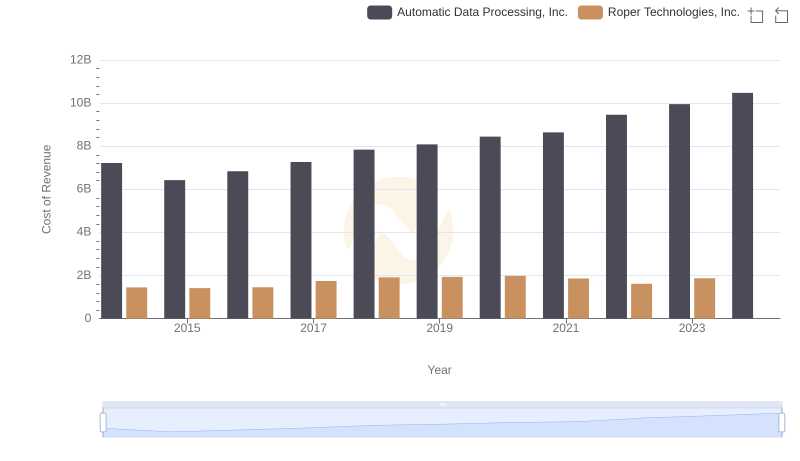

| __timestamp | Automatic Data Processing, Inc. | Roper Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1102426000 |

| Thursday, January 1, 2015 | 2496900000 | 1136728000 |

| Friday, January 1, 2016 | 2637000000 | 1277847000 |

| Sunday, January 1, 2017 | 2783200000 | 1654552000 |

| Monday, January 1, 2018 | 2971500000 | 1883100000 |

| Tuesday, January 1, 2019 | 3064200000 | 1928700000 |

| Wednesday, January 1, 2020 | 3003000000 | 2111900000 |

| Friday, January 1, 2021 | 3040500000 | 2337700000 |

| Saturday, January 1, 2022 | 3233200000 | 2228300000 |

| Sunday, January 1, 2023 | 3551400000 | 1915900000 |

| Monday, January 1, 2024 | 3778900000 | 2881500000 |

Unleashing the power of data

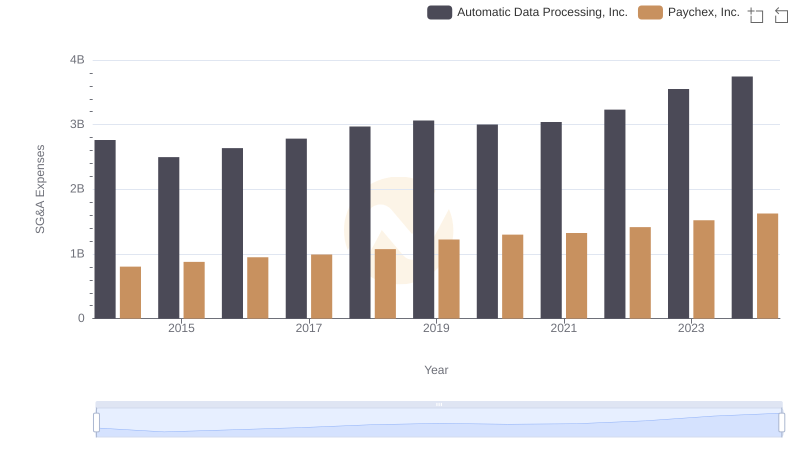

In the competitive landscape of corporate America, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Automatic Data Processing, Inc. (ADP) and Roper Technologies, Inc. have shown distinct trends over the past decade. From 2014 to 2023, ADP's SG&A expenses grew by approximately 36%, reflecting a strategic expansion. In contrast, Roper Technologies saw a 74% increase in SG&A expenses from 2014 to 2022, before a notable decline in 2023. This divergence highlights differing operational strategies. ADP's consistent growth suggests a stable expansion, while Roper's fluctuation may indicate strategic shifts or market challenges. Notably, data for 2024 is incomplete, emphasizing the need for ongoing analysis. As businesses navigate economic uncertainties, understanding these trends can offer valuable insights into corporate efficiency and strategic planning.

