| __timestamp | Cintas Corporation | TransDigm Group Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 276446000 |

| Thursday, January 1, 2015 | 1224930000 | 321624000 |

| Friday, January 1, 2016 | 1348122000 | 382858000 |

| Sunday, January 1, 2017 | 1527380000 | 415575000 |

| Monday, January 1, 2018 | 1916792000 | 450095000 |

| Tuesday, January 1, 2019 | 1980644000 | 747773000 |

| Wednesday, January 1, 2020 | 2071052000 | 727000000 |

| Friday, January 1, 2021 | 1929159000 | 685000000 |

| Saturday, January 1, 2022 | 2044876000 | 748000000 |

| Sunday, January 1, 2023 | 2370704000 | 780000000 |

| Monday, January 1, 2024 | 2617783000 | 931000000 |

Unleashing insights

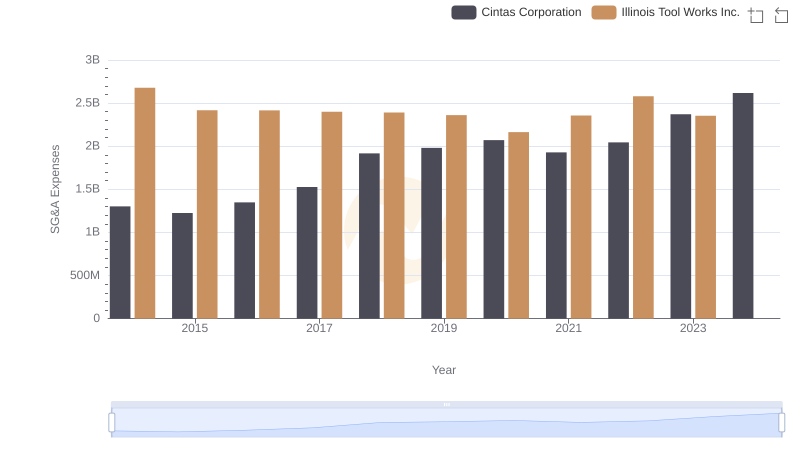

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cintas Corporation and TransDigm Group Incorporated, two industry giants, have shown contrasting approaches over the past decade. From 2014 to 2024, Cintas has seen a steady increase in SG&A expenses, peaking at approximately $2.62 billion in 2024, reflecting a growth of over 100% from 2014. In contrast, TransDigm's SG&A expenses have grown at a slower pace, reaching around $931 million in 2024, marking a 237% increase from 2014. This disparity highlights Cintas's aggressive expansion strategy, while TransDigm focuses on cost efficiency. As businesses navigate economic uncertainties, understanding these strategies offers valuable insights into effective cost management.

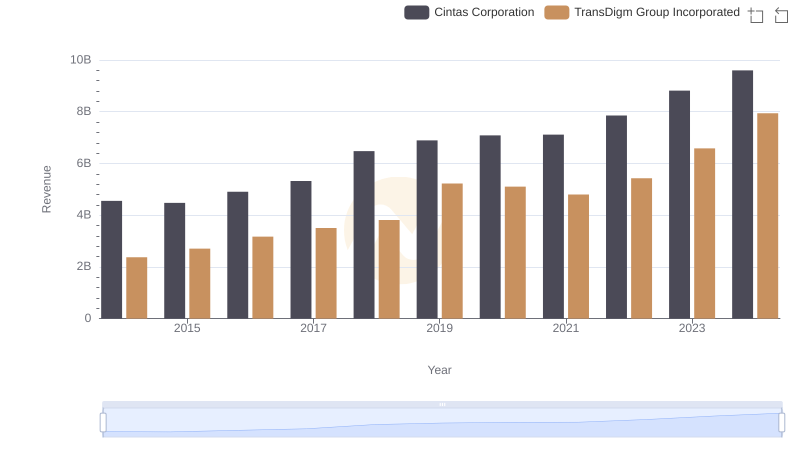

Cintas Corporation or TransDigm Group Incorporated: Who Leads in Yearly Revenue?

