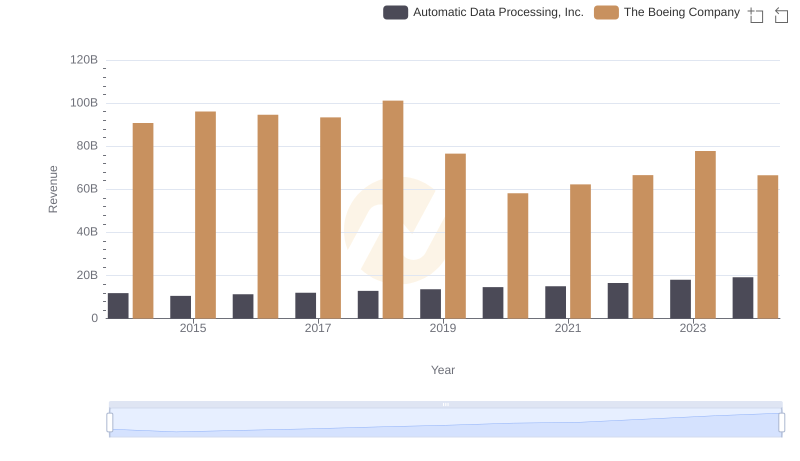

| __timestamp | Automatic Data Processing, Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 76752000000 |

| Thursday, January 1, 2015 | 6427600000 | 82088000000 |

| Friday, January 1, 2016 | 6840300000 | 80790000000 |

| Sunday, January 1, 2017 | 7269800000 | 76066000000 |

| Monday, January 1, 2018 | 7842600000 | 81490000000 |

| Tuesday, January 1, 2019 | 8086600000 | 72093000000 |

| Wednesday, January 1, 2020 | 8445100000 | 63843000000 |

| Friday, January 1, 2021 | 8640300000 | 59237000000 |

| Saturday, January 1, 2022 | 9461900000 | 63078000000 |

| Sunday, January 1, 2023 | 9953400000 | 70070000000 |

| Monday, January 1, 2024 | 10476700000 | 68508000000 |

Unleashing insights

In the ever-evolving landscape of American industry, understanding the cost of revenue is crucial for evaluating a company's financial health. This analysis delves into the cost of revenue trends for two giants: The Boeing Company and Automatic Data Processing, Inc. (ADP), from 2014 to 2024.

Boeing, a leader in aerospace, saw its cost of revenue peak in 2015, with a gradual decline of approximately 17% by 2021, reflecting the industry's challenges during the pandemic. In contrast, ADP, a titan in human resources management, experienced a steady increase in its cost of revenue, growing by about 45% over the same period. This divergence highlights the resilience of the tech-driven HR sector compared to the cyclical nature of aerospace.

As we look to the future, these trends offer valuable insights into the strategic shifts and market dynamics shaping these industries.

The Boeing Company vs Automatic Data Processing, Inc.: Examining Key Revenue Metrics

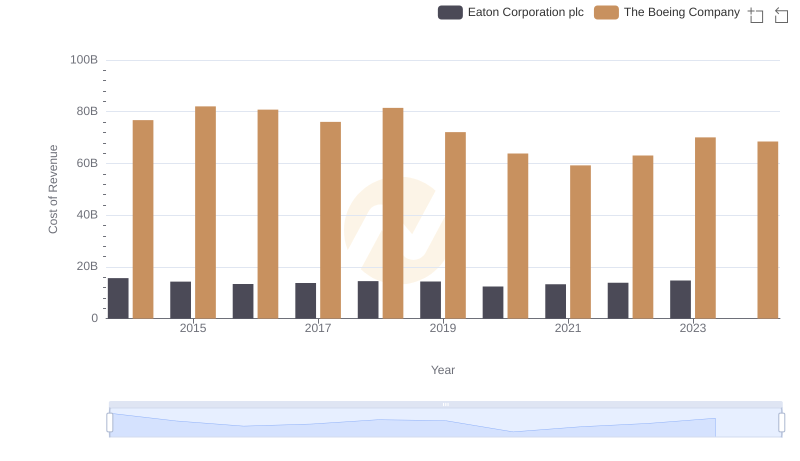

Cost Insights: Breaking Down The Boeing Company and Eaton Corporation plc's Expenses

