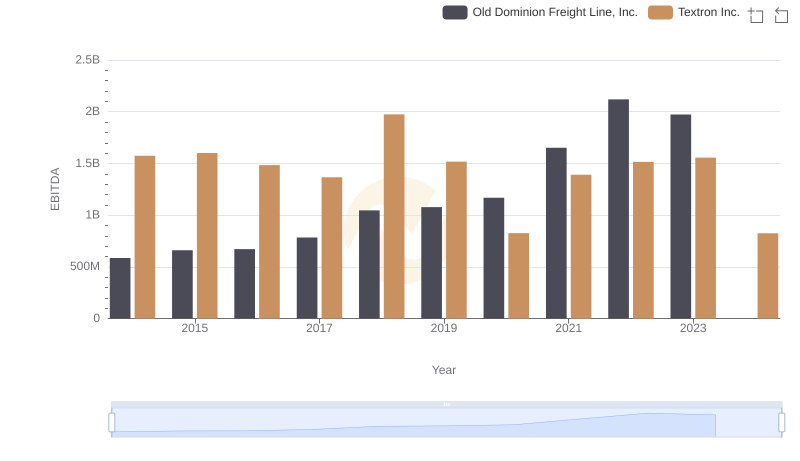

| __timestamp | Old Dominion Freight Line, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 1361000000 |

| Thursday, January 1, 2015 | 153589000 | 1304000000 |

| Friday, January 1, 2016 | 152391000 | 1304000000 |

| Sunday, January 1, 2017 | 177205000 | 1337000000 |

| Monday, January 1, 2018 | 194368000 | 1275000000 |

| Tuesday, January 1, 2019 | 206125000 | 1152000000 |

| Wednesday, January 1, 2020 | 184185000 | 1045000000 |

| Friday, January 1, 2021 | 223757000 | 1221000000 |

| Saturday, January 1, 2022 | 258883000 | 1186000000 |

| Sunday, January 1, 2023 | 281053000 | 1225000000 |

| Monday, January 1, 2024 | 1156000000 |

In pursuit of knowledge

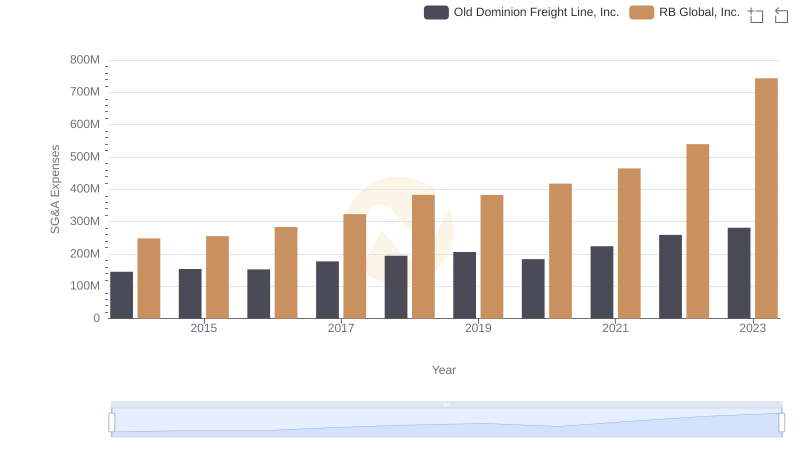

In the competitive landscape of American business, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Old Dominion Freight Line, Inc. and Textron Inc. offer a fascinating comparison over the past decade. From 2014 to 2023, Old Dominion's SG&A expenses grew by approximately 94%, reflecting its strategic investments in operational efficiency. In contrast, Textron's expenses remained relatively stable, with a notable spike in 2024, indicating a potential strategic shift or one-time expense. This analysis highlights the importance of SG&A management in maintaining competitive advantage. While Old Dominion's consistent growth suggests a focus on scaling operations, Textron's stable expenses may point to a more conservative approach. Missing data for 2024 in Old Dominion's records suggests a need for further investigation into recent trends.

