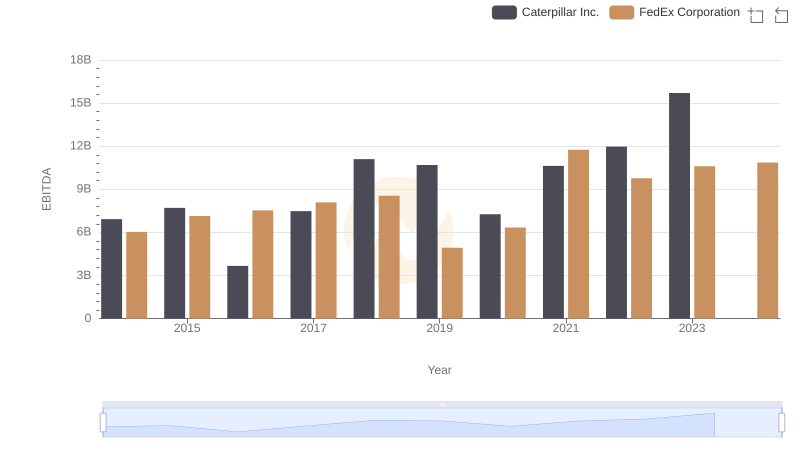

| __timestamp | Caterpillar Inc. | Thomson Reuters Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 6929000000 | 4289000000 |

| Thursday, January 1, 2015 | 7705000000 | 3151000000 |

| Friday, January 1, 2016 | 3671000000 | 2999000000 |

| Sunday, January 1, 2017 | 7482000000 | 1495930891 |

| Monday, January 1, 2018 | 11102000000 | 1345686008 |

| Tuesday, January 1, 2019 | 10690000000 | 1913474675 |

| Wednesday, January 1, 2020 | 7267000000 | 2757000000 |

| Friday, January 1, 2021 | 10627000000 | 1994296441 |

| Saturday, January 1, 2022 | 11974000000 | 3010000000 |

| Sunday, January 1, 2023 | 15705000000 | 2950000000 |

| Monday, January 1, 2024 | 16038000000 |

Data in motion

In the ever-evolving landscape of global business, understanding the financial health of industry giants is crucial. Over the past decade, Caterpillar Inc. and Thomson Reuters Corporation have showcased contrasting EBITDA trajectories. From 2014 to 2023, Caterpillar's EBITDA surged by approximately 127%, peaking in 2023. This growth reflects its robust adaptation to market demands and strategic innovations in heavy machinery. In contrast, Thomson Reuters experienced a more volatile journey, with a notable dip in 2017 and a modest recovery by 2023. Their EBITDA in 2023 was about 31% lower than in 2014, highlighting challenges in the media and information services sector. This comparative analysis underscores the resilience of industrial manufacturing against the backdrop of fluctuating media landscapes. As we delve deeper into these trends, the data offers invaluable insights into strategic business maneuvers and market adaptability.

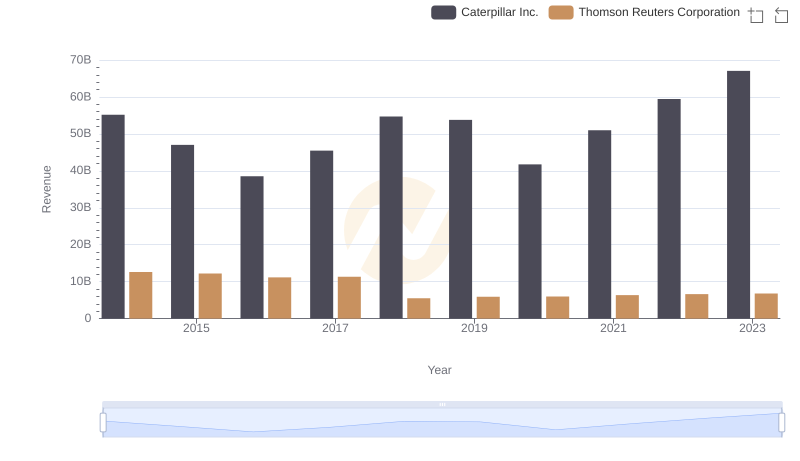

Comparing Revenue Performance: Caterpillar Inc. or Thomson Reuters Corporation?

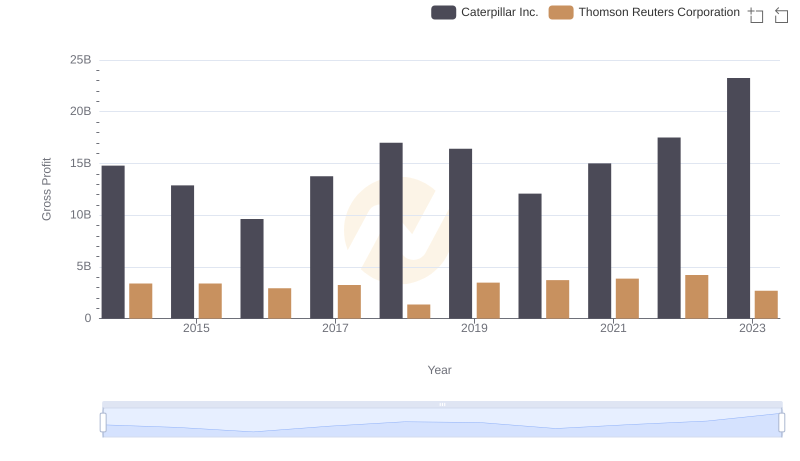

Caterpillar Inc. vs Thomson Reuters Corporation: A Gross Profit Performance Breakdown

Comparative EBITDA Analysis: Caterpillar Inc. vs Trane Technologies plc

EBITDA Metrics Evaluated: Caterpillar Inc. vs Parker-Hannifin Corporation

Comprehensive EBITDA Comparison: Caterpillar Inc. vs FedEx Corporation

A Professional Review of EBITDA: Caterpillar Inc. Compared to Canadian National Railway Company

Comprehensive EBITDA Comparison: Caterpillar Inc. vs Republic Services, Inc.