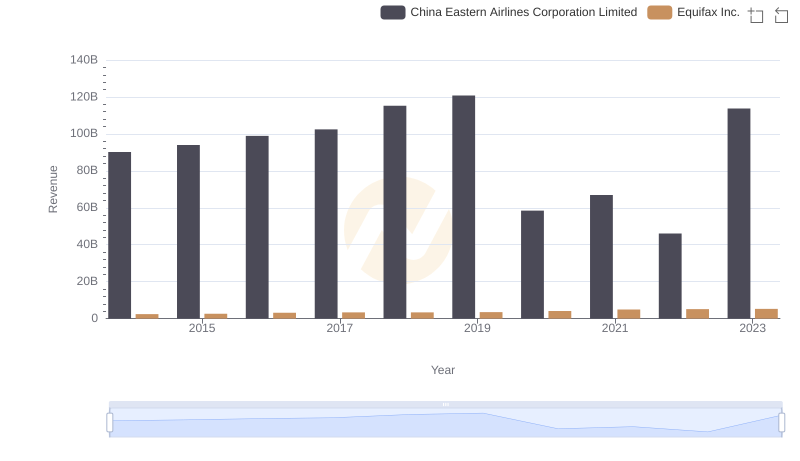

| __timestamp | China Eastern Airlines Corporation Limited | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 78741000000 | 844700000 |

| Thursday, January 1, 2015 | 77237000000 | 887400000 |

| Friday, January 1, 2016 | 82676000000 | 1113400000 |

| Sunday, January 1, 2017 | 91592000000 | 1210700000 |

| Monday, January 1, 2018 | 103476000000 | 1440400000 |

| Tuesday, January 1, 2019 | 108865000000 | 1521700000 |

| Wednesday, January 1, 2020 | 72523000000 | 1737400000 |

| Friday, January 1, 2021 | 81828000000 | 1980900000 |

| Saturday, January 1, 2022 | 74599000000 | 2177200000 |

| Sunday, January 1, 2023 | 112461000000 | 2335100000 |

| Monday, January 1, 2024 | 0 |

Unleashing insights

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's financial health. This analysis delves into the cost of revenue trends for Equifax Inc. and China Eastern Airlines Corporation Limited from 2014 to 2023.

Over the past decade, China Eastern Airlines has seen a fluctuating yet generally upward trend in its cost of revenue, peaking in 2023 with a 15% increase from its 2014 figures. This reflects the airline industry's dynamic nature, influenced by factors such as fuel prices and operational expansions. In contrast, Equifax Inc. has experienced a steady rise, with its cost of revenue growing by approximately 176% over the same period. This growth underscores the increasing demand for data analytics and credit reporting services.

These insights highlight the diverse challenges and opportunities faced by companies in different sectors, offering a window into their strategic financial management.

