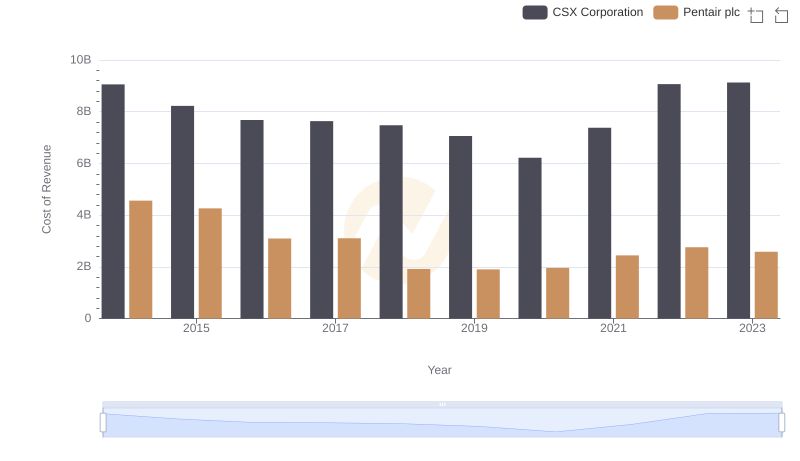

| __timestamp | CSX Corporation | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 12669000000 | 7039000000 |

| Thursday, January 1, 2015 | 11811000000 | 6449000000 |

| Friday, January 1, 2016 | 11069000000 | 4890000000 |

| Sunday, January 1, 2017 | 11408000000 | 4936500000 |

| Monday, January 1, 2018 | 12250000000 | 2965100000 |

| Tuesday, January 1, 2019 | 11937000000 | 2957200000 |

| Wednesday, January 1, 2020 | 10583000000 | 3017800000 |

| Friday, January 1, 2021 | 12522000000 | 3764800000 |

| Saturday, January 1, 2022 | 14853000000 | 4121800000 |

| Sunday, January 1, 2023 | 14657000000 | 4104500000 |

| Monday, January 1, 2024 | 4082800000 |

Data in motion

In the ever-evolving landscape of American industry, CSX Corporation and Pentair plc stand as titans in their respective fields. Over the past decade, CSX Corporation, a leader in rail transportation, has consistently outperformed Pentair plc, a global water solutions provider, in terms of annual revenue. From 2014 to 2023, CSX's revenue surged by approximately 16%, peaking in 2022 with a remarkable 48% increase from its 2016 low. In contrast, Pentair's revenue experienced a more volatile journey, with a notable dip in 2018, but managed a steady recovery, achieving a 39% increase by 2023 from its 2018 nadir. This comparison not only highlights the resilience and growth strategies of these companies but also reflects broader economic trends and sector-specific challenges. As we look to the future, the strategic decisions made by these corporations will undoubtedly shape their trajectories in the competitive global market.

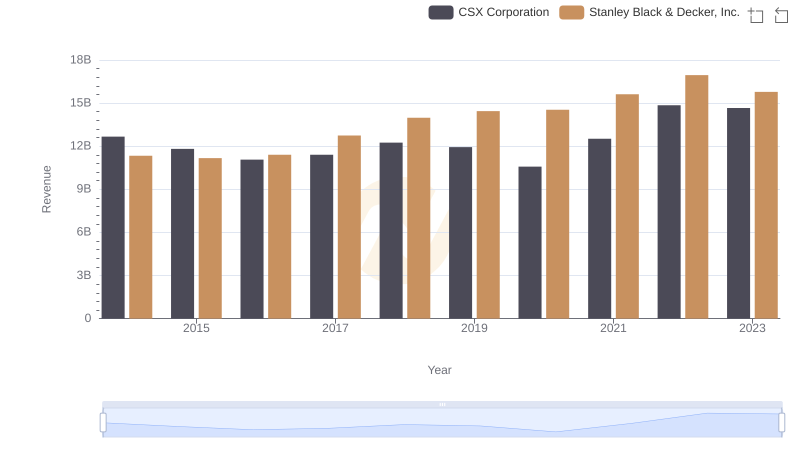

Revenue Insights: CSX Corporation and Stanley Black & Decker, Inc. Performance Compared

