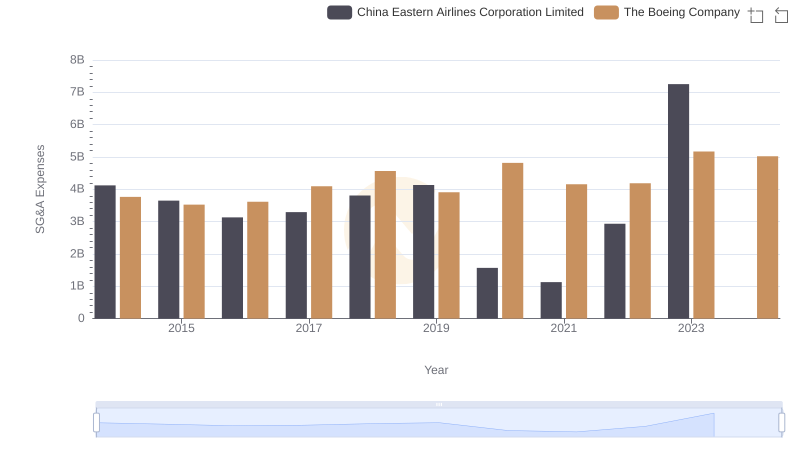

| __timestamp | Owens Corning | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 487000000 | 3767000000 |

| Thursday, January 1, 2015 | 525000000 | 3525000000 |

| Friday, January 1, 2016 | 584000000 | 3616000000 |

| Sunday, January 1, 2017 | 620000000 | 4094000000 |

| Monday, January 1, 2018 | 700000000 | 4567000000 |

| Tuesday, January 1, 2019 | 698000000 | 3909000000 |

| Wednesday, January 1, 2020 | 664000000 | 4817000000 |

| Friday, January 1, 2021 | 757000000 | 4157000000 |

| Saturday, January 1, 2022 | 803000000 | 4187000000 |

| Sunday, January 1, 2023 | 831000000 | 5168000000 |

| Monday, January 1, 2024 | 5021000000 |

Igniting the spark of knowledge

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Owens Corning and The Boeing Company have demonstrated contrasting approaches to handling these costs. From 2014 to 2023, Owens Corning's SG&A expenses increased by approximately 71%, reflecting a steady growth in operational scale. In contrast, Boeing's SG&A expenses fluctuated, peaking in 2023 with a 37% increase from 2014, highlighting the challenges faced by the aerospace giant.

While Owens Corning's expenses grew consistently, Boeing's expenses showed volatility, particularly during the pandemic years. This suggests that Owens Corning may have a more stable cost management strategy. However, Boeing's larger scale and industry-specific challenges, such as supply chain disruptions, may account for its higher SG&A costs. As we look to the future, these trends offer valuable insights into each company's financial strategies.

