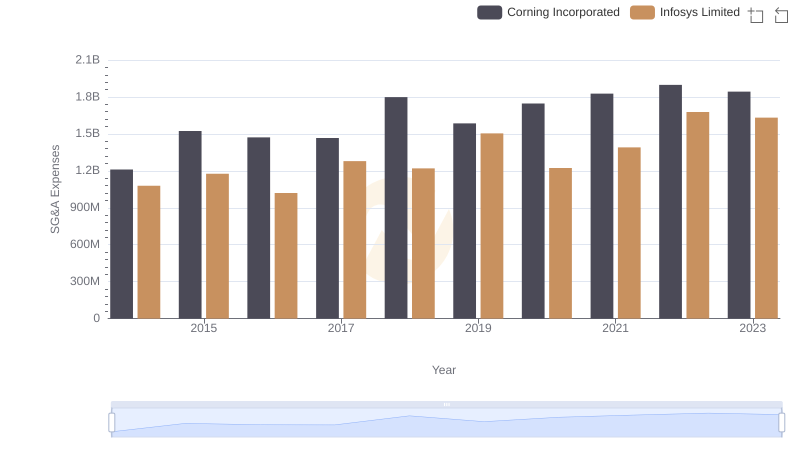

| __timestamp | Corning Incorporated | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 3046000000 | 2258000000 |

| Thursday, January 1, 2015 | 2517000000 | 2590000000 |

| Friday, January 1, 2016 | 2640000000 | 2765000000 |

| Sunday, January 1, 2017 | 2766000000 | 2936000000 |

| Monday, January 1, 2018 | 2897000000 | 2984000000 |

| Tuesday, January 1, 2019 | 3163000000 | 3053000000 |

| Wednesday, January 1, 2020 | 2865000000 | 4053342784 |

| Friday, January 1, 2021 | 3774000000 | 4116000000 |

| Saturday, January 1, 2022 | 3357000000 | 4707334610 |

| Sunday, January 1, 2023 | 2514000000 | 4206000000 |

| Monday, January 1, 2024 | 2492000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, the financial health of companies is often gauged by their EBITDA—Earnings Before Interest, Taxes, Depreciation, and Amortization. This metric provides a clear picture of operational profitability. Over the past decade, Infosys Limited and Corning Incorporated have showcased intriguing trends in their EBITDA figures.

From 2014 to 2023, Infosys has demonstrated a robust upward trajectory. Starting at approximately $2.26 billion in 2014, Infosys saw a remarkable 108% increase, peaking at around $4.71 billion in 2022. This growth underscores Infosys's strategic prowess in the tech industry.

Corning's journey, however, has been more volatile. While it began with a strong EBITDA of about $3.05 billion in 2014, it experienced fluctuations, culminating in a significant drop to $1.14 billion in 2024. This decline highlights the challenges faced by Corning in maintaining consistent profitability.

The contrasting EBITDA trends of Infosys and Corning over the past decade offer valuable insights into their respective industries. While Infosys's steady growth reflects its adaptability and innovation, Corning's volatility suggests a need for strategic recalibration. As we move forward, these trends will undoubtedly shape the future strategies of both companies.

