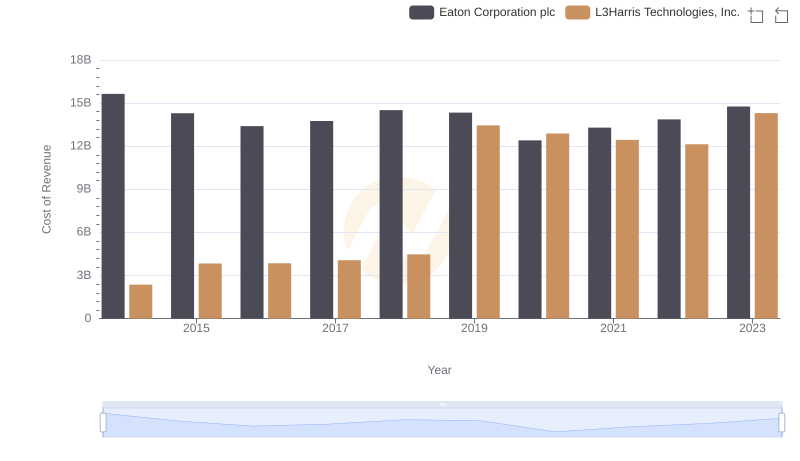

| __timestamp | Eaton Corporation plc | L3Harris Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 883000000 |

| Thursday, January 1, 2015 | 3596000000 | 1105000000 |

| Friday, January 1, 2016 | 3505000000 | 1150000000 |

| Sunday, January 1, 2017 | 3565000000 | 1182000000 |

| Monday, January 1, 2018 | 3548000000 | 1242000000 |

| Tuesday, January 1, 2019 | 3583000000 | 2156000000 |

| Wednesday, January 1, 2020 | 3075000000 | 3315000000 |

| Friday, January 1, 2021 | 3256000000 | 3280000000 |

| Saturday, January 1, 2022 | 3227000000 | 2998000000 |

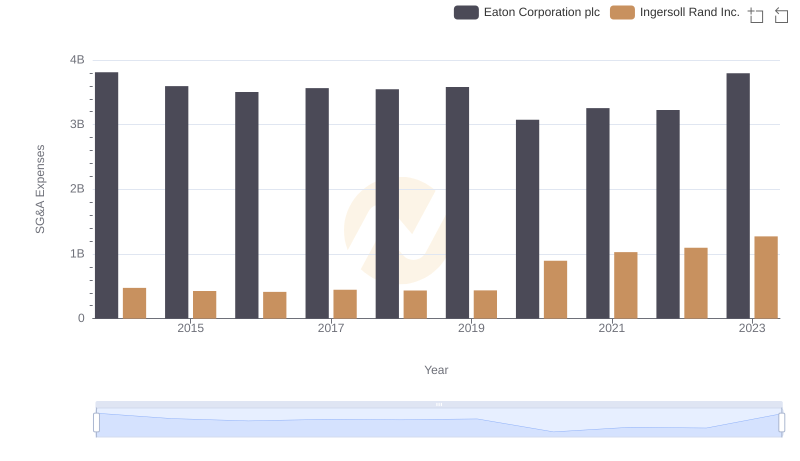

| Sunday, January 1, 2023 | 3795000000 | 1921000000 |

| Monday, January 1, 2024 | 4077000000 | 3568000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial and defense sectors, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Eaton Corporation plc and L3Harris Technologies, Inc. have demonstrated contrasting strategies in optimizing these costs.

From 2014 to 2023, Eaton consistently maintained higher SG&A expenses, peaking at approximately $3.8 billion in 2014 and 2023. However, their expenses showed a slight downward trend, decreasing by about 1% annually. In contrast, L3Harris, starting with a modest $883 million in 2014, saw a significant increase, reaching a peak of $3.3 billion in 2020. This represents a staggering 275% rise over six years, before a reduction to $1.9 billion in 2023.

Eaton's steady approach contrasts with L3Harris's fluctuating expenses, reflecting different strategic priorities. As these companies navigate economic challenges, their SG&A management will remain a key indicator of operational efficiency.

Analyzing Cost of Revenue: Eaton Corporation plc and L3Harris Technologies, Inc.

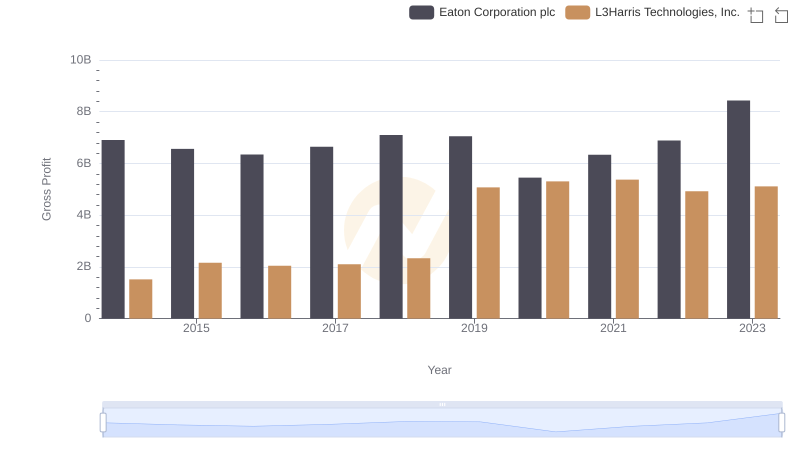

Gross Profit Comparison: Eaton Corporation plc and L3Harris Technologies, Inc. Trends

Cost Management Insights: SG&A Expenses for Eaton Corporation plc and AMETEK, Inc.

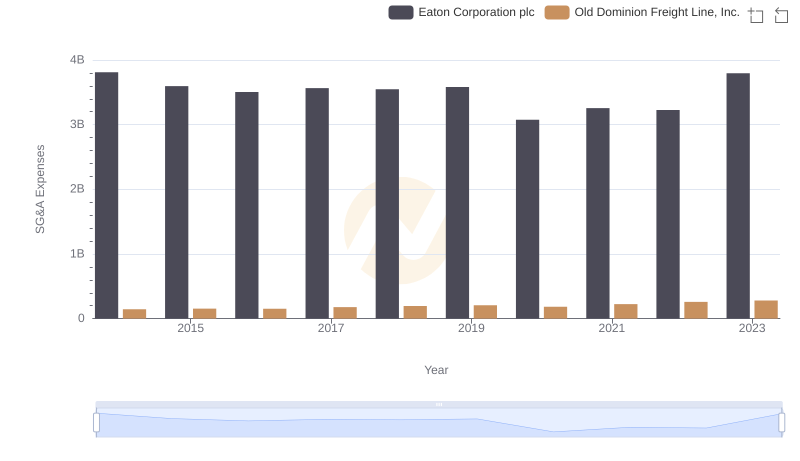

Eaton Corporation plc or Old Dominion Freight Line, Inc.: Who Manages SG&A Costs Better?

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Ingersoll Rand Inc.