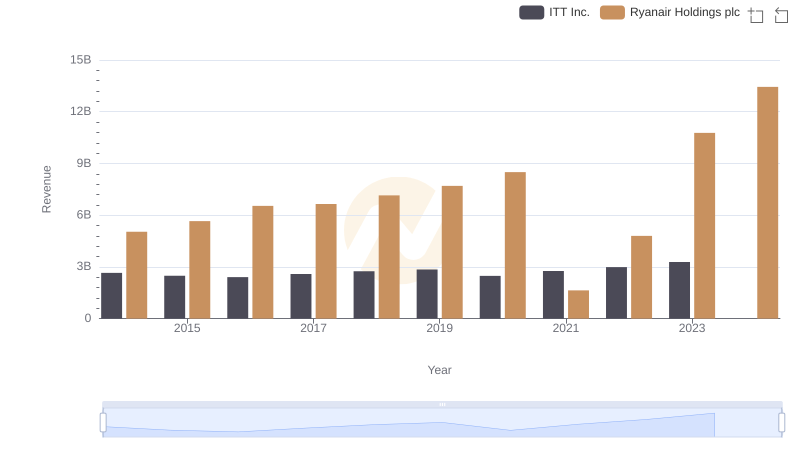

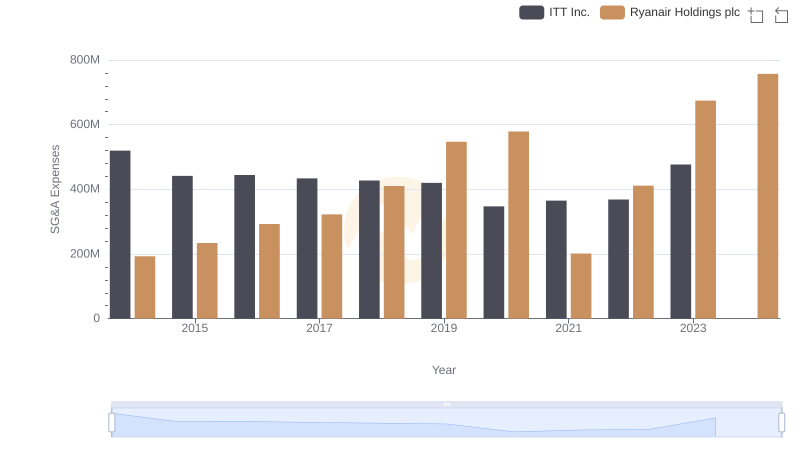

| __timestamp | ITT Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1788200000 | 3838100000 |

| Thursday, January 1, 2015 | 1676500000 | 3999600000 |

| Friday, January 1, 2016 | 1647200000 | 4355900000 |

| Sunday, January 1, 2017 | 1768100000 | 4294000000 |

| Monday, January 1, 2018 | 1857900000 | 4512300000 |

| Tuesday, January 1, 2019 | 1936300000 | 5492800000 |

| Wednesday, January 1, 2020 | 1695600000 | 6039900000 |

| Friday, January 1, 2021 | 1865500000 | 1702700000 |

| Saturday, January 1, 2022 | 2065400000 | 4009800000 |

| Sunday, January 1, 2023 | 2175700000 | 7735000000 |

| Monday, January 1, 2024 | 2383400000 | 9566400000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for assessing a company's financial health. This analysis delves into the cost of revenue trends for Ryanair Holdings plc and ITT Inc. from 2014 to 2023.

Ryanair, Europe's largest low-cost airline, has seen its cost of revenue soar by approximately 150% over the decade, peaking at an impressive $7.7 billion in 2023. This surge reflects the airline's aggressive expansion and operational challenges, including fluctuating fuel prices and increased competition.

Conversely, ITT Inc., a leader in engineering and manufacturing, has maintained a more stable trajectory. Its cost of revenue increased by about 22% over the same period, reaching $2.2 billion in 2023. This stability underscores ITT's strategic focus on efficiency and innovation.

Interestingly, 2024 data for ITT Inc. is missing, highlighting the need for continuous data monitoring to make informed decisions.

