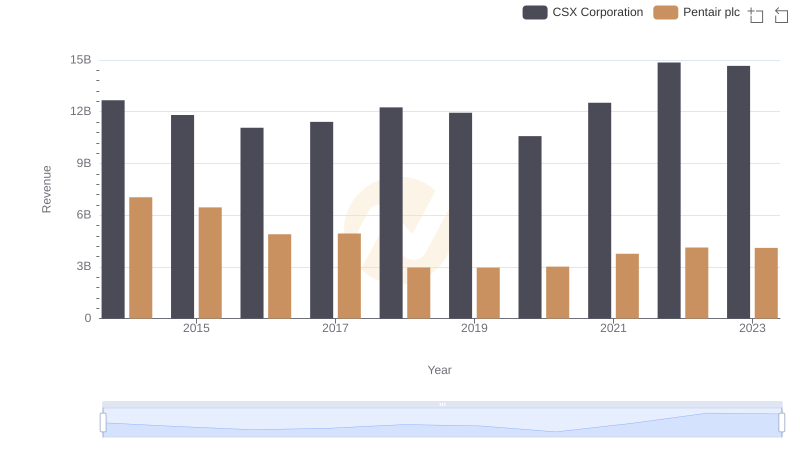

| __timestamp | CSX Corporation | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 9056000000 | 4563000000 |

| Thursday, January 1, 2015 | 8227000000 | 4263200000 |

| Friday, January 1, 2016 | 7680000000 | 3095900000 |

| Sunday, January 1, 2017 | 7635000000 | 3107400000 |

| Monday, January 1, 2018 | 7477000000 | 1917400000 |

| Tuesday, January 1, 2019 | 7063000000 | 1905700000 |

| Wednesday, January 1, 2020 | 6221000000 | 1960200000 |

| Friday, January 1, 2021 | 7382000000 | 2445600000 |

| Saturday, January 1, 2022 | 9068000000 | 2757200000 |

| Sunday, January 1, 2023 | 9130000000 | 2585300000 |

| Monday, January 1, 2024 | 2484000000 |

Unleashing the power of data

In the ever-evolving landscape of the transportation and industrial sectors, understanding cost dynamics is crucial. From 2014 to 2023, CSX Corporation and Pentair plc have shown distinct trends in their cost of revenue, reflecting broader industry shifts. CSX Corporation, a leader in rail transportation, saw its cost of revenue decrease by approximately 31% from 2014 to 2020, before rebounding by 47% in 2023. This fluctuation highlights the company's strategic adjustments in response to market demands and operational efficiencies.

Conversely, Pentair plc, a key player in water solutions, experienced a 58% reduction in cost of revenue from 2014 to 2019, followed by a gradual increase, reaching a peak in 2022. This trend underscores Pentair's focus on optimizing production costs while navigating economic challenges. These insights provide a window into the financial strategies of two major corporations, offering valuable lessons for investors and industry analysts alike.

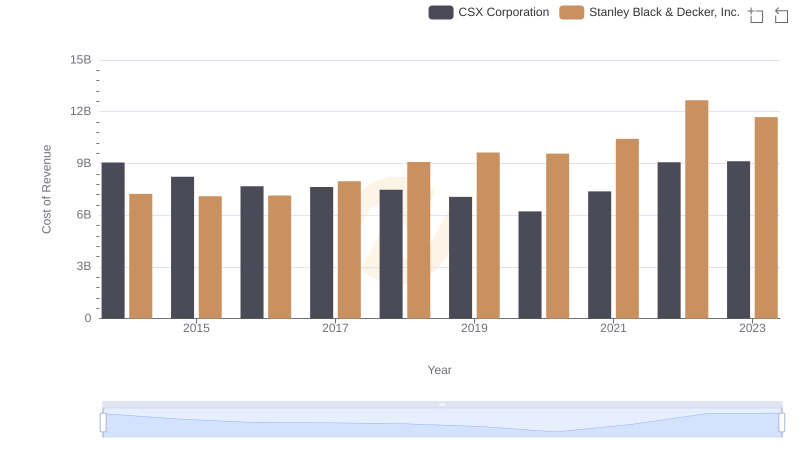

Cost Insights: Breaking Down CSX Corporation and Stanley Black & Decker, Inc.'s Expenses

Annual Revenue Comparison: CSX Corporation vs Pentair plc

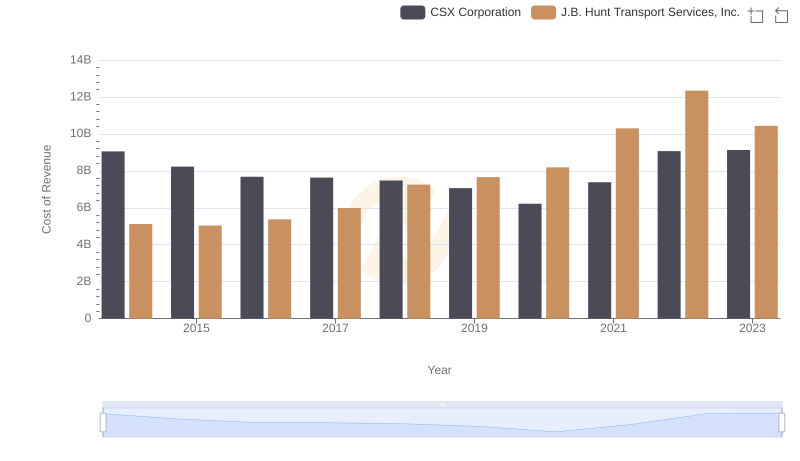

Analyzing Cost of Revenue: CSX Corporation and J.B. Hunt Transport Services, Inc.

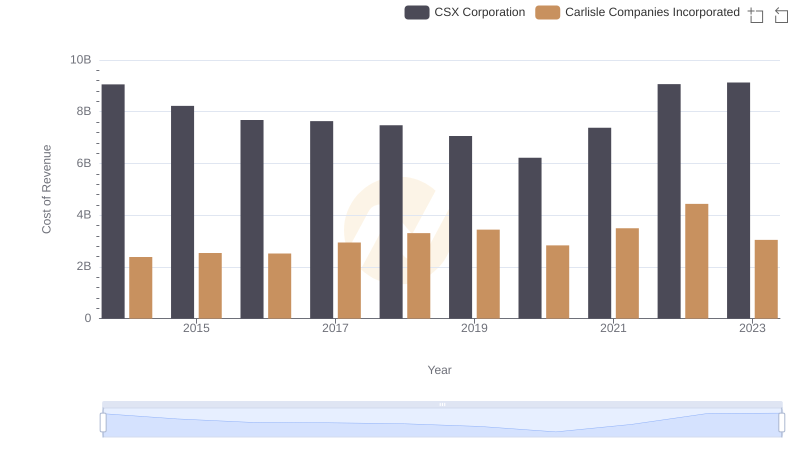

Comparing Cost of Revenue Efficiency: CSX Corporation vs Carlisle Companies Incorporated