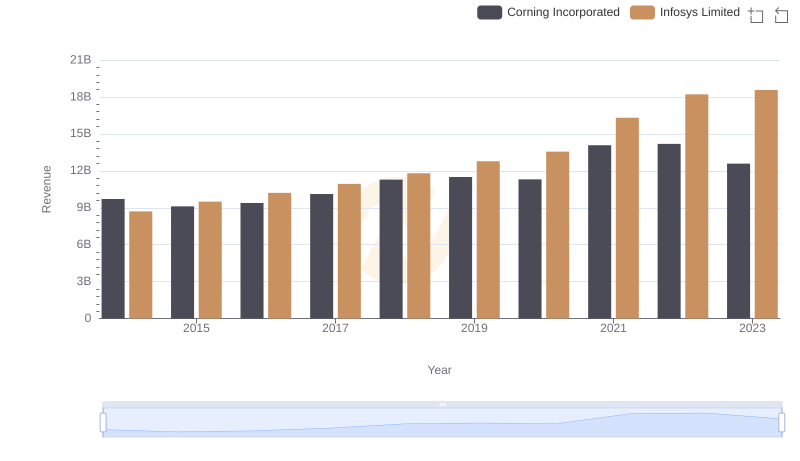

Infosys Limited vs Corning Incorporated: Examining Key Revenue Metrics

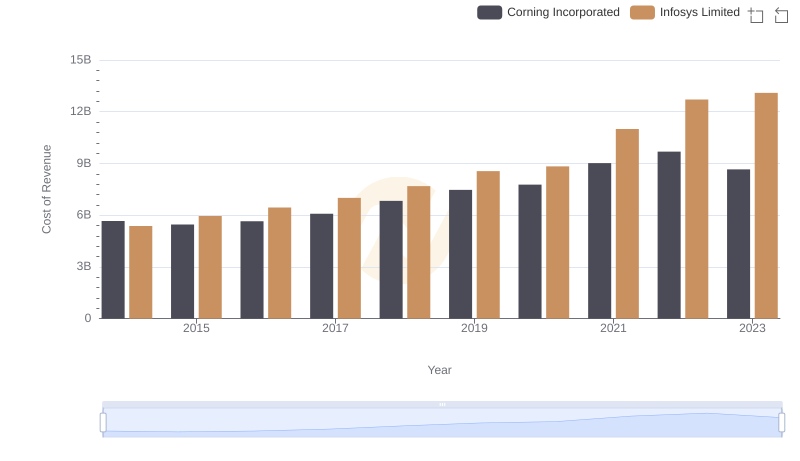

Infosys Limited vs Corning Incorporated: Efficiency in Cost of Revenue Explored

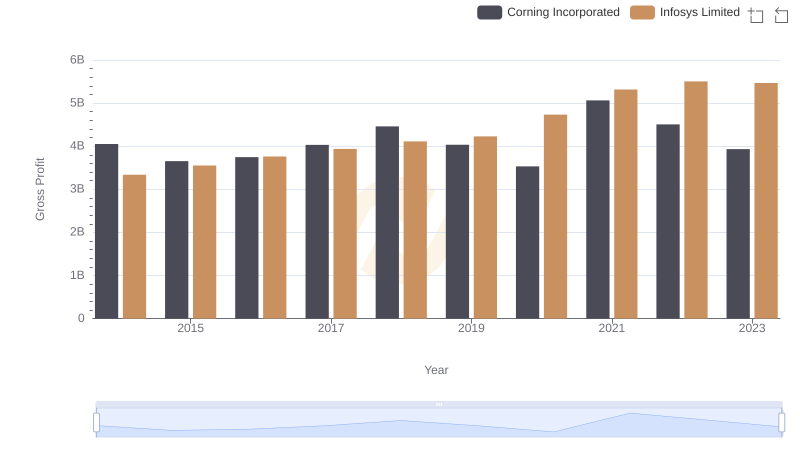

Infosys Limited vs Corning Incorporated: A Gross Profit Performance Breakdown

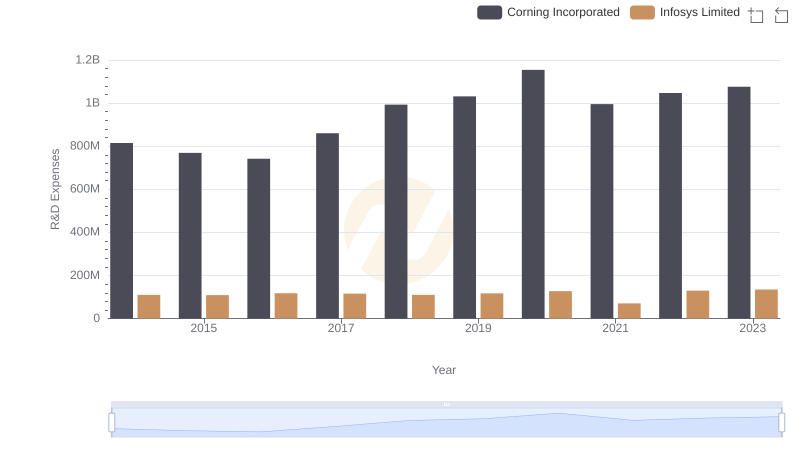

R&D Insights: How Infosys Limited and Corning Incorporated Allocate Funds

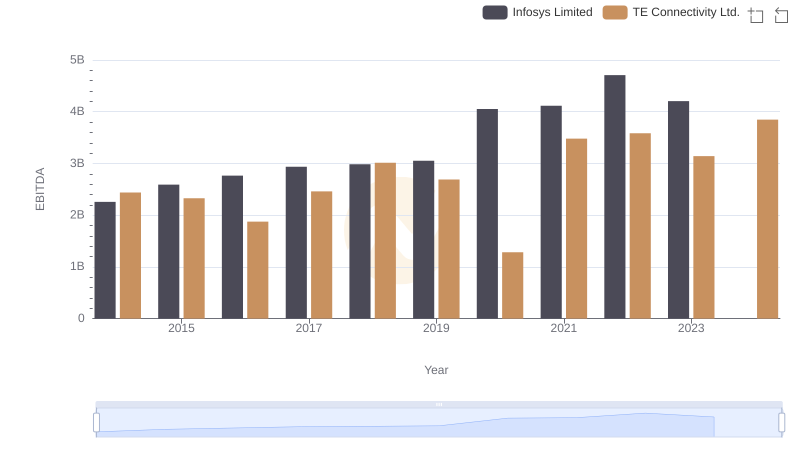

