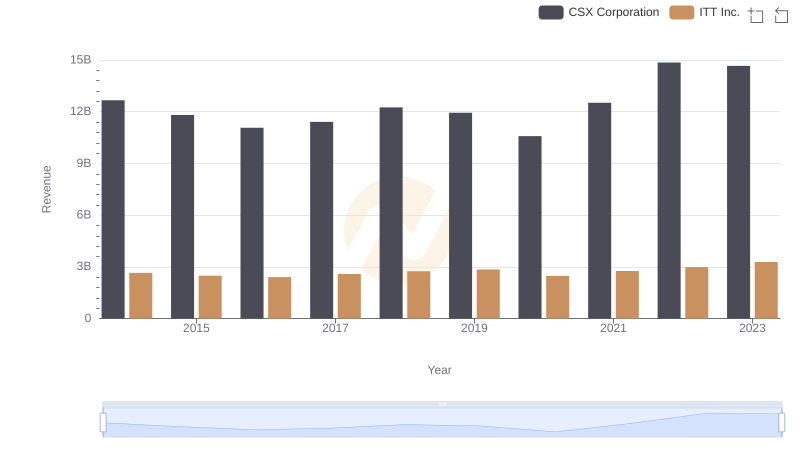

| __timestamp | CSX Corporation | ITT Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 9056000000 | 1788200000 |

| Thursday, January 1, 2015 | 8227000000 | 1676500000 |

| Friday, January 1, 2016 | 7680000000 | 1647200000 |

| Sunday, January 1, 2017 | 7635000000 | 1768100000 |

| Monday, January 1, 2018 | 7477000000 | 1857900000 |

| Tuesday, January 1, 2019 | 7063000000 | 1936300000 |

| Wednesday, January 1, 2020 | 6221000000 | 1695600000 |

| Friday, January 1, 2021 | 7382000000 | 1865500000 |

| Saturday, January 1, 2022 | 9068000000 | 2065400000 |

| Sunday, January 1, 2023 | 9130000000 | 2175700000 |

| Monday, January 1, 2024 | 2383400000 |

Data in motion

In the ever-evolving landscape of American industry, understanding the cost of revenue is crucial for evaluating a company's financial health. Over the past decade, CSX Corporation and ITT Inc. have shown distinct trends in their cost of revenue, reflecting their strategic priorities and market conditions.

From 2014 to 2023, CSX Corporation's cost of revenue fluctuated, peaking in 2023 with a 47% increase from its lowest point in 2020. This rise suggests a strategic shift or increased operational costs. In contrast, ITT Inc. experienced a steady climb, culminating in a 32% increase over the same period, indicating consistent growth or expansion efforts.

These trends highlight the differing strategies of these companies. CSX's volatility may point to adaptive strategies in response to market demands, while ITT's steady increase suggests a focus on sustainable growth. Investors and analysts should consider these patterns when evaluating potential opportunities.

