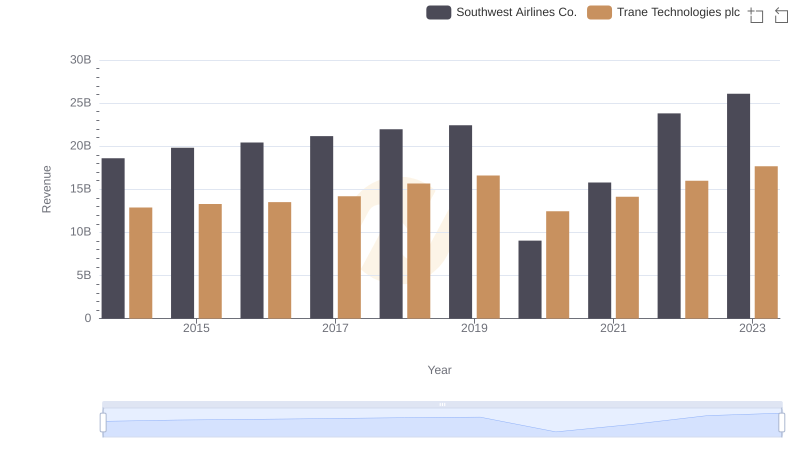

| __timestamp | Southwest Airlines Co. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 14049000000 | 8982800000 |

| Thursday, January 1, 2015 | 13423000000 | 9301600000 |

| Friday, January 1, 2016 | 14151000000 | 9329300000 |

| Sunday, January 1, 2017 | 14968000000 | 9811600000 |

| Monday, January 1, 2018 | 15907000000 | 10847600000 |

| Tuesday, January 1, 2019 | 16445000000 | 11451500000 |

| Wednesday, January 1, 2020 | 10938000000 | 8651300000 |

| Friday, January 1, 2021 | 11675000000 | 9666800000 |

| Saturday, January 1, 2022 | 19062000000 | 11026900000 |

| Sunday, January 1, 2023 | 21868000000 | 11820400000 |

| Monday, January 1, 2024 | 23024000000 | 12757700000 |

Unleashing insights

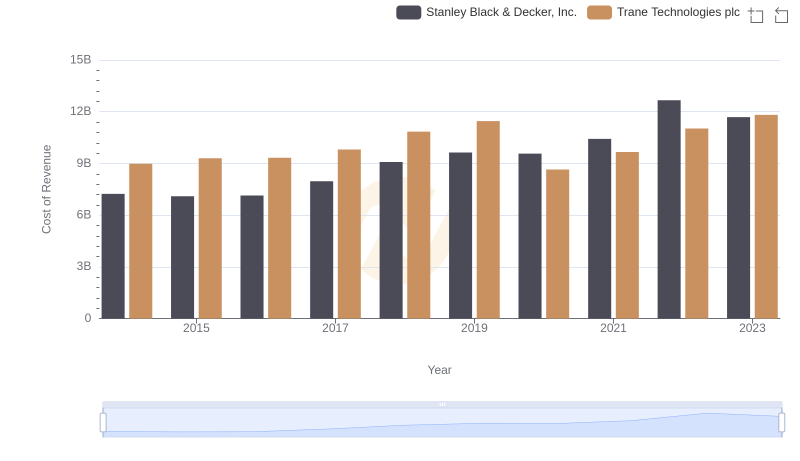

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's financial health. This analysis delves into the cost of revenue trends for Trane Technologies plc and Southwest Airlines Co. from 2014 to 2023.

Southwest Airlines Co. has seen a significant increase in its cost of revenue, rising by approximately 56% over the decade, peaking at $21.9 billion in 2023. This surge reflects the airline industry's dynamic nature, influenced by fluctuating fuel prices and operational costs. Meanwhile, Trane Technologies plc, a leader in climate solutions, experienced a more modest growth of around 32%, reaching $11.8 billion in 2023. This steady increase underscores the company's strategic focus on sustainable solutions and innovation.

These insights offer a window into the strategic priorities and market challenges faced by these industry giants.

