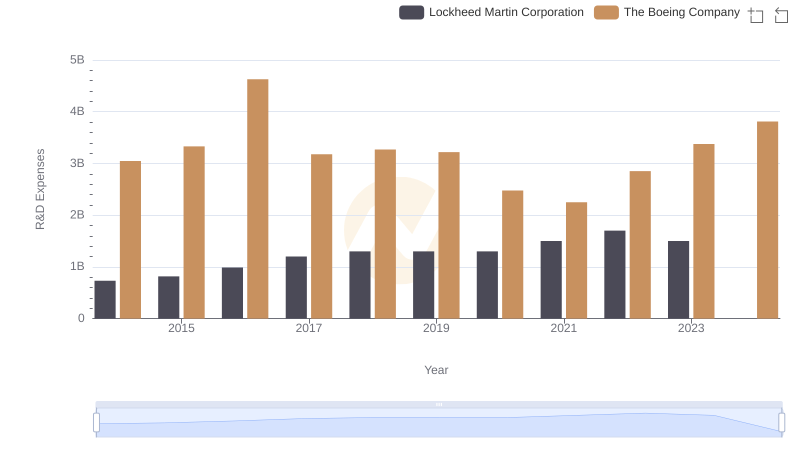

| __timestamp | Lockheed Martin Corporation | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 40226000000 | 76752000000 |

| Thursday, January 1, 2015 | 40830000000 | 82088000000 |

| Friday, January 1, 2016 | 42106000000 | 80790000000 |

| Sunday, January 1, 2017 | 45500000000 | 76066000000 |

| Monday, January 1, 2018 | 46392000000 | 81490000000 |

| Tuesday, January 1, 2019 | 51445000000 | 72093000000 |

| Wednesday, January 1, 2020 | 56744000000 | 63843000000 |

| Friday, January 1, 2021 | 57983000000 | 59237000000 |

| Saturday, January 1, 2022 | 57697000000 | 63078000000 |

| Sunday, January 1, 2023 | 59092000000 | 70070000000 |

| Monday, January 1, 2024 | 64113000000 | 68508000000 |

In pursuit of knowledge

In the competitive aerospace and defense industry, understanding cost structures is crucial. Over the past decade, The Boeing Company and Lockheed Martin Corporation have showcased distinct trends in their cost of revenue. From 2014 to 2024, Boeing's cost of revenue fluctuated, peaking in 2015 and 2018, while Lockheed Martin demonstrated a steady upward trajectory, culminating in a 60% increase by 2024.

Boeing's cost of revenue saw a notable decline of approximately 20% from its 2015 peak to 2021, reflecting strategic shifts and market challenges. In contrast, Lockheed Martin's costs rose consistently, highlighting its expanding operations and market presence. By 2024, Lockheed Martin's cost of revenue surpassed Boeing's, marking a significant shift in industry dynamics.

These insights reveal the evolving financial strategies of two aerospace giants, offering a window into their operational priorities and market adaptations.

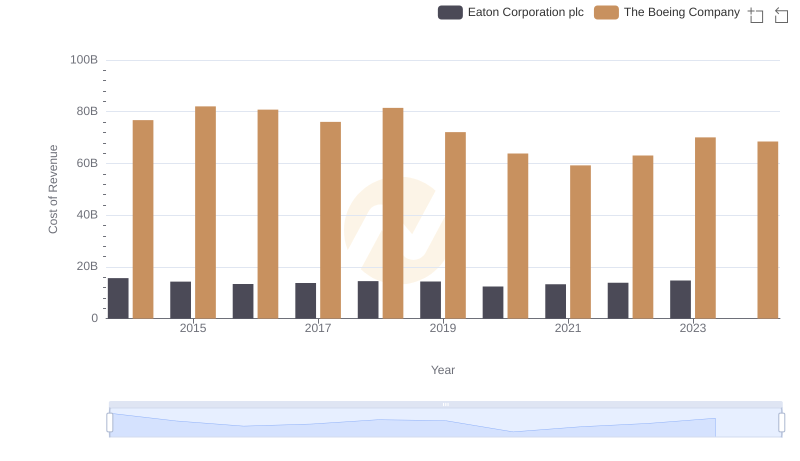

Cost Insights: Breaking Down The Boeing Company and Eaton Corporation plc's Expenses

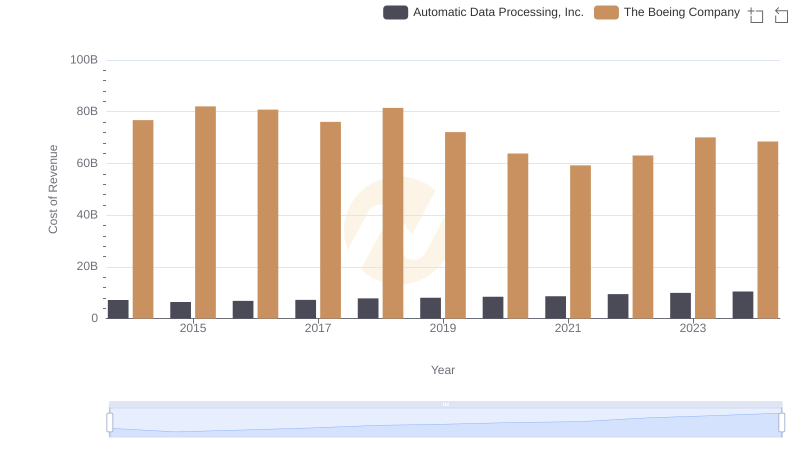

Analyzing Cost of Revenue: The Boeing Company and Automatic Data Processing, Inc.

