| __timestamp | Equifax Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 3767000000 |

| Thursday, January 1, 2015 | 884300000 | 3525000000 |

| Friday, January 1, 2016 | 948200000 | 3616000000 |

| Sunday, January 1, 2017 | 1039100000 | 4094000000 |

| Monday, January 1, 2018 | 1213300000 | 4567000000 |

| Tuesday, January 1, 2019 | 1990200000 | 3909000000 |

| Wednesday, January 1, 2020 | 1322500000 | 4817000000 |

| Friday, January 1, 2021 | 1324600000 | 4157000000 |

| Saturday, January 1, 2022 | 1328900000 | 4187000000 |

| Sunday, January 1, 2023 | 1385700000 | 5168000000 |

| Monday, January 1, 2024 | 1450500000 | 5021000000 |

Cracking the code

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. This analysis delves into the SG&A trends of two industry titans: The Boeing Company and Equifax Inc., from 2014 to 2023.

Boeing's SG&A expenses have shown a steady upward trajectory, peaking in 2023 with a 37% increase from 2014. This reflects Boeing's strategic investments in innovation and market expansion, despite the challenges faced in the aviation sector.

Equifax, a leader in consumer credit reporting, experienced a significant 84% rise in SG&A expenses by 2019, likely due to increased cybersecurity measures post-2017 data breach. However, their expenses stabilized post-2020, indicating a more controlled financial strategy.

While Boeing's expenses soared, Equifax's plateaued, highlighting different strategic priorities. Missing data for 2024 suggests ongoing financial adjustments. Understanding these trends offers valuable insights into corporate strategies and market dynamics.

The Boeing Company vs Equifax Inc.: Efficiency in Cost of Revenue Explored

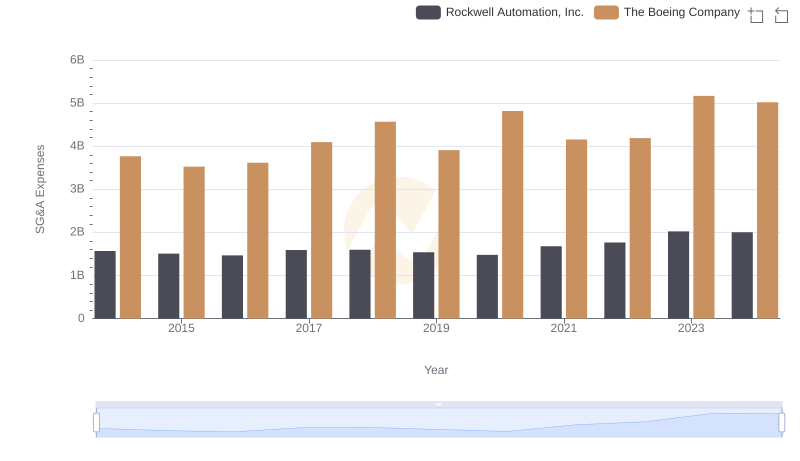

Who Optimizes SG&A Costs Better? The Boeing Company or Rockwell Automation, Inc.

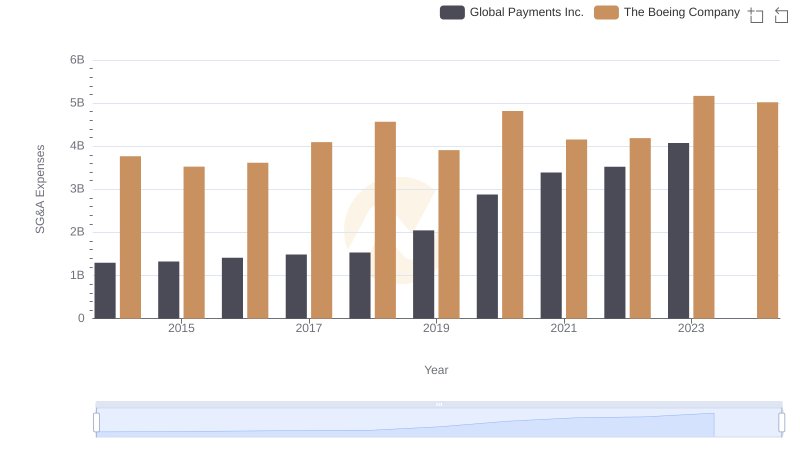

Comparing SG&A Expenses: The Boeing Company vs Global Payments Inc. Trends and Insights

