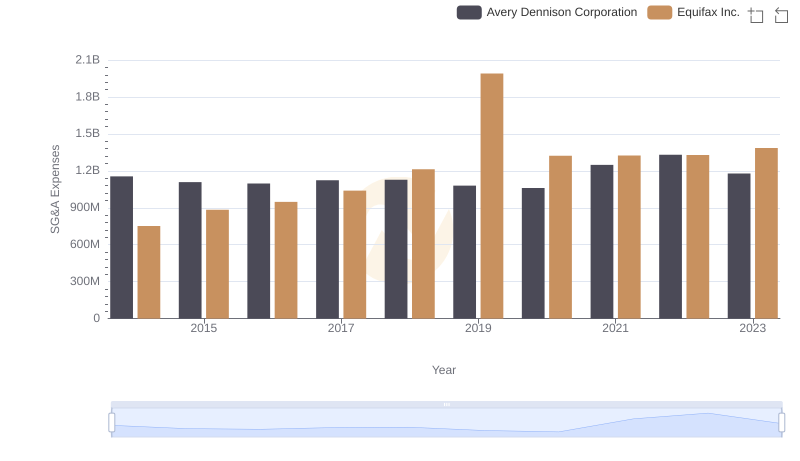

| __timestamp | Equifax Inc. | RB Global, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 248220000 |

| Thursday, January 1, 2015 | 884300000 | 254990000 |

| Friday, January 1, 2016 | 948200000 | 283529000 |

| Sunday, January 1, 2017 | 1039100000 | 323270000 |

| Monday, January 1, 2018 | 1213300000 | 382676000 |

| Tuesday, January 1, 2019 | 1990200000 | 382389000 |

| Wednesday, January 1, 2020 | 1322500000 | 417523000 |

| Friday, January 1, 2021 | 1324600000 | 464599000 |

| Saturday, January 1, 2022 | 1328900000 | 539933000 |

| Sunday, January 1, 2023 | 1385700000 | 743700000 |

| Monday, January 1, 2024 | 1450500000 | 773900000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. Over the past decade, Equifax Inc. and RB Global, Inc. have demonstrated contrasting trajectories in their SG&A expenditures. From 2014 to 2023, Equifax's SG&A costs surged by approximately 84%, reflecting strategic investments and expansion efforts. In contrast, RB Global, Inc. experienced a more modest increase of around 200%, indicating a significant scaling of operations.

These trends underscore the dynamic nature of corporate strategies and their impact on financial health, offering valuable insights for investors and analysts alike.

