| __timestamp | Axon Enterprise, Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 164525000 | 3277700000 |

| Thursday, January 1, 2015 | 197892000 | 3352800000 |

| Friday, January 1, 2016 | 268245000 | 3430400000 |

| Sunday, January 1, 2017 | 343798000 | 3686900000 |

| Monday, January 1, 2018 | 420068000 | 3740700000 |

| Tuesday, January 1, 2019 | 530860000 | 3730000000 |

| Wednesday, January 1, 2020 | 681003000 | 3592500000 |

| Friday, January 1, 2021 | 863381000 | 4252000000 |

| Saturday, January 1, 2022 | 1189935000 | 4492800000 |

| Sunday, January 1, 2023 | 1563391000 | 5108300000 |

| Monday, January 1, 2024 | 4707400000 |

Unleashing the power of data

In the ever-evolving landscape of American industry, Axon Enterprise, Inc. and Snap-on Incorporated stand as two distinct pillars. Over the past decade, Axon has seen a remarkable growth trajectory, with its revenue surging by over 850% from 2014 to 2023. This growth is a testament to Axon's innovative approach in the public safety sector. Meanwhile, Snap-on, a stalwart in the tool manufacturing industry, has maintained a steady revenue increase of approximately 56% during the same period. This stability underscores Snap-on's enduring appeal and market dominance.

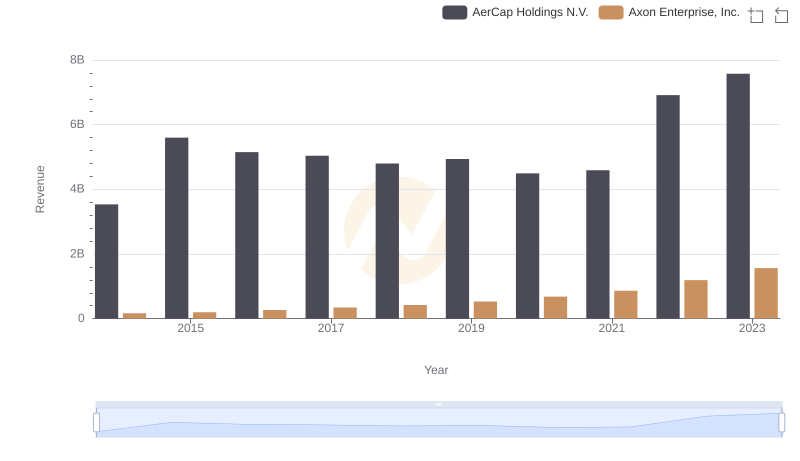

Comparing Revenue Performance: Axon Enterprise, Inc. or AerCap Holdings N.V.?

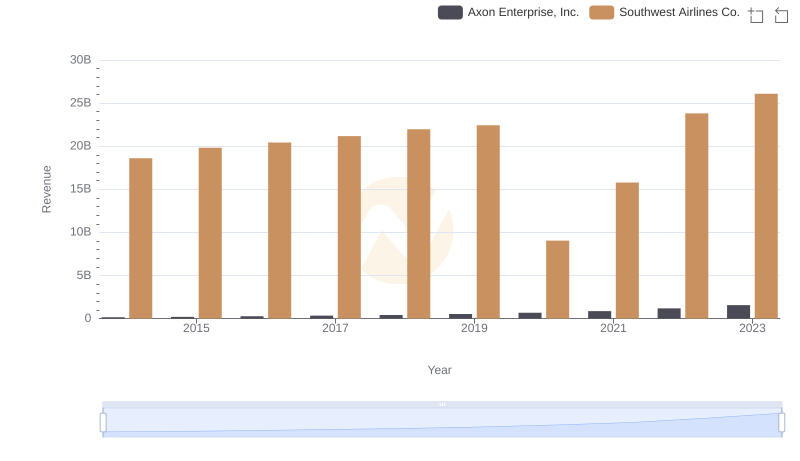

Revenue Showdown: Axon Enterprise, Inc. vs Southwest Airlines Co.