Professional EBITDA Benchmarking: Infosys Limited vs TE Connectivity Ltd.

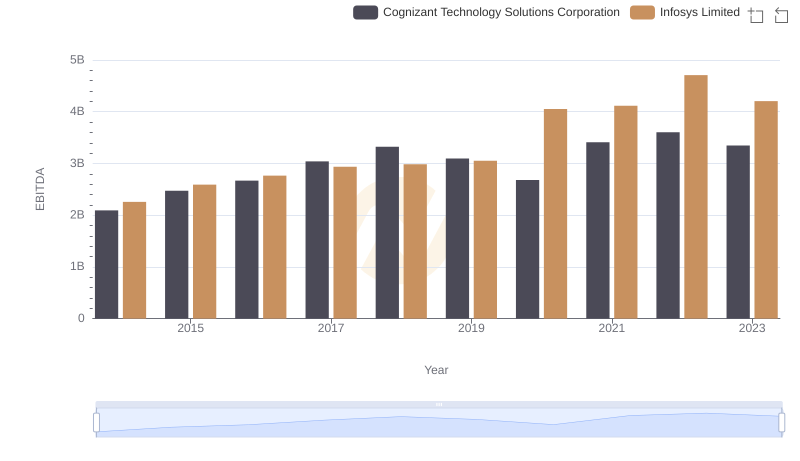

Professional EBITDA Benchmarking: Infosys Limited vs Cognizant Technology Solutions Corporation

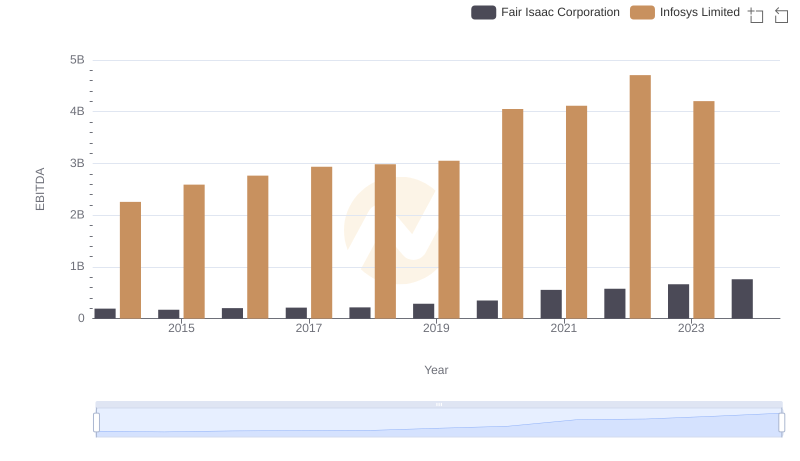

A Side-by-Side Analysis of EBITDA: Infosys Limited and Fair Isaac Corporation

Selling, General, and Administrative Costs: Infosys Limited vs Corning Incorporated

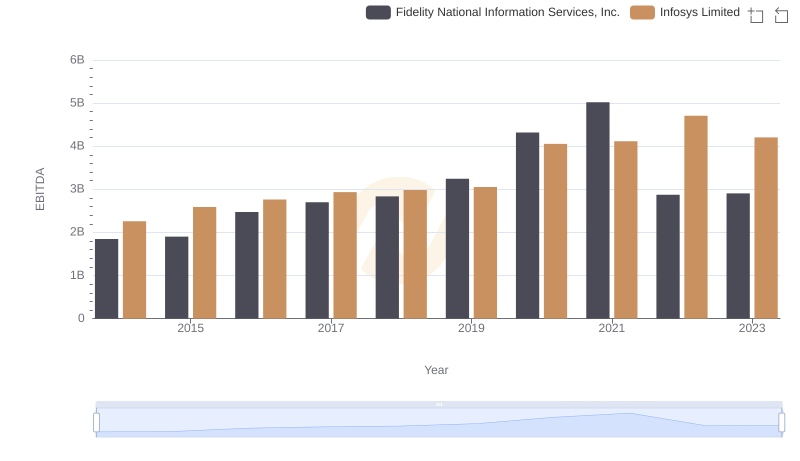

A Professional Review of EBITDA: Infosys Limited Compared to Fidelity National Information Services, Inc.