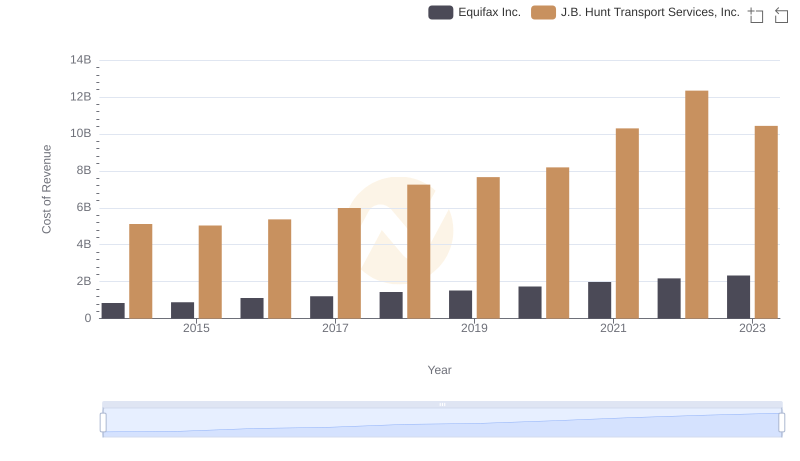

Cost of Revenue Trends: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

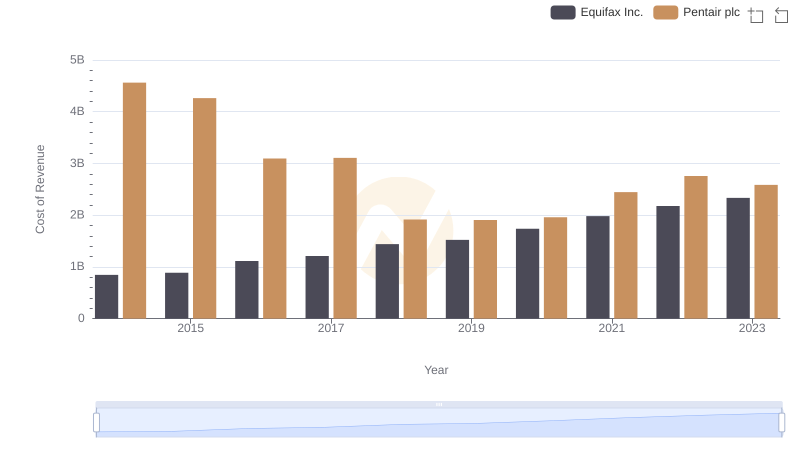

Analyzing Cost of Revenue: Equifax Inc. and Pentair plc

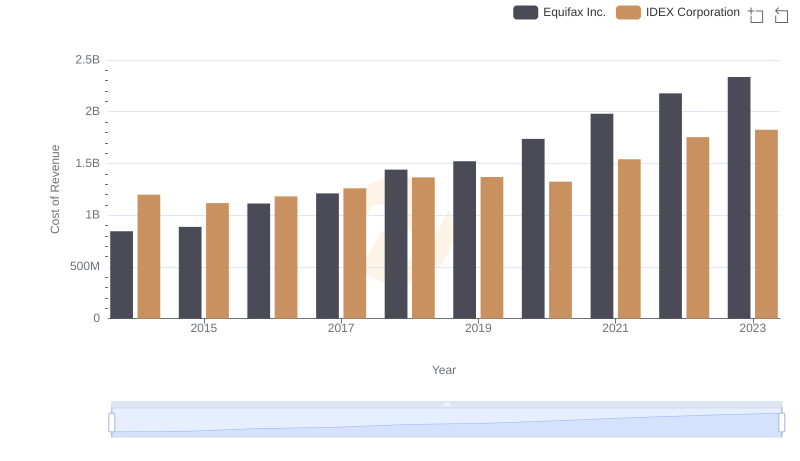

Cost Insights: Breaking Down Equifax Inc. and IDEX Corporation's Expenses

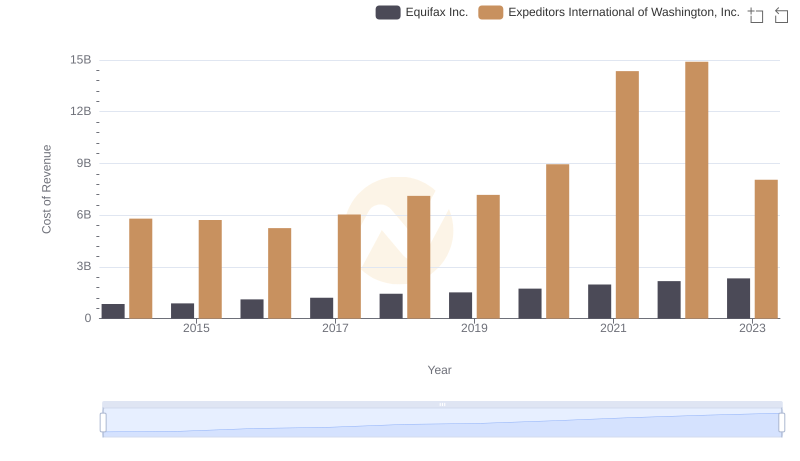

Cost of Revenue: Key Insights for Equifax Inc. and Expeditors International of Washington, Inc.

Breaking Down Revenue Trends: Equifax Inc. vs China Eastern Airlines Corporation Limited

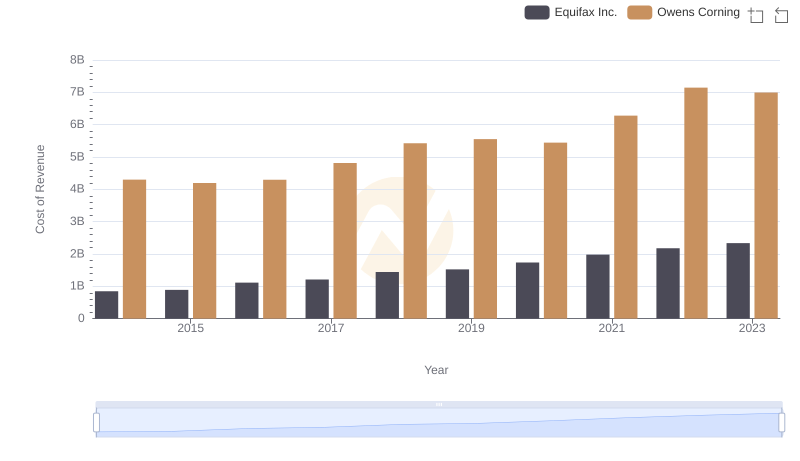

Cost of Revenue Trends: Equifax Inc. vs Owens Corning

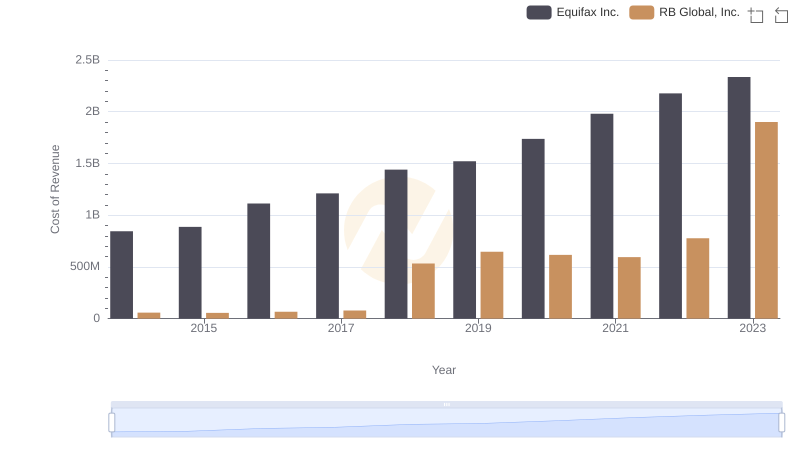

Cost Insights: Breaking Down Equifax Inc. and RB Global, Inc.'s Expenses