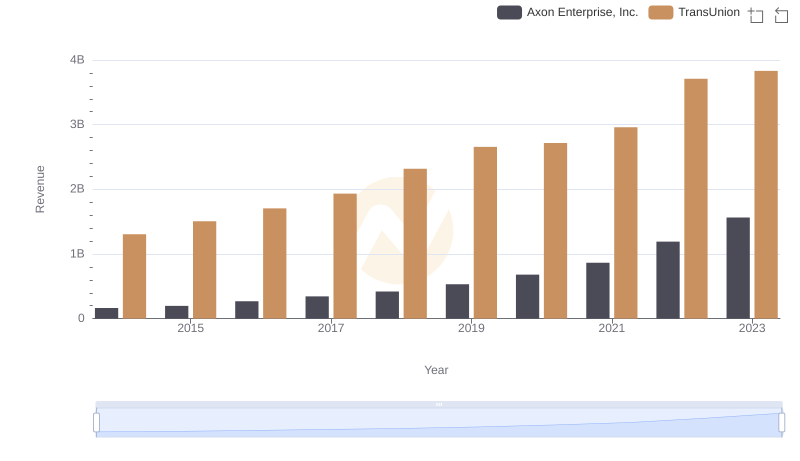

Breaking Down Revenue Trends: Axon Enterprise, Inc. vs TransUnion

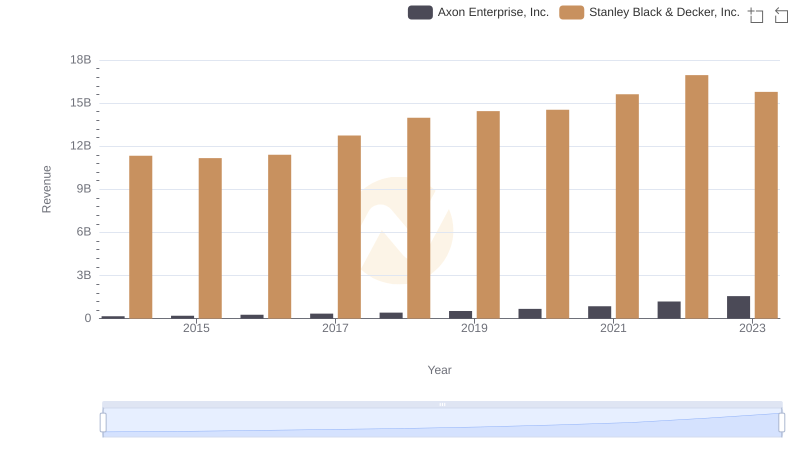

Revenue Showdown: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

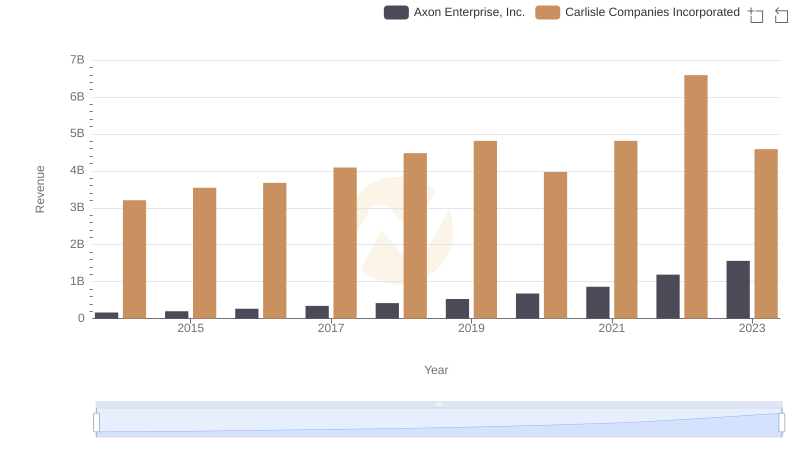

Axon Enterprise, Inc. and Carlisle Companies Incorporated: A Comprehensive Revenue Analysis