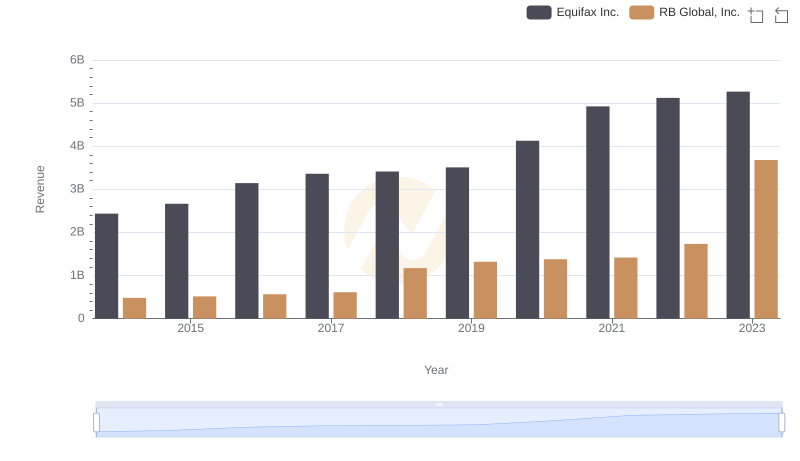

Equifax Inc. vs RB Global, Inc.: Examining Key Revenue Metrics

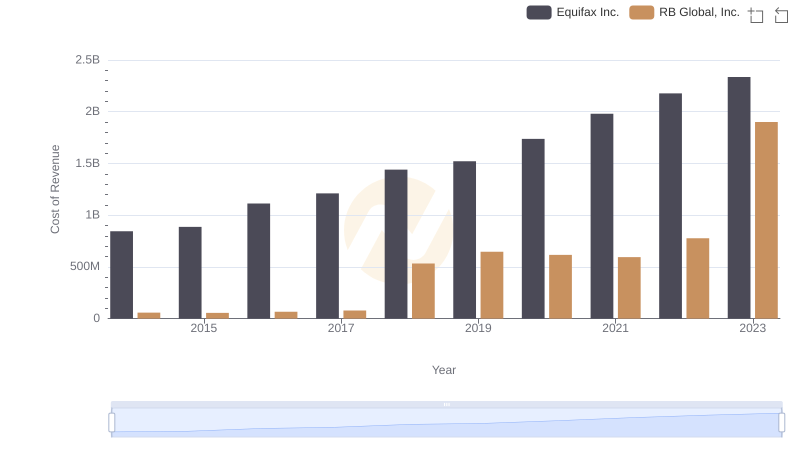

Cost Insights: Breaking Down Equifax Inc. and RB Global, Inc.'s Expenses

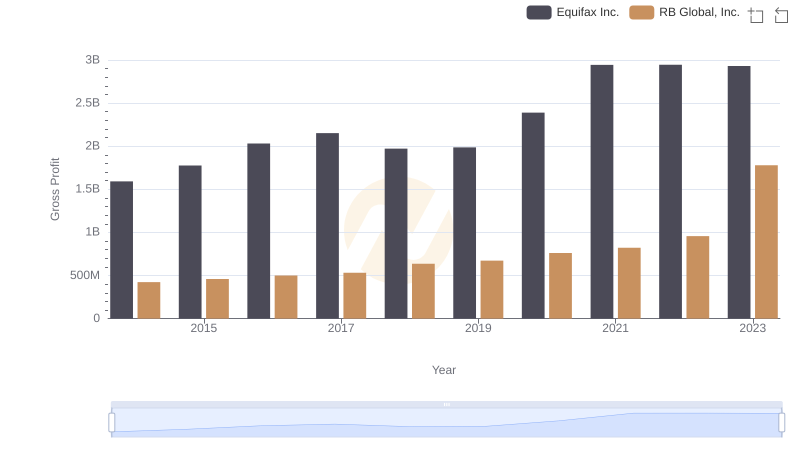

Gross Profit Comparison: Equifax Inc. and RB Global, Inc. Trends

Breaking Down SG&A Expenses: Equifax Inc. vs Avery Dennison Corporation

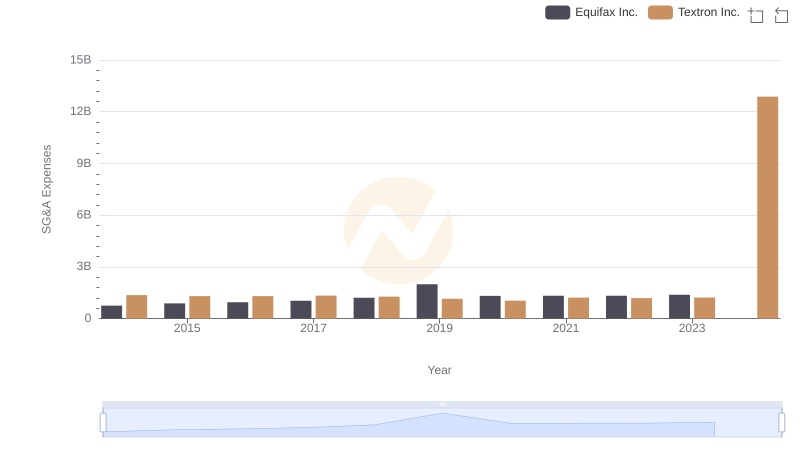

Equifax Inc. vs Textron Inc.: SG&A Expense Trends