| __timestamp | Automatic Data Processing, Inc. | Avery Dennison Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1155300000 |

| Thursday, January 1, 2015 | 2496900000 | 1108100000 |

| Friday, January 1, 2016 | 2637000000 | 1097500000 |

| Sunday, January 1, 2017 | 2783200000 | 1123200000 |

| Monday, January 1, 2018 | 2971500000 | 1127500000 |

| Tuesday, January 1, 2019 | 3064200000 | 1080400000 |

| Wednesday, January 1, 2020 | 3003000000 | 1060500000 |

| Friday, January 1, 2021 | 3040500000 | 1248500000 |

| Saturday, January 1, 2022 | 3233200000 | 1330800000 |

| Sunday, January 1, 2023 | 3551400000 | 1177900000 |

| Monday, January 1, 2024 | 3778900000 | 1415300000 |

Unveiling the hidden dimensions of data

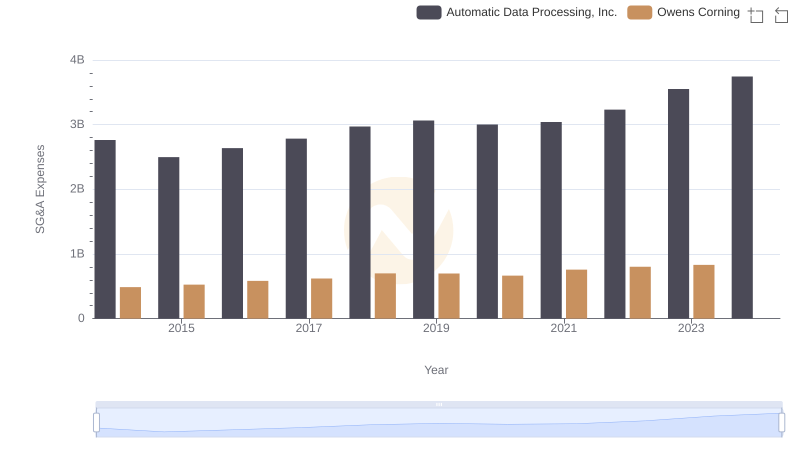

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and Avery Dennison Corporation (AVY) have been navigating this financial terrain since 2014. Over the past decade, ADP has consistently maintained higher SG&A expenses, peaking at approximately $3.7 billion in 2024, a 36% increase from 2014. In contrast, Avery Dennison's SG&A expenses have shown a more modest growth, reaching around $1.3 billion in 2022, a 15% rise from 2014.

While ADP's expenses surged, Avery Dennison demonstrated a steadier approach, with a notable dip in 2023. This data suggests that ADP's strategy may involve aggressive expansion or investment in administrative capabilities, whereas Avery Dennison might be focusing on cost efficiency. The absence of data for Avery Dennison in 2024 leaves room for speculation on their future financial strategies.

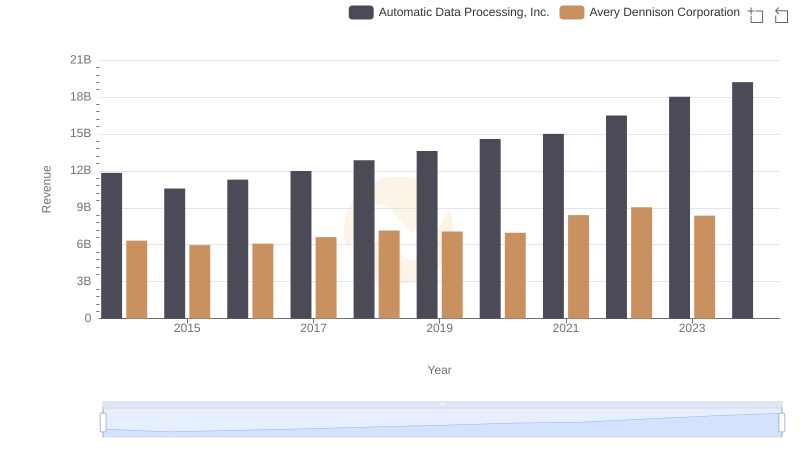

Automatic Data Processing, Inc. or Avery Dennison Corporation: Who Leads in Yearly Revenue?

