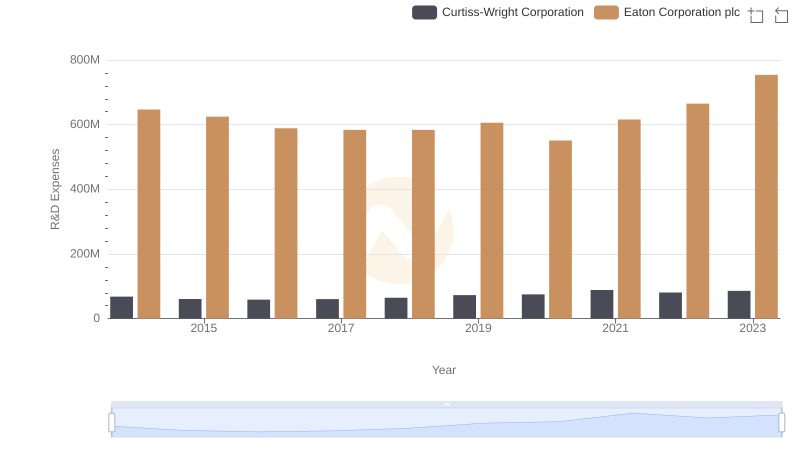

| __timestamp | Eaton Corporation plc | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 647000000 | 174600000 |

| Thursday, January 1, 2015 | 625000000 | 188000000 |

| Friday, January 1, 2016 | 589000000 | 204400000 |

| Sunday, January 1, 2017 | 584000000 | 252300000 |

| Monday, January 1, 2018 | 584000000 | 275800000 |

| Tuesday, January 1, 2019 | 606000000 | 240800000 |

| Wednesday, January 1, 2020 | 551000000 | 200000000 |

| Friday, January 1, 2021 | 616000000 | 276300000 |

| Saturday, January 1, 2022 | 665000000 | 357400000 |

| Sunday, January 1, 2023 | 754000000 | 362000000 |

| Monday, January 1, 2024 | 794000000 | 0 |

In pursuit of knowledge

In the competitive landscape of industrial manufacturing, research and development (R&D) spending is a key indicator of a company's commitment to innovation. Over the past decade, Eaton Corporation plc and Stanley Black & Decker, Inc. have demonstrated contrasting approaches to R&D investment. From 2014 to 2023, Eaton consistently allocated a higher percentage of its budget to R&D, peaking in 2023 with a 16% increase from the previous year. Meanwhile, Stanley Black & Decker, Inc. showed a more volatile pattern, with a notable 105% increase in R&D spending from 2014 to 2023. This surge reflects a strategic pivot towards innovation, particularly in recent years. As these industry giants continue to evolve, their R&D investments will likely play a pivotal role in shaping their future market positions.

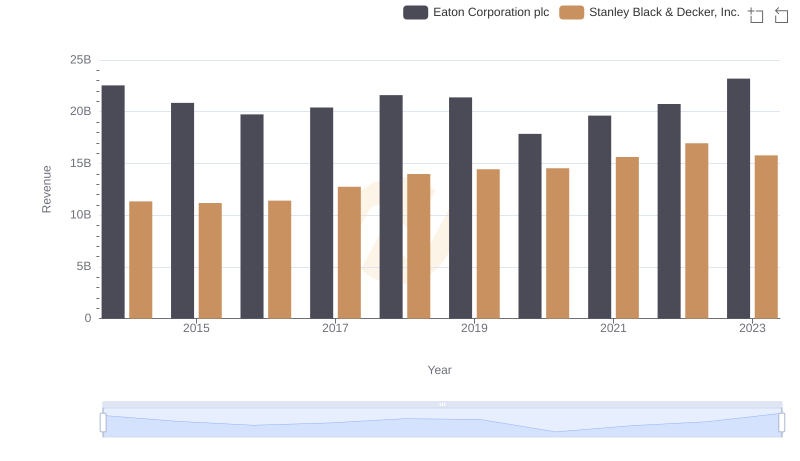

Annual Revenue Comparison: Eaton Corporation plc vs Stanley Black & Decker, Inc.

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Stanley Black & Decker, Inc.