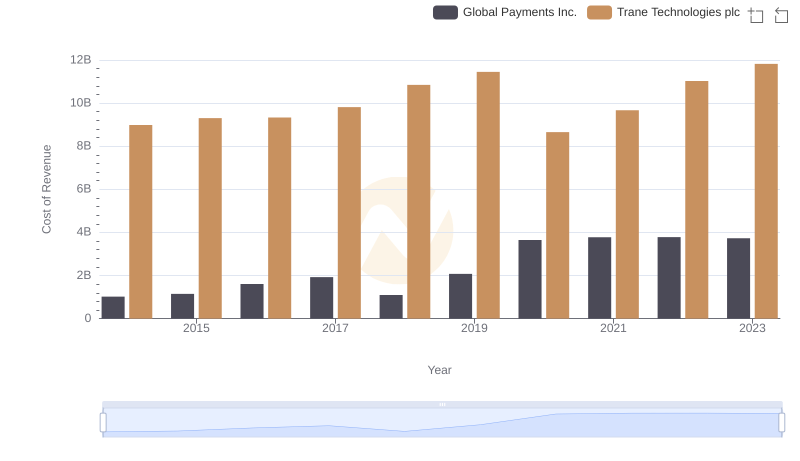

Cost of Revenue Comparison: Trane Technologies plc vs Global Payments Inc.

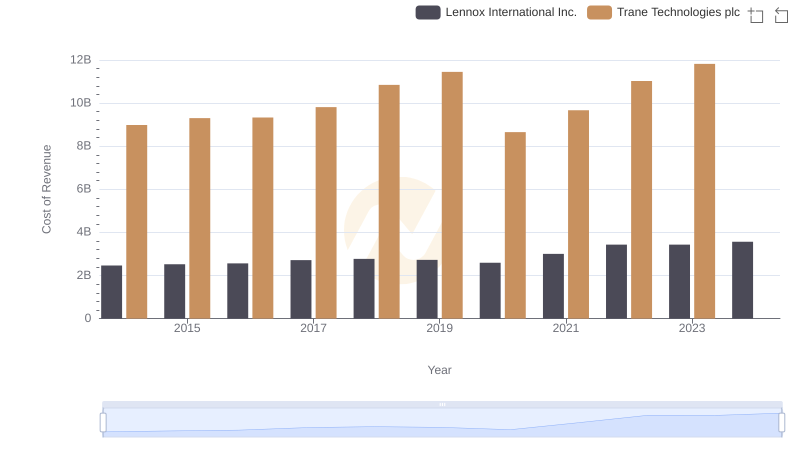

Cost Insights: Breaking Down Trane Technologies plc and Lennox International Inc.'s Expenses

Comparing Revenue Performance: Trane Technologies plc or Southwest Airlines Co.?

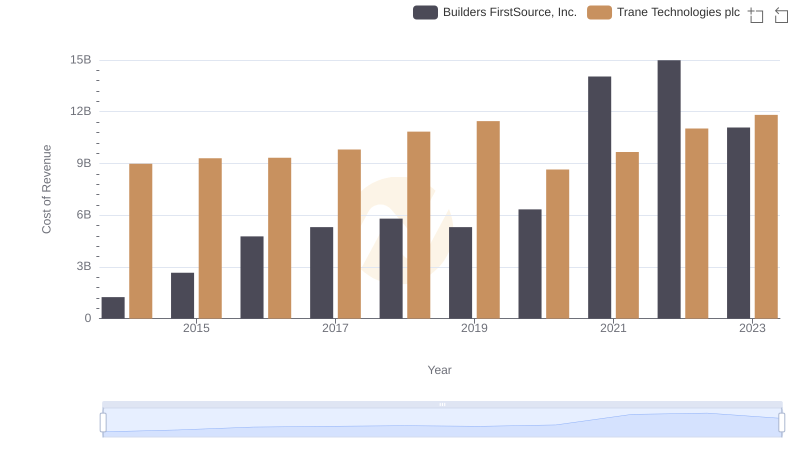

Cost of Revenue: Key Insights for Trane Technologies plc and Builders FirstSource, Inc.

