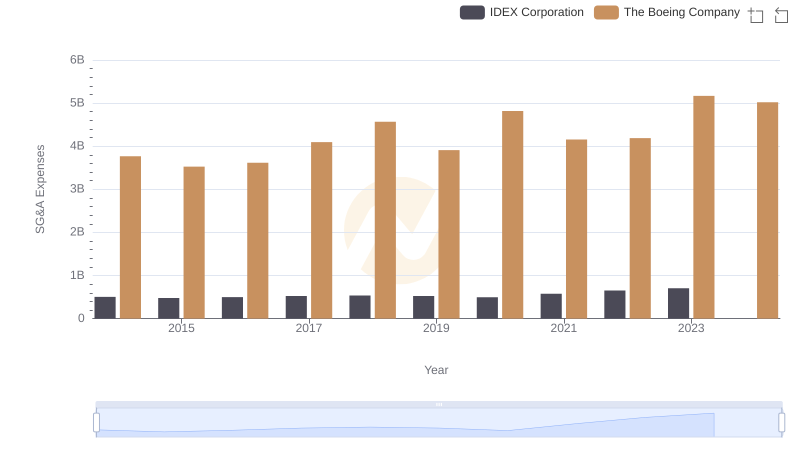

| __timestamp | IDEX Corporation | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1198452000 | 76752000000 |

| Thursday, January 1, 2015 | 1116353000 | 82088000000 |

| Friday, January 1, 2016 | 1182276000 | 80790000000 |

| Sunday, January 1, 2017 | 1260634000 | 76066000000 |

| Monday, January 1, 2018 | 1365771000 | 81490000000 |

| Tuesday, January 1, 2019 | 1369539000 | 72093000000 |

| Wednesday, January 1, 2020 | 1324222000 | 63843000000 |

| Friday, January 1, 2021 | 1540300000 | 59237000000 |

| Saturday, January 1, 2022 | 1755000000 | 63078000000 |

| Sunday, January 1, 2023 | 1825400000 | 70070000000 |

| Monday, January 1, 2024 | 1814000000 | 68508000000 |

Unlocking the unknown

In the ever-evolving landscape of aerospace and industrial manufacturing, understanding cost dynamics is crucial. The Boeing Company, a titan in aerospace, and IDEX Corporation, a leader in fluid and metering technologies, present a fascinating study in contrasts. From 2014 to 2023, Boeing's cost of revenue has seen a significant decline of approximately 9%, reflecting the industry's challenges and the company's strategic adjustments. In contrast, IDEX Corporation has experienced a robust 52% increase in its cost of revenue, indicative of its growth and expansion strategies.

This comparison highlights the diverse strategies and market conditions faced by these industry leaders.

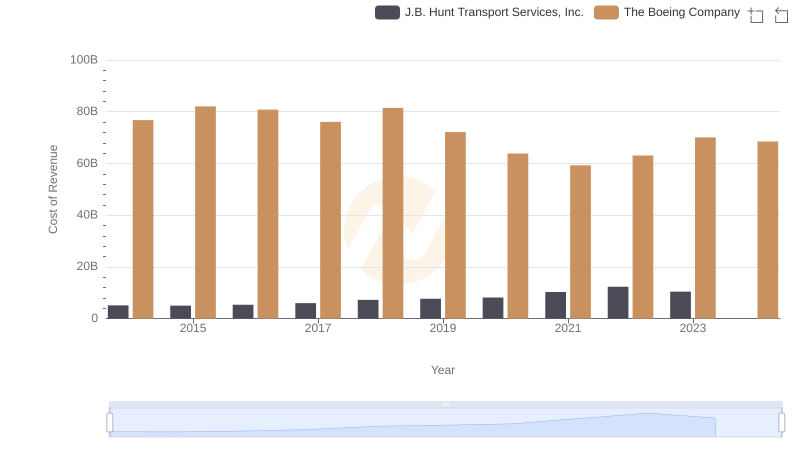

Comparing Cost of Revenue Efficiency: The Boeing Company vs J.B. Hunt Transport Services, Inc.