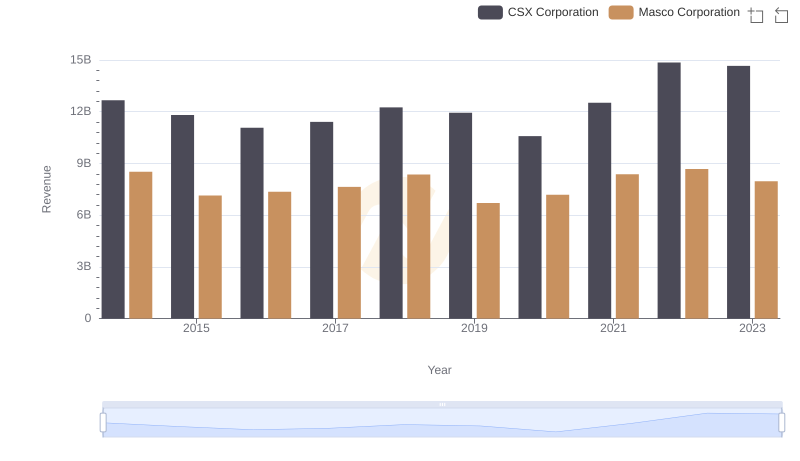

Breaking Down Revenue Trends: CSX Corporation vs Masco Corporation

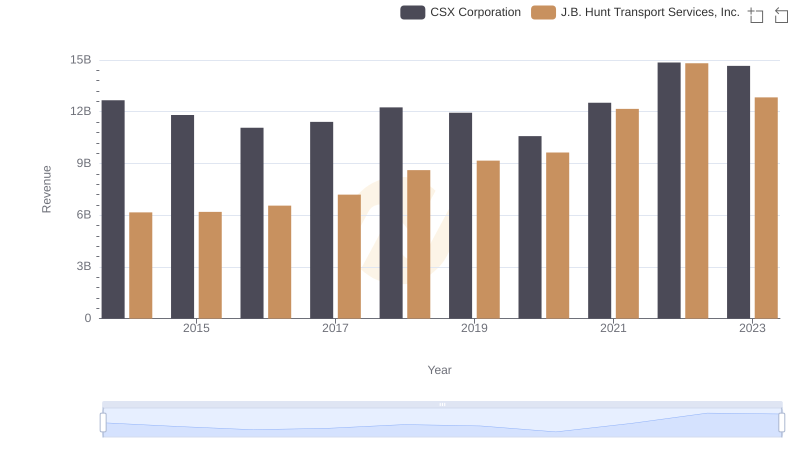

CSX Corporation or J.B. Hunt Transport Services, Inc.: Who Leads in Yearly Revenue?

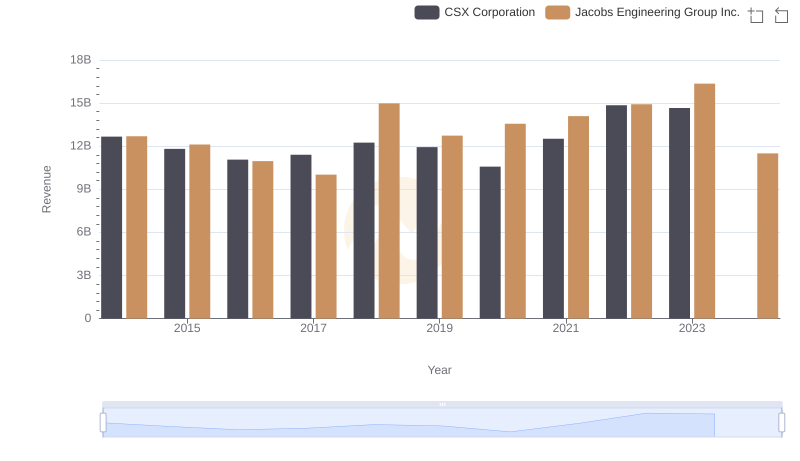

Breaking Down Revenue Trends: CSX Corporation vs Jacobs Engineering Group Inc.

Cost of Revenue: Key Insights for CSX Corporation and Pentair plc

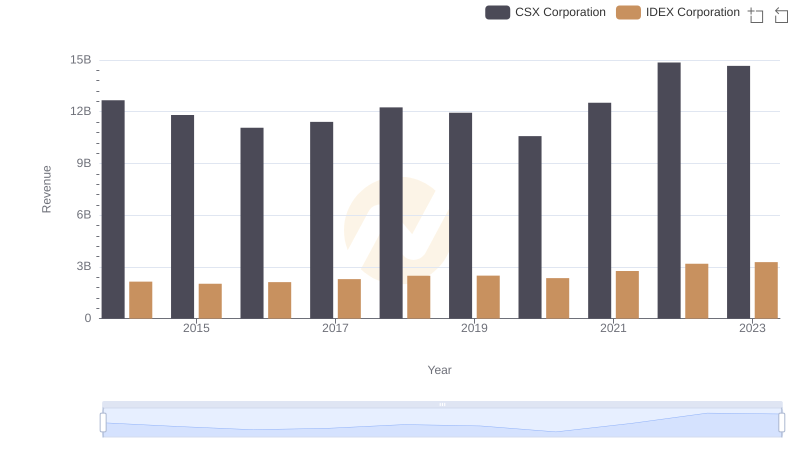

Breaking Down Revenue Trends: CSX Corporation vs IDEX Corporation