| __timestamp | Expeditors International of Washington, Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 5800725000 | 76752000000 |

| Thursday, January 1, 2015 | 5720848000 | 82088000000 |

| Friday, January 1, 2016 | 5247244000 | 80790000000 |

| Sunday, January 1, 2017 | 6037921000 | 76066000000 |

| Monday, January 1, 2018 | 7118083000 | 81490000000 |

| Tuesday, January 1, 2019 | 7178405000 | 72093000000 |

| Wednesday, January 1, 2020 | 8953716000 | 63843000000 |

| Friday, January 1, 2021 | 14358105000 | 59237000000 |

| Saturday, January 1, 2022 | 14900154000 | 63078000000 |

| Sunday, January 1, 2023 | 8054634000 | 70070000000 |

| Monday, January 1, 2024 | 0 | 68508000000 |

Unleashing insights

In the ever-evolving landscape of global commerce, The Boeing Company and Expeditors International of Washington, Inc. stand as titans in their respective fields. Over the past decade, these companies have navigated the turbulent waters of economic shifts, technological advancements, and global disruptions.

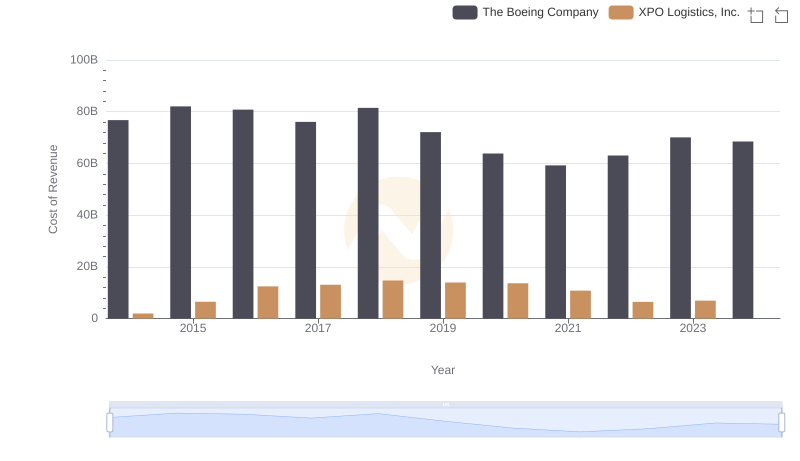

From 2014 to 2023, Boeing's cost of revenue has seen fluctuations, peaking in 2015 and 2018, with a notable dip in 2020, reflecting the impact of global events on the aerospace industry. In contrast, Expeditors International experienced a steady rise, with a significant surge in 2021, marking a 75% increase from 2014. This divergence highlights the resilience and adaptability of logistics in a world increasingly reliant on efficient supply chains.

While 2024 data for Expeditors is missing, Boeing's figures suggest a stabilization post-pandemic. As these companies continue to adapt, their financial strategies will be pivotal in shaping their future trajectories.

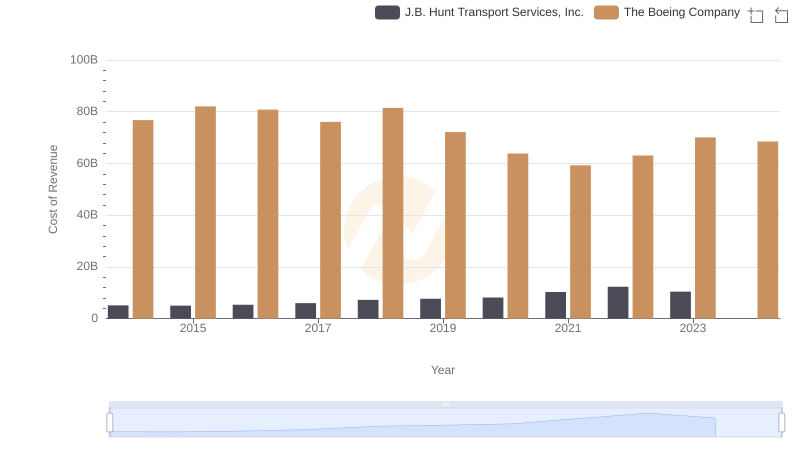

Comparing Cost of Revenue Efficiency: The Boeing Company vs J.B. Hunt Transport Services, Inc.

