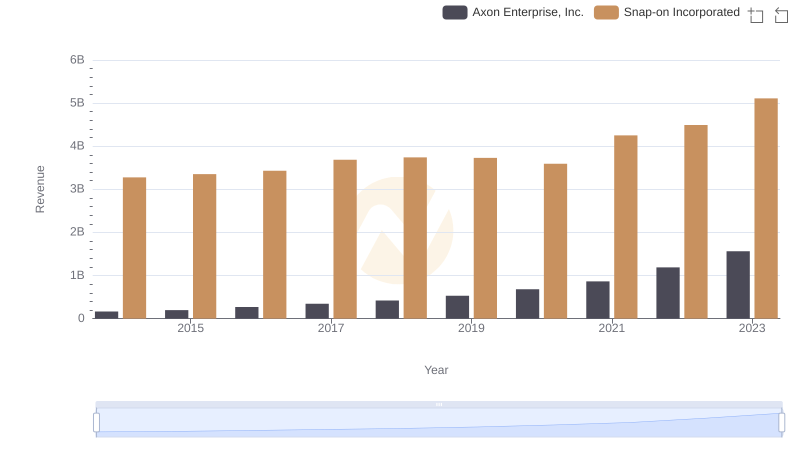

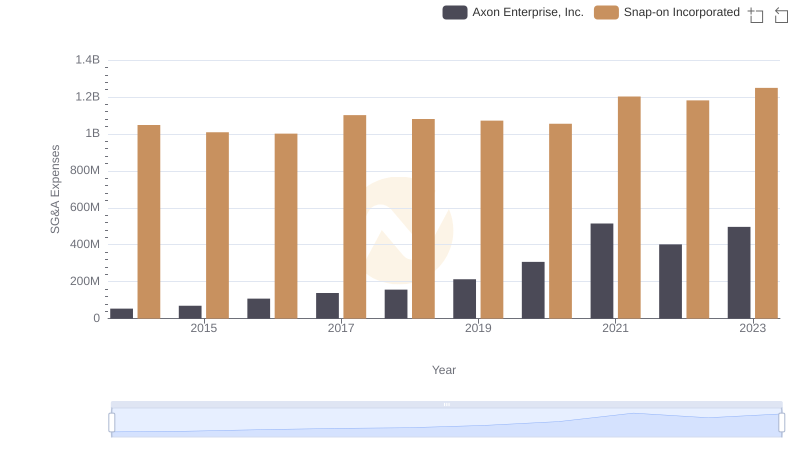

| __timestamp | Axon Enterprise, Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 14885000 | 66000000 |

| Thursday, January 1, 2015 | 23614000 | 49300000 |

| Friday, January 1, 2016 | 30609000 | 53400000 |

| Sunday, January 1, 2017 | 55373000 | 60900000 |

| Monday, January 1, 2018 | 76856000 | 61200000 |

| Tuesday, January 1, 2019 | 100721000 | 59100000 |

| Wednesday, January 1, 2020 | 123195000 | 57400000 |

| Friday, January 1, 2021 | 194026000 | 61100000 |

| Saturday, January 1, 2022 | 233810000 | 60100000 |

| Sunday, January 1, 2023 | 303719000 | 64700000 |

| Monday, January 1, 2024 | 0 |

Data in motion

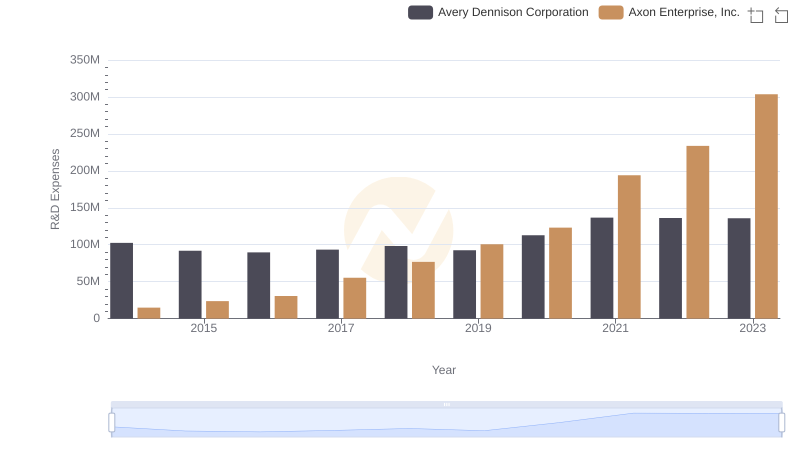

In the ever-evolving landscape of innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, Axon Enterprise, Inc. and Snap-on Incorporated have demonstrated contrasting approaches to R&D investment.

