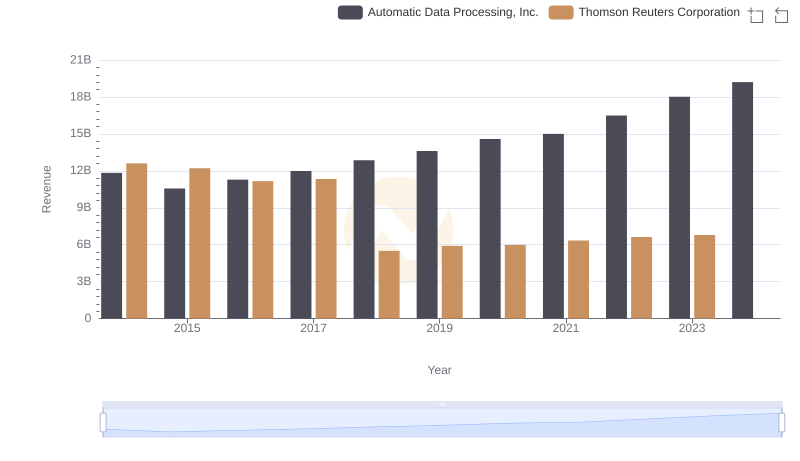

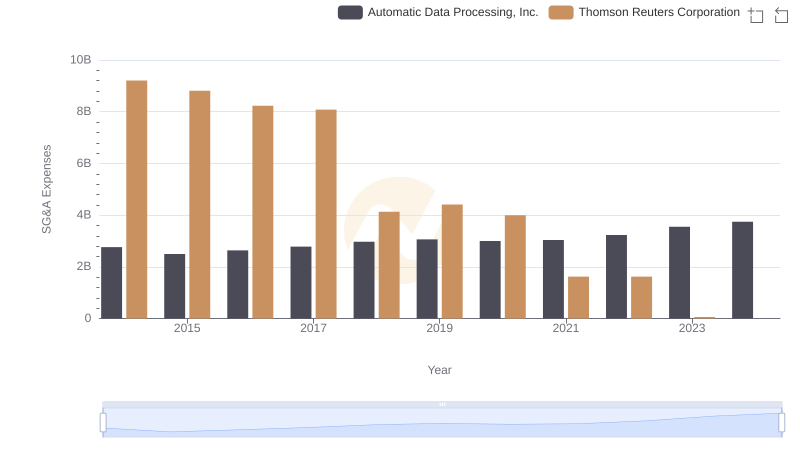

| __timestamp | Automatic Data Processing, Inc. | Thomson Reuters Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 9209000000 |

| Thursday, January 1, 2015 | 6427600000 | 8810000000 |

| Friday, January 1, 2016 | 6840300000 | 8232000000 |

| Sunday, January 1, 2017 | 7269800000 | 8079000000 |

| Monday, January 1, 2018 | 7842600000 | 4131000000 |

| Tuesday, January 1, 2019 | 8086600000 | 2431000000 |

| Wednesday, January 1, 2020 | 8445100000 | 2269000000 |

| Friday, January 1, 2021 | 8640300000 | 2478000000 |

| Saturday, January 1, 2022 | 9461900000 | 2408000000 |

| Sunday, January 1, 2023 | 9953400000 | 4095000000 |

| Monday, January 1, 2024 | 10476700000 |

Cracking the code

In the ever-evolving landscape of corporate finance, understanding cost structures is pivotal. Over the past decade, Automatic Data Processing, Inc. (ADP) and Thomson Reuters Corporation have showcased contrasting trajectories in their cost of revenue. ADP's cost of revenue has seen a steady climb, increasing by approximately 45% from 2014 to 2023. This growth reflects ADP's strategic investments and expansion efforts. In contrast, Thomson Reuters experienced a significant decline, with costs dropping by nearly 75% from 2014 to 2022, before a slight rebound in 2023. This reduction aligns with the company's restructuring and divestiture strategies. Notably, 2024 data for Thomson Reuters remains unavailable, highlighting potential gaps in financial reporting. These trends underscore the diverse approaches these industry giants have taken in managing their operational expenses, offering valuable insights for investors and analysts alike.

