| __timestamp | Automatic Data Processing, Inc. | Avery Dennison Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 1651200000 |

| Thursday, January 1, 2015 | 4133200000 | 1645800000 |

| Friday, January 1, 2016 | 4450200000 | 1699700000 |

| Sunday, January 1, 2017 | 4712600000 | 1812200000 |

| Monday, January 1, 2018 | 5016700000 | 1915500000 |

| Tuesday, January 1, 2019 | 5526700000 | 1904100000 |

| Wednesday, January 1, 2020 | 6144700000 | 1923300000 |

| Friday, January 1, 2021 | 6365100000 | 2312800000 |

| Saturday, January 1, 2022 | 7036400000 | 2404200000 |

| Sunday, January 1, 2023 | 8058800000 | 2277499999 |

| Monday, January 1, 2024 | 8725900000 | 2530700000 |

Infusing magic into the data realm

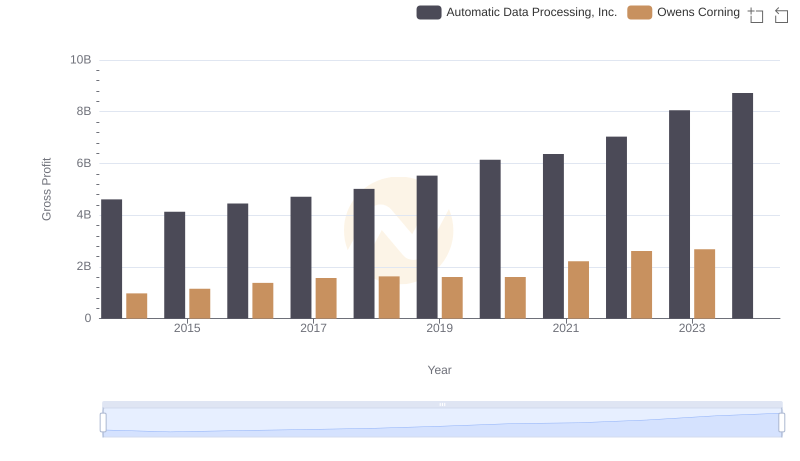

In the competitive landscape of the U.S. stock market, Automatic Data Processing, Inc. (ADP) and Avery Dennison Corporation (AVY) have showcased distinct trajectories in their gross profit performance over the past decade. ADP, a leader in human resources management software, has seen its gross profit soar by approximately 89% from 2014 to 2023, reflecting its robust growth and market adaptability. In contrast, Avery Dennison, a key player in the labeling and packaging industry, experienced a more modest increase of around 38% during the same period.

The data reveals a consistent upward trend for both companies, with ADP's gross profit peaking in 2023, while Avery Dennison reached its highest in 2022. Notably, the data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting. This analysis underscores the importance of strategic innovation and market positioning in driving financial success.

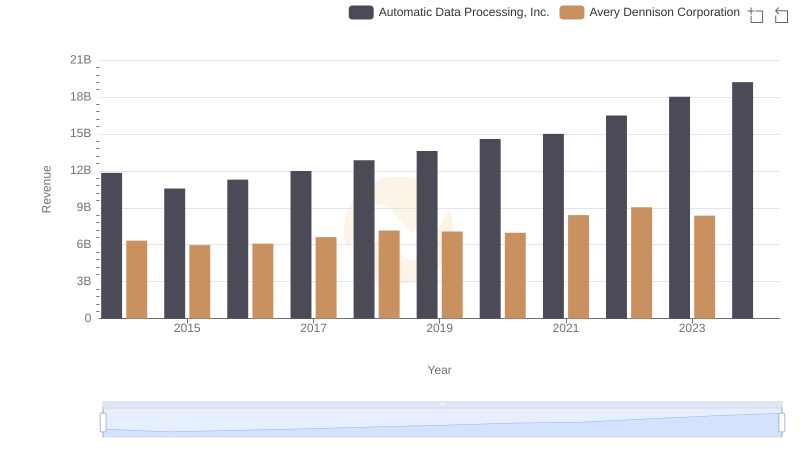

Automatic Data Processing, Inc. or Avery Dennison Corporation: Who Leads in Yearly Revenue?

