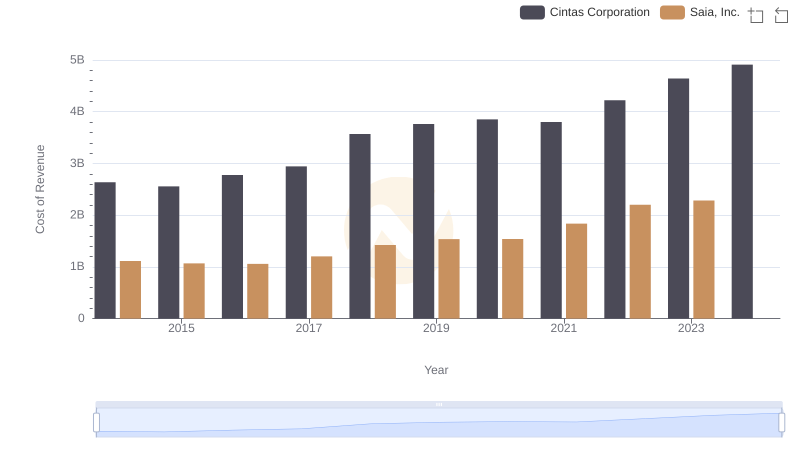

| __timestamp | Cintas Corporation | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 1272321000 |

| Thursday, January 1, 2015 | 4476886000 | 1221311000 |

| Friday, January 1, 2016 | 4905458000 | 1218481000 |

| Sunday, January 1, 2017 | 5323381000 | 1378510000 |

| Monday, January 1, 2018 | 6476632000 | 1653849000 |

| Tuesday, January 1, 2019 | 6892303000 | 1786735000 |

| Wednesday, January 1, 2020 | 7085120000 | 1822366000 |

| Friday, January 1, 2021 | 7116340000 | 2288704000 |

| Saturday, January 1, 2022 | 7854459000 | 2792057000 |

| Sunday, January 1, 2023 | 8815769000 | 2881433000 |

| Monday, January 1, 2024 | 9596615000 |

In pursuit of knowledge

In the competitive landscape of American business, Cintas Corporation and Saia, Inc. have emerged as significant players in their respective industries. Over the past decade, Cintas has demonstrated a robust growth trajectory, with its revenue surging by approximately 111% from 2014 to 2023. This growth underscores Cintas's strategic prowess in the corporate services sector. Meanwhile, Saia, Inc., a key player in the transportation industry, has also shown impressive growth, with its revenue increasing by about 126% over the same period.

The data reveals a consistent upward trend for both companies, with Cintas's revenue peaking in 2024, while Saia's data for 2024 remains unavailable. This missing data point for Saia could indicate a potential shift or strategic change. As these companies continue to evolve, their financial trajectories offer valuable insights into their operational strategies and market positioning.

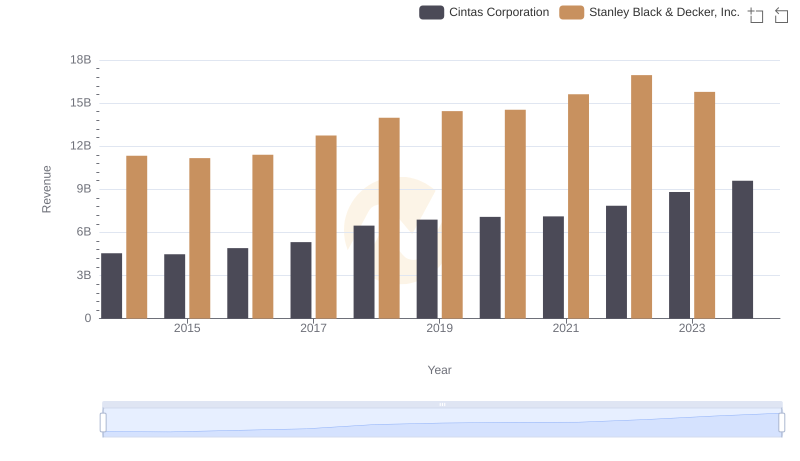

Breaking Down Revenue Trends: Cintas Corporation vs Stanley Black & Decker, Inc.