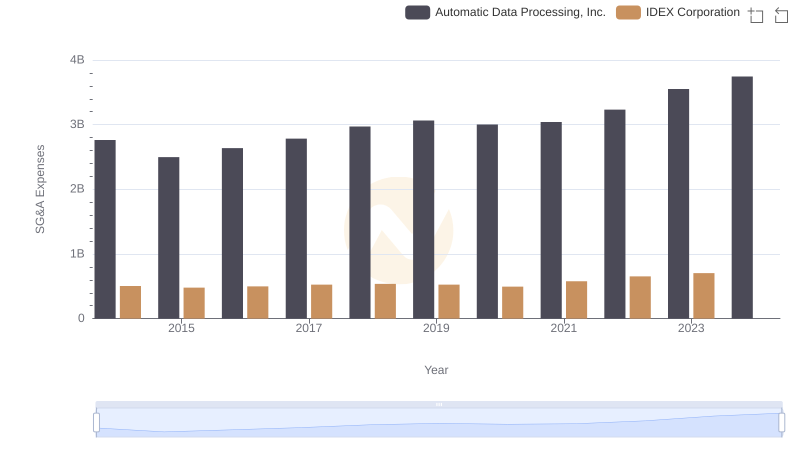

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs IDEX Corporation

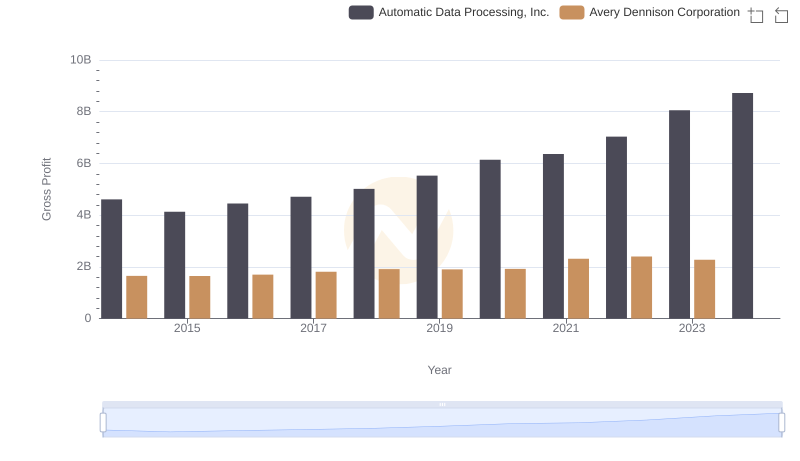

Automatic Data Processing, Inc. vs Avery Dennison Corporation: A Gross Profit Performance Breakdown

Automatic Data Processing, Inc. vs Owens Corning: SG&A Expense Trends

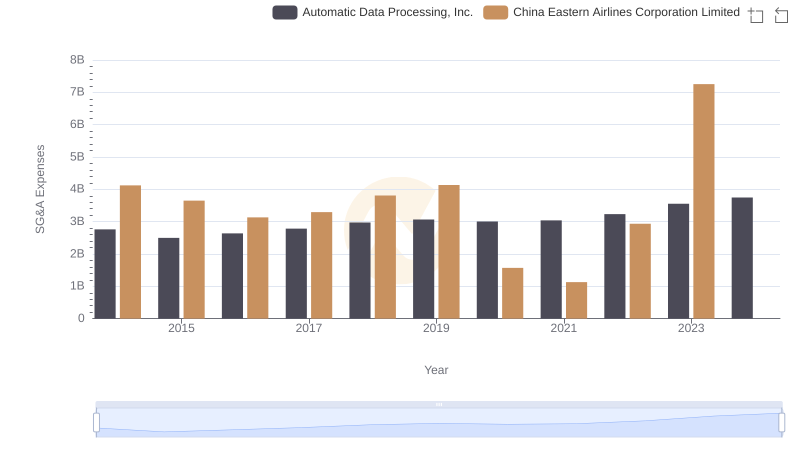

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs China Eastern Airlines Corporation Limited Trends and Insights