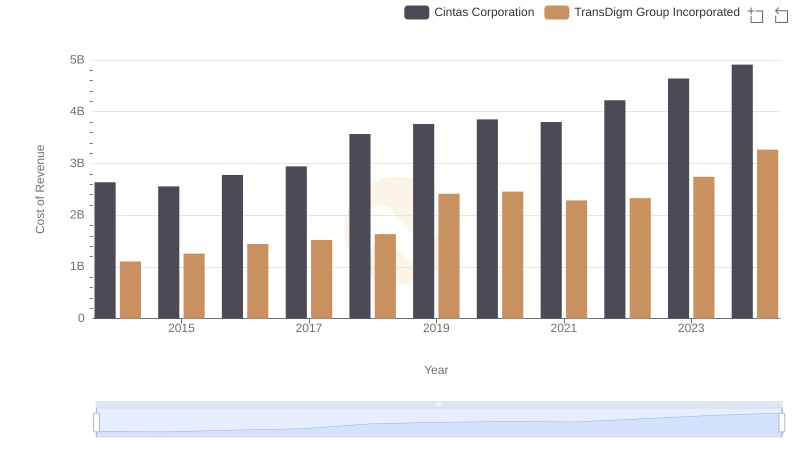

Cost of Revenue Comparison: Cintas Corporation vs TransDigm Group Incorporated

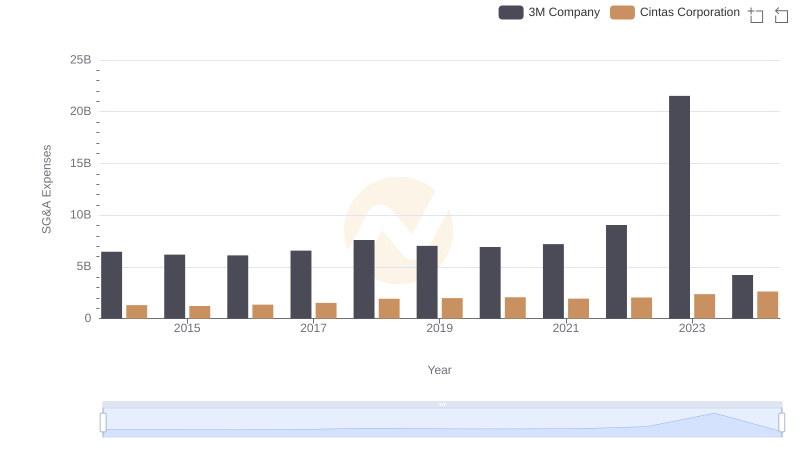

Cintas Corporation and 3M Company: SG&A Spending Patterns Compared

Breaking Down SG&A Expenses: Cintas Corporation vs Illinois Tool Works Inc.

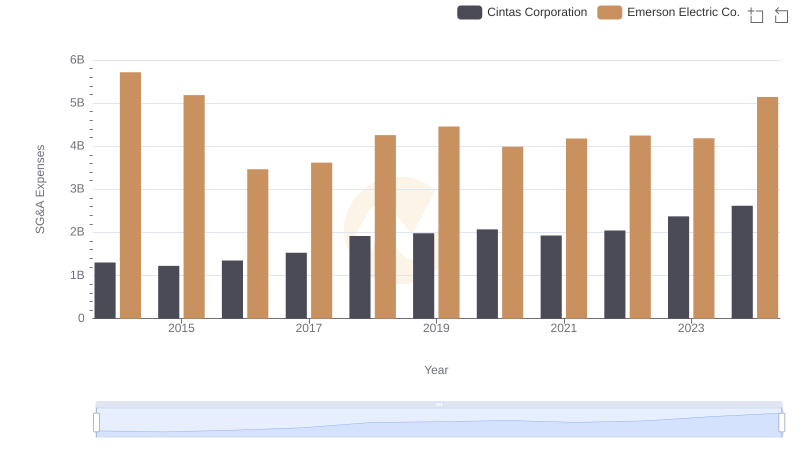

Cintas Corporation vs Emerson Electric Co.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Cintas Corporation and Republic Services, Inc.