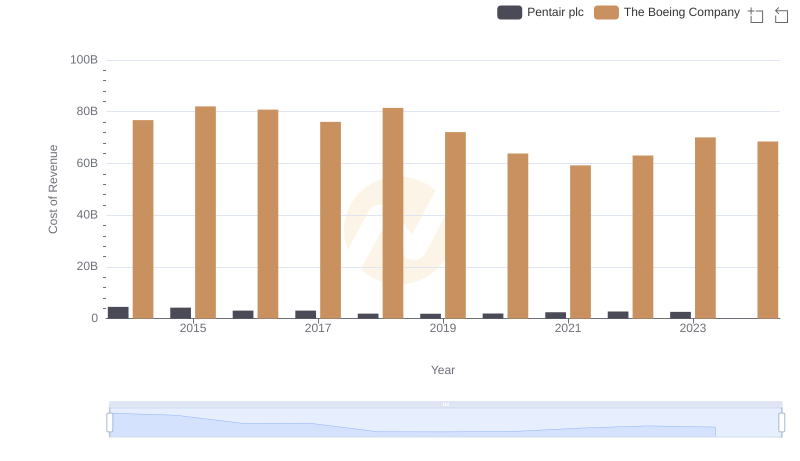

Comparing Cost of Revenue Efficiency: The Boeing Company vs Pentair plc

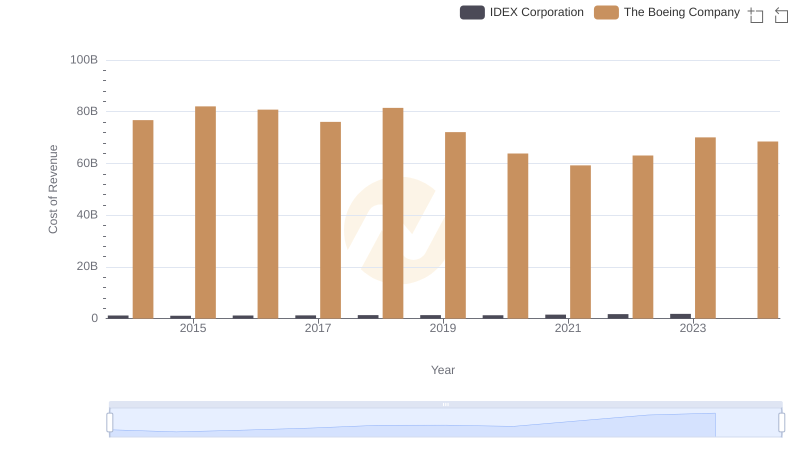

Cost of Revenue Comparison: The Boeing Company vs IDEX Corporation

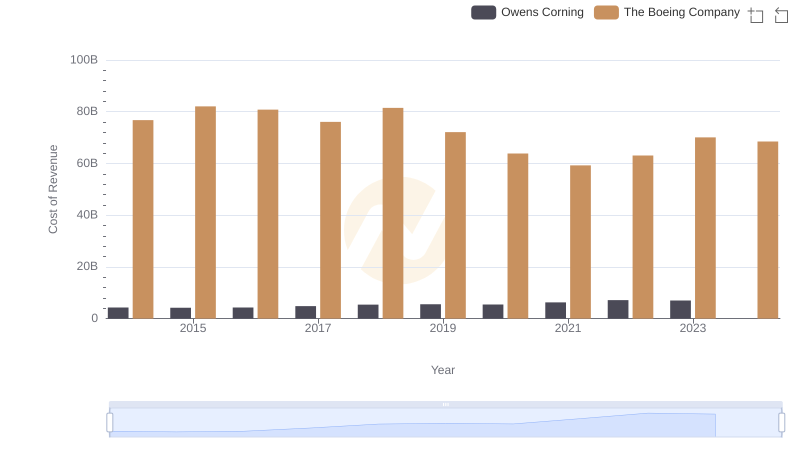

Cost of Revenue: Key Insights for The Boeing Company and Owens Corning

Analyzing Cost of Revenue: The Boeing Company and XPO Logistics, Inc.

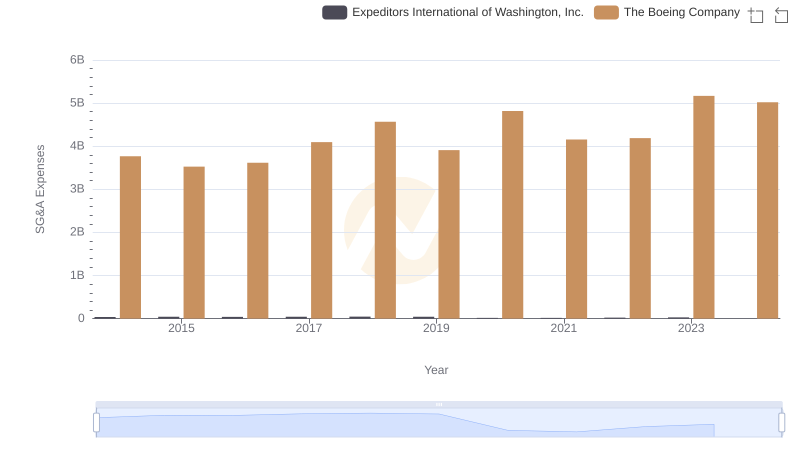

Cost Management Insights: SG&A Expenses for The Boeing Company and Expeditors International of Washington, Inc.