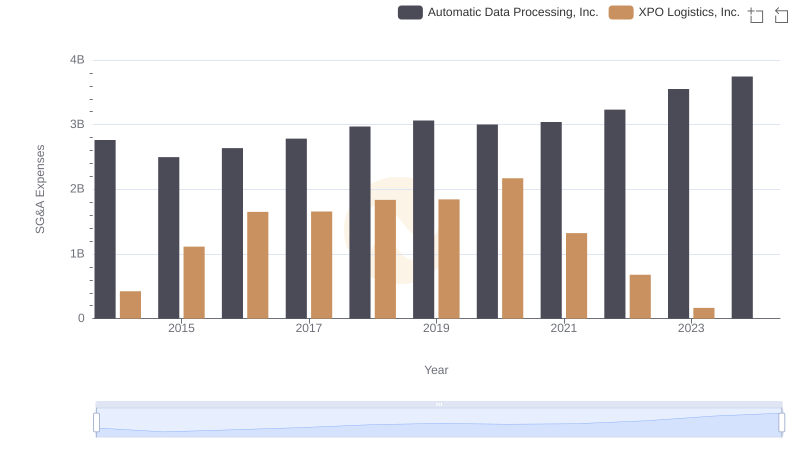

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and XPO Logistics, Inc.

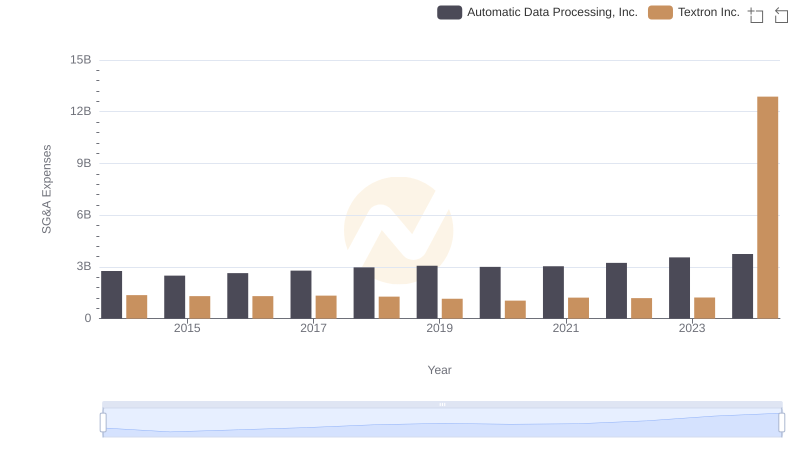

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Textron Inc.

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc. Trends and Insights

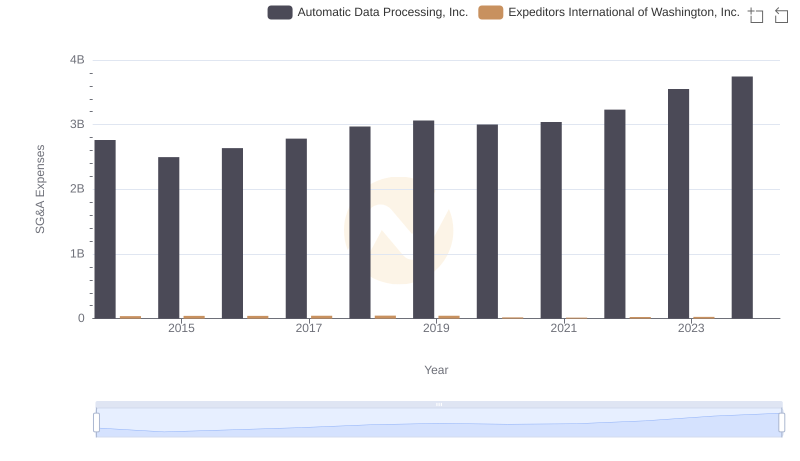

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc. Trends and Insights

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Avery Dennison Corporation