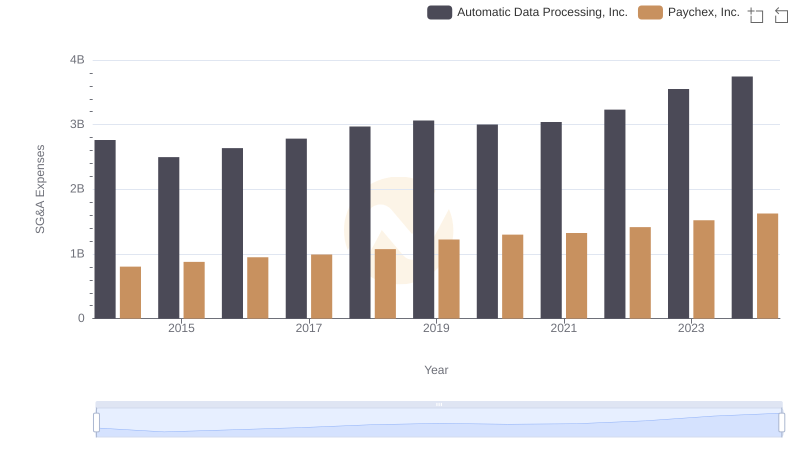

| __timestamp | Automatic Data Processing, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 758000000 |

| Thursday, January 1, 2015 | 2496900000 | 714000000 |

| Friday, January 1, 2016 | 2637000000 | 719000000 |

| Sunday, January 1, 2017 | 2783200000 | 903000000 |

| Monday, January 1, 2018 | 2971500000 | 1038000000 |

| Tuesday, January 1, 2019 | 3064200000 | 1092000000 |

| Wednesday, January 1, 2020 | 3003000000 | 979000000 |

| Friday, January 1, 2021 | 3040500000 | 1199000000 |

| Saturday, January 1, 2022 | 3233200000 | 1400000000 |

| Sunday, January 1, 2023 | 3551400000 | 1527000000 |

| Monday, January 1, 2024 | 3778900000 | 1645000000 |

Igniting the spark of knowledge

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and United Rentals, Inc. (URI) have shown distinct strategies over the past decade. From 2014 to 2024, ADP's SG&A expenses have grown by approximately 36%, reflecting a steady increase in operational costs. In contrast, URI's expenses have surged by about 117%, indicating a more aggressive expansion strategy.

ADP's consistent approach, with expenses averaging around $3 billion annually, suggests a focus on stable growth and efficiency. Meanwhile, URI's expenses, which started at $758 million in 2014 and reached $1.645 billion in 2024, highlight its rapid scaling efforts. This comparison underscores the diverse strategies companies employ to balance growth and cost management, offering valuable insights for investors and business strategists alike.

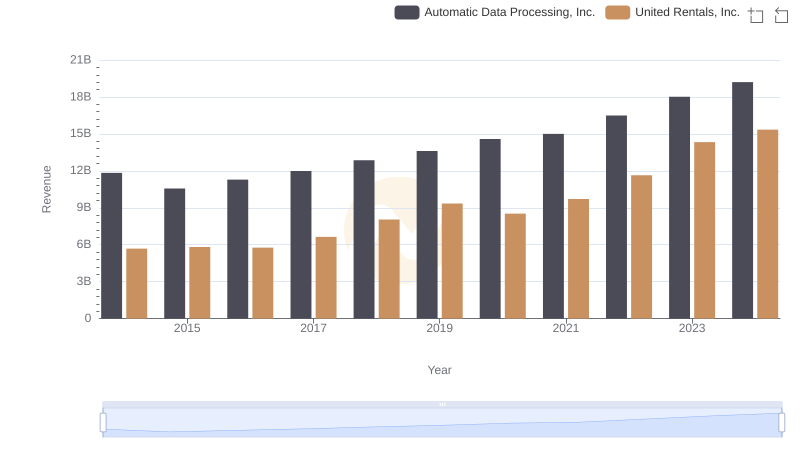

Automatic Data Processing, Inc. and United Rentals, Inc.: A Comprehensive Revenue Analysis