Since 2014, Axon has increased its R&D expenses by an impressive 1,900%, reflecting its aggressive pursuit of technological advancements. By 2023, Axon's R&D spending reached a peak, showcasing its dedication to innovation in public safety technology.

In contrast, Snap-on's R&D investment has remained relatively stable, with a modest 10% increase over the same period. This steady approach underscores Snap-on's focus on incremental improvements in its tool and equipment offerings.

These divergent strategies highlight the unique paths companies take in their quest for innovation, shaping their future trajectories in distinct ways.

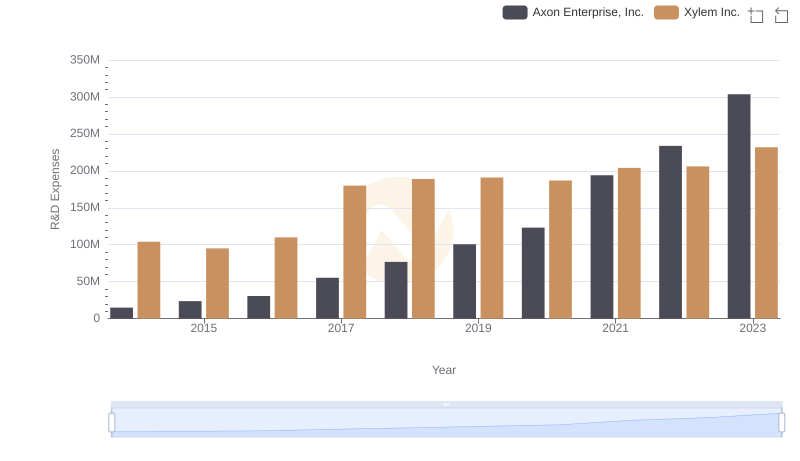

Research and Development: Comparing Key Metrics for Axon Enterprise, Inc. and Xylem Inc.

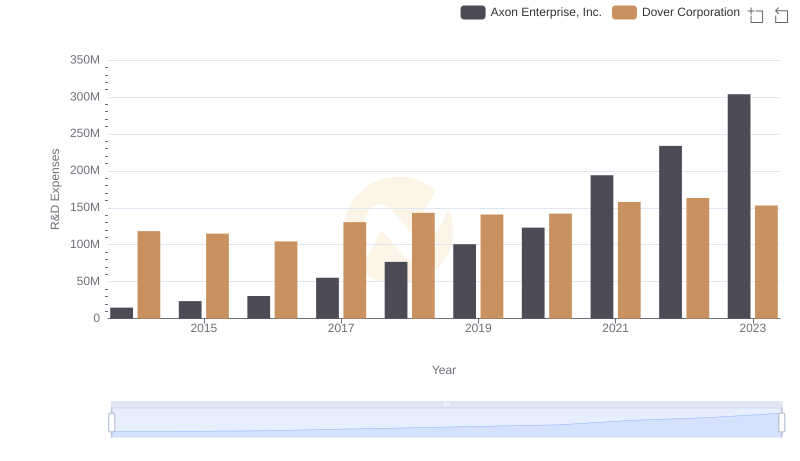

Axon Enterprise, Inc. or Dover Corporation: Who Invests More in Innovation?

Axon Enterprise, Inc. vs Snap-on Incorporated: Examining Key Revenue Metrics

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and Snap-on Incorporated

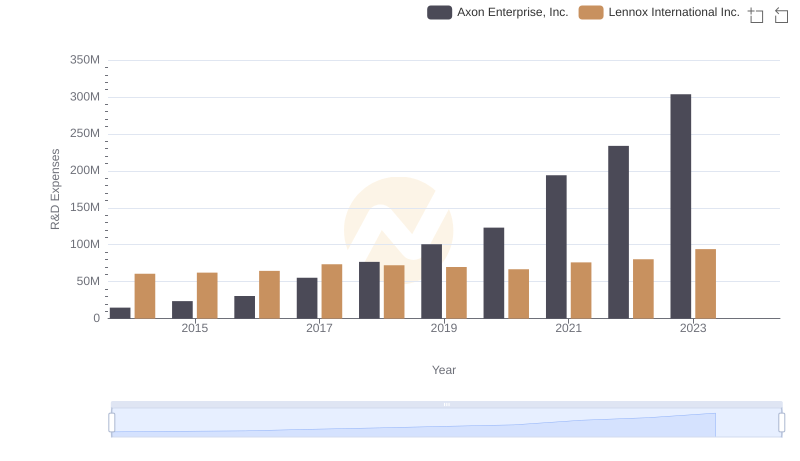

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Lennox International Inc.

