| __timestamp | Automatic Data Processing, Inc. | Paychex, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 803700000 |

| Thursday, January 1, 2015 | 2496900000 | 878000000 |

| Friday, January 1, 2016 | 2637000000 | 948200000 |

| Sunday, January 1, 2017 | 2783200000 | 992100000 |

| Monday, January 1, 2018 | 2971500000 | 1075600000 |

| Tuesday, January 1, 2019 | 3064200000 | 1223400000 |

| Wednesday, January 1, 2020 | 3003000000 | 1299200000 |

| Friday, January 1, 2021 | 3040500000 | 1324900000 |

| Saturday, January 1, 2022 | 3233200000 | 1415400000 |

| Sunday, January 1, 2023 | 3551400000 | 1521000000 |

| Monday, January 1, 2024 | 3778900000 | 1624900000 |

Igniting the spark of knowledge

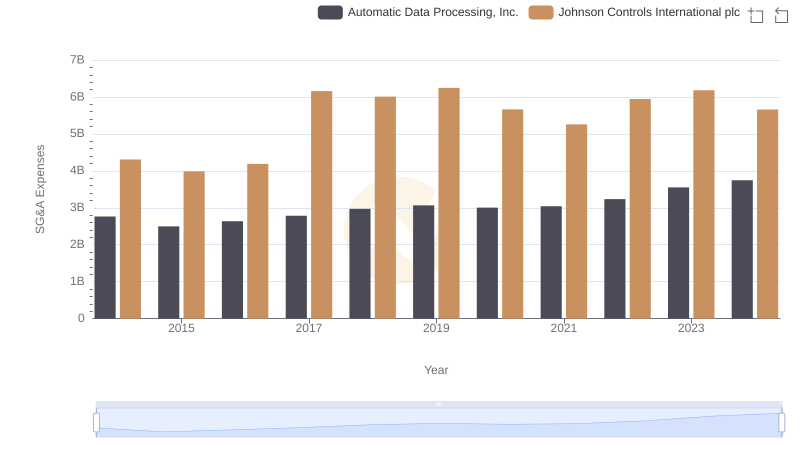

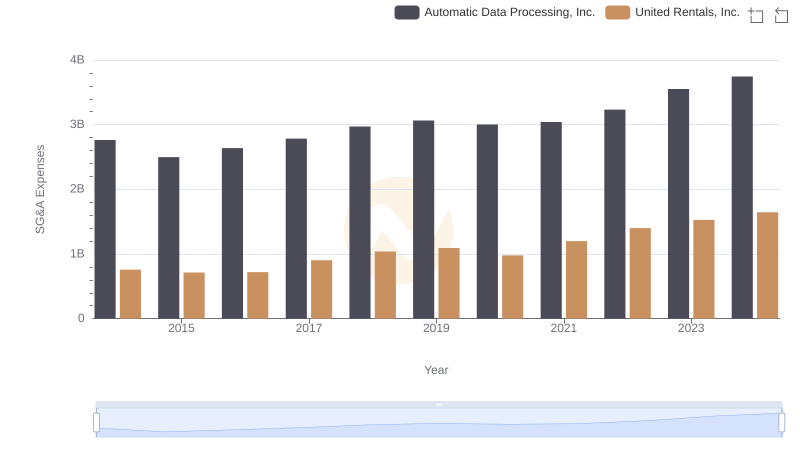

In the competitive world of payroll and human resources services, Automatic Data Processing, Inc. (ADP) and Paychex, Inc. have long been industry leaders. Over the past decade, from 2014 to 2024, these companies have demonstrated distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses.

ADP, with its expansive operations, has seen its SG&A expenses grow by approximately 36% over this period, reflecting its investment in scaling operations and enhancing service offerings. In contrast, Paychex has managed a more modest increase of around 102%, indicating a more conservative approach to cost management while still expanding its market presence.

This data provides a fascinating insight into how two industry titans balance growth and efficiency. As businesses navigate the post-pandemic economy, understanding these strategies becomes crucial for stakeholders and investors alike.

