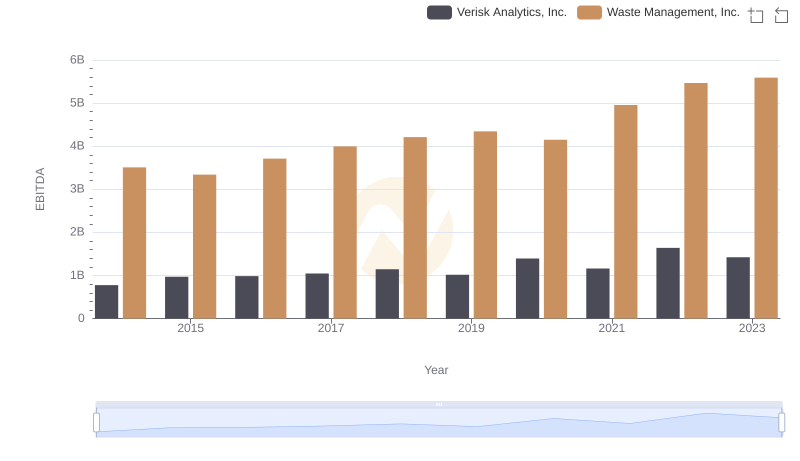

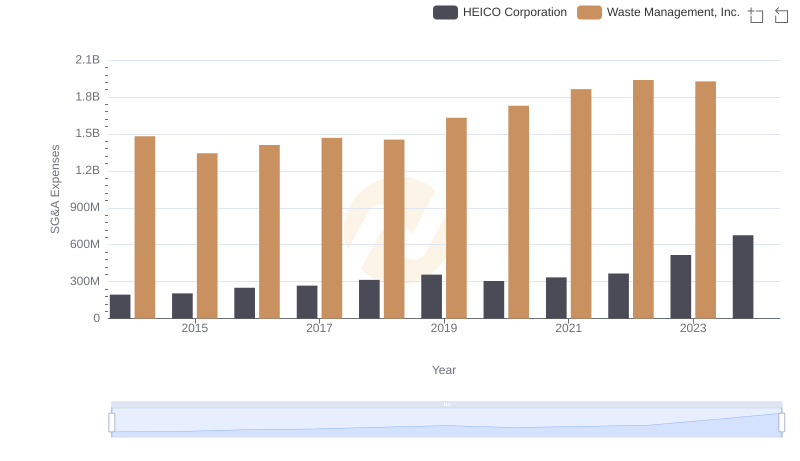

| __timestamp | HEICO Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 251213000 | 3509000000 |

| Thursday, January 1, 2015 | 276790000 | 3342000000 |

| Friday, January 1, 2016 | 325022000 | 3713000000 |

| Sunday, January 1, 2017 | 372581000 | 3996000000 |

| Monday, January 1, 2018 | 452287000 | 4212000000 |

| Tuesday, January 1, 2019 | 542136000 | 4344000000 |

| Wednesday, January 1, 2020 | 465714000 | 4149000000 |

| Friday, January 1, 2021 | 486243000 | 4956000000 |

| Saturday, January 1, 2022 | 592709000 | 5466000000 |

| Sunday, January 1, 2023 | 756767000 | 5592000000 |

| Monday, January 1, 2024 | 824455000 | 5128000000 |

Cracking the code

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. Over the past decade, Waste Management, Inc. and HEICO Corporation have demonstrated contrasting trajectories in their EBITDA growth. From 2014 to 2023, Waste Management's EBITDA surged by approximately 60%, peaking in 2023. Meanwhile, HEICO Corporation exhibited a remarkable growth of over 200% during the same period, reflecting its dynamic expansion strategy.

While Waste Management consistently maintained a higher EBITDA, HEICO's rapid growth rate is noteworthy. The data reveals a missing value for Waste Management in 2024, suggesting potential volatility or data reporting issues. This analysis underscores the importance of strategic planning and market adaptability in achieving financial success. As we look to the future, these trends offer valuable insights for investors and industry analysts alike.