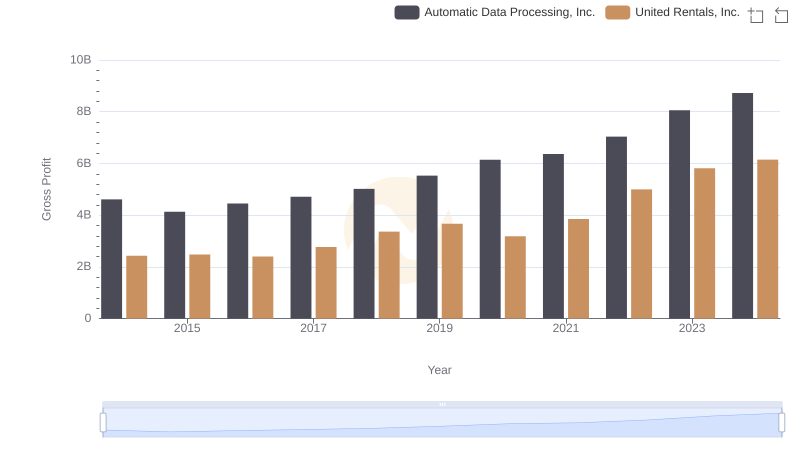

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or United Rentals, Inc.

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Paychex, Inc.

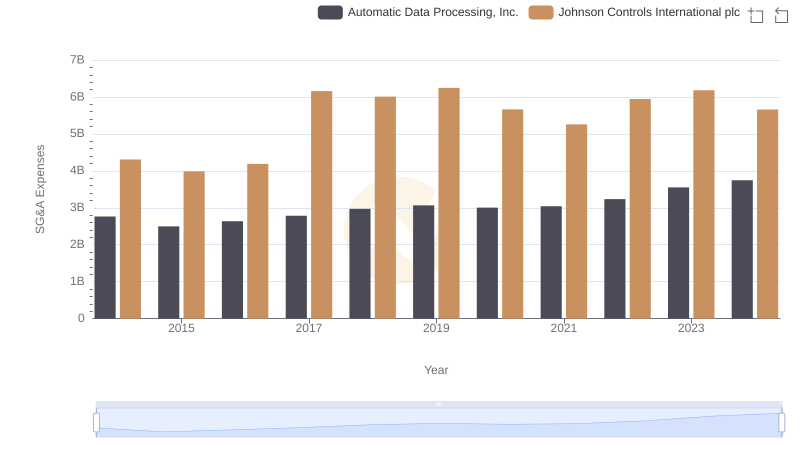

Automatic Data Processing, Inc. or Johnson Controls International plc: Who Manages SG&A Costs Better?

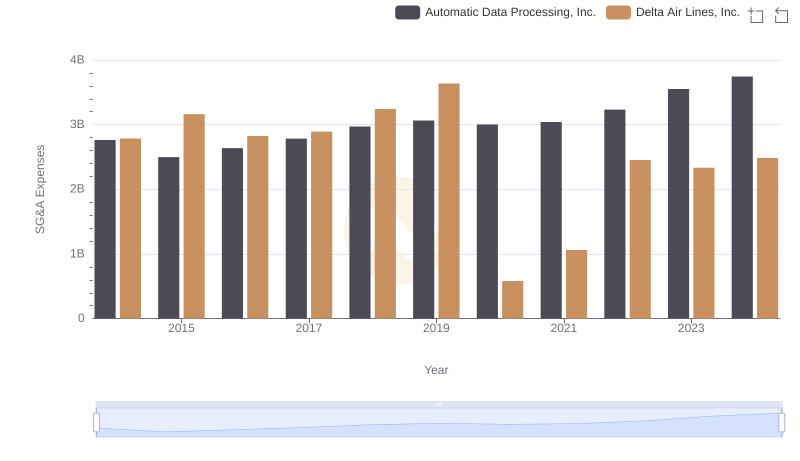

Automatic Data Processing, Inc. and Delta Air Lines, Inc.: SG&A Spending Patterns Compared