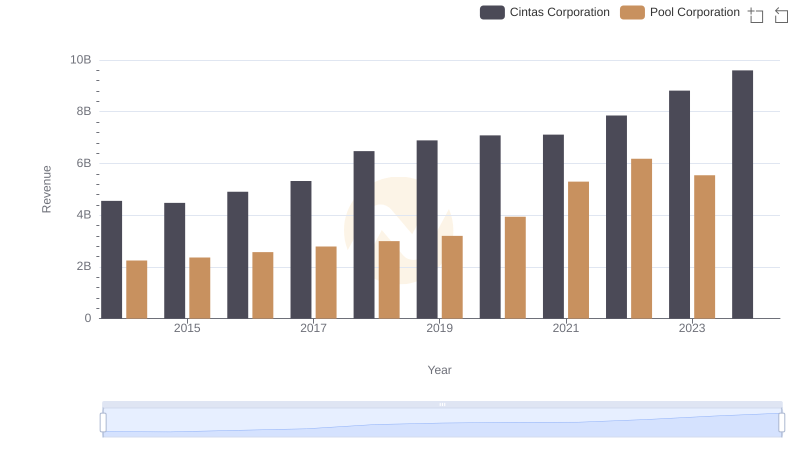

Who Generates More Revenue? Cintas Corporation or Pool Corporation

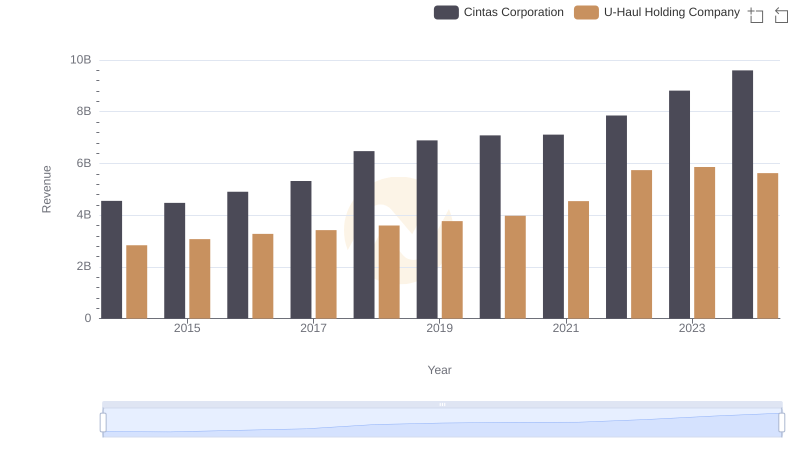

Who Generates More Revenue? Cintas Corporation or U-Haul Holding Company

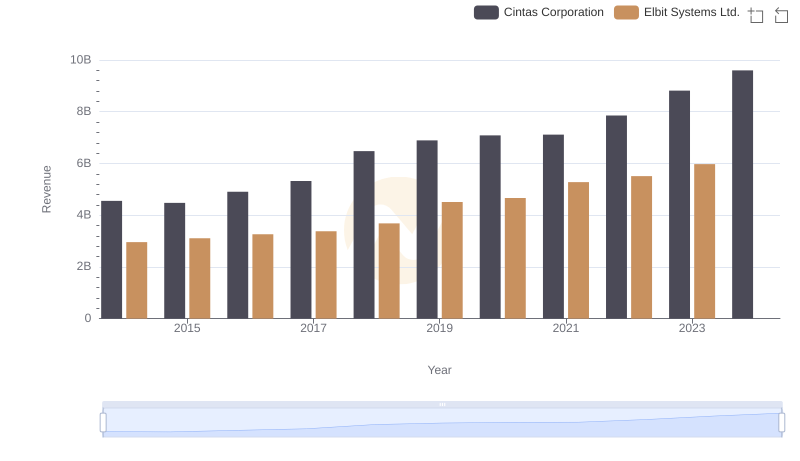

Who Generates More Revenue? Cintas Corporation or Elbit Systems Ltd.