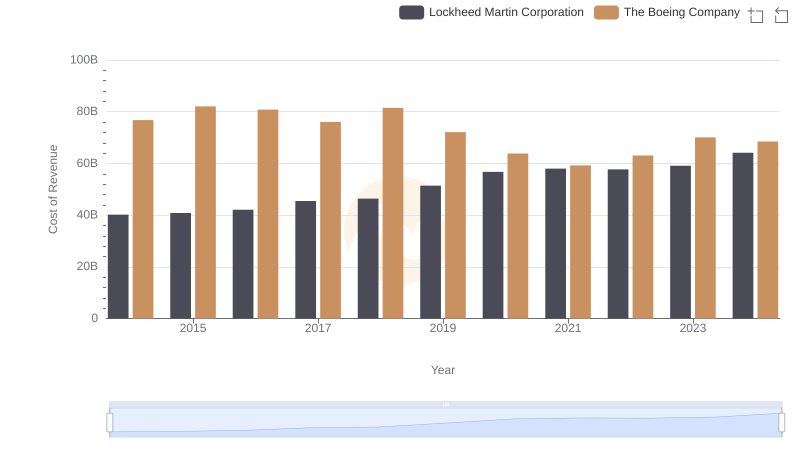

Cost Insights: Breaking Down The Boeing Company and Lockheed Martin Corporation's Expenses

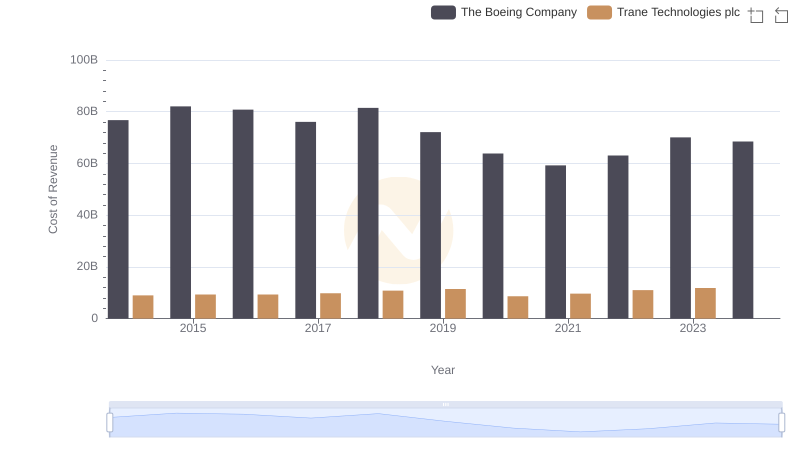

Comparing Cost of Revenue Efficiency: The Boeing Company vs Trane Technologies plc

Cost of Revenue Comparison: The Boeing Company vs 3M Company

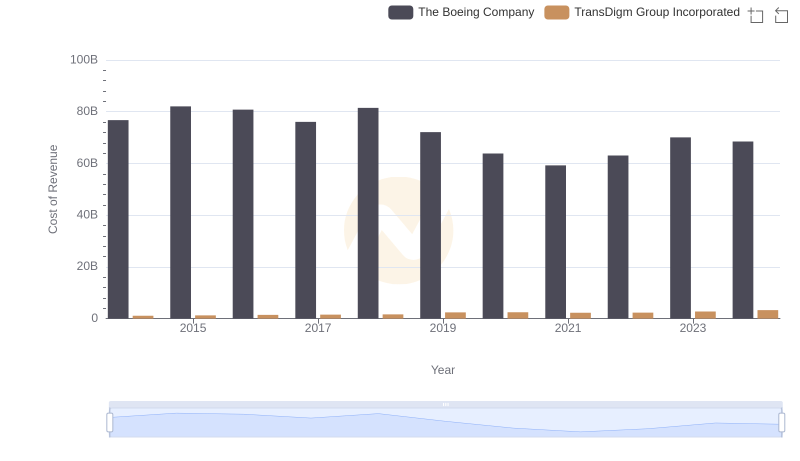

Cost of Revenue Trends: The Boeing Company vs TransDigm Group Incorporated

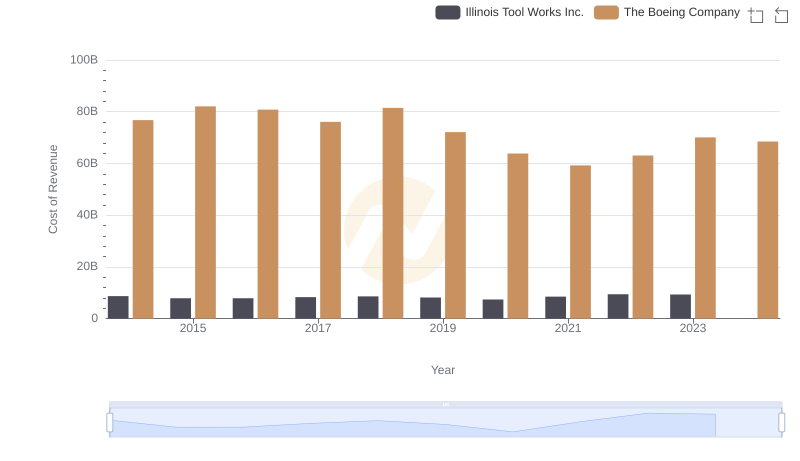

Cost Insights: Breaking Down The Boeing Company and Illinois Tool Works Inc.'s Expenses