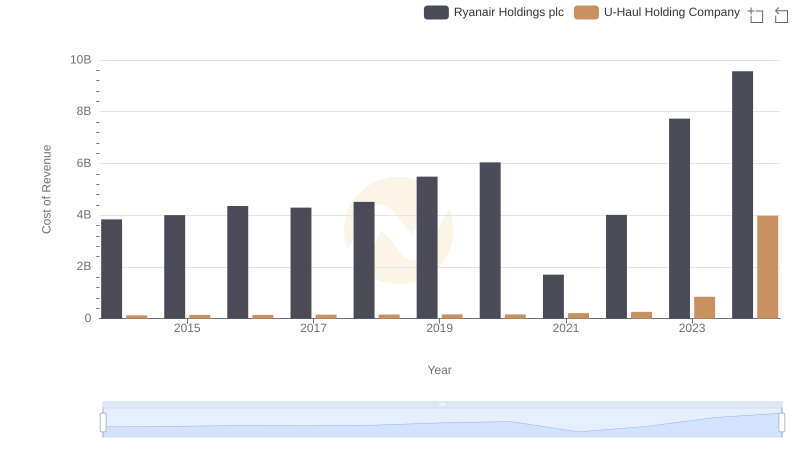

Ryanair Holdings plc vs U-Haul Holding Company: Efficiency in Cost of Revenue Explored

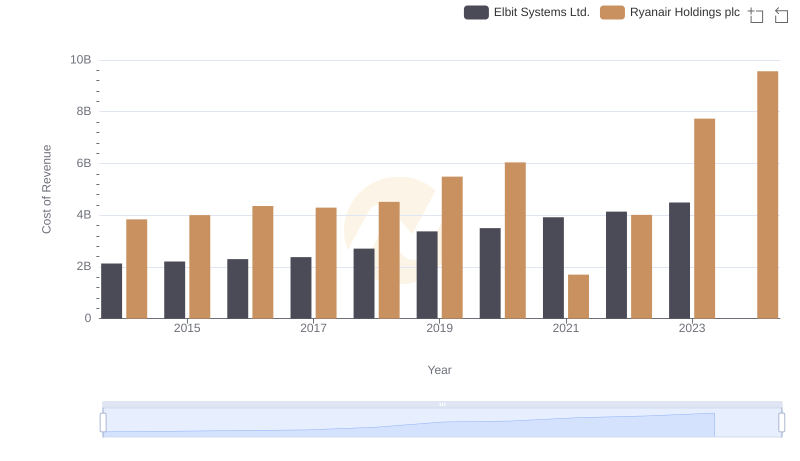

Analyzing Cost of Revenue: Ryanair Holdings plc and Elbit Systems Ltd.

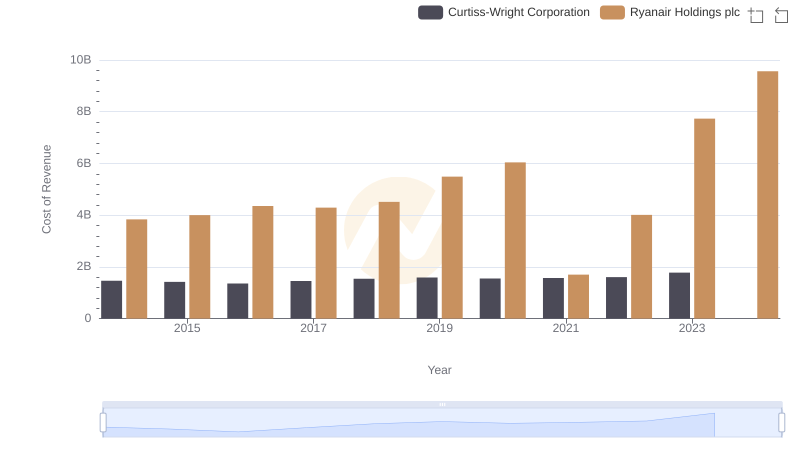

Cost of Revenue Trends: Ryanair Holdings plc vs Curtiss-Wright Corporation

Who Generates More Revenue? Ryanair Holdings plc or ITT Inc.