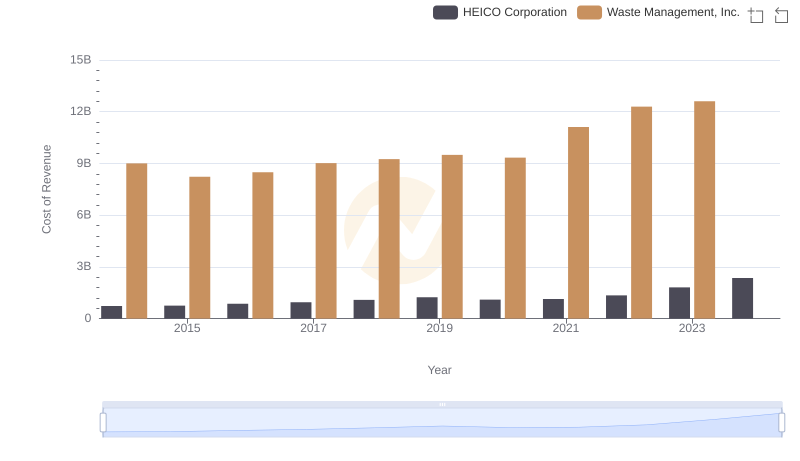

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs HEICO Corporation

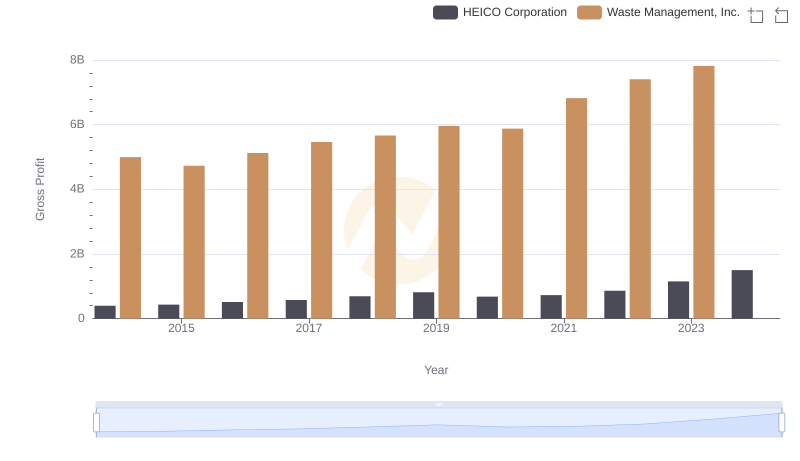

Gross Profit Analysis: Comparing Waste Management, Inc. and HEICO Corporation

A Professional Review of EBITDA: Waste Management, Inc. Compared to Verisk Analytics, Inc.

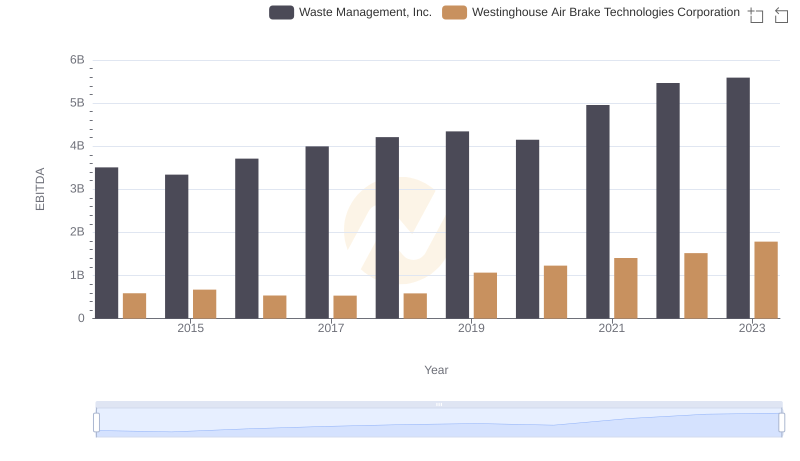

A Professional Review of EBITDA: Waste Management, Inc. Compared to Westinghouse Air Brake Technologies Corporation

