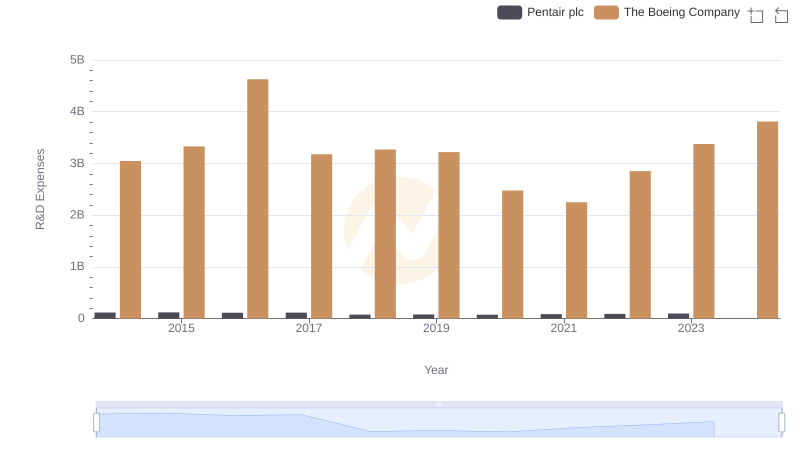

| __timestamp | Pentair plc | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 4563000000 | 76752000000 |

| Thursday, January 1, 2015 | 4263200000 | 82088000000 |

| Friday, January 1, 2016 | 3095900000 | 80790000000 |

| Sunday, January 1, 2017 | 3107400000 | 76066000000 |

| Monday, January 1, 2018 | 1917400000 | 81490000000 |

| Tuesday, January 1, 2019 | 1905700000 | 72093000000 |

| Wednesday, January 1, 2020 | 1960200000 | 63843000000 |

| Friday, January 1, 2021 | 2445600000 | 59237000000 |

| Saturday, January 1, 2022 | 2757200000 | 63078000000 |

| Sunday, January 1, 2023 | 2585300000 | 70070000000 |

| Monday, January 1, 2024 | 2484000000 | 68508000000 |

Unlocking the unknown

In the world of industrial titans, The Boeing Company and Pentair plc stand as paragons of cost efficiency. Over the past decade, Boeing's cost of revenue has seen a notable fluctuation, peaking in 2015 and 2018, with a significant dip in 2021. This reflects the broader challenges faced by the aerospace industry, including supply chain disruptions and global economic shifts. Meanwhile, Pentair, a leader in water solutions, has maintained a more stable cost structure, with a notable reduction in 2018, suggesting strategic cost management.

From 2014 to 2023, Boeing's cost of revenue averaged around 72 billion, while Pentair's hovered near 2.9 billion. This stark contrast highlights the scale and operational differences between the two. As we look to 2024, Boeing's data remains robust, while Pentair's absence suggests a need for further insights.

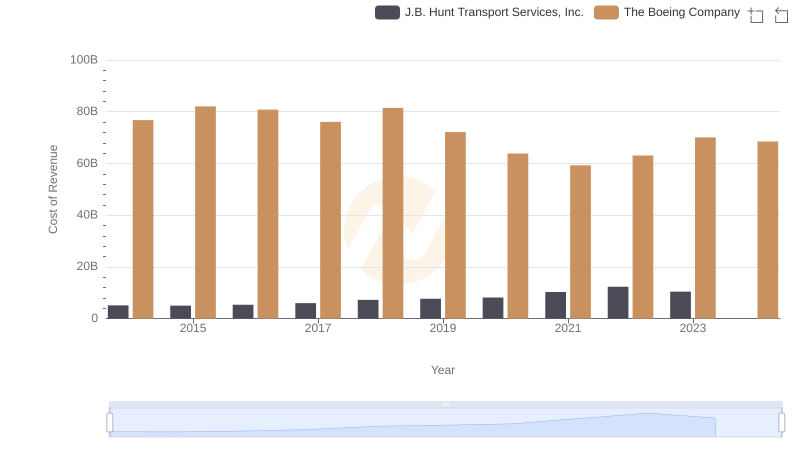

Comparing Cost of Revenue Efficiency: The Boeing Company vs J.B. Hunt Transport Services, Inc.