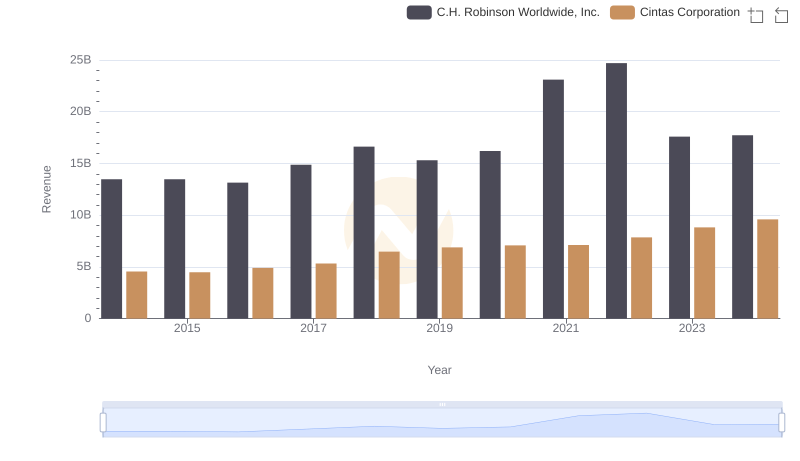

Revenue Showdown: Cintas Corporation vs C.H. Robinson Worldwide, Inc.

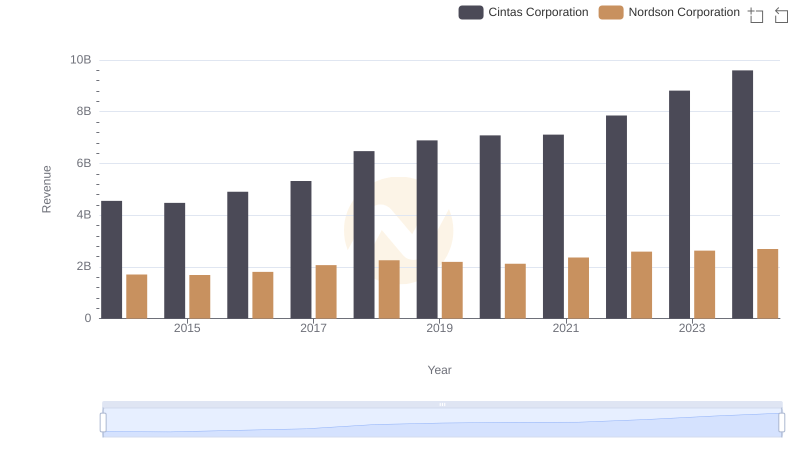

Cintas Corporation vs Nordson Corporation: Annual Revenue Growth Compared

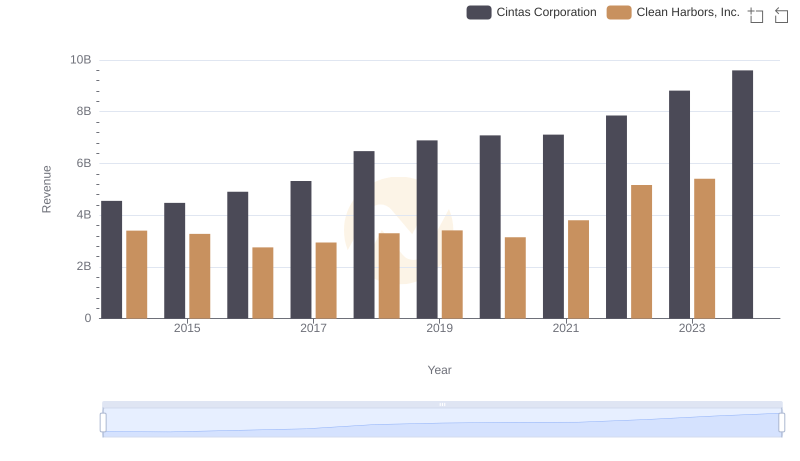

Revenue Insights: Cintas Corporation and Clean Harbors, Inc. Performance Compared

Cost of Revenue Trends: Cintas Corporation vs Saia, Inc.

