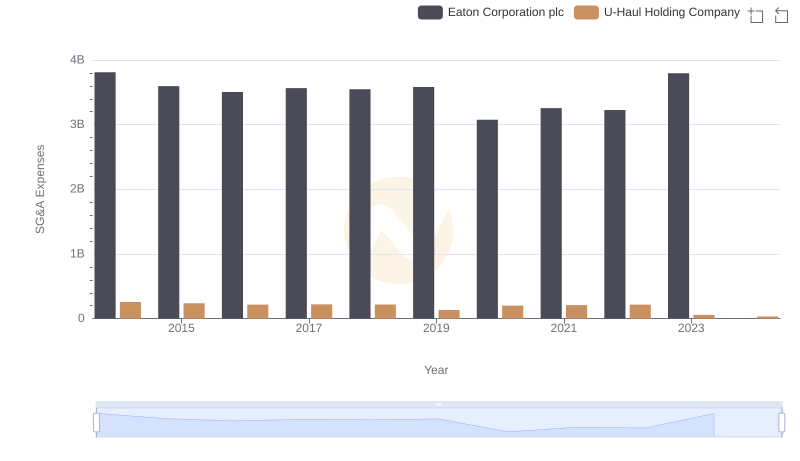

| __timestamp | Eaton Corporation plc | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 935700000 |

| Thursday, January 1, 2015 | 3596000000 | 965700000 |

| Friday, January 1, 2016 | 3505000000 | 1197600000 |

| Sunday, January 1, 2017 | 3565000000 | 1329600000 |

| Monday, January 1, 2018 | 3548000000 | 1364000000 |

| Tuesday, January 1, 2019 | 3583000000 | 322500000 |

| Wednesday, January 1, 2020 | 3075000000 | 352000000 |

| Friday, January 1, 2021 | 3256000000 | 348600000 |

| Saturday, January 1, 2022 | 3227000000 | 479000000 |

| Sunday, January 1, 2023 | 3795000000 | 2870000000 |

| Monday, January 1, 2024 | 4077000000 |

Unlocking the unknown

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of operational efficiency. This article delves into the SG&A trends of Eaton Corporation plc and Rentokil Initial plc from 2014 to 2023.

Eaton Corporation plc has consistently maintained high SG&A expenses, peaking in 2014 and 2023. Despite a dip in 2020, their expenses have shown resilience, averaging around $3.5 billion annually. This stability reflects Eaton's robust operational strategies.

Rentokil Initial plc, on the other hand, has experienced a dramatic rise in SG&A expenses, culminating in a staggering 200% increase from 2014 to 2023. This surge highlights Rentokil's aggressive expansion and market penetration strategies.

The contrasting trends of these two companies offer valuable insights into their strategic priorities and market dynamics.