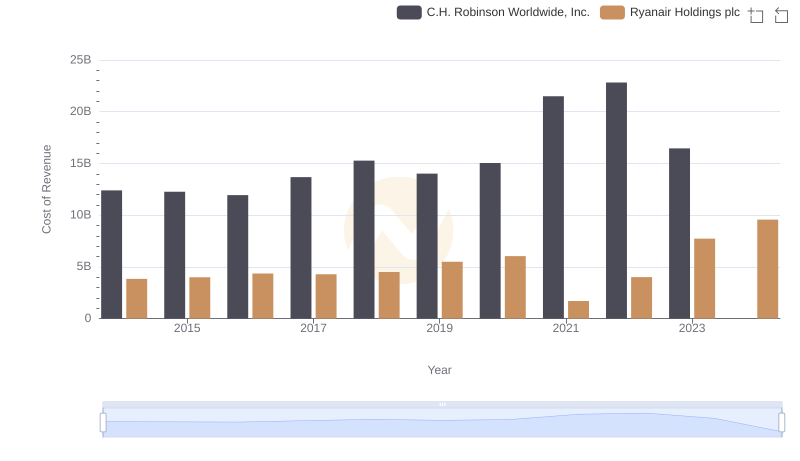

Cost Insights: Breaking Down Ryanair Holdings plc and C.H. Robinson Worldwide, Inc.'s Expenses

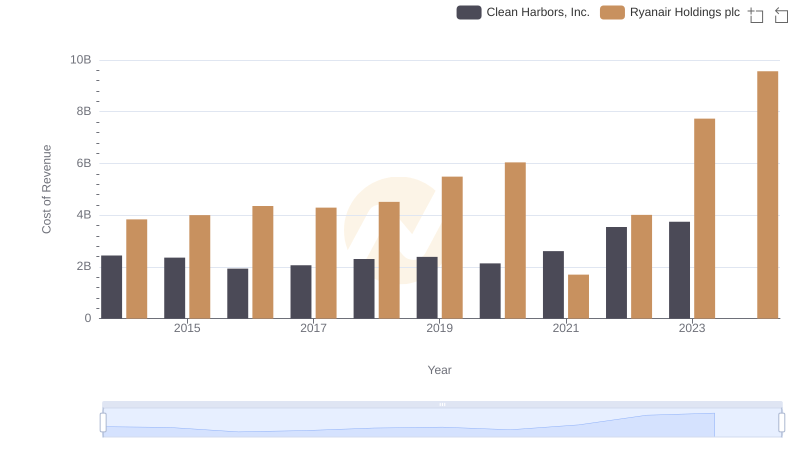

Cost of Revenue Trends: Ryanair Holdings plc vs Clean Harbors, Inc.

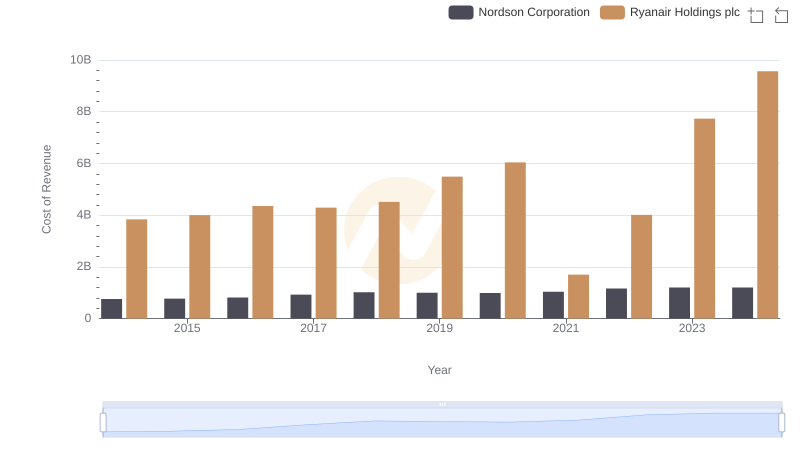

Cost Insights: Breaking Down Ryanair Holdings plc and Nordson Corporation's Expenses