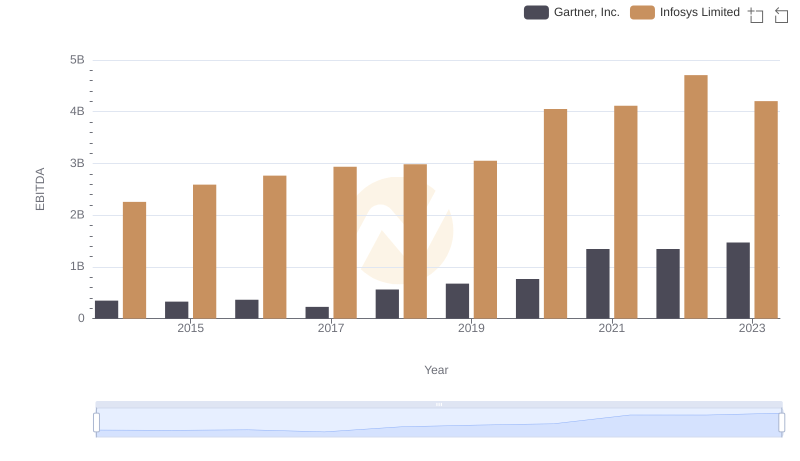

A Side-by-Side Analysis of EBITDA: Infosys Limited and Gartner, Inc.

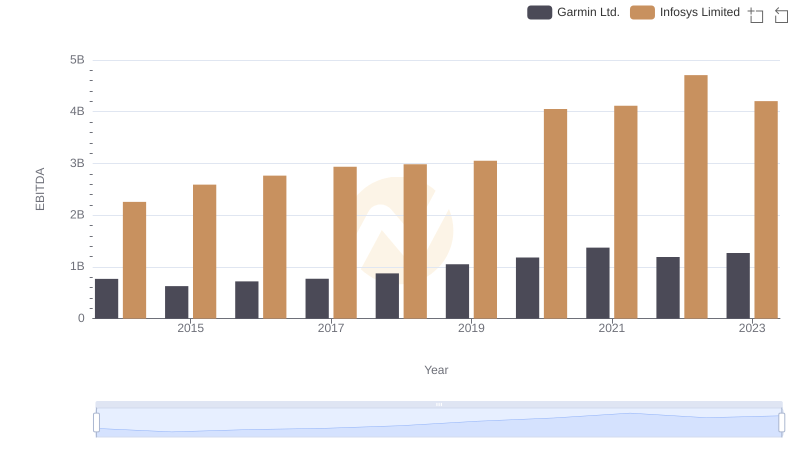

EBITDA Analysis: Evaluating Infosys Limited Against Garmin Ltd.

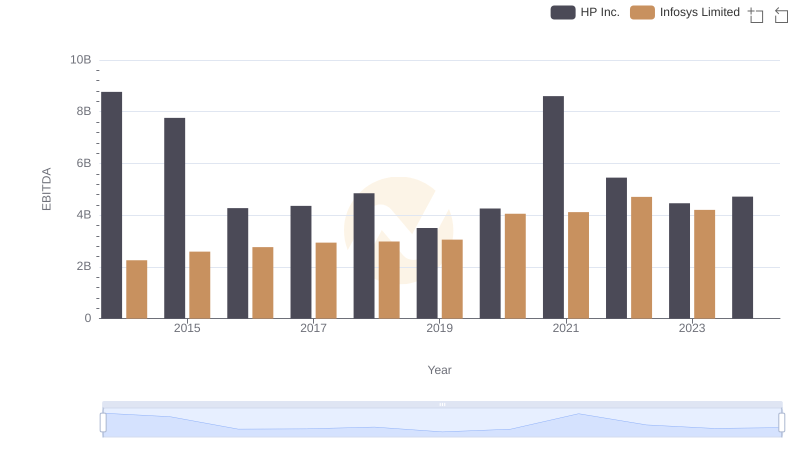

Infosys Limited and HP Inc.: A Detailed Examination of EBITDA Performance