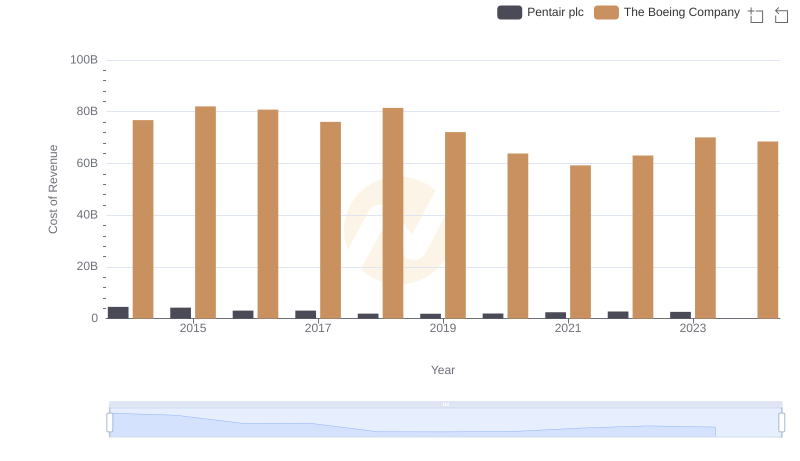

Comparing Cost of Revenue Efficiency: The Boeing Company vs Pentair plc

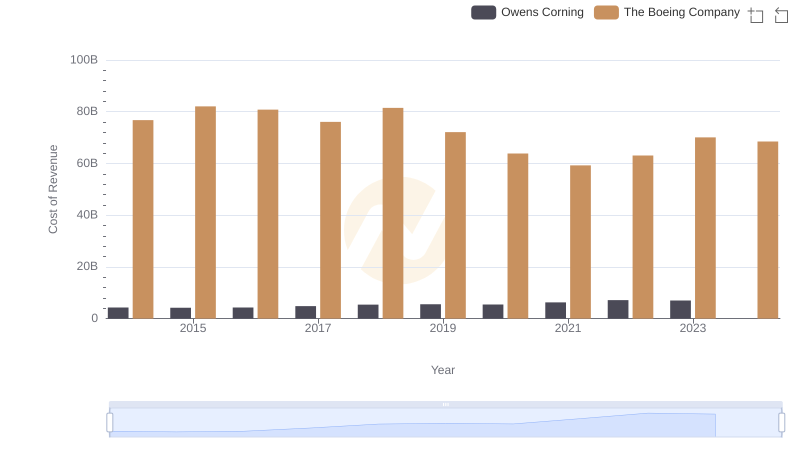

Cost of Revenue: Key Insights for The Boeing Company and Owens Corning

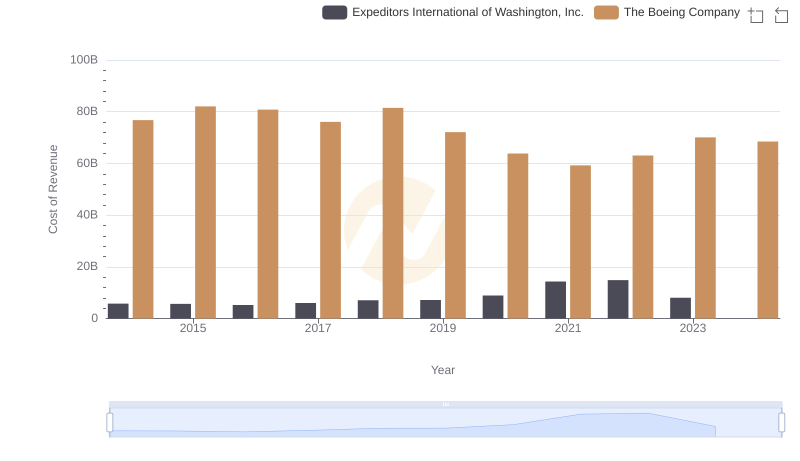

Cost of Revenue Comparison: The Boeing Company vs Expeditors International of Washington, Inc.

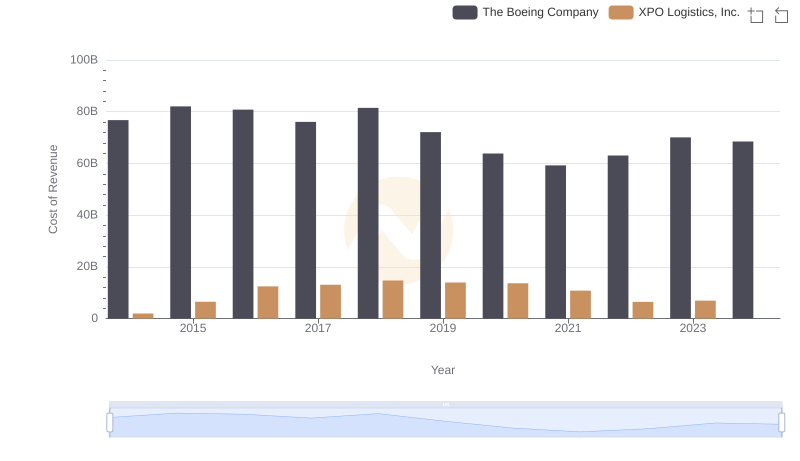

Analyzing Cost of Revenue: The Boeing Company and XPO Logistics, Inc.

The Boeing Company and IDEX Corporation: SG&A Spending Patterns Compared