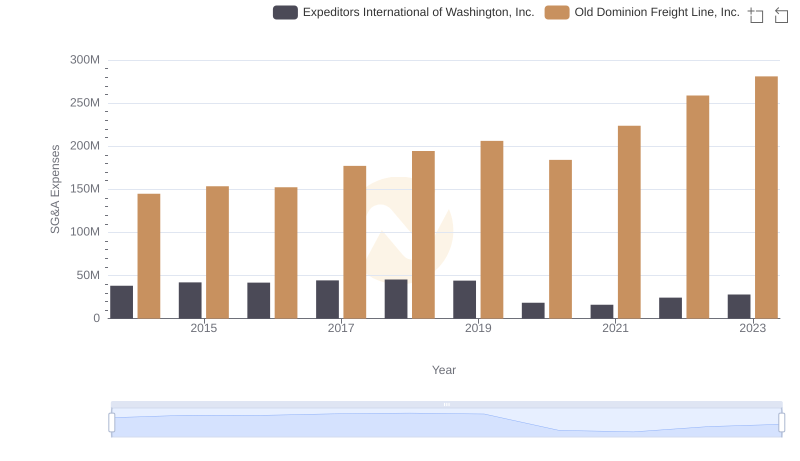

| __timestamp | Old Dominion Freight Line, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 534537000 |

| Thursday, January 1, 2015 | 153589000 | 591738000 |

| Friday, January 1, 2016 | 152391000 | 705995000 |

| Sunday, January 1, 2017 | 177205000 | 780517000 |

| Monday, January 1, 2018 | 194368000 | 1210717000 |

| Tuesday, January 1, 2019 | 206125000 | 1546227000 |

| Wednesday, January 1, 2020 | 184185000 | 1663712000 |

| Friday, January 1, 2021 | 223757000 | 1875869000 |

| Saturday, January 1, 2022 | 258883000 | 2077372000 |

| Sunday, January 1, 2023 | 281053000 | 2425253000 |

Unveiling the hidden dimensions of data

In the world of logistics, Old Dominion Freight Line, Inc. and ZTO Express (Cayman) Inc. stand as titans, each with a unique story of growth and strategy. Over the past decade, from 2014 to 2023, these companies have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses.

Old Dominion Freight Line, Inc. has seen a steady increase in SG&A expenses, growing by approximately 94% over the period. This reflects their strategic investments in infrastructure and technology to enhance service efficiency. Meanwhile, ZTO Express (Cayman) Inc. has experienced a staggering 354% rise in SG&A expenses, indicative of their aggressive expansion in the burgeoning Chinese logistics market.

These trends highlight the contrasting strategies of these logistics giants: Old Dominion's focus on operational excellence versus ZTO's rapid market expansion. As the logistics landscape evolves, these insights offer a glimpse into the future of global freight dynamics.

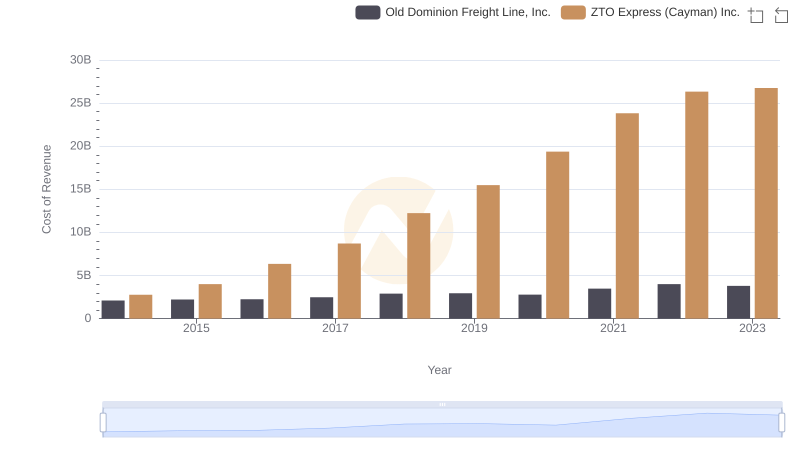

Old Dominion Freight Line, Inc. vs ZTO Express (Cayman) Inc.: Efficiency in Cost of Revenue Explored

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Expeditors International of Washington, Inc.