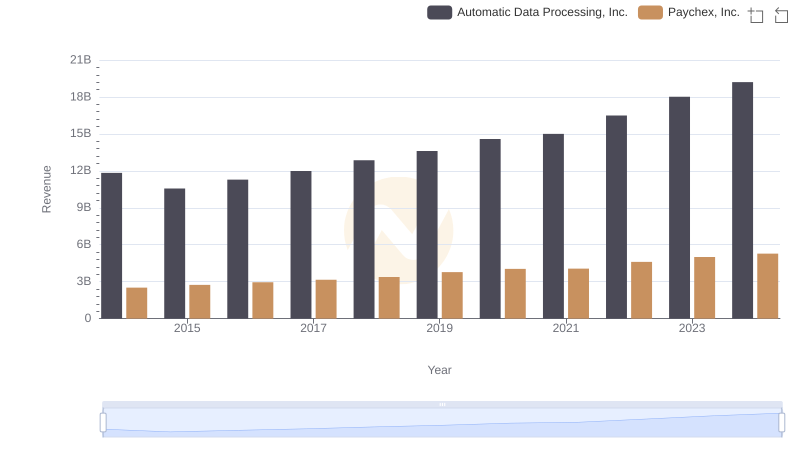

Automatic Data Processing, Inc. or Paychex, Inc.: Who Leads in Yearly Revenue?

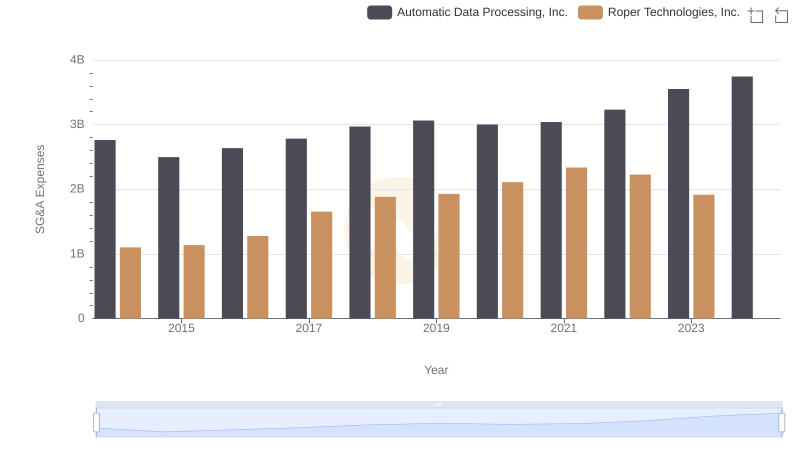

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Roper Technologies, Inc.

Automatic Data Processing, Inc. or Johnson Controls International plc: Who Manages SG&A Costs Better?

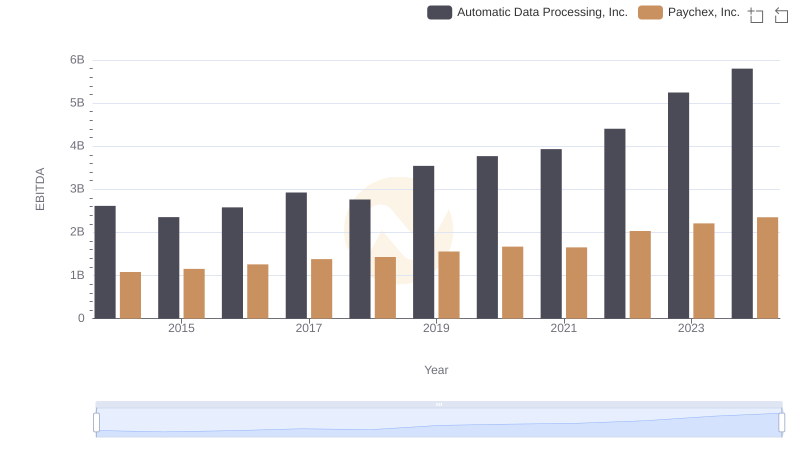

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Paychex, Inc.

Automatic Data Processing, Inc. or United Rentals, Inc.: Who Manages SG&A Costs Better?