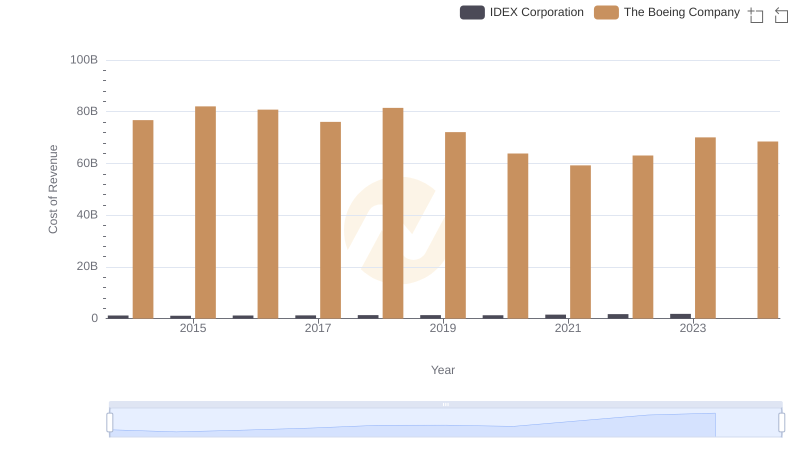

Cost of Revenue Comparison: The Boeing Company vs IDEX Corporation

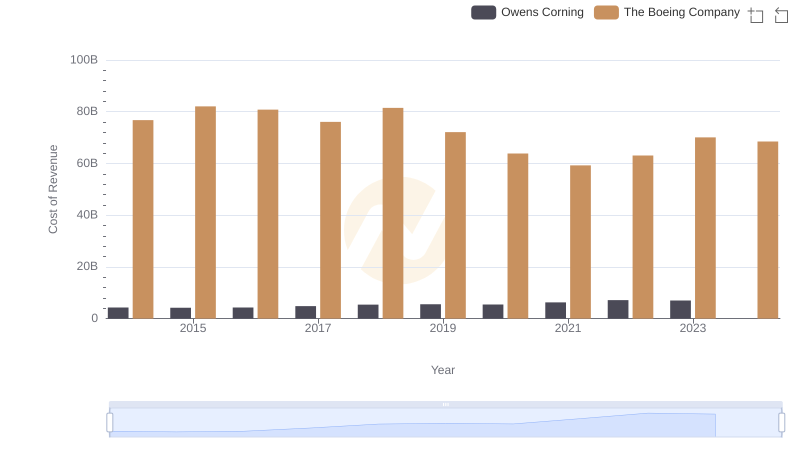

Cost of Revenue: Key Insights for The Boeing Company and Owens Corning

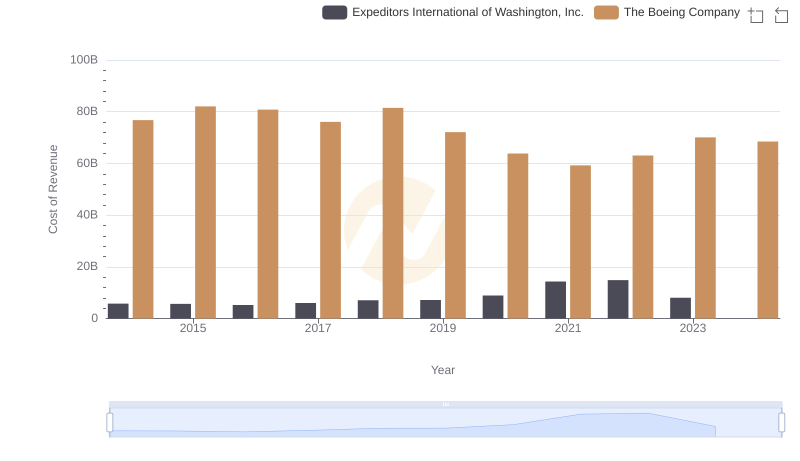

Cost of Revenue Comparison: The Boeing Company vs Expeditors International of Washington, Inc.

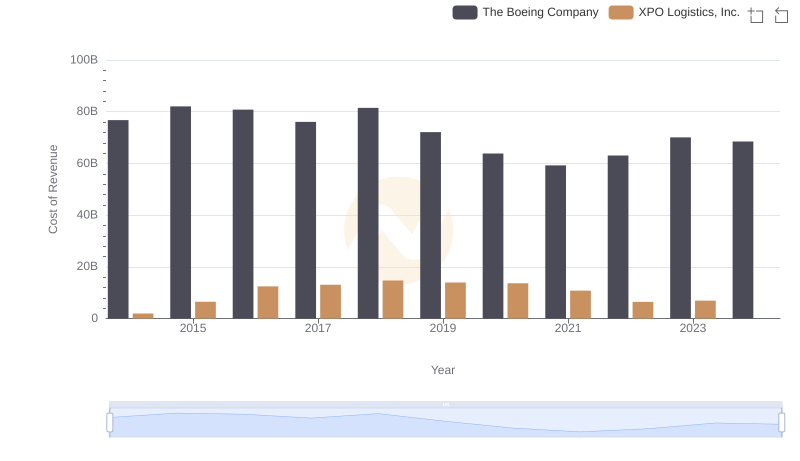

Analyzing Cost of Revenue: The Boeing Company and XPO Logistics, Inc.

R&D Spending Showdown: The Boeing Company vs Pentair plc