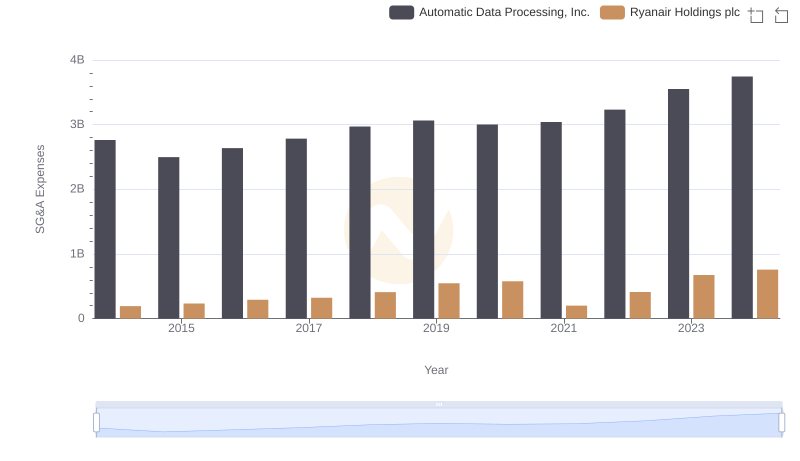

| __timestamp | Automatic Data Processing, Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 3838100000 |

| Thursday, January 1, 2015 | 6427600000 | 3999600000 |

| Friday, January 1, 2016 | 6840300000 | 4355900000 |

| Sunday, January 1, 2017 | 7269800000 | 4294000000 |

| Monday, January 1, 2018 | 7842600000 | 4512300000 |

| Tuesday, January 1, 2019 | 8086600000 | 5492800000 |

| Wednesday, January 1, 2020 | 8445100000 | 6039900000 |

| Friday, January 1, 2021 | 8640300000 | 1702700000 |

| Saturday, January 1, 2022 | 9461900000 | 4009800000 |

| Sunday, January 1, 2023 | 9953400000 | 7735000000 |

| Monday, January 1, 2024 | 10476700000 | 9566400000 |

Unleashing the power of data

In the ever-evolving landscape of global business, understanding cost structures is crucial. This analysis delves into the cost of revenue trends for Automatic Data Processing, Inc. (ADP) and Ryanair Holdings plc from 2014 to 2024. Over this decade, ADP's cost of revenue has shown a steady increase, rising approximately 45% from 2014 to 2024. This growth reflects ADP's expanding operations and strategic investments. In contrast, Ryanair's cost of revenue experienced more volatility, with a notable dip in 2021, likely due to the pandemic's impact on the airline industry. However, Ryanair rebounded strongly, with a 450% increase from 2021 to 2024, underscoring its resilience and adaptability. This comparative analysis highlights the distinct financial trajectories of a tech giant and a leading airline, offering valuable insights into their operational strategies and market responses.