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and Snap-on Incorporated

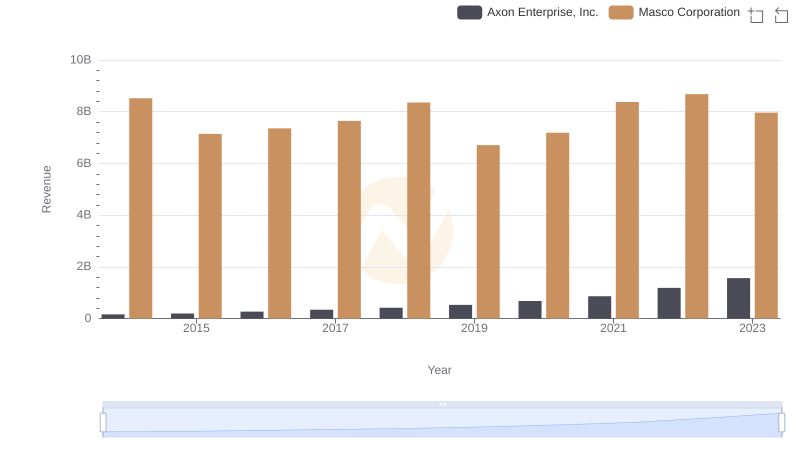

Axon Enterprise, Inc. and Masco Corporation: A Comprehensive Revenue Analysis

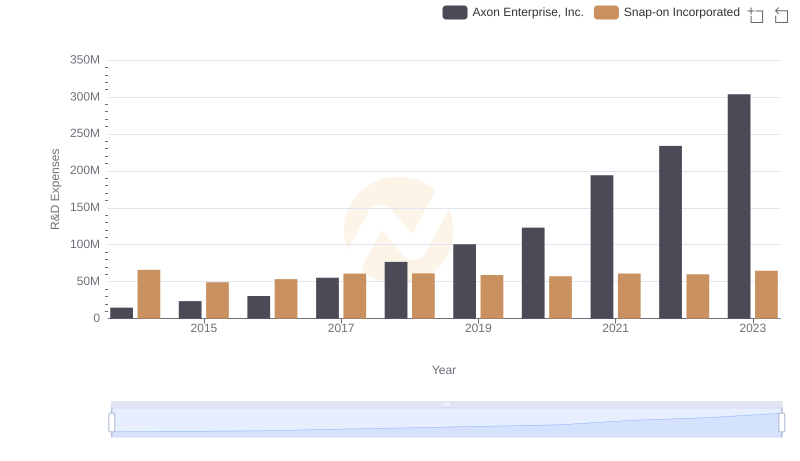

R&D Insights: How Axon Enterprise, Inc. and Snap-on Incorporated Allocate Funds

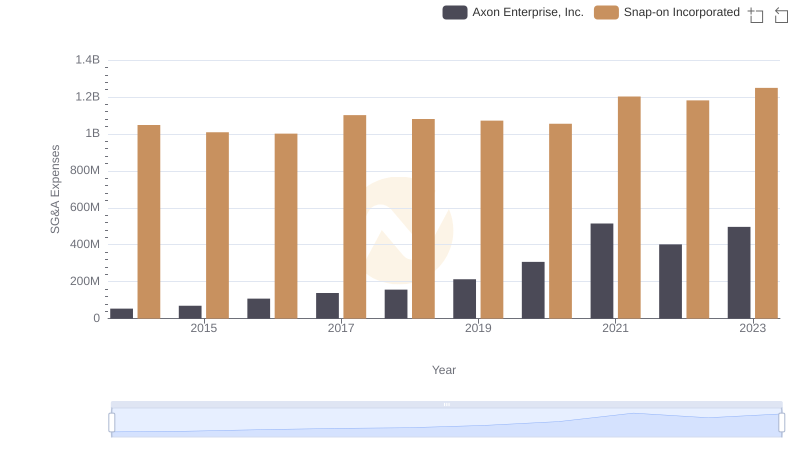

Axon Enterprise, Inc. or Snap-on Incorporated: Who Manages SG&A Costs Better?