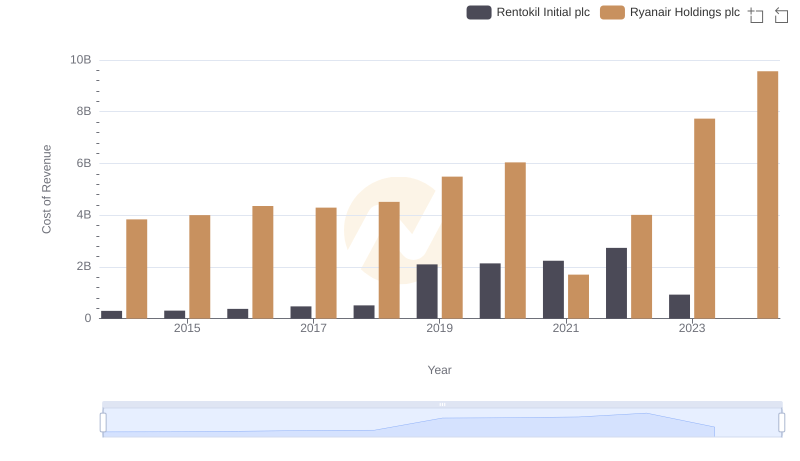

Cost of Revenue: Key Insights for Ryanair Holdings plc and Rentokil Initial plc

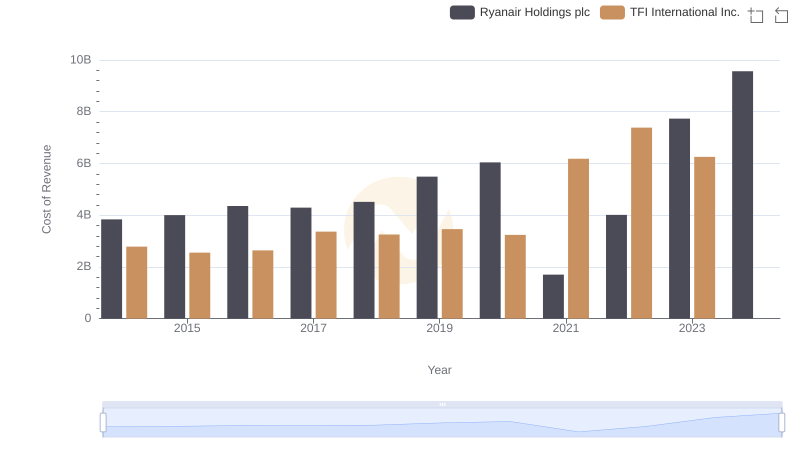

Cost Insights: Breaking Down Ryanair Holdings plc and TFI International Inc.'s Expenses

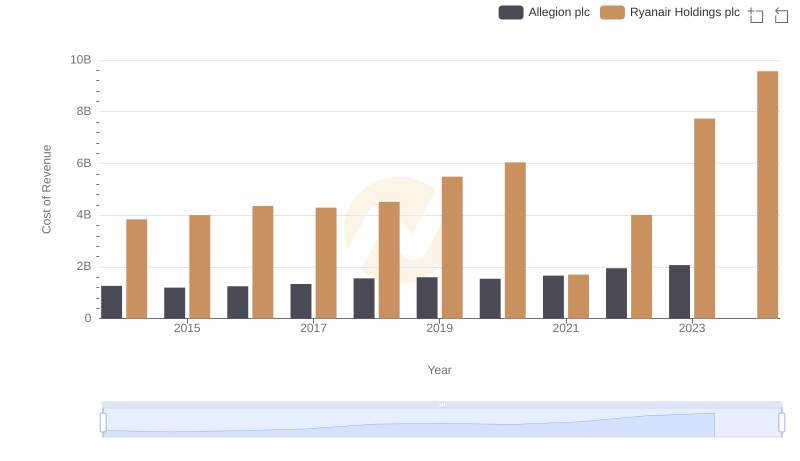

Cost Insights: Breaking Down Ryanair Holdings plc and Allegion plc's Expenses

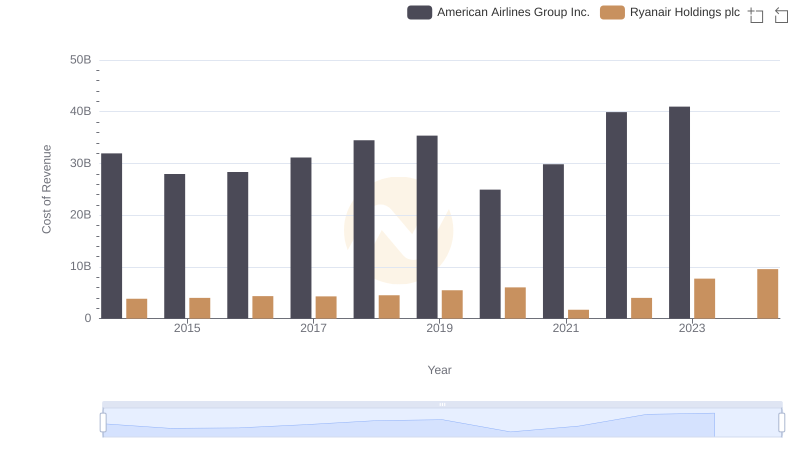

Cost of Revenue Comparison: Ryanair Holdings plc vs American Airlines Group Inc.

Ryanair Holdings plc and ITT Inc.: SG&A Spending Patterns Compared