Research and Development: Comparing Key Metrics for The Boeing Company and Lockheed Martin Corporation

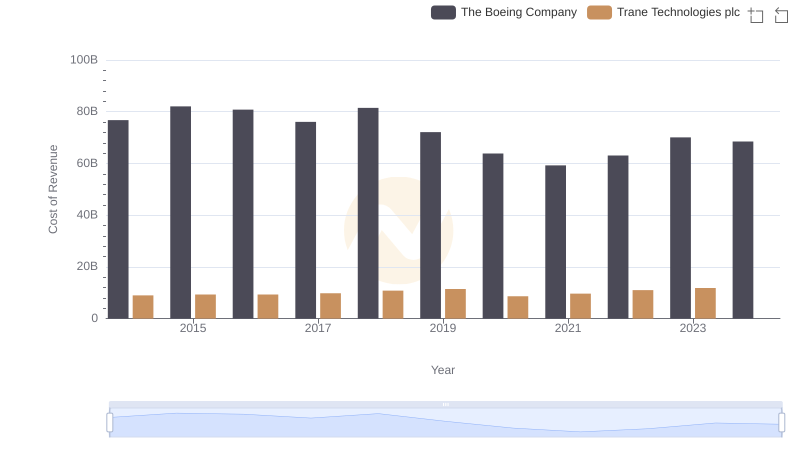

Comparing Cost of Revenue Efficiency: The Boeing Company vs Trane Technologies plc

Cost of Revenue Comparison: The Boeing Company vs 3M Company

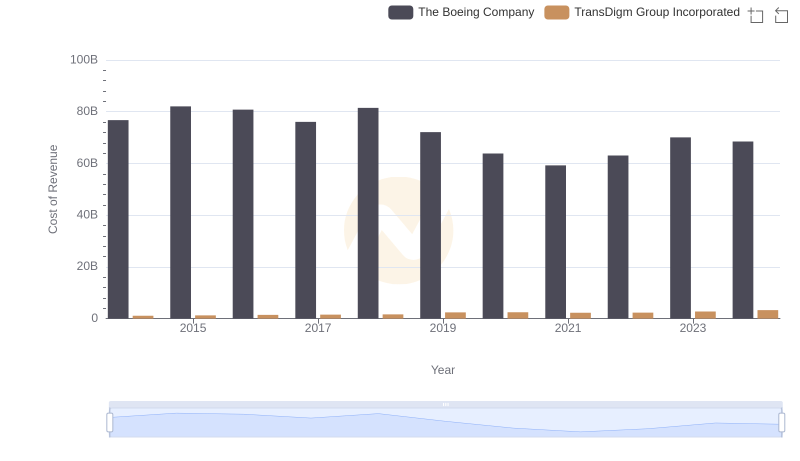

Cost of Revenue Trends: The Boeing Company vs TransDigm Group Incorporated

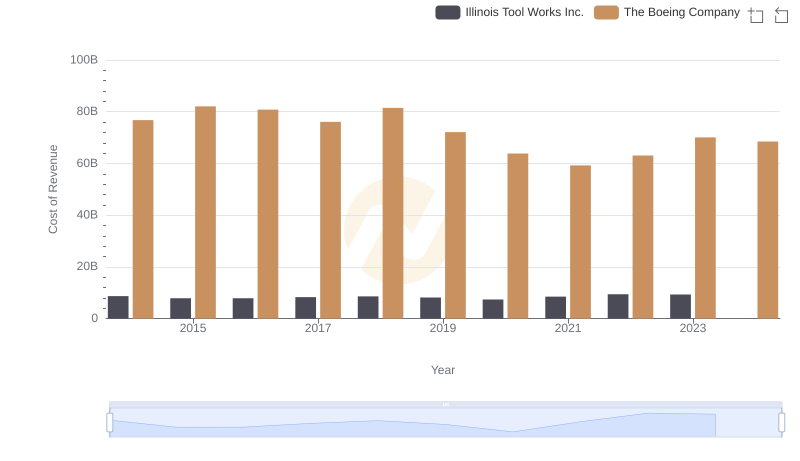

Cost Insights: Breaking Down The Boeing Company and Illinois Tool Works Inc.'s Expenses