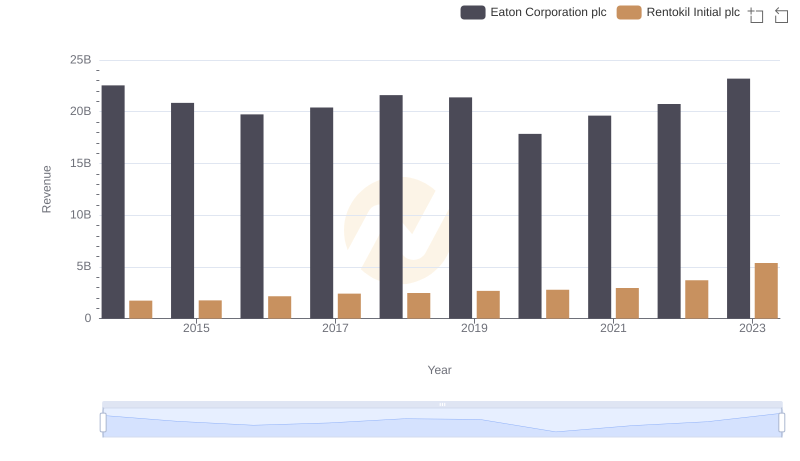

Eaton Corporation plc vs Rentokil Initial plc: Examining Key Revenue Metrics

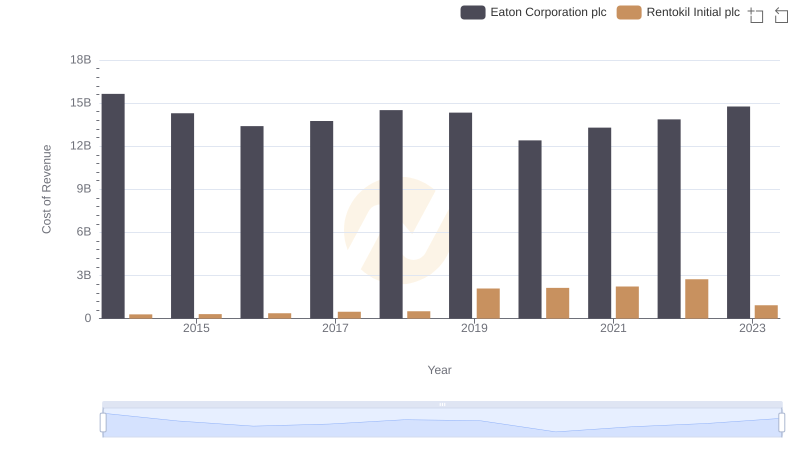

Cost of Revenue: Key Insights for Eaton Corporation plc and Rentokil Initial plc

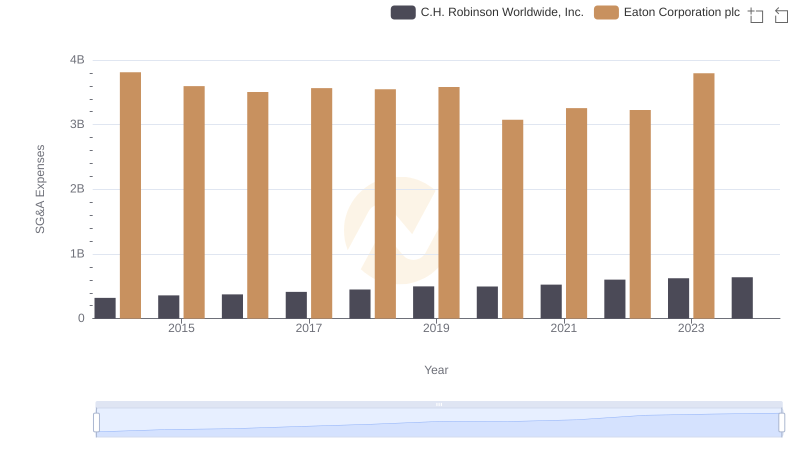

Cost Management Insights: SG&A Expenses for Eaton Corporation plc and C.H. Robinson Worldwide, Inc.

Eaton Corporation plc vs U-Haul Holding Company: SG&A Expense Trends

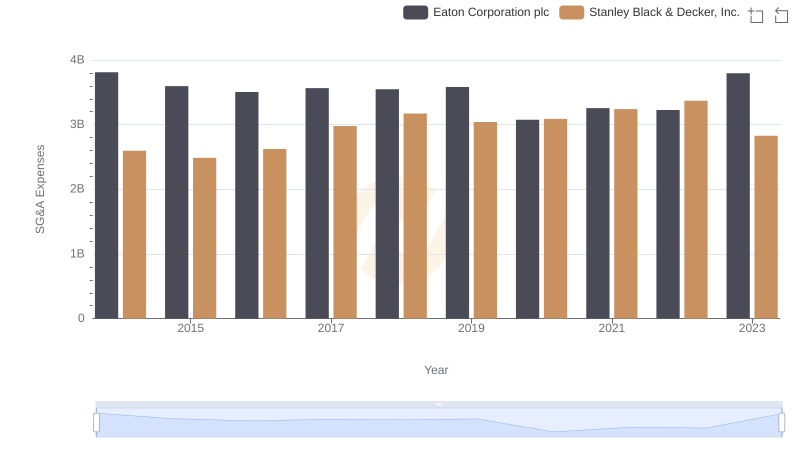

Selling, General, and Administrative Costs: Eaton Corporation plc vs Stanley Black & Decker, Inc.

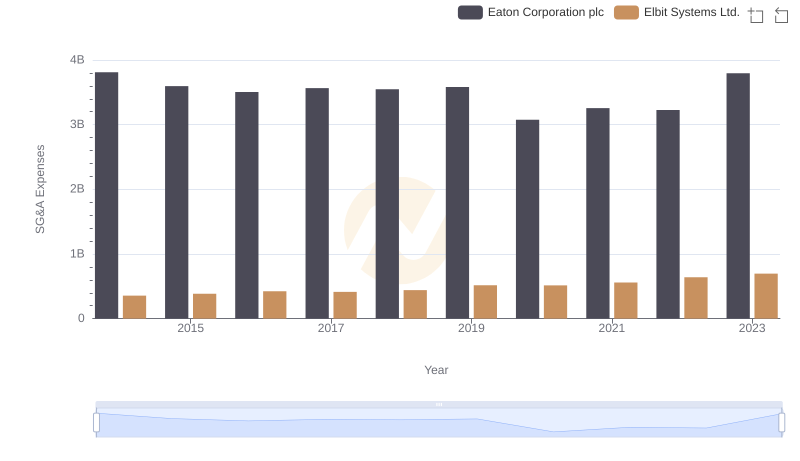

Comparing SG&A Expenses: Eaton Corporation plc vs Elbit Systems Ltd. Trends and Insights

Eaton Corporation plc and ITT Inc.: SG&A Spending Patterns Compared