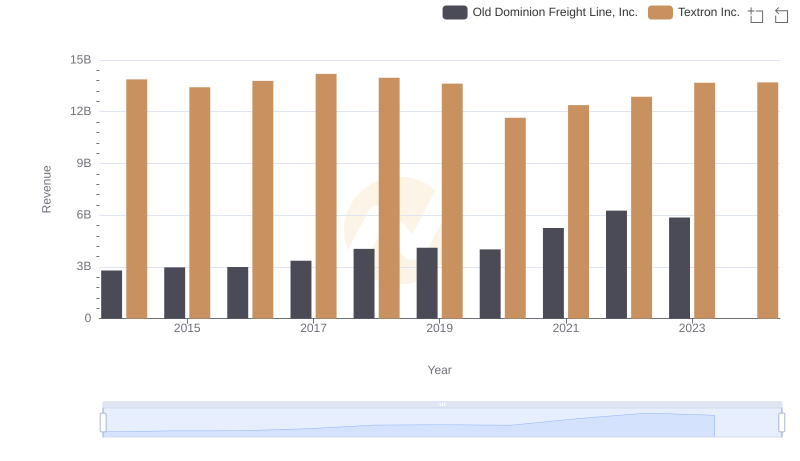

Comparing Revenue Performance: Old Dominion Freight Line, Inc. or Textron Inc.?

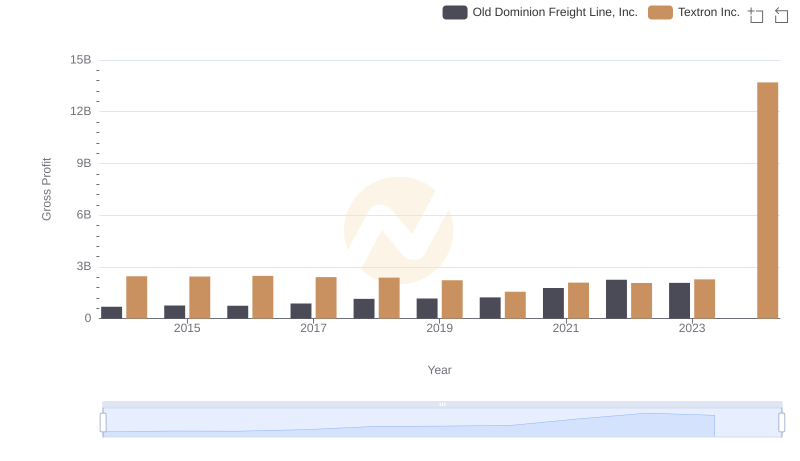

Old Dominion Freight Line, Inc. vs Textron Inc.: A Gross Profit Performance Breakdown

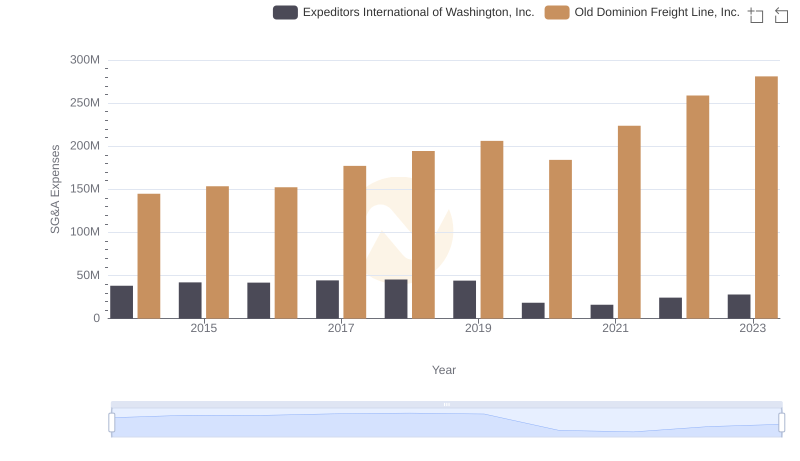

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Expeditors International of Washington, Inc.