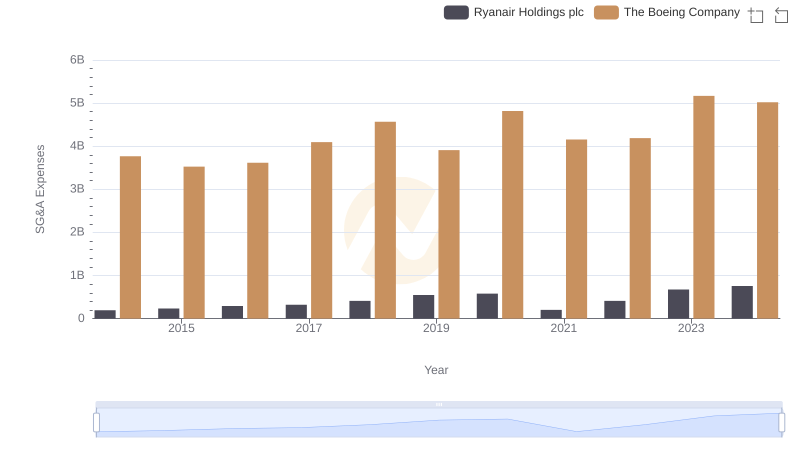

Breaking Down SG&A Expenses: The Boeing Company vs Ryanair Holdings plc

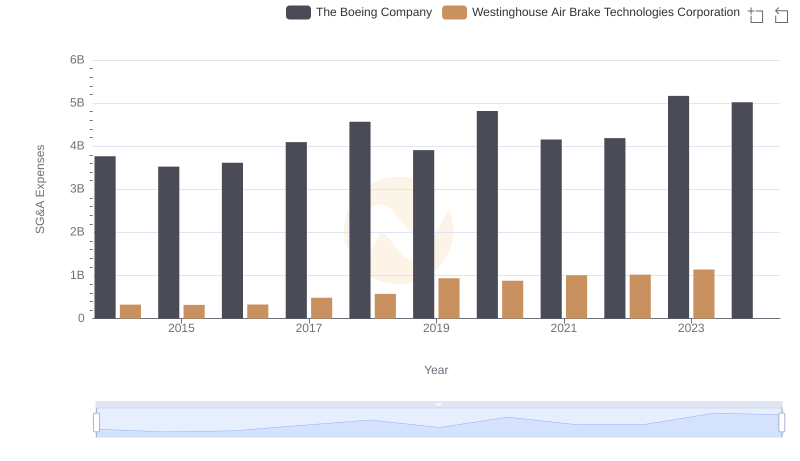

Who Optimizes SG&A Costs Better? The Boeing Company or Westinghouse Air Brake Technologies Corporation

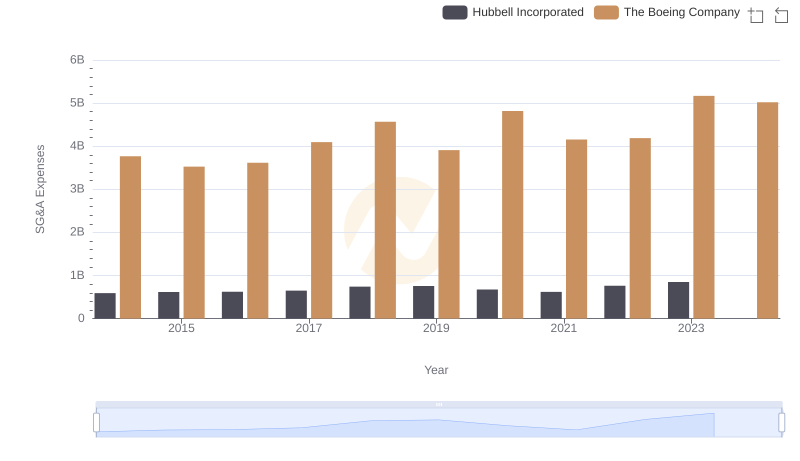

The Boeing Company vs Hubbell Incorporated: SG&A Expense Trends

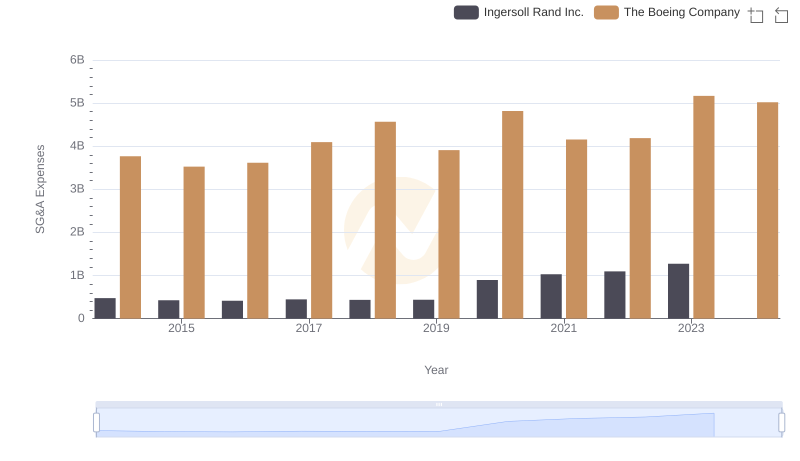

SG&A Efficiency Analysis: Comparing The Boeing Company and Ingersoll Rand Inc.