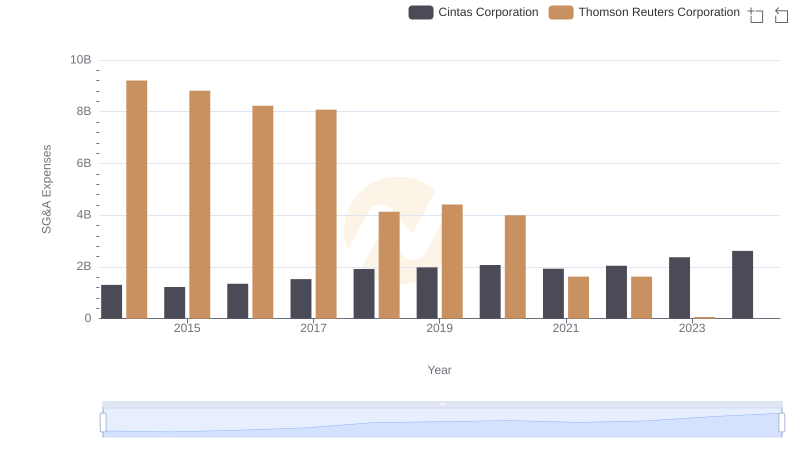

Cost Management Insights: SG&A Expenses for Cintas Corporation and Thomson Reuters Corporation

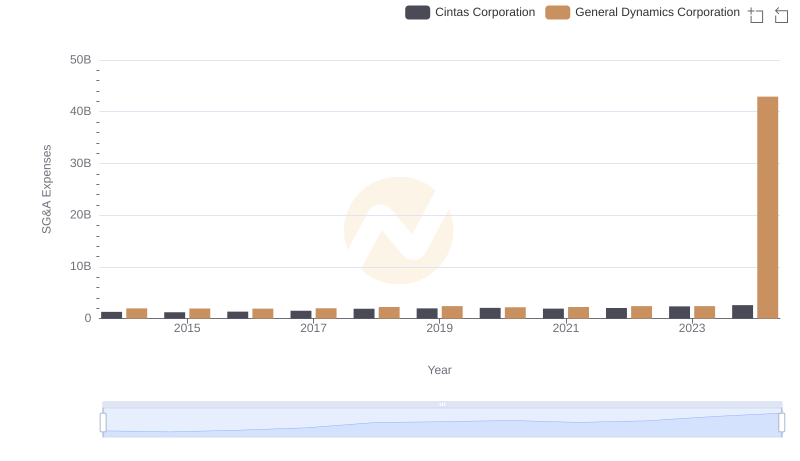

Comparing SG&A Expenses: Cintas Corporation vs General Dynamics Corporation Trends and Insights

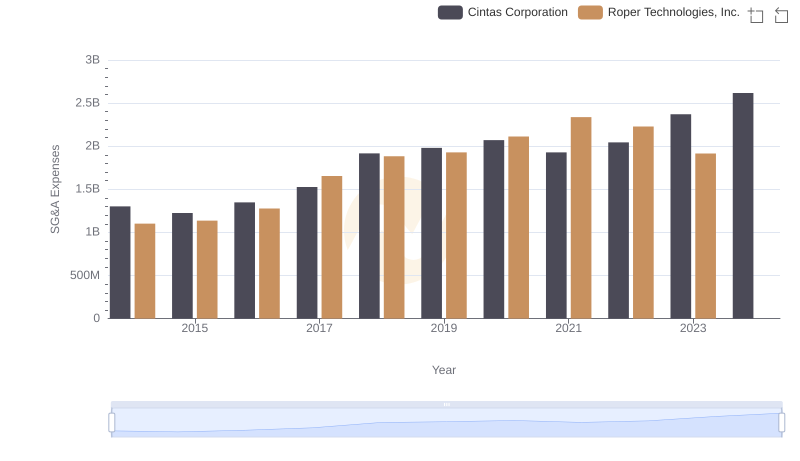

Comparing SG&A Expenses: Cintas Corporation vs Roper Technologies, Inc. Trends and Insights