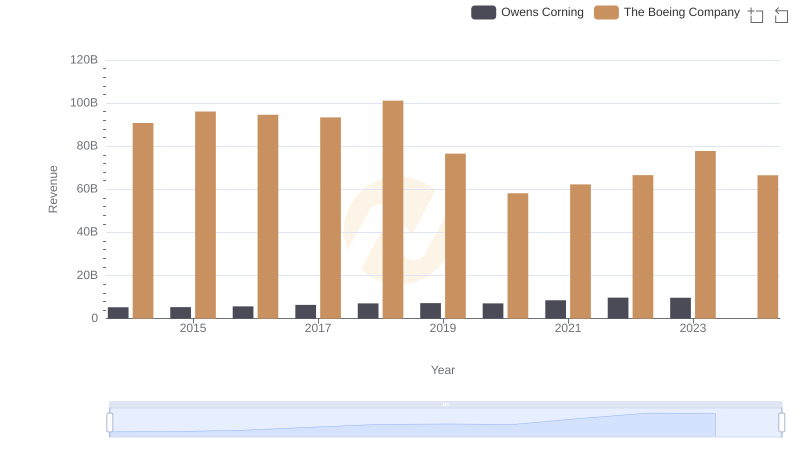

The Boeing Company and Owens Corning: A Comprehensive Revenue Analysis

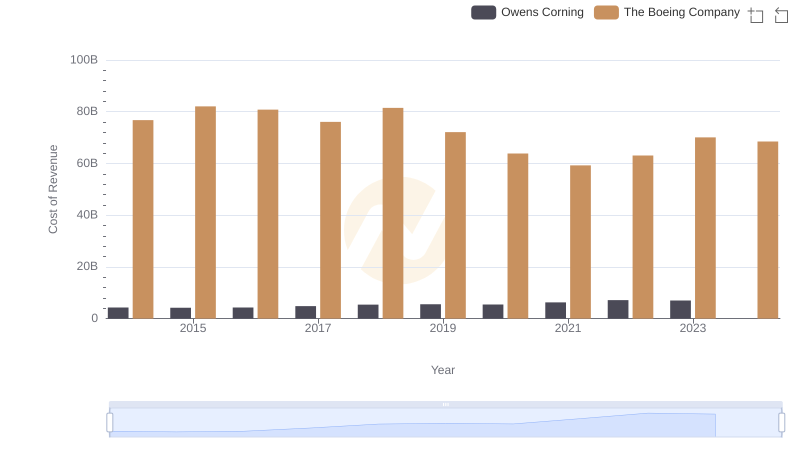

Cost of Revenue: Key Insights for The Boeing Company and Owens Corning

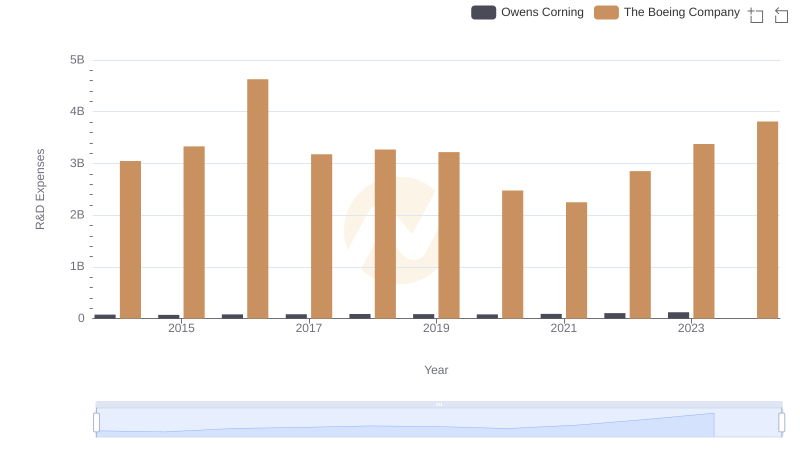

The Boeing Company vs Owens Corning: Strategic Focus on R&D Spending

Who Optimizes SG&A Costs Better? The Boeing Company or China Eastern Airlines Corporation Limited

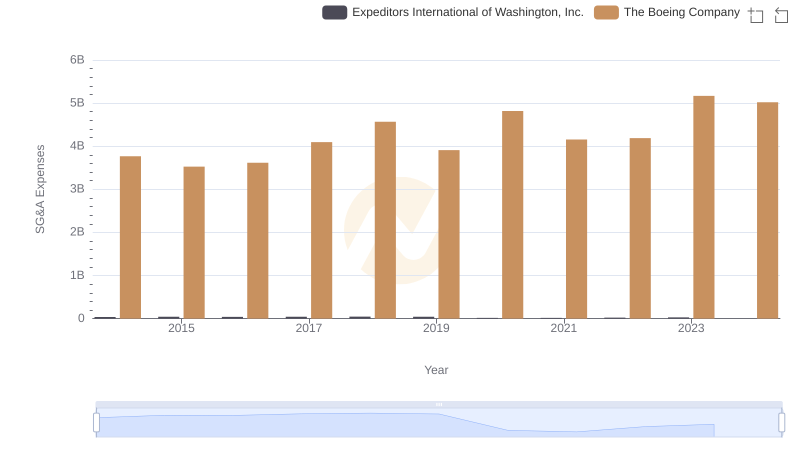

Cost Management Insights: SG&A Expenses for The Boeing Company and Expeditors International of Washington, Inc.

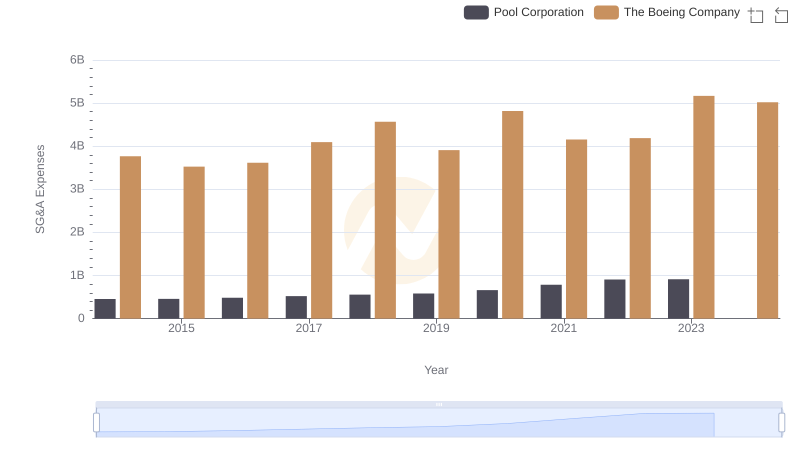

The Boeing Company or Pool Corporation: Who Manages SG&A Costs Better?

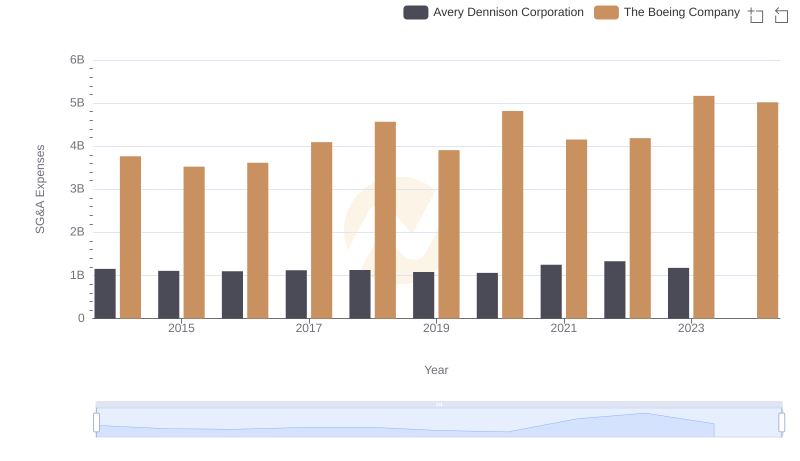

SG&A Efficiency Analysis: Comparing The Boeing Company and Avery Dennison Corporation