| __timestamp | Caterpillar Inc. | FedEx Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 6929000000 | 6036000000 |

| Thursday, January 1, 2015 | 7705000000 | 7141000000 |

| Friday, January 1, 2016 | 3671000000 | 7531000000 |

| Sunday, January 1, 2017 | 7482000000 | 8093000000 |

| Monday, January 1, 2018 | 11102000000 | 8555000000 |

| Tuesday, January 1, 2019 | 10690000000 | 4934000000 |

| Wednesday, January 1, 2020 | 7267000000 | 6345000000 |

| Friday, January 1, 2021 | 10627000000 | 11749000000 |

| Saturday, January 1, 2022 | 11974000000 | 9767000000 |

| Sunday, January 1, 2023 | 15705000000 | 10603000000 |

| Monday, January 1, 2024 | 16038000000 | 10868000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global industry, Caterpillar Inc. and FedEx Corporation stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these giants have showcased their financial prowess through EBITDA performance. Caterpillar Inc. has seen a remarkable growth trajectory, with its EBITDA surging by approximately 127% from 2014 to 2023. Notably, 2023 marked a peak year for Caterpillar, with EBITDA reaching its highest point. Meanwhile, FedEx Corporation has demonstrated consistent growth, with a notable 75% increase in EBITDA over the same period. The year 2021 was particularly significant for FedEx, as it recorded its highest EBITDA, surpassing Caterpillar for that year. However, the data for 2024 remains incomplete, leaving room for speculation on future trends. This comparison not only highlights the resilience of these companies but also underscores the dynamic nature of the global market.

Comparative EBITDA Analysis: Caterpillar Inc. vs Trane Technologies plc

EBITDA Metrics Evaluated: Caterpillar Inc. vs Parker-Hannifin Corporation

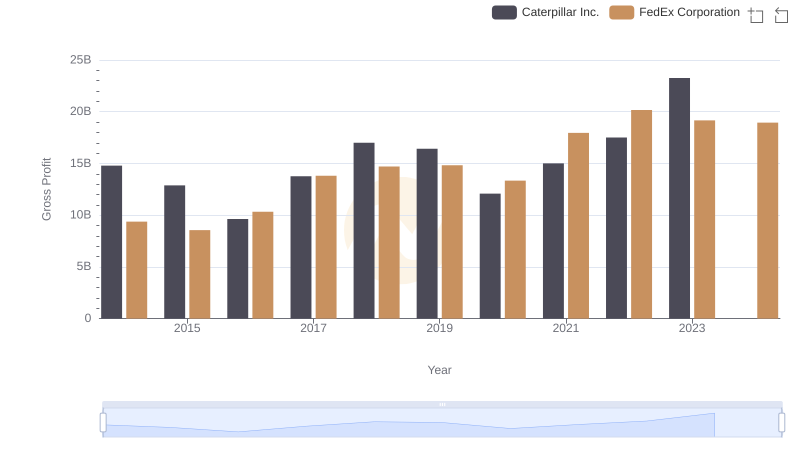

Caterpillar Inc. and FedEx Corporation: A Detailed Gross Profit Analysis

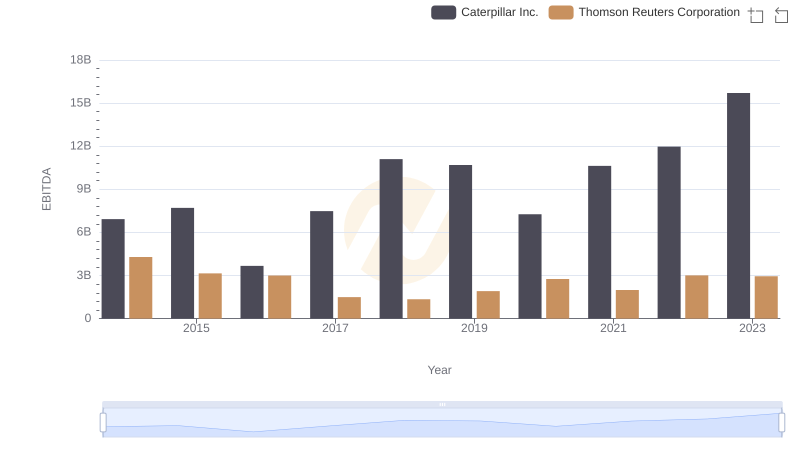

Comparative EBITDA Analysis: Caterpillar Inc. vs Thomson Reuters Corporation

A Professional Review of EBITDA: Caterpillar Inc. Compared to Canadian National Railway Company

Comprehensive EBITDA Comparison: Caterpillar Inc. vs Republic Services, Inc.

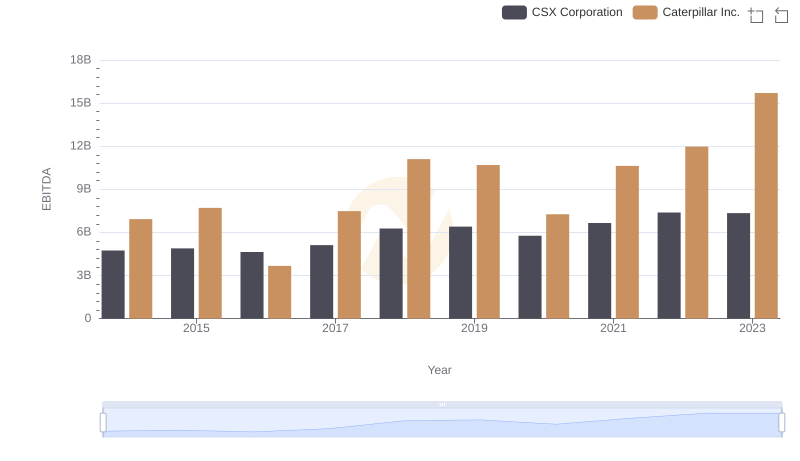

Professional EBITDA Benchmarking: Caterpillar Inc. vs CSX Corporation