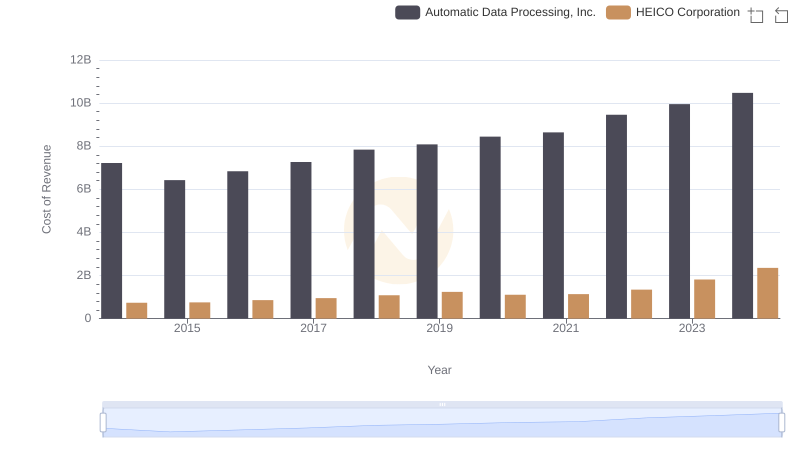

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and HEICO Corporation

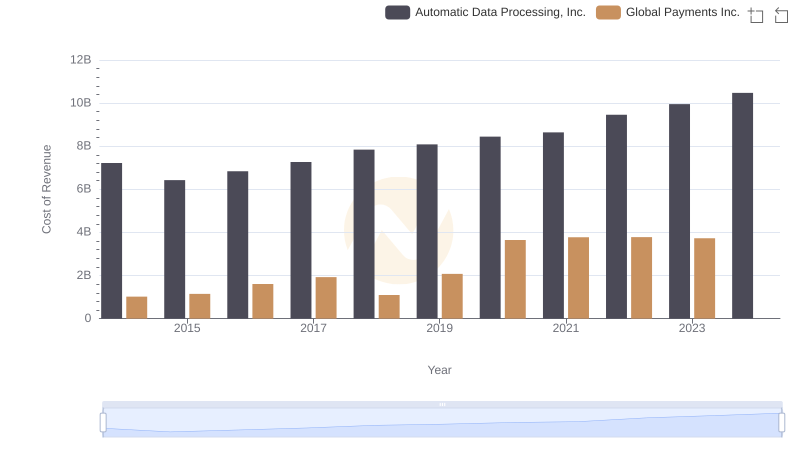

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Global Payments Inc.

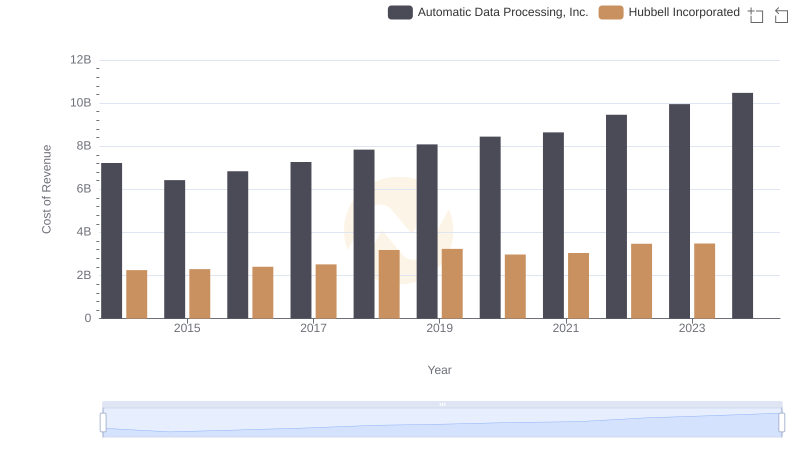

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Hubbell Incorporated

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Ryanair Holdings plc

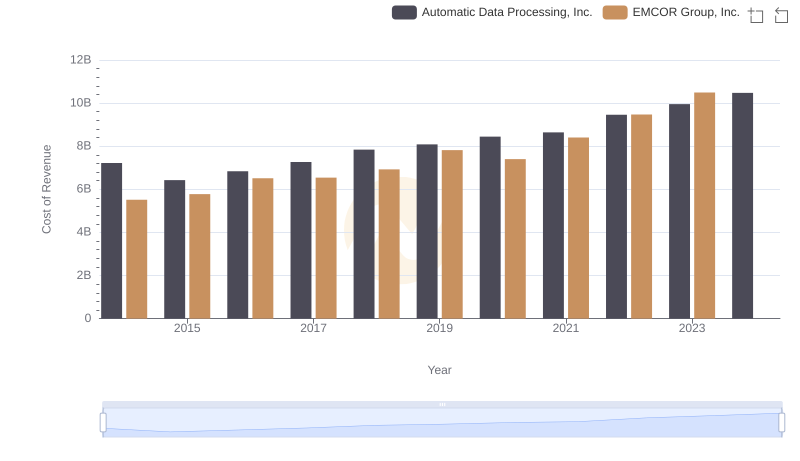

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs EMCOR Group, Inc.

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Watsco, Inc.

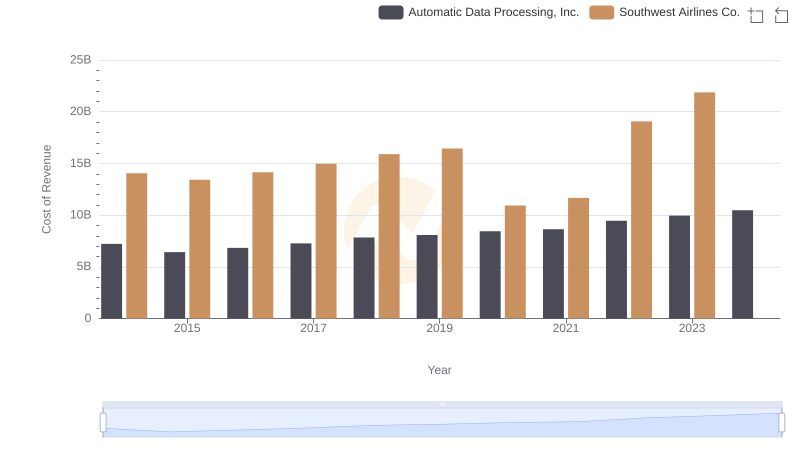

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Efficiency in Cost of Revenue Explored