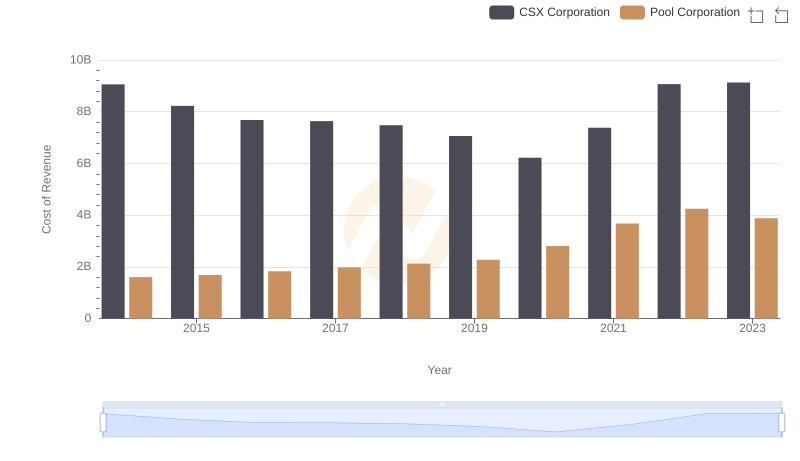

Comparing Cost of Revenue Efficiency: CSX Corporation vs Pool Corporation

CSX Corporation vs ITT Inc.: Annual Revenue Growth Compared

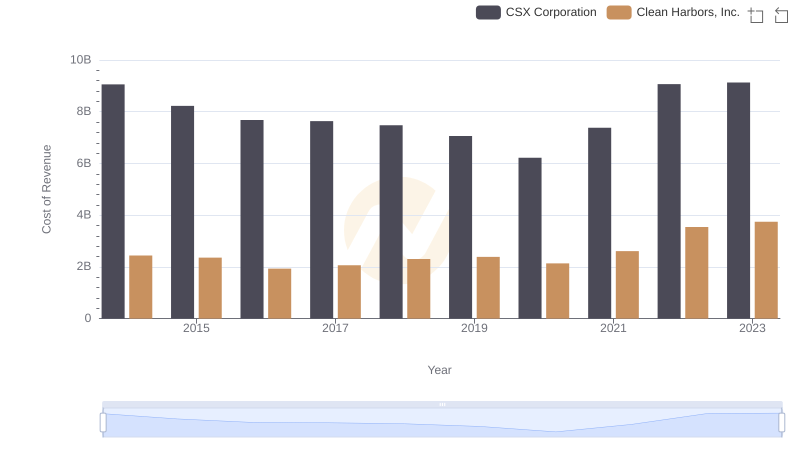

Cost of Revenue Comparison: CSX Corporation vs Clean Harbors, Inc.