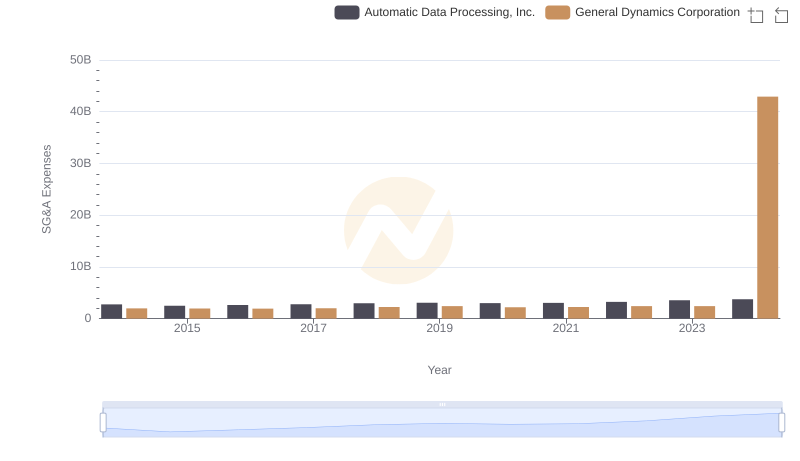

Automatic Data Processing, Inc. or General Dynamics Corporation: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Northrop Grumman Corporation

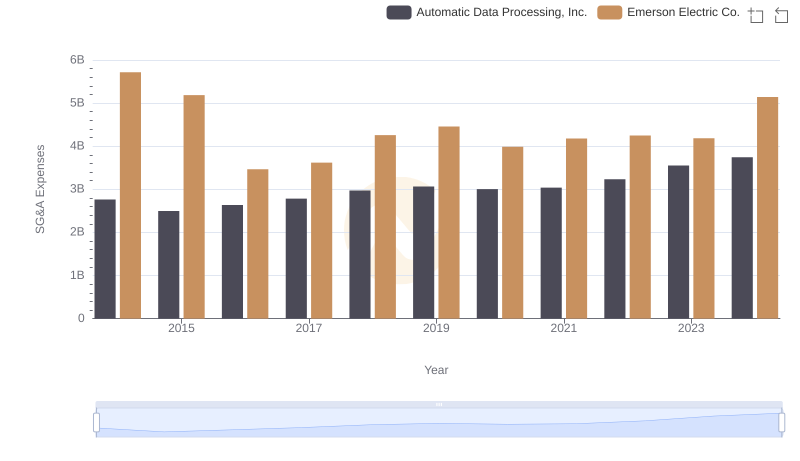

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Emerson Electric Co. Trends and Insights

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Roper Technologies, Inc.'s Expenses

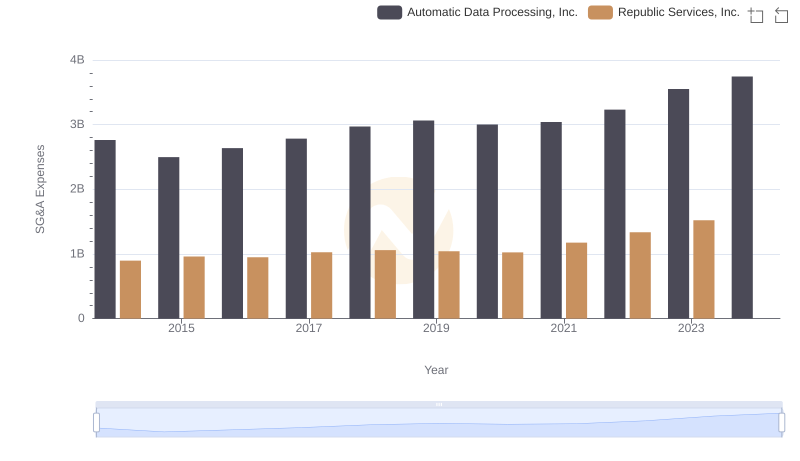

Automatic Data Processing, Inc. and Republic Services, Inc.: SG&A Spending Patterns Compared

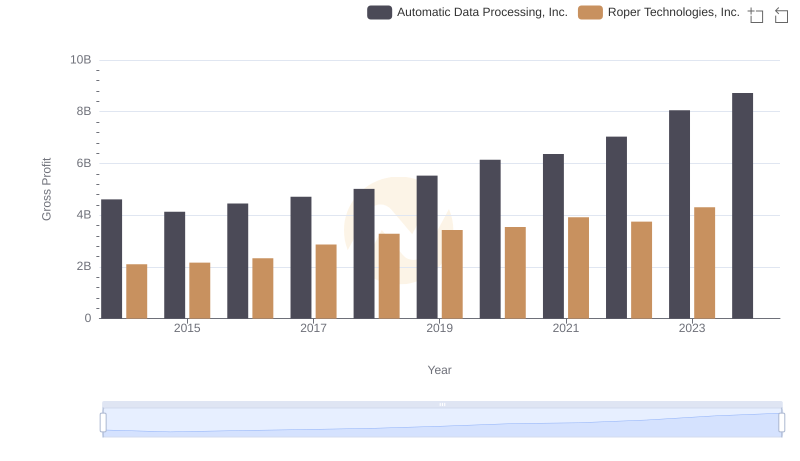

Automatic Data Processing, Inc. and Roper Technologies, Inc.: A Detailed Gross Profit Analysis

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Paychex, Inc.

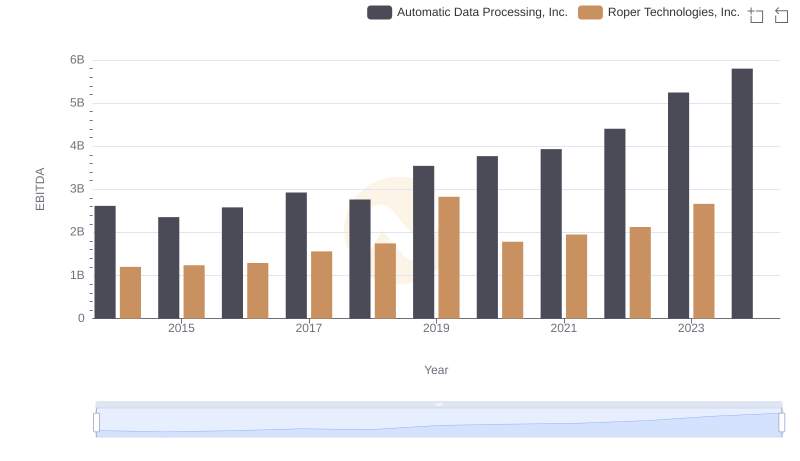

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Roper Technologies, Inc.

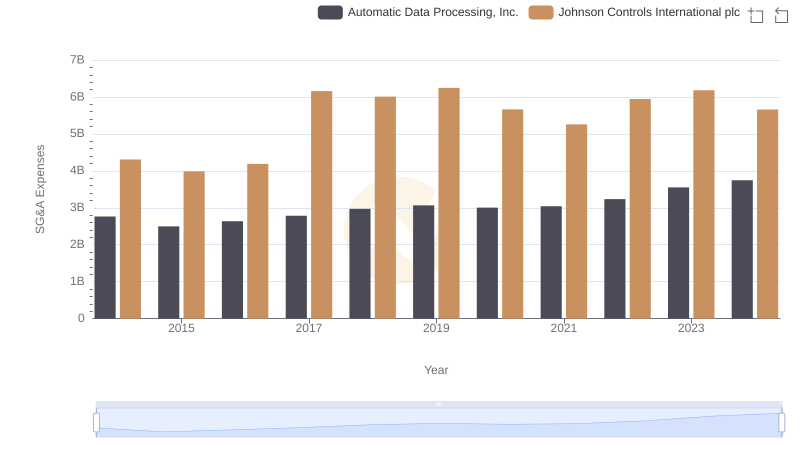

Automatic Data Processing, Inc. or Johnson Controls International plc: Who Manages SG&A Costs Better?