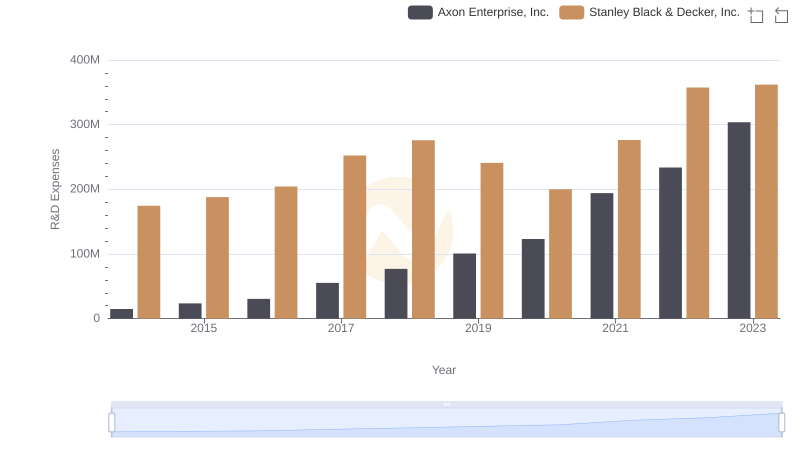

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

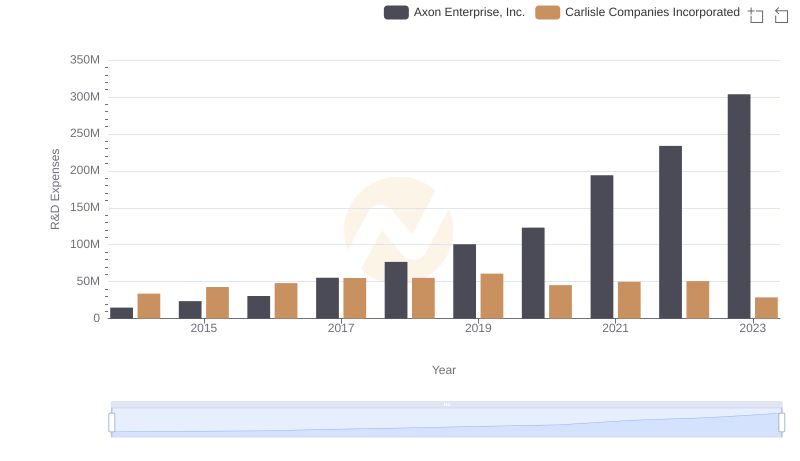

Analyzing R&D Budgets: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

Axon Enterprise, Inc. or Snap-on Incorporated: Who Manages SG&A Costs Better?

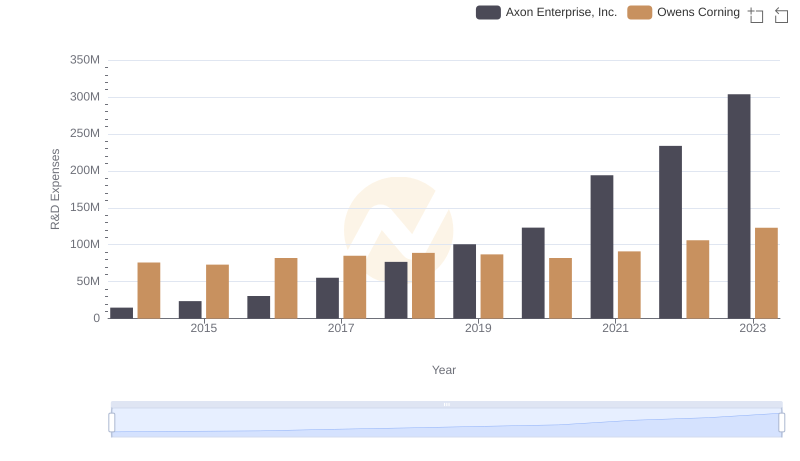

Research and Development Investment: Axon Enterprise, Inc. vs Owens Corning

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Avery Dennison Corporation