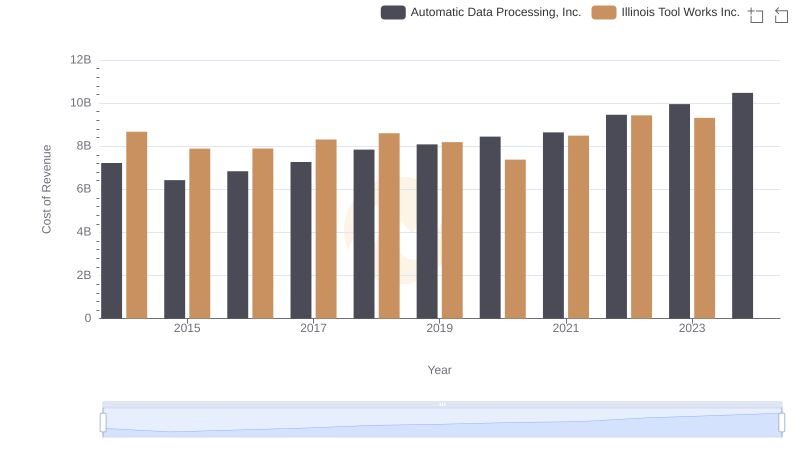

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Illinois Tool Works Inc.

Automatic Data Processing, Inc. or Thomson Reuters Corporation: Who Leads in Yearly Revenue?

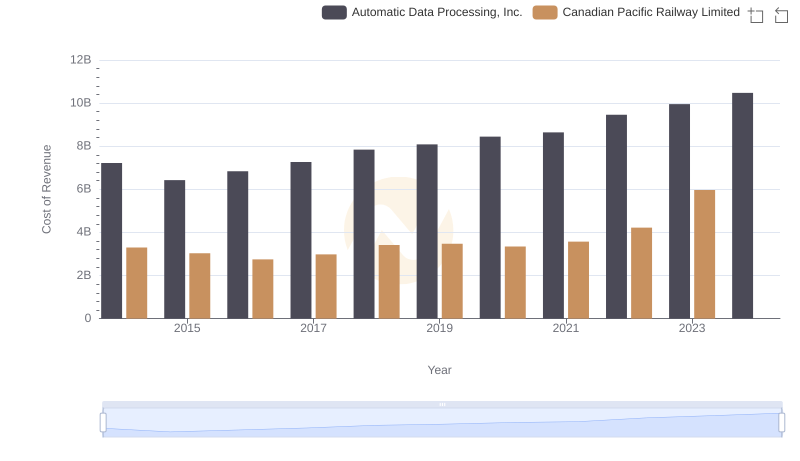

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Canadian Pacific Railway Limited's Expenses

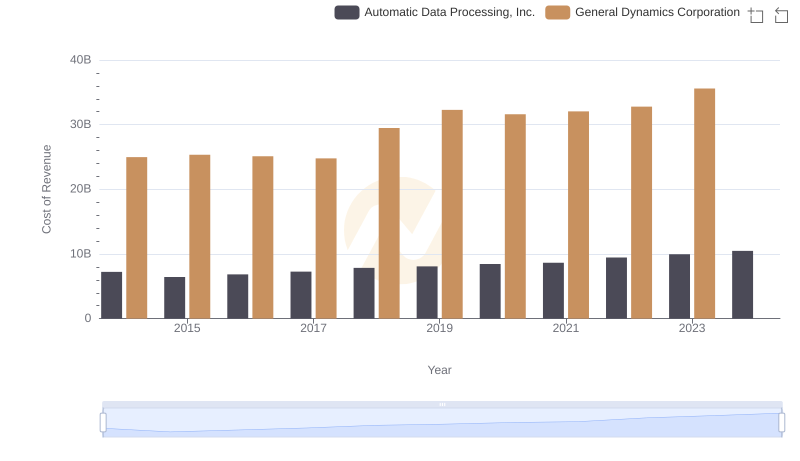

Cost of Revenue Trends: Automatic Data Processing, Inc. vs General Dynamics Corporation