Breaking Down SG&A Expenses: Waste Management, Inc. vs HEICO Corporation

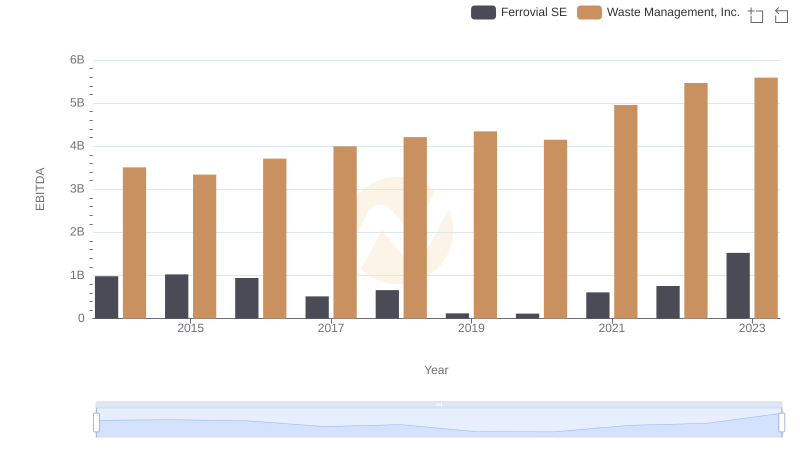

Waste Management, Inc. vs Ferrovial SE: In-Depth EBITDA Performance Comparison

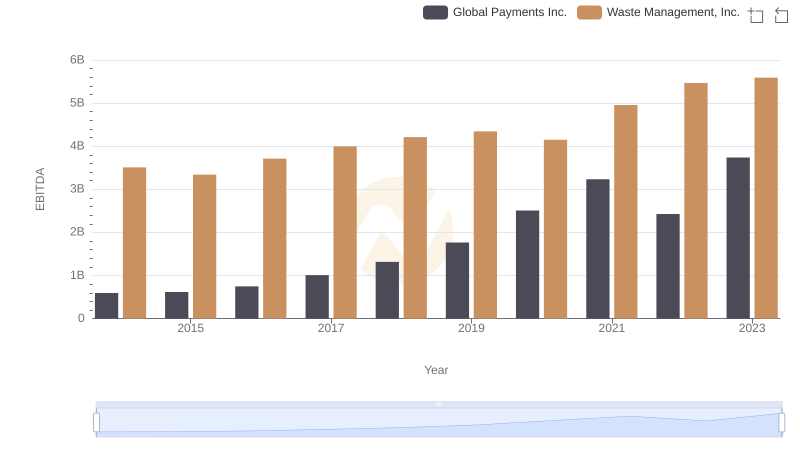

A Professional Review of EBITDA: Waste Management, Inc. Compared to Global Payments Inc.

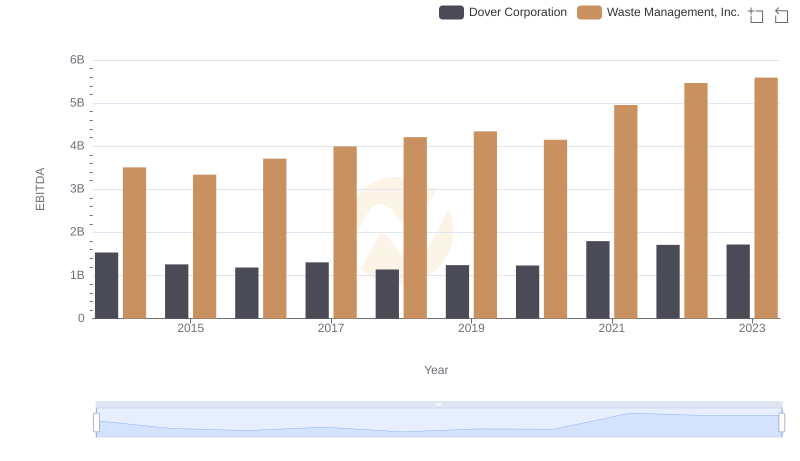

EBITDA Performance Review: Waste Management, Inc. vs Dover Corporation