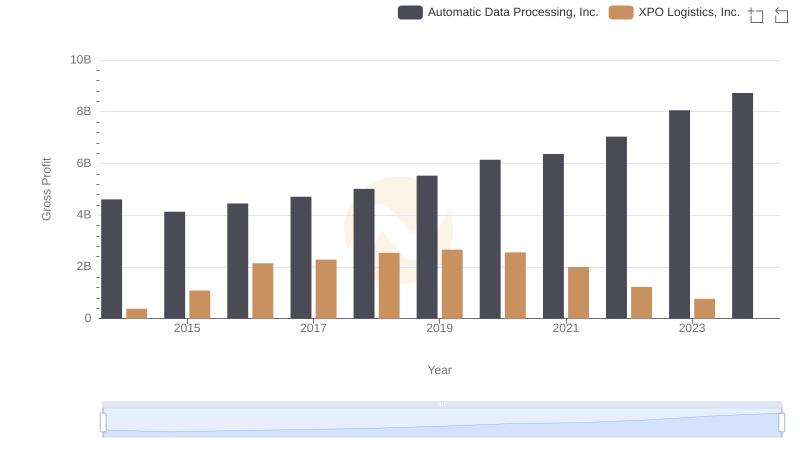

Gross Profit Comparison: Automatic Data Processing, Inc. and XPO Logistics, Inc. Trends

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Owens Corning

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc.

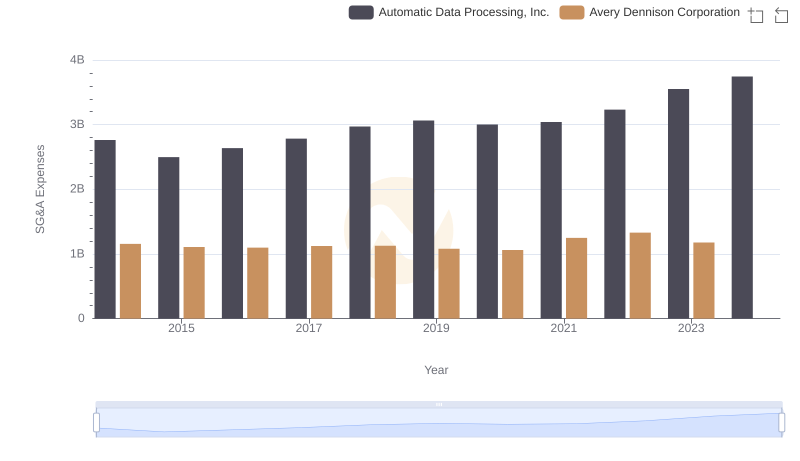

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Avery Dennison Corporation

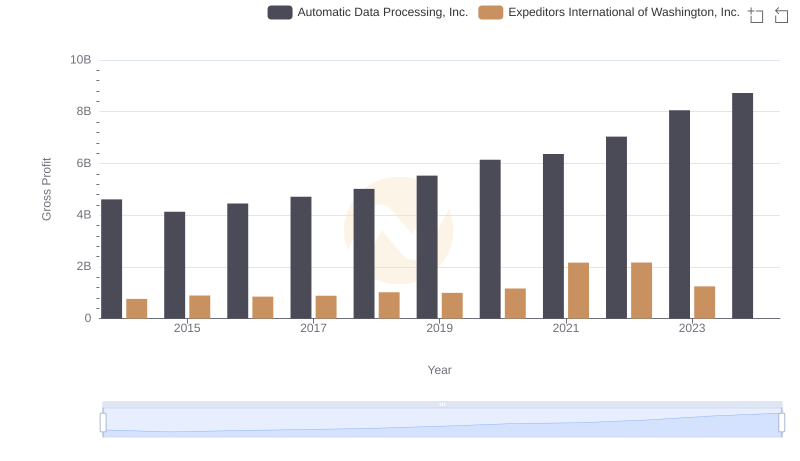

Gross Profit Comparison: Automatic Data Processing, Inc. and Expeditors International of Washington, Inc. Trends

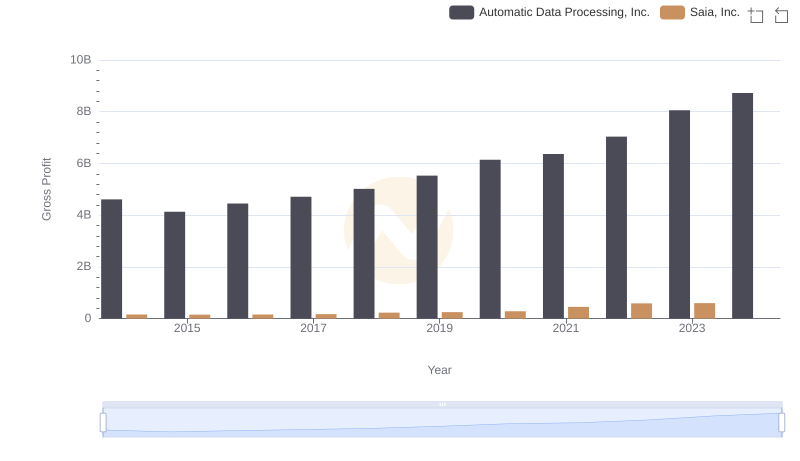

Automatic Data Processing, Inc. and Saia, Inc.: A Detailed Gross Profit Analysis

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Avery Dennison Corporation