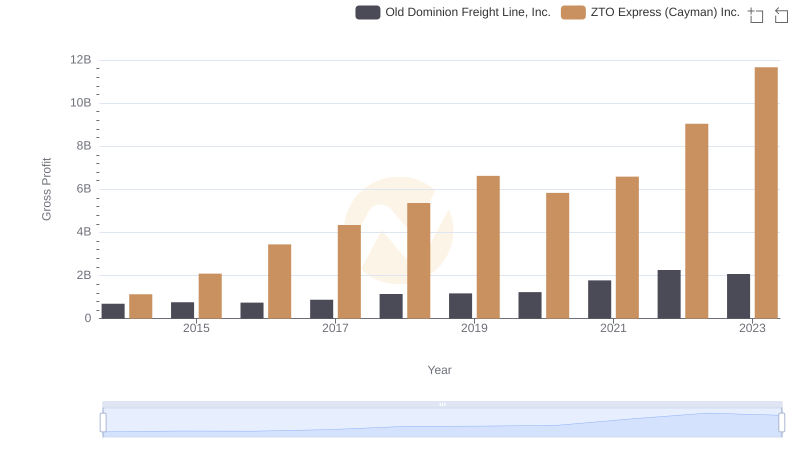

Gross Profit Comparison: Old Dominion Freight Line, Inc. and ZTO Express (Cayman) Inc. Trends

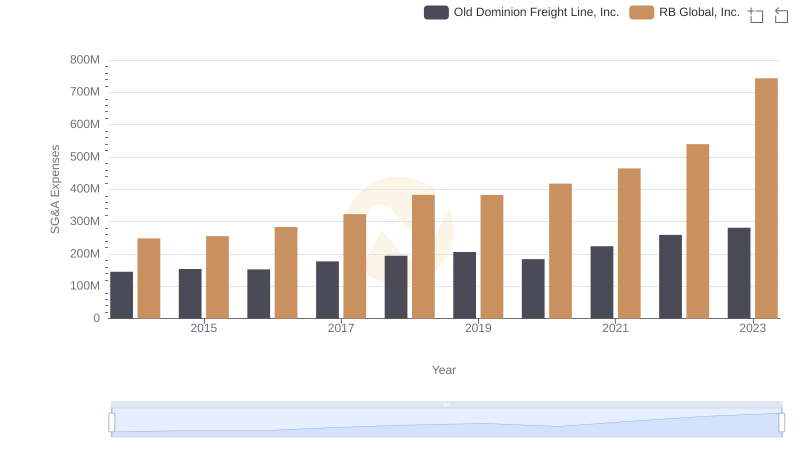

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and RB Global, Inc.

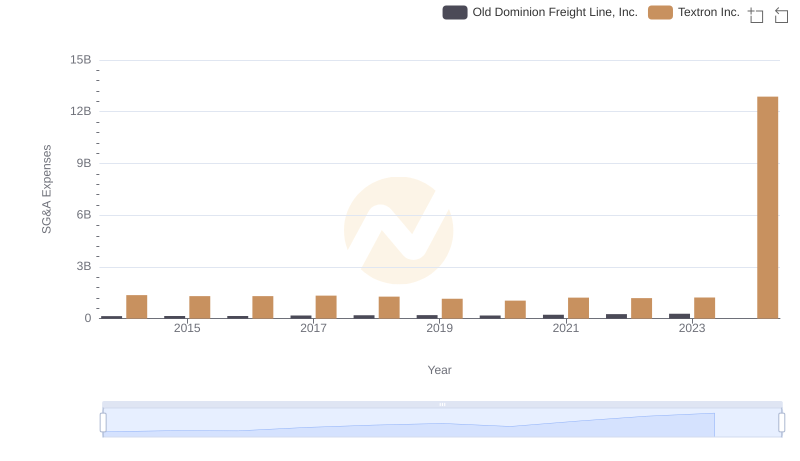

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Textron Inc.

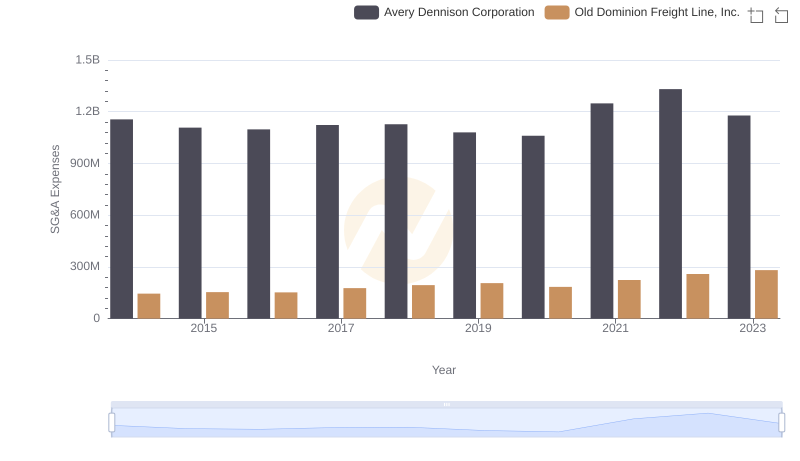

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Avery Dennison Corporation

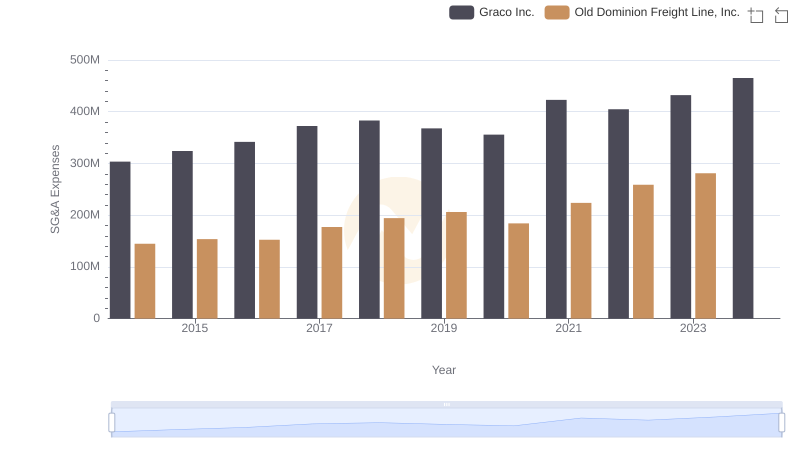

Old Dominion Freight Line, Inc. vs Graco Inc.: SG&A Expense Trends

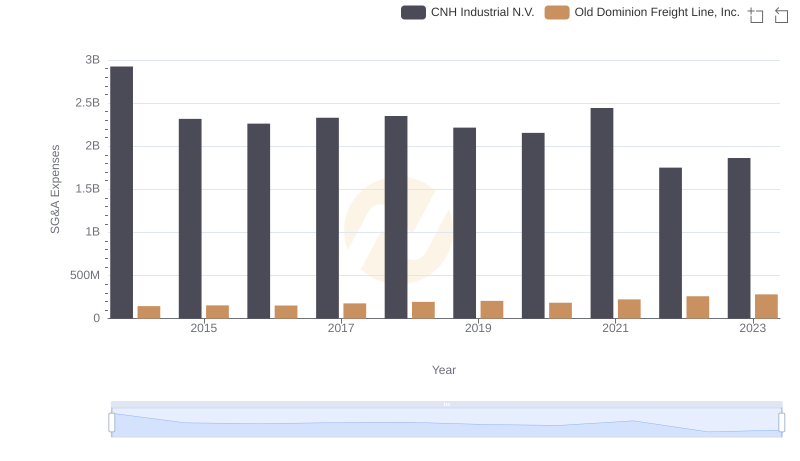

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or CNH Industrial N.V.

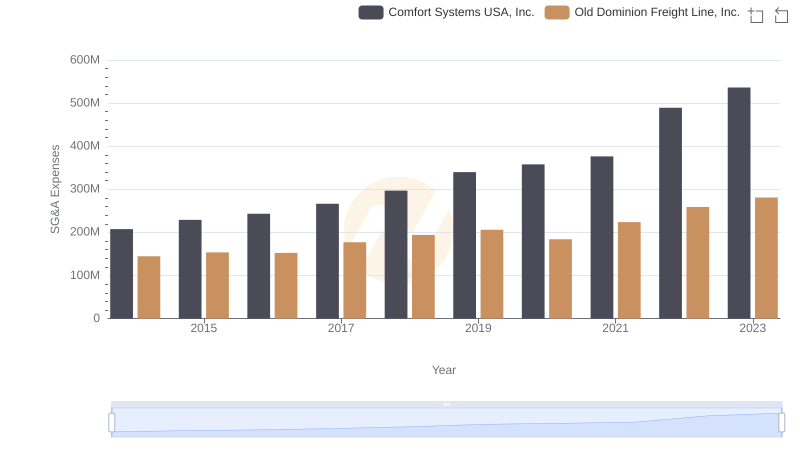

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Comfort Systems USA, Inc. Trends and Insights