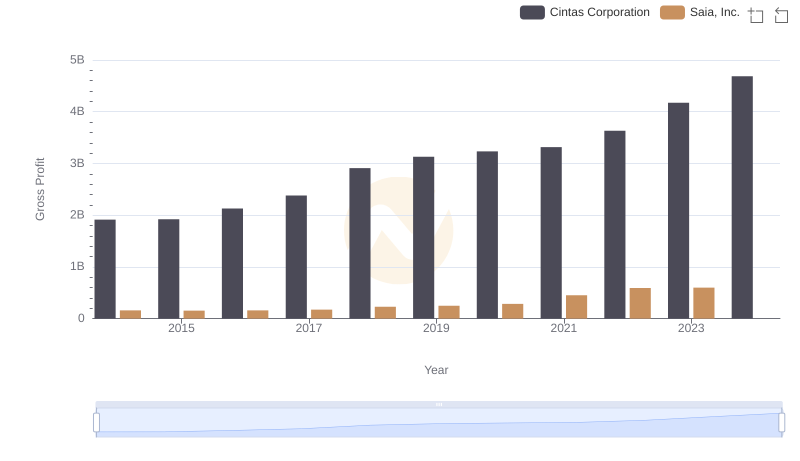

Who Generates Higher Gross Profit? Cintas Corporation or Saia, Inc.

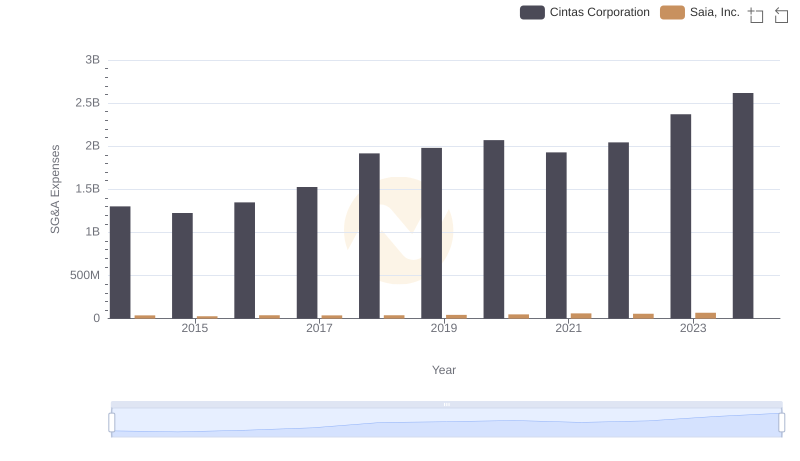

Selling, General, and Administrative Costs: Cintas Corporation vs Saia, Inc.

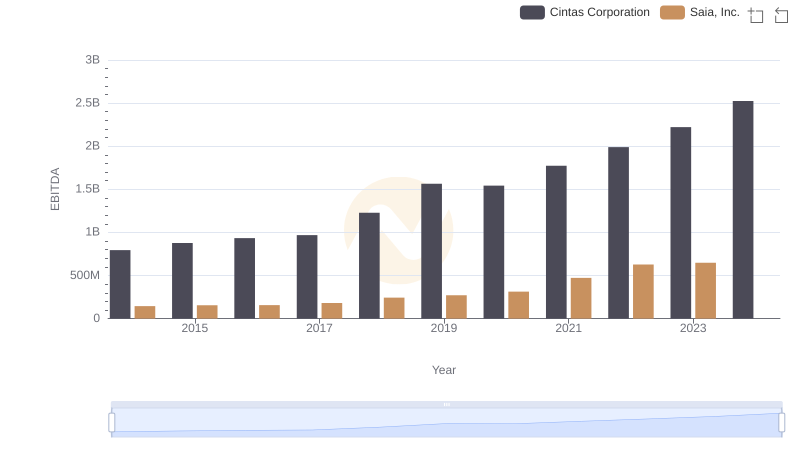

Cintas Corporation and Saia, Inc.: A Detailed Examination of EBITDA Performance