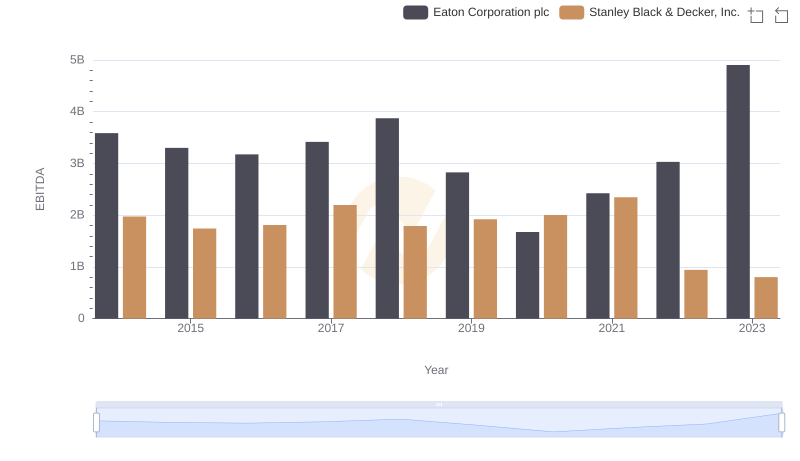

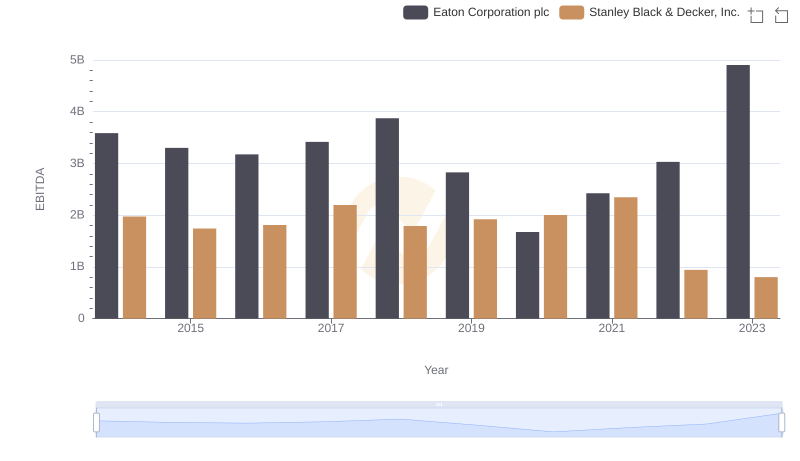

Professional EBITDA Benchmarking: Eaton Corporation plc vs Stanley Black & Decker, Inc.

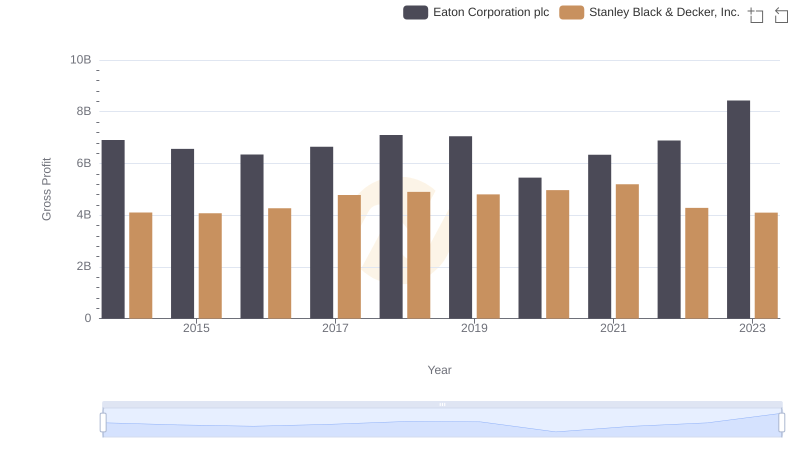

Gross Profit Trends Compared: Eaton Corporation plc vs Stanley Black & Decker, Inc.

Eaton Corporation plc vs Curtiss-Wright Corporation: Strategic Focus on R&D Spending

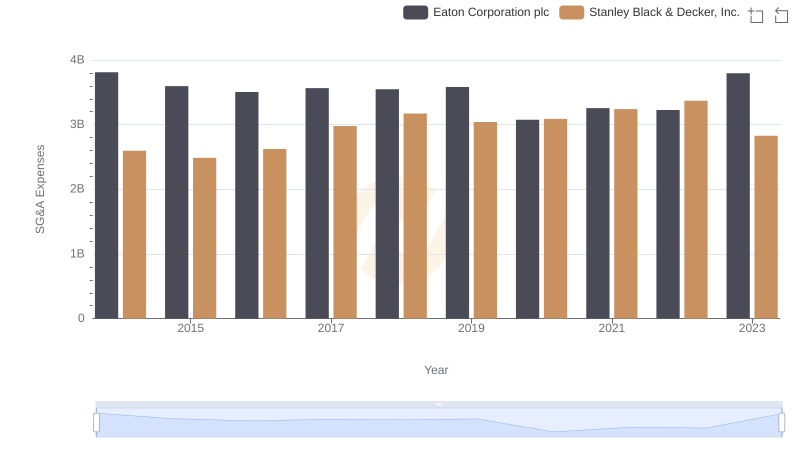

Selling, General, and Administrative Costs: Eaton Corporation plc vs Stanley Black & Decker, Inc.

Eaton Corporation plc and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance