| __timestamp | NetApp, Inc. | Zebra Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2179200000 | 351518000 |

| Thursday, January 1, 2015 | 2197400000 | 763025000 |

| Friday, January 1, 2016 | 2099000000 | 751000000 |

| Sunday, January 1, 2017 | 1904000000 | 749000000 |

| Monday, January 1, 2018 | 2009000000 | 811000000 |

| Tuesday, January 1, 2019 | 1935000000 | 826000000 |

| Wednesday, January 1, 2020 | 1848000000 | 787000000 |

| Friday, January 1, 2021 | 2001000000 | 935000000 |

| Saturday, January 1, 2022 | 2136000000 | 982000000 |

| Sunday, January 1, 2023 | 2094000000 | 915000000 |

| Monday, January 1, 2024 | 2136000000 | 981000000 |

Infusing magic into the data realm

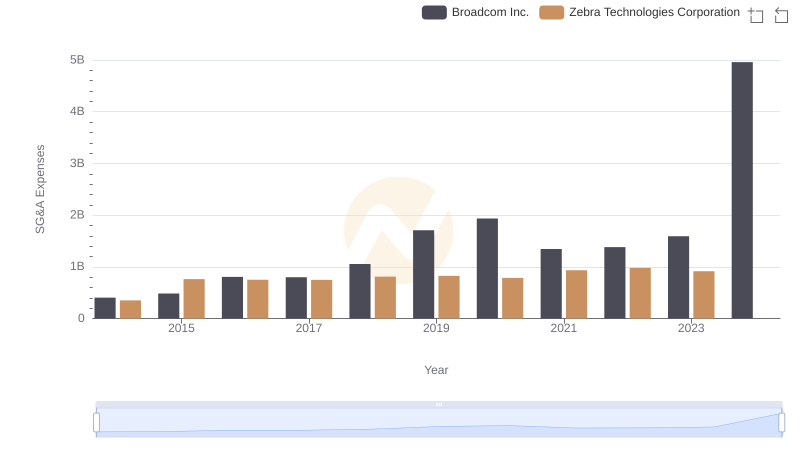

In the competitive landscape of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, NetApp, Inc. and Zebra Technologies Corporation have showcased distinct strategies in optimizing these costs. From 2014 to 2023, NetApp's SG&A expenses fluctuated, peaking in 2015 and 2022, while Zebra Technologies saw a steady increase, with a notable jump in 2022. Despite NetApp's higher absolute expenses, their trend shows a more stable control, with a decrease of approximately 4% from 2015 to 2020. Zebra, on the other hand, experienced a 180% increase from 2014 to 2022, reflecting their aggressive growth strategy. As of 2023, Zebra's data is incomplete, highlighting the need for continuous monitoring. This analysis underscores the importance of strategic SG&A management in sustaining competitive advantage in the tech industry.

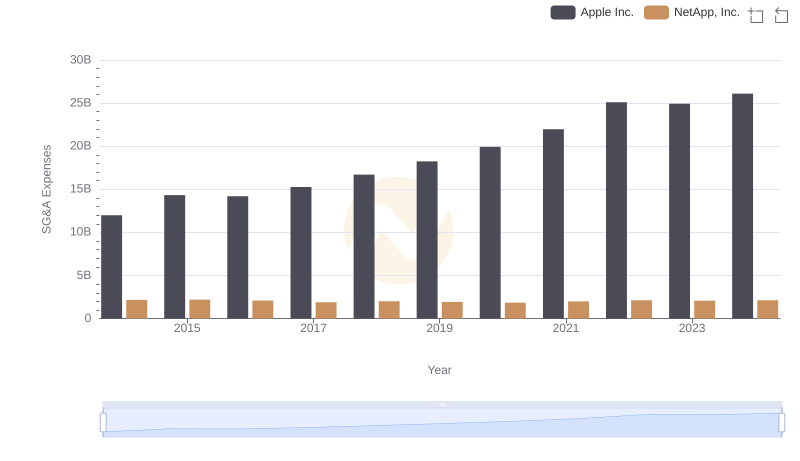

SG&A Efficiency Analysis: Comparing Apple Inc. and NetApp, Inc.

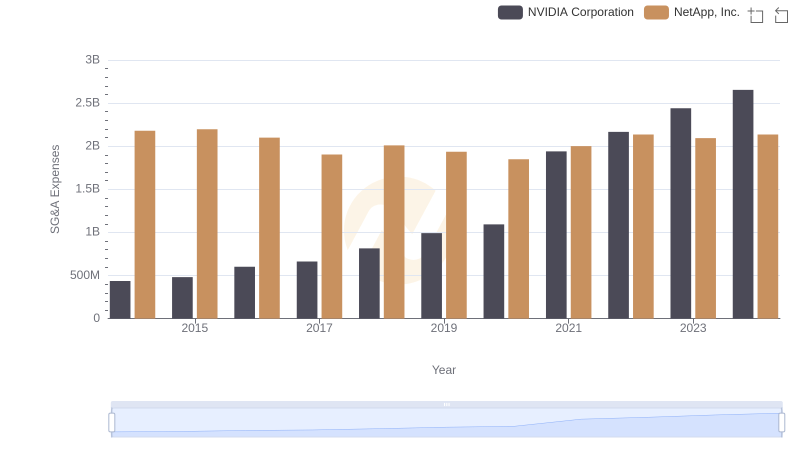

NVIDIA Corporation or NetApp, Inc.: Who Manages SG&A Costs Better?

Who Optimizes SG&A Costs Better? NVIDIA Corporation or Zebra Technologies Corporation

SG&A Efficiency Analysis: Comparing Taiwan Semiconductor Manufacturing Company Limited and NetApp, Inc.

Cost Management Insights: SG&A Expenses for Taiwan Semiconductor Manufacturing Company Limited and Zebra Technologies Corporation

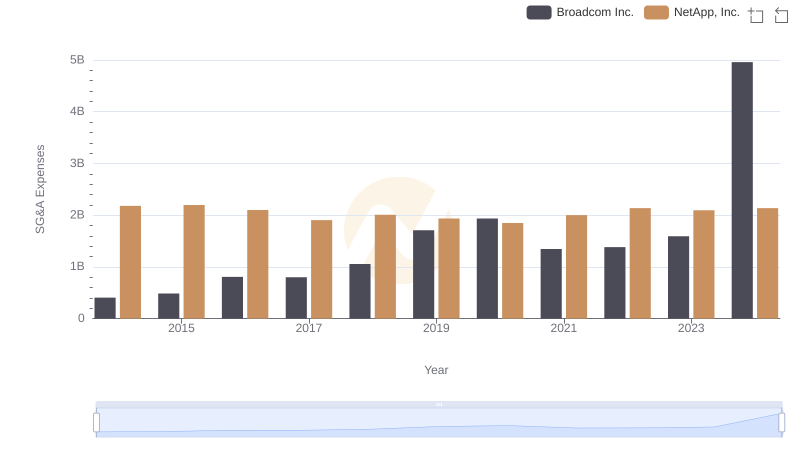

Breaking Down SG&A Expenses: Broadcom Inc. vs NetApp, Inc.

Broadcom Inc. vs Zebra Technologies Corporation: SG&A Expense Trends

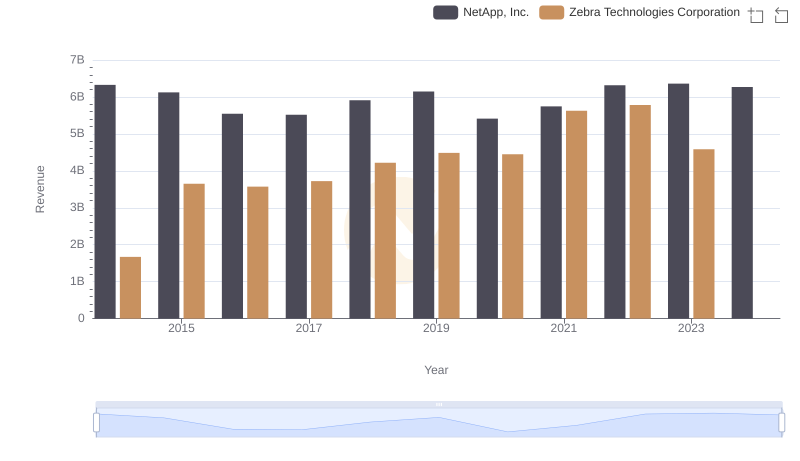

NetApp, Inc. and Zebra Technologies Corporation: A Comprehensive Revenue Analysis

Cost of Revenue Trends: NetApp, Inc. vs Zebra Technologies Corporation

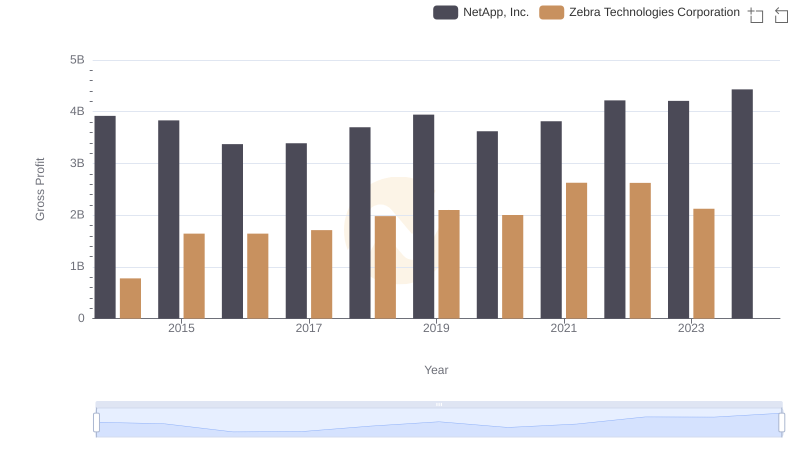

Gross Profit Analysis: Comparing NetApp, Inc. and Zebra Technologies Corporation

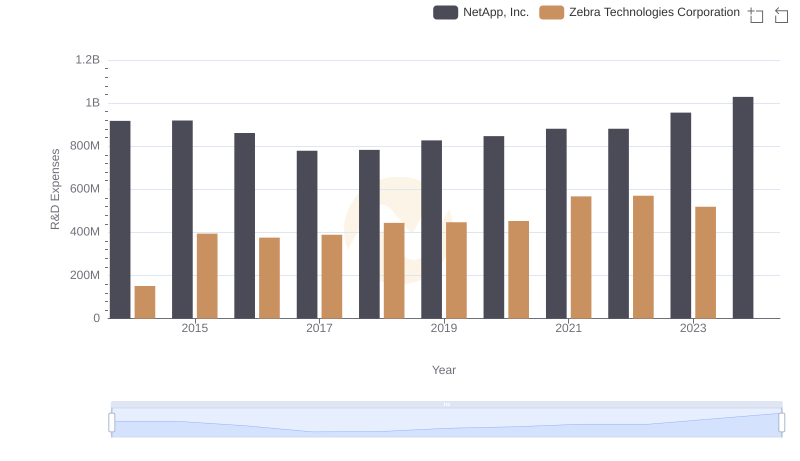

Who Prioritizes Innovation? R&D Spending Compared for NetApp, Inc. and Zebra Technologies Corporation

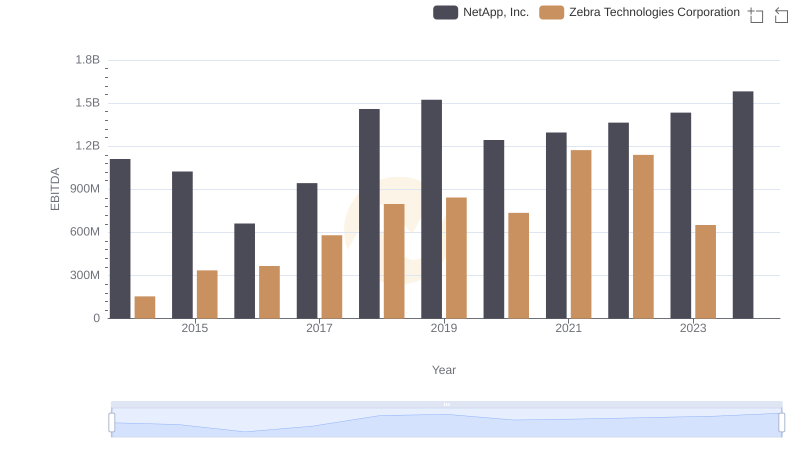

A Professional Review of EBITDA: NetApp, Inc. Compared to Zebra Technologies Corporation