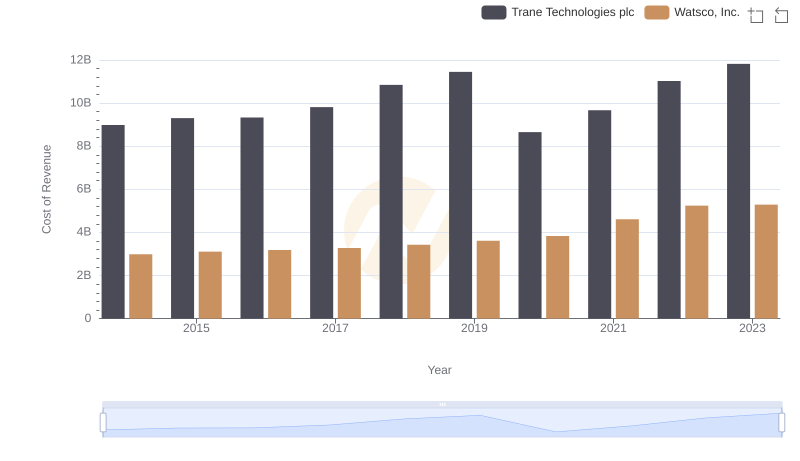

Cost of Revenue Trends: Trane Technologies plc vs Watsco, Inc.

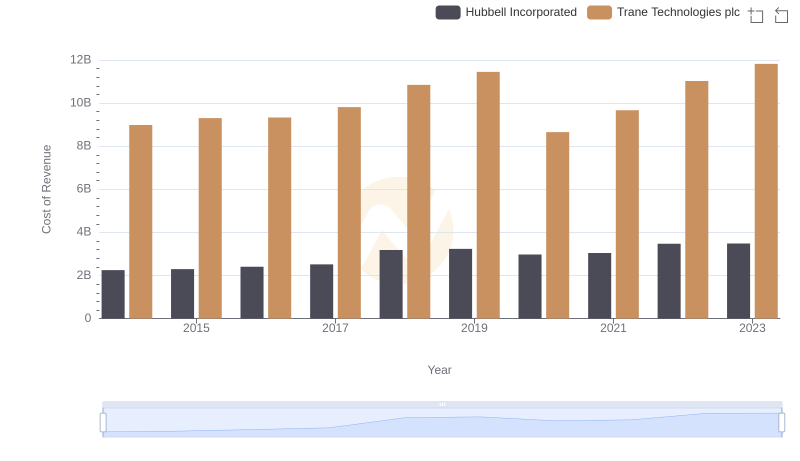

Analyzing Cost of Revenue: Trane Technologies plc and Hubbell Incorporated

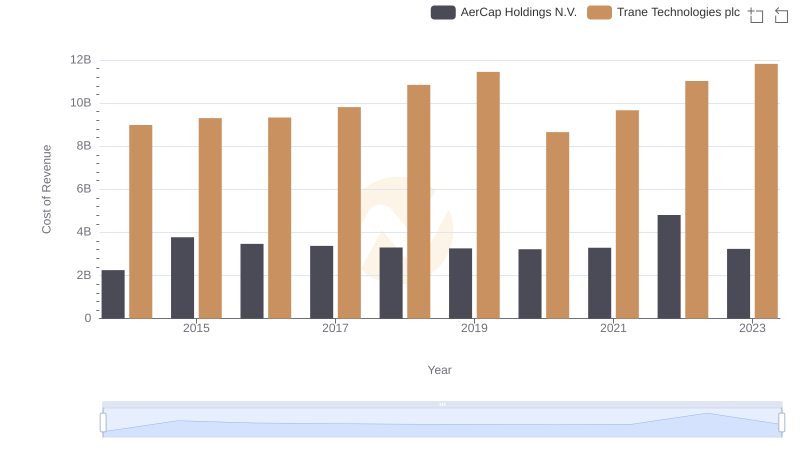

Trane Technologies plc vs AerCap Holdings N.V.: Efficiency in Cost of Revenue Explored