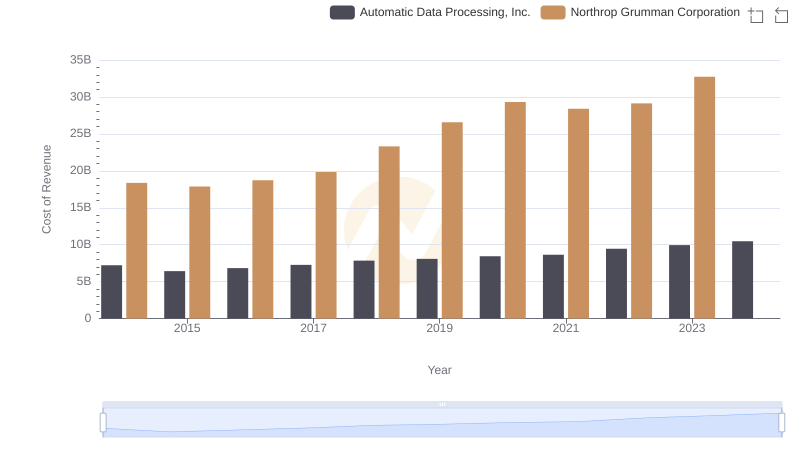

Automatic Data Processing, Inc. vs Northrop Grumman Corporation: Efficiency in Cost of Revenue Explored

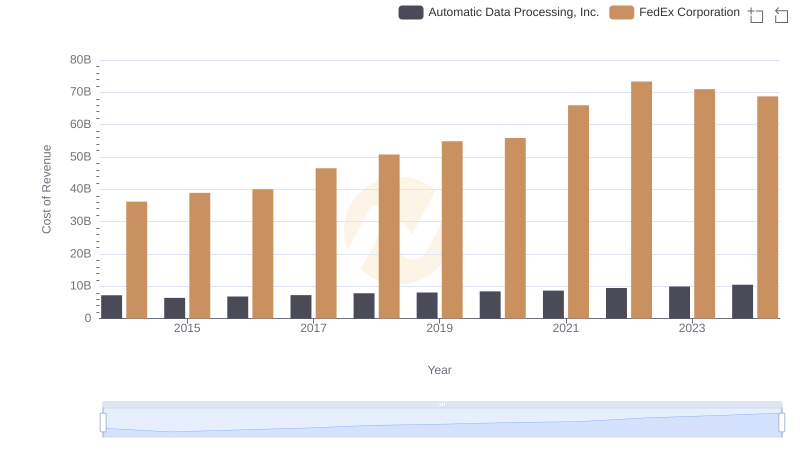

Cost Insights: Breaking Down Automatic Data Processing, Inc. and FedEx Corporation's Expenses

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Thomson Reuters Corporation

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

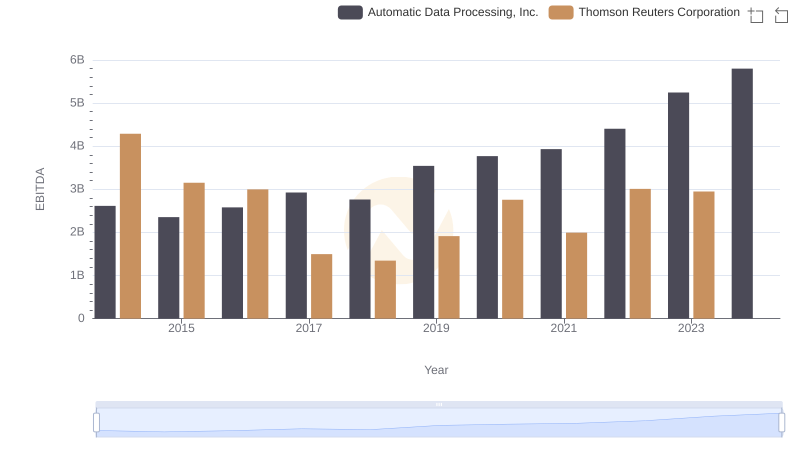

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Thomson Reuters Corporation