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and RB Global, Inc.

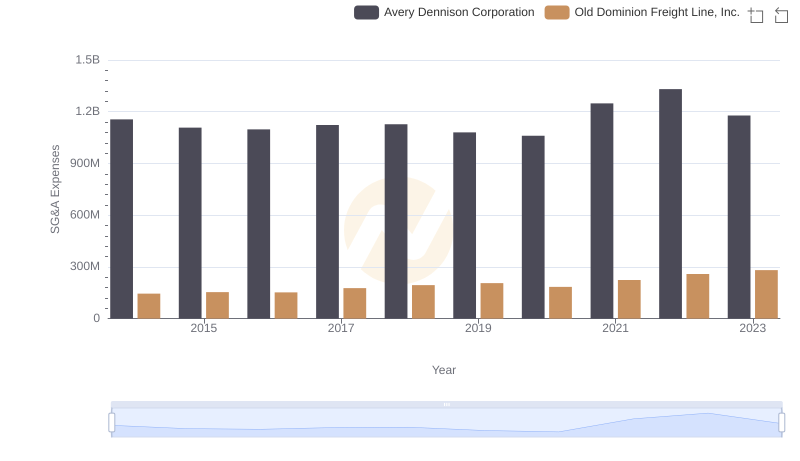

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Avery Dennison Corporation

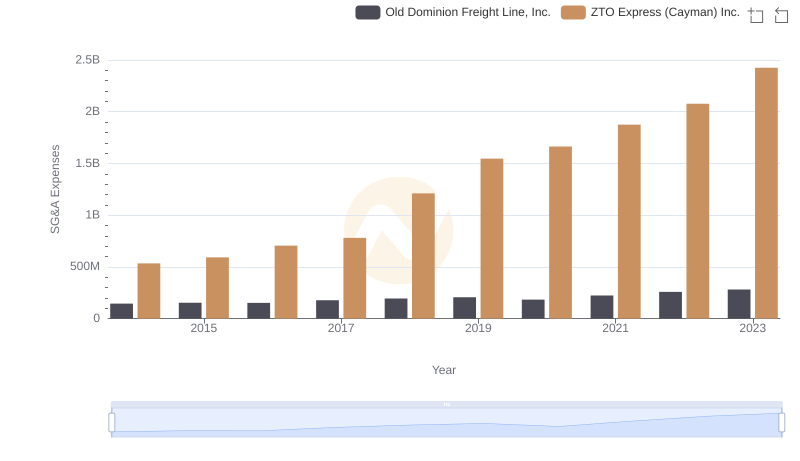

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs ZTO Express (Cayman) Inc. Trends and Insights

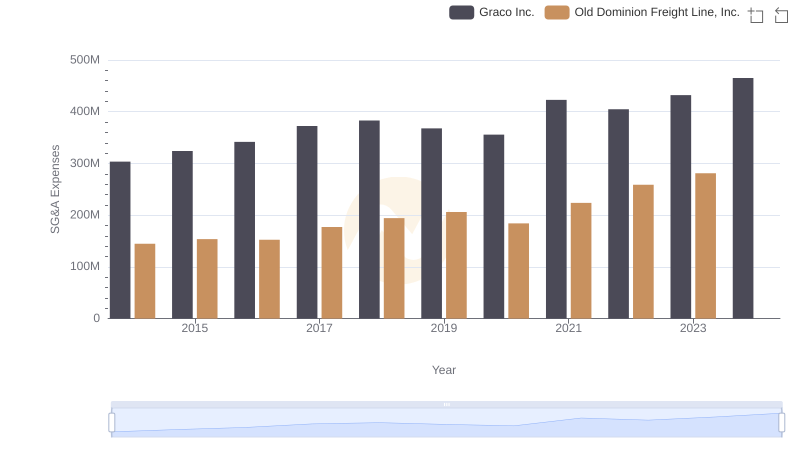

Old Dominion Freight Line, Inc. vs Graco Inc.: SG&A Expense Trends

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Textron Inc.