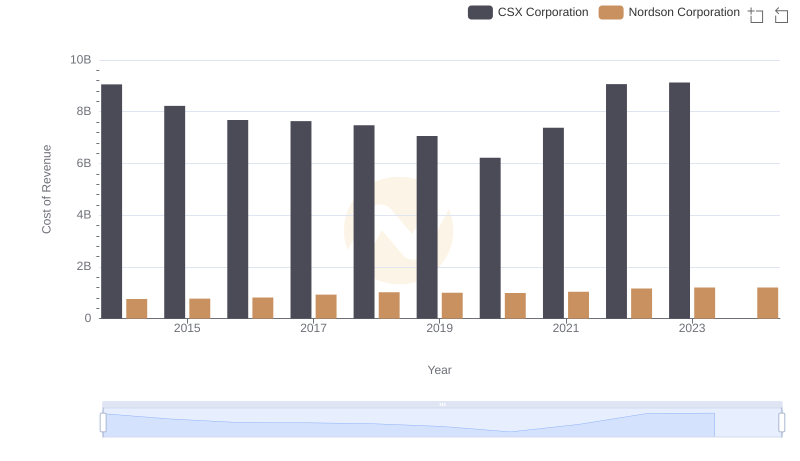

Cost Insights: Breaking Down CSX Corporation and Nordson Corporation's Expenses

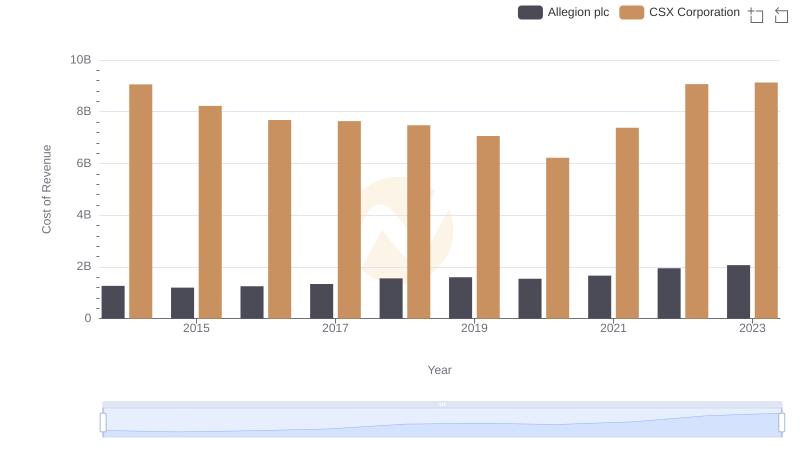

CSX Corporation vs Allegion plc: Efficiency in Cost of Revenue Explored

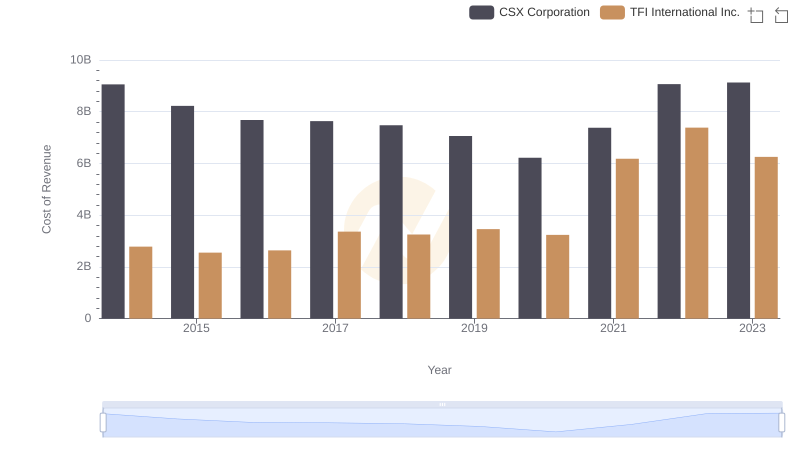

Cost of Revenue: Key Insights for CSX Corporation and TFI International Inc.

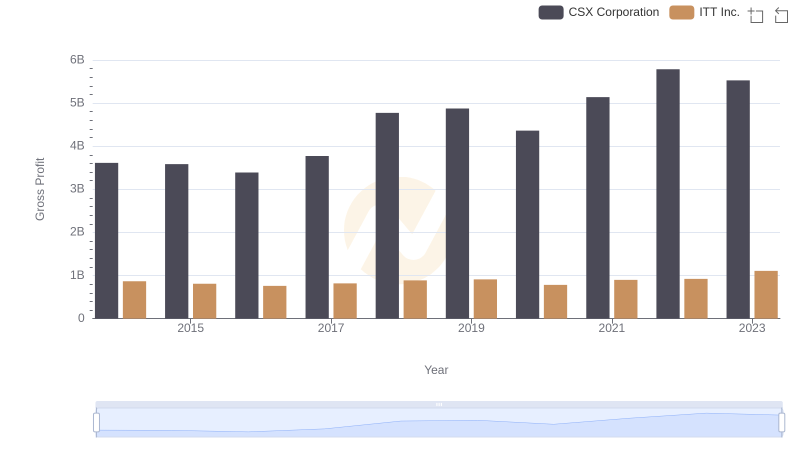

Gross Profit Comparison: CSX Corporation and ITT Inc. Trends

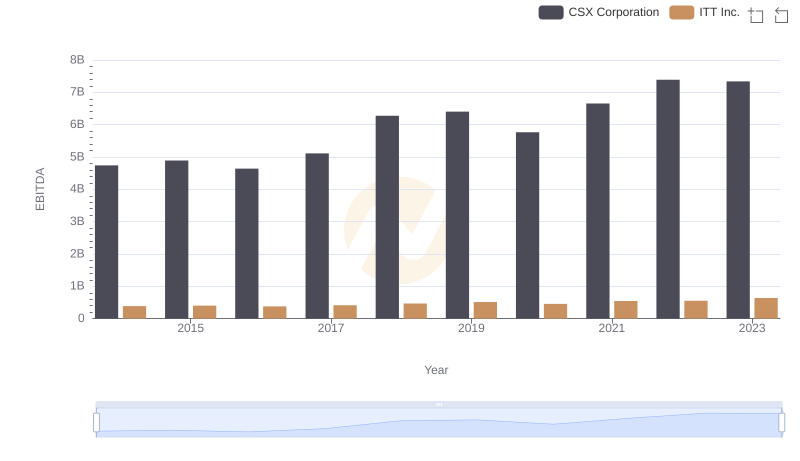

CSX Corporation and ITT Inc.: A Detailed Examination of EBITDA Performance