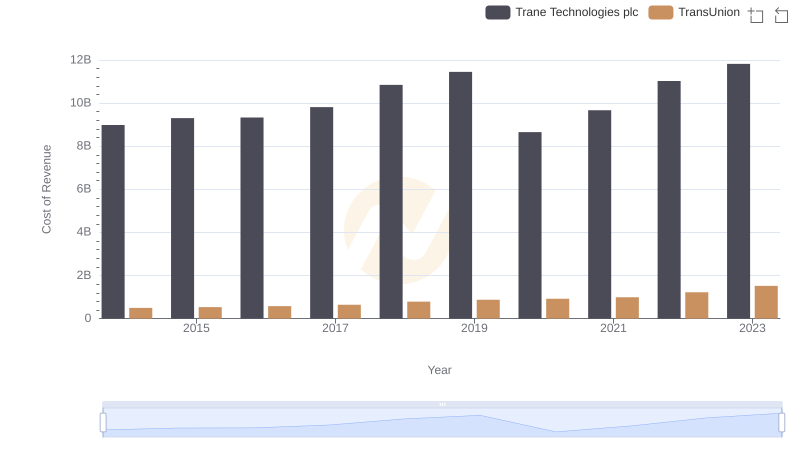

Cost of Revenue Comparison: Trane Technologies plc vs TransUnion

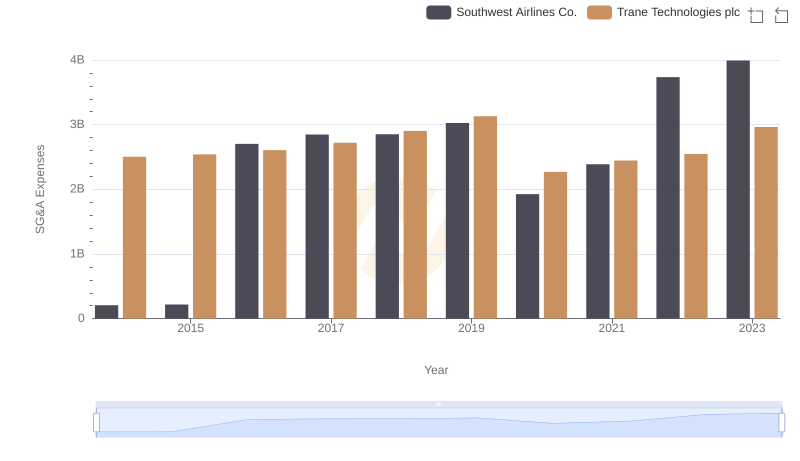

Operational Costs Compared: SG&A Analysis of Trane Technologies plc and Southwest Airlines Co.

Cost of Revenue Trends: Trane Technologies plc vs Stanley Black & Decker, Inc.

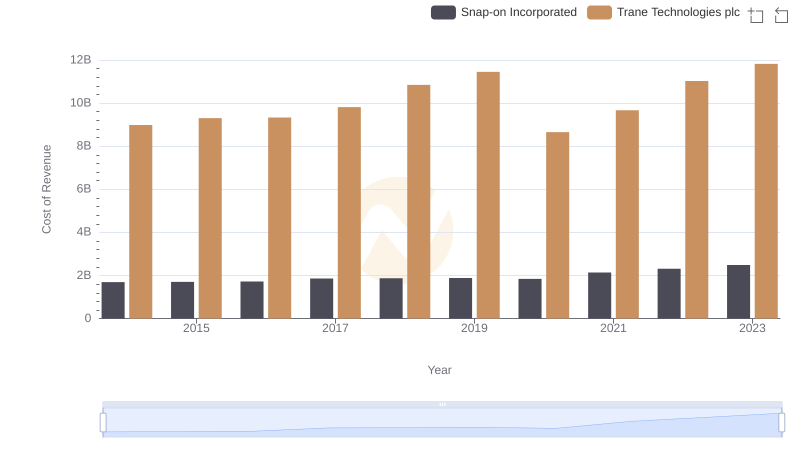

Cost Insights: Breaking Down Trane Technologies plc and Snap-on Incorporated's Expenses