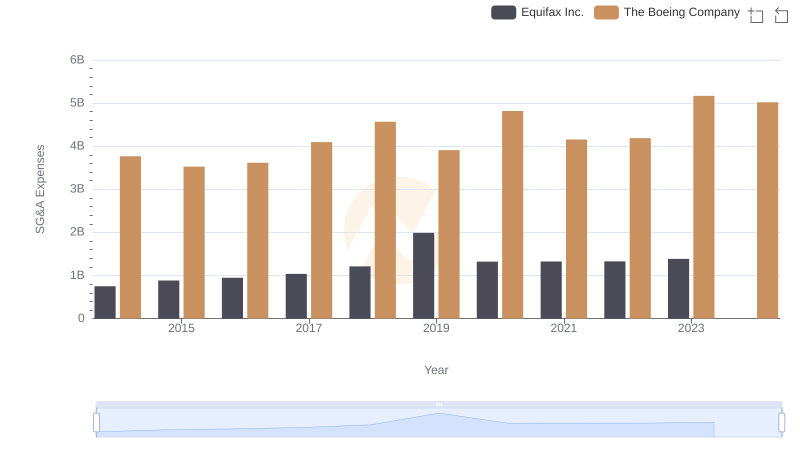

| __timestamp | Equifax Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 76752000000 |

| Thursday, January 1, 2015 | 887400000 | 82088000000 |

| Friday, January 1, 2016 | 1113400000 | 80790000000 |

| Sunday, January 1, 2017 | 1210700000 | 76066000000 |

| Monday, January 1, 2018 | 1440400000 | 81490000000 |

| Tuesday, January 1, 2019 | 1521700000 | 72093000000 |

| Wednesday, January 1, 2020 | 1737400000 | 63843000000 |

| Friday, January 1, 2021 | 1980900000 | 59237000000 |

| Saturday, January 1, 2022 | 2177200000 | 63078000000 |

| Sunday, January 1, 2023 | 2335100000 | 70070000000 |

| Monday, January 1, 2024 | 0 | 68508000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. This analysis delves into the cost of revenue trends for The Boeing Company and Equifax Inc. from 2014 to 2023. Boeing, a titan in aerospace, consistently reported a cost of revenue averaging around $72 billion annually, peaking in 2015. However, a notable decline of approximately 23% was observed by 2021, reflecting industry challenges. In contrast, Equifax, a leader in consumer credit reporting, showcased a steady increase in cost efficiency, with a 176% rise from 2014 to 2023. This divergence highlights the distinct operational dynamics of these industries. While Boeing faced fluctuations, Equifax's upward trajectory underscores its strategic growth. Missing data for 2024 suggests ongoing developments. This comparative analysis offers valuable insights into the financial strategies of these industry giants.

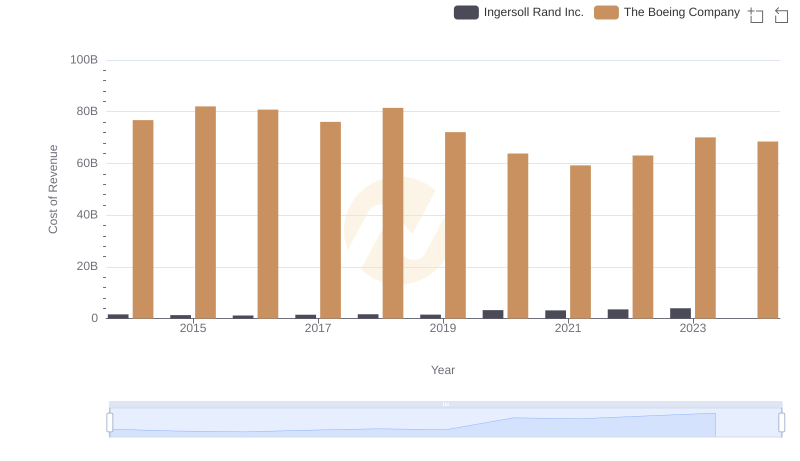

Cost of Revenue: Key Insights for The Boeing Company and Ingersoll Rand Inc.

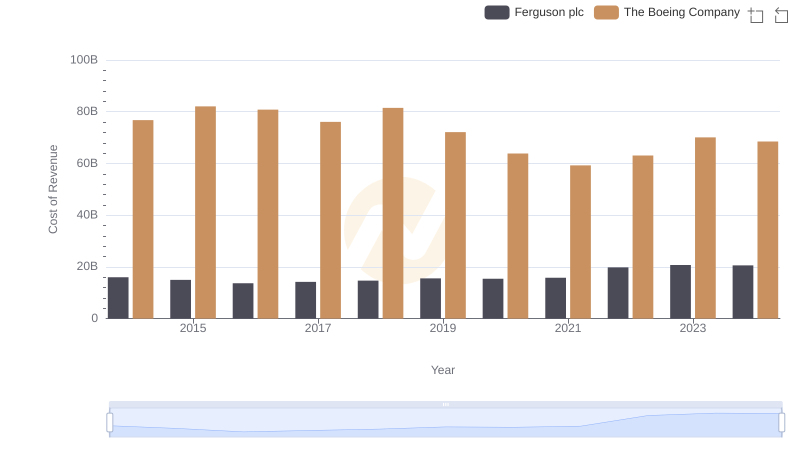

Comparing Cost of Revenue Efficiency: The Boeing Company vs Ferguson plc

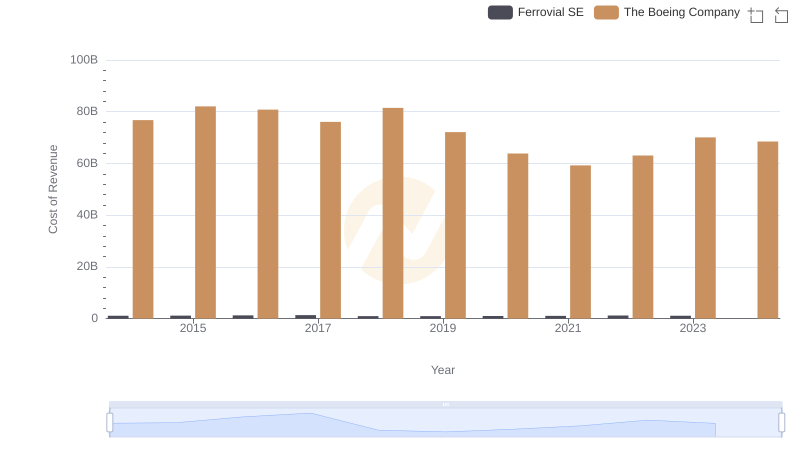

Cost of Revenue Trends: The Boeing Company vs Ferrovial SE

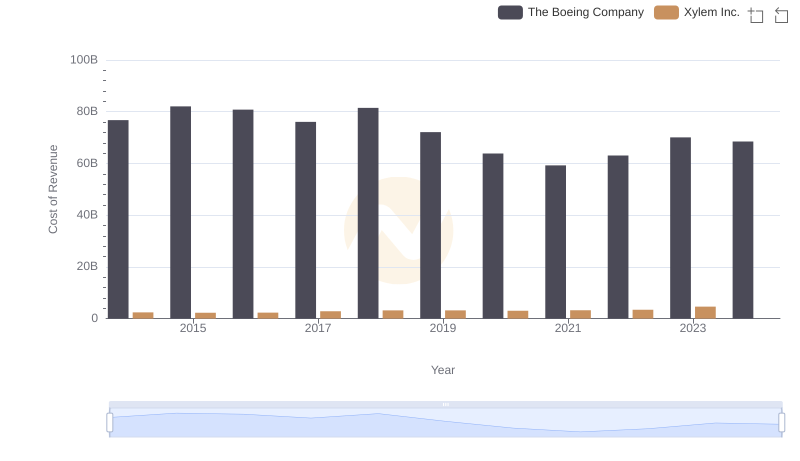

Cost of Revenue Trends: The Boeing Company vs Xylem Inc.

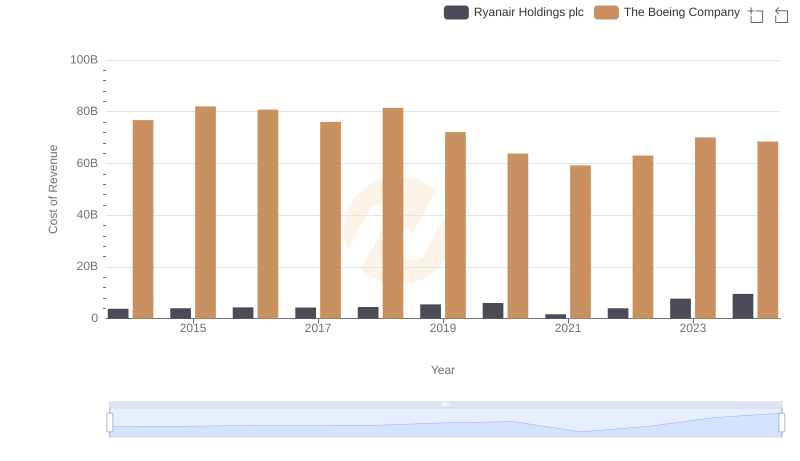

Cost of Revenue: Key Insights for The Boeing Company and Ryanair Holdings plc

Comparing SG&A Expenses